Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 60

Examining Home Depot's Capital Structure

To answer the following questions use the financial statements for Home Depot , Inc , inAppendixA at the end of the textbook

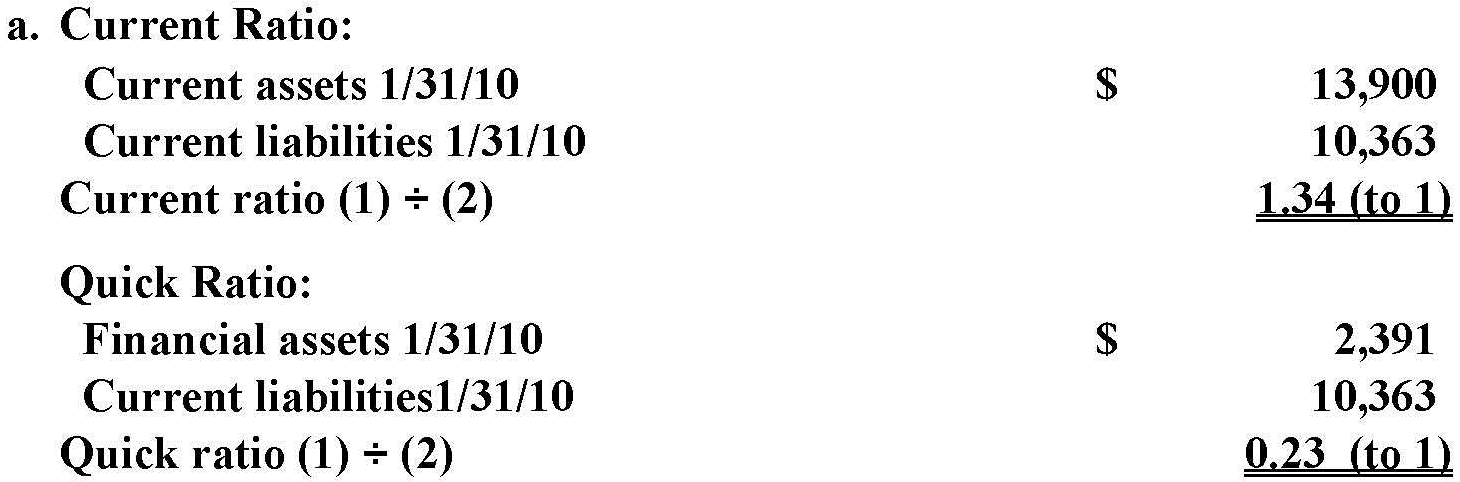

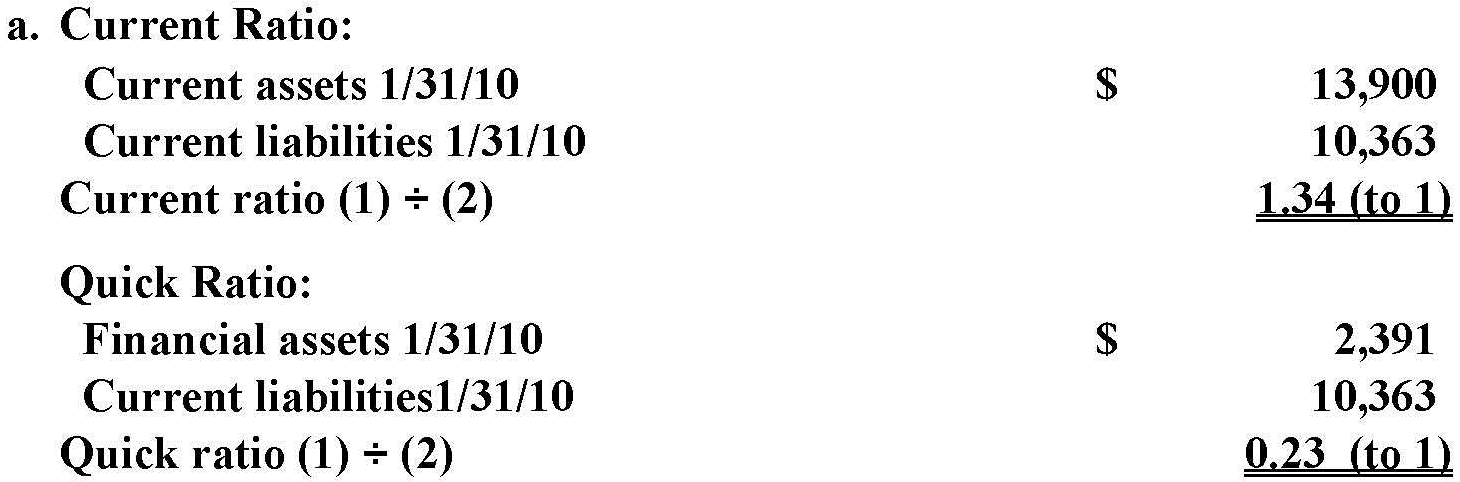

a.ompute the company's current ratio and quick ratio for the most recent year reported.o these ratios provide support that Home Depot is able to repay its current liabilities asthey , come due Explain.

b.ompute the company's debt ratio.oes Home Depot appear to have excessive debt Explain.

c.xamine the company's statement ofcash flows.oes Home Depot's cash flow from operating activities appear adequate tocover itscurrent liabilities as they come due Explain.

To answer the following questions use the financial statements for Home Depot , Inc , inAppendixA at the end of the textbook

a.ompute the company's current ratio and quick ratio for the most recent year reported.o these ratios provide support that Home Depot is able to repay its current liabilities asthey , come due Explain.

b.ompute the company's debt ratio.oes Home Depot appear to have excessive debt Explain.

c.xamine the company's statement ofcash flows.oes Home Depot's cash flow from operating activities appear adequate tocover itscurrent liabilities as they come due Explain.

التوضيح

Current Ratio:

Current ratio is the rat...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255