Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 51

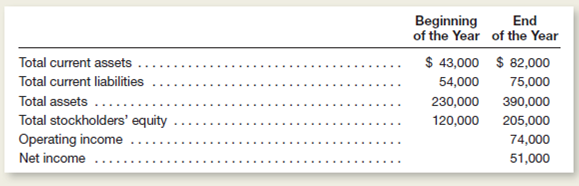

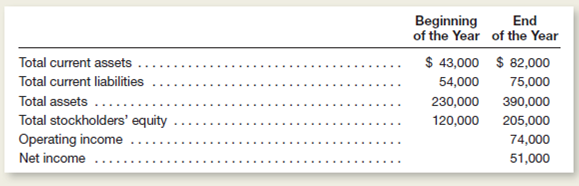

Rochester Corporation is engaged primarily in the business of manufacturing raincoats and umbrellas.hown below are selected information from a recent annual report.Dollar amounts are stated in thousands.)

The company has long-term liabilities that bear interest at annual rates ranging from 8 percent to 12 percent.

Instructions

a.ompute the company's current ratio at ( 1 ) the beginning of the year and ( 2 ) the end of the year.Carry to two decimal places.)

b.ompute the company's working capital at ( 1 ) the beginning of the year and ( 2 ) the end of the year.Express dollar amounts in thousands.)

c.s the company's short-term debt-paying ability improving or deteriorating

d.ompute the company's ( 1 ) return on average total assets and ( 2 ) return on average stockholders' equity.Round average assets and average equity to the nearest dollar and final computations to the nearest 1 percent.)

e.s an equity investor, do you think that Rochester's management is utilizing the company's resources in a reasonably efficient manner Explain.

The company has long-term liabilities that bear interest at annual rates ranging from 8 percent to 12 percent.

Instructions

a.ompute the company's current ratio at ( 1 ) the beginning of the year and ( 2 ) the end of the year.Carry to two decimal places.)

b.ompute the company's working capital at ( 1 ) the beginning of the year and ( 2 ) the end of the year.Express dollar amounts in thousands.)

c.s the company's short-term debt-paying ability improving or deteriorating

d.ompute the company's ( 1 ) return on average total assets and ( 2 ) return on average stockholders' equity.Round average assets and average equity to the nearest dollar and final computations to the nearest 1 percent.)

e.s an equity investor, do you think that Rochester's management is utilizing the company's resources in a reasonably efficient manner Explain.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255