Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 27

Financial Statement Analysis

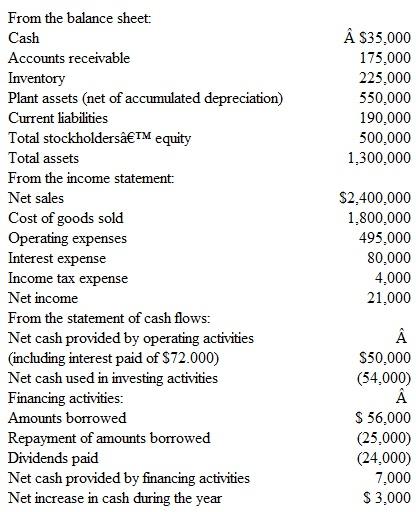

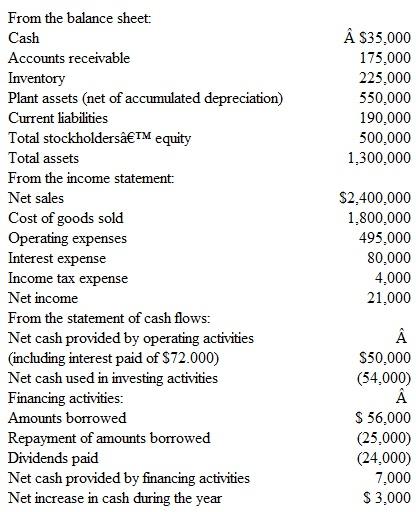

Shown below are selected data from the financial statements of Hamilton Stores, a retail lighting store.

Instructions

a.xplain how the interest expense shown in the income statement could be $80,000, when the interest payment appearing in the statement of cash flows is only $72,000.

b.ompute the following (round to one decimal place):

1.urrent ratio Working capital

2.uick ratio

3.orking capital

4.ebt ratio

c.omment on these measurements and evaluate Hamilton's short-term debt-paying ability.

d.ompute the following ratios (assume that the year-end amounts of total assets and total stockholders' equity also represent the average amounts throughout the year):

1.eturn on assets

2.eturn on equity

e.omment on the company's performance under these measurements.xplain why the return on assets and return on equity are so different.

f.iscuss ( 1 )the apparent safety of long-term creditors' claims and ( 2 ) the prospects for Hamilton Stores continuing its dividend payments at the present level.

Shown below are selected data from the financial statements of Hamilton Stores, a retail lighting store.

Instructions

a.xplain how the interest expense shown in the income statement could be $80,000, when the interest payment appearing in the statement of cash flows is only $72,000.

b.ompute the following (round to one decimal place):

1.urrent ratio Working capital

2.uick ratio

3.orking capital

4.ebt ratio

c.omment on these measurements and evaluate Hamilton's short-term debt-paying ability.

d.ompute the following ratios (assume that the year-end amounts of total assets and total stockholders' equity also represent the average amounts throughout the year):

1.eturn on assets

2.eturn on equity

e.omment on the company's performance under these measurements.xplain why the return on assets and return on equity are so different.

f.iscuss ( 1 )the apparent safety of long-term creditors' claims and ( 2 ) the prospects for Hamilton Stores continuing its dividend payments at the present level.

التوضيح

b. c. By traditional measures, the comp...

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255