Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 18

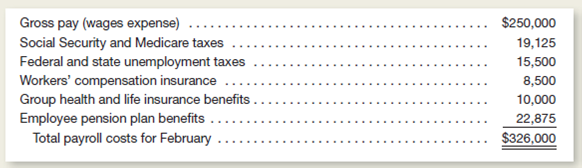

Spirit Corporation reported the following payroll-related costs for the month of February:

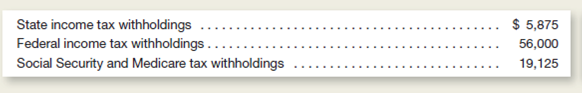

Spirit's insurance premiums for workers' compensation and group health and life insurance were paid for in a prior period and recorded initially as prepaid insurance expense.ithholdings from employee wages in February were as follows:

a.ecord Spirit's gross wages, employee withholdings, and employee take-home pay for February.

b.ecord Spirit's payroll tax expense for February.

c.ecord Spirit's employee benefit expenses for February.

d.o the amounts withheld from spirit's employees represent taxes levied on spirit Corporation Explain.

Spirit's insurance premiums for workers' compensation and group health and life insurance were paid for in a prior period and recorded initially as prepaid insurance expense.ithholdings from employee wages in February were as follows:

a.ecord Spirit's gross wages, employee withholdings, and employee take-home pay for February.

b.ecord Spirit's payroll tax expense for February.

c.ecord Spirit's employee benefit expenses for February.

d.o the amounts withheld from spirit's employees represent taxes levied on spirit Corporation Explain.

التوضيح

Payroll is the collective term used to d...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255