Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 50

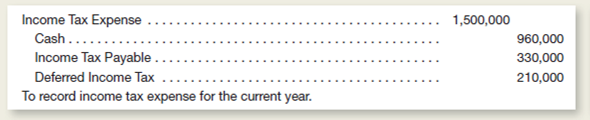

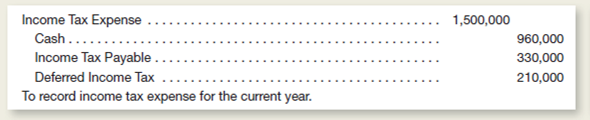

The following journal entry summarizes for the current year the income tax expense of Sophie's Software Warehouse:

Of the deferred income taxes, only $30,000 is classified as a current liability.

a.efine the term deferred income tax.

b.hat is the amount of income tax that the company has paid or expects to pay in conjunction with its income tax return for the current year

c.llustrate the allocation of the liabilities shown in the above journal entry between the classifications of current liabilities and long-term liabilities.

Of the deferred income taxes, only $30,000 is classified as a current liability.

a.efine the term deferred income tax.

b.hat is the amount of income tax that the company has paid or expects to pay in conjunction with its income tax return for the current year

c.llustrate the allocation of the liabilities shown in the above journal entry between the classifications of current liabilities and long-term liabilities.

التوضيح

Liabilities:

Liabilities are the claims...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255