Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 7

You are the controller for Foxboro Technologies.our staff has prepared an income statement for the current year and has developed the following additional information by analyzing changes in the company's balance sheet accounts.

Additional Information

1.ccounts receivable increased by $60,000.

2.ccrued interest receivable decreased by $5,000.

3.nventory decreased by $30,000, and accounts payable to suppliers of merchandise decreased by $22,000.

4.hort-term prepayments of operating expenses increased by $8,000, and accrued liabilities for operating expenses decreased by $9,000.

5.he liability for accrued interest payable increased by $4,000 during the year.

6.he liability for accrued income taxes payable decreased by $10,000 during the year.

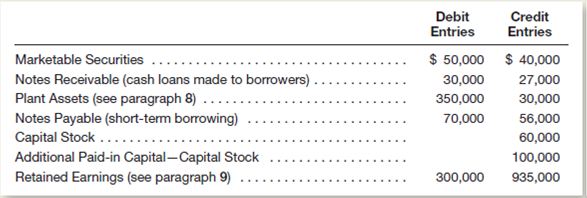

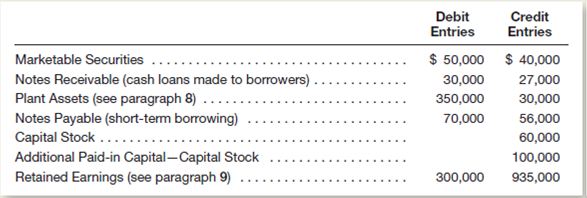

7.he following schedule summarizes the total debit and credit entries during the year in other balance sheet accounts:

8.he $30,000 in credit entries to the Plant Assets account is net of any debits to Accumulated Depreciation when plant assets were retired.hus the $30,000 in credit entries represents the book value of all plant assets sold or retired during the year.

9.he $300,000 debit to Retained Earnings represents dividends declared and paid during the year.he $935,000 credit entry represents the net income shown in the income statement.

10.ll investing and financing activities were cash transactions.

11.ash and cash equivalents amount to $20,000 at the beginning of the year and to $473,000 at year-end.

Instructions

a.repare a statement of cash flows for the current year.se the direct method of reporting cash flows from operating activities.lace brackets around dollar amounts representing cash outflows.how separately your computations of the following amounts:

1.ash received from customers.

2.nterest received.

3.ash paid to suppliers and employees

4.nterest paid.

5.ncome taxes paid

6.roceeds from sales of marketable securities.

7.roceeds from sales of plant assets.

8.roceeds from issuing capital stock

b.xplain why cash paid to suppliers is so much higher than cost of goods sold.

c.oes the fact that Foxboro's cash flows from both investing and financing activities are negative indicate that the company is in a weak cash position

Additional Information

1.ccounts receivable increased by $60,000.

2.ccrued interest receivable decreased by $5,000.

3.nventory decreased by $30,000, and accounts payable to suppliers of merchandise decreased by $22,000.

4.hort-term prepayments of operating expenses increased by $8,000, and accrued liabilities for operating expenses decreased by $9,000.

5.he liability for accrued interest payable increased by $4,000 during the year.

6.he liability for accrued income taxes payable decreased by $10,000 during the year.

7.he following schedule summarizes the total debit and credit entries during the year in other balance sheet accounts:

8.he $30,000 in credit entries to the Plant Assets account is net of any debits to Accumulated Depreciation when plant assets were retired.hus the $30,000 in credit entries represents the book value of all plant assets sold or retired during the year.

9.he $300,000 debit to Retained Earnings represents dividends declared and paid during the year.he $935,000 credit entry represents the net income shown in the income statement.

10.ll investing and financing activities were cash transactions.

11.ash and cash equivalents amount to $20,000 at the beginning of the year and to $473,000 at year-end.

Instructions

a.repare a statement of cash flows for the current year.se the direct method of reporting cash flows from operating activities.lace brackets around dollar amounts representing cash outflows.how separately your computations of the following amounts:

1.ash received from customers.

2.nterest received.

3.ash paid to suppliers and employees

4.nterest paid.

5.ncome taxes paid

6.roceeds from sales of marketable securities.

7.roceeds from sales of plant assets.

8.roceeds from issuing capital stock

b.xplain why cash paid to suppliers is so much higher than cost of goods sold.

c.oes the fact that Foxboro's cash flows from both investing and financing activities are negative indicate that the company is in a weak cash position

التوضيح

Statement of cash flows is the kind of f...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255