Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 31

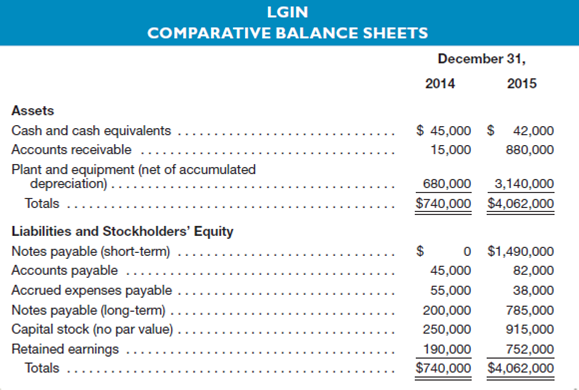

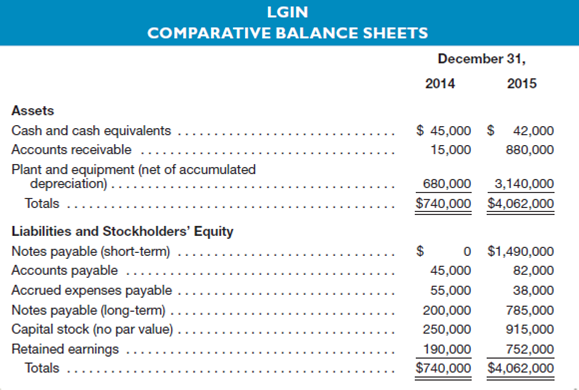

LGIN was founded in 2014 to apply a new technology for the Internet.he company earned a profit of $190,000 in 2014, its first year of operations.anagement expects both sales and net income to more than double in each of the next four years.omparative balance sheets at the end of 2014 and 2015, the company's first two years of operations, appear below.Notice that the balances at the end of the current year appear in the right-hand column.)

Additional Information

The following information regarding the company's operations in 2015 is available in either the company's income statement or its accounting records:

1.et income for the year was $562,000.he company has never paid a dividend.

2.epreciation for the year amounted to $125,000.

3.uring the year the company purchased plant assets costing $2,585,000, for which it paid $2,000,000 in cash and financed $585,000 by issuing a long-term note payable.Much of the cash used in these purchases was provided by short-term borrowing, as described below.)

4.n 2015, LGIN borrowed $1,490,000 against a $4.5 million line of credit with a local bank.n its balance sheet, the resulting obligations are reported as notes payable (short-term).

5.dditional shares of capital stock (no par value) were issued to investors for $665,000 cash.

Instructions

a.repare a formal statement of cash flows for 2015, including a supplementary schedule of noncash investing and financing activities.Follow the format illustrated in Exhibit 13-8.ash provided by operating activities is to be presented by the indirect method.

b.riefly explain how operating activities can be a net use of cash when the company is operating so profitably.

c.ecause of the expected rapid growth, management forecasts that operating activities will include an even greater use of cash in the year 2016 than in 2015.f this forecast is correct, does LGIN appear to be heading toward insolvency Explain.

Additional Information

The following information regarding the company's operations in 2015 is available in either the company's income statement or its accounting records:

1.et income for the year was $562,000.he company has never paid a dividend.

2.epreciation for the year amounted to $125,000.

3.uring the year the company purchased plant assets costing $2,585,000, for which it paid $2,000,000 in cash and financed $585,000 by issuing a long-term note payable.Much of the cash used in these purchases was provided by short-term borrowing, as described below.)

4.n 2015, LGIN borrowed $1,490,000 against a $4.5 million line of credit with a local bank.n its balance sheet, the resulting obligations are reported as notes payable (short-term).

5.dditional shares of capital stock (no par value) were issued to investors for $665,000 cash.

Instructions

a.repare a formal statement of cash flows for 2015, including a supplementary schedule of noncash investing and financing activities.Follow the format illustrated in Exhibit 13-8.ash provided by operating activities is to be presented by the indirect method.

b.riefly explain how operating activities can be a net use of cash when the company is operating so profitably.

c.ecause of the expected rapid growth, management forecasts that operating activities will include an even greater use of cash in the year 2016 than in 2015.f this forecast is correct, does LGIN appear to be heading toward insolvency Explain.

التوضيح

Statement of cash flows is the kind of f...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255