Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 55

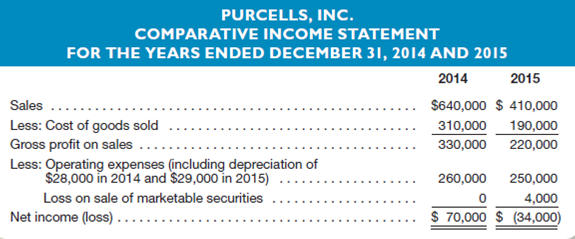

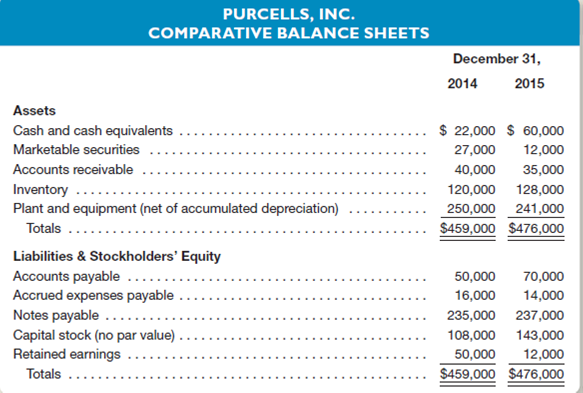

Purcells, Inc., sells a single product (Pulsa) exclusively through newspaper advertising.he comparative income statements and balance sheets are for the past two years.

Additional Information

The following information regarding the company's operations in 2015 is available from the company's accounting records:

1.arly in the year the company declared and paid a $4,000 cash dividend.

2.uring the year marketable securities costing $15,000 were sold for $11,000 cash, resulting in a $4,000 nonoperating loss.

3.he company purchased plant assets for $20,000, paying $8,000 in cash and issuing a note payable for the $12,000 balance.

4.uring the year the company repaid a $10,000 note payable, but incurred an additional $12,000 in long-term debt as described in 3, above.

5.he owners invested $35,000 cash in the business as a condition of the new loans described in paragraphs 3 and 4, above.

Instructions

a.repare a worksheet for a statement of cash flows, following the example shown in Exhibit 13-7.

b.repare a formal statement of cash flows for 2011, including a supplementary schedule of noncash investing and financing activities.Use the format illustrated in Exhibit 13-8.ash provided by operating activities is to be presented by the indirect method.

c.xplain how Purcells, Inc., achieved positive cash flows from operating activities, despite incurring a net loss for the year.

d.oes the company's financial position appear to be improving or deteriorating Explain.

e.oes Purcells, Inc., appear to be a company whose operations are growing or contracting Explain.

f.ssume that management agrees with your conclusions in parts c, d, and e.hat decisions should be made and what actions (if any) should be taken Explain.

Additional Information

The following information regarding the company's operations in 2015 is available from the company's accounting records:

1.arly in the year the company declared and paid a $4,000 cash dividend.

2.uring the year marketable securities costing $15,000 were sold for $11,000 cash, resulting in a $4,000 nonoperating loss.

3.he company purchased plant assets for $20,000, paying $8,000 in cash and issuing a note payable for the $12,000 balance.

4.uring the year the company repaid a $10,000 note payable, but incurred an additional $12,000 in long-term debt as described in 3, above.

5.he owners invested $35,000 cash in the business as a condition of the new loans described in paragraphs 3 and 4, above.

Instructions

a.repare a worksheet for a statement of cash flows, following the example shown in Exhibit 13-7.

b.repare a formal statement of cash flows for 2011, including a supplementary schedule of noncash investing and financing activities.Use the format illustrated in Exhibit 13-8.ash provided by operating activities is to be presented by the indirect method.

c.xplain how Purcells, Inc., achieved positive cash flows from operating activities, despite incurring a net loss for the year.

d.oes the company's financial position appear to be improving or deteriorating Explain.

e.oes Purcells, Inc., appear to be a company whose operations are growing or contracting Explain.

f.ssume that management agrees with your conclusions in parts c, d, and e.hat decisions should be made and what actions (if any) should be taken Explain.

التوضيح

Statement of cash flows is the kind of f...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255