Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 26

S.-based company, Global Products Inc., has wholly owned subsidiaries across the world.lobal Products Inc.ells products linked to major holidays in each country.

The president and board members of Global Products Inc.elieve that the managers of their wholly owned country-level subsidiaries are best motivated and rewarded with both annual salaries and annual bonuses.he bonuses are calculated as a predetermined percentage of pretax annual income.

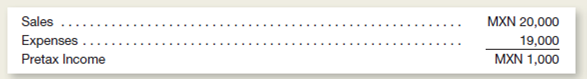

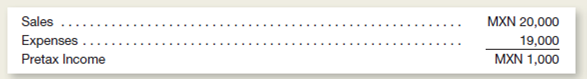

Senora Larza, the president of Global Products of Mexico, has worked hard this year to make her Mexican subsidiary profitable.he is looking forward to receiving her annual bonus, which is calculated as a predetermined percentage of this year's pretax annual income earned by Global Products of Mexico. condensed income statement for Global Products of Mexico for the most recent year is as follows (amounts in thousands of pesos):

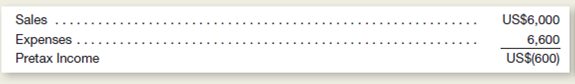

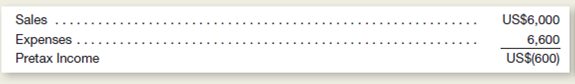

The U.S.eadquarters financial group translates each of its wholly owned subsidiary's results into U.S.ollars for evaluation.fter translating the Mexican pesos income statement into U.S.ollars, the condensed income statement for Global Products of Mexico is as follows (amounts in thousands of dollars):

Instructions

a.alculate the bonus amount based on (1) the Mexican pesos-based Pretax Income and (2) the U.S.ollar-based Pretax Income.ranslate the pesos-based bonus to U.S.ollars using a current exchange rate.

b.alculate the average exchange rate used to translate the Mexican pesos income statement into the U.S.ollar statement for the categories: (1) Sales and (2) Expenses.

c.efer to the answers in parts a and b.se those answers to explain why or how Global Products of Mexico's pretax income became a U.S.-dollar pretax loss.

d.xplain one reason why the dollar-based pretax income would be appropriate for evaluating Senora Larza and one reason why the pesos-based pretax income would be appropriate.hich would you choose and why

The president and board members of Global Products Inc.elieve that the managers of their wholly owned country-level subsidiaries are best motivated and rewarded with both annual salaries and annual bonuses.he bonuses are calculated as a predetermined percentage of pretax annual income.

Senora Larza, the president of Global Products of Mexico, has worked hard this year to make her Mexican subsidiary profitable.he is looking forward to receiving her annual bonus, which is calculated as a predetermined percentage of this year's pretax annual income earned by Global Products of Mexico. condensed income statement for Global Products of Mexico for the most recent year is as follows (amounts in thousands of pesos):

The U.S.eadquarters financial group translates each of its wholly owned subsidiary's results into U.S.ollars for evaluation.fter translating the Mexican pesos income statement into U.S.ollars, the condensed income statement for Global Products of Mexico is as follows (amounts in thousands of dollars):

Instructions

a.alculate the bonus amount based on (1) the Mexican pesos-based Pretax Income and (2) the U.S.ollar-based Pretax Income.ranslate the pesos-based bonus to U.S.ollars using a current exchange rate.

b.alculate the average exchange rate used to translate the Mexican pesos income statement into the U.S.ollar statement for the categories: (1) Sales and (2) Expenses.

c.efer to the answers in parts a and b.se those answers to explain why or how Global Products of Mexico's pretax income became a U.S.-dollar pretax loss.

d.xplain one reason why the dollar-based pretax income would be appropriate for evaluating Senora Larza and one reason why the pesos-based pretax income would be appropriate.hich would you choose and why

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255