Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 22

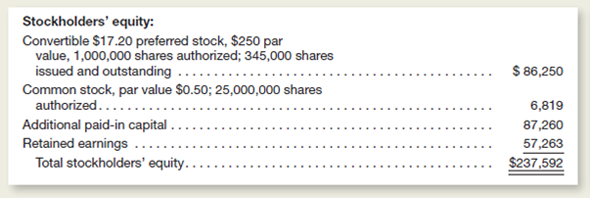

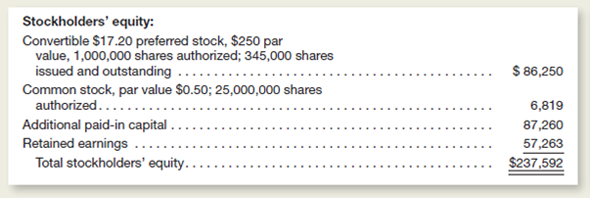

Parsons, Inc., is a publicly owned company.he following information is excerpted from a recent balance sheet.ollar amounts (except for per share amounts) are stated in thousands.

Instructions

From this information, answer the following questions:

a.ow many shares of common stock have been issued

b.hat is the total amount of the annual dividends paid to preferred stockholders

c.hat is the total amount of paid-in capital

d.hat is the book value per share of common stock, assuming no dividends in arrears

e.riefly explain the advantages and disadvantages to Parsons of being publicly owned rather than operating as a closely held corporation.

f.hat is meant by the term convertible used in the caption of the preferred stock Is there any more information that investors need to know to evaluate this conversion feature

g.ssume that the preferred stock currently is selling at $248 per share.oes this provide a higher or lower dividend yield than an 8 percent, $50 par value preferred with a market price of $57 per share Show computations (round to the nearest tenth of 1 percent).xplain why one preferred stock might yield less than another.

Instructions

From this information, answer the following questions:

a.ow many shares of common stock have been issued

b.hat is the total amount of the annual dividends paid to preferred stockholders

c.hat is the total amount of paid-in capital

d.hat is the book value per share of common stock, assuming no dividends in arrears

e.riefly explain the advantages and disadvantages to Parsons of being publicly owned rather than operating as a closely held corporation.

f.hat is meant by the term convertible used in the caption of the preferred stock Is there any more information that investors need to know to evaluate this conversion feature

g.ssume that the preferred stock currently is selling at $248 per share.oes this provide a higher or lower dividend yield than an 8 percent, $50 par value preferred with a market price of $57 per share Show computations (round to the nearest tenth of 1 percent).xplain why one preferred stock might yield less than another.

التوضيح

a.The number of common shares issued can...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255