Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

النسخة 16الرقم المعياري الدولي: 978-0077862381 تمرين 35

Foreign Currency Transactions

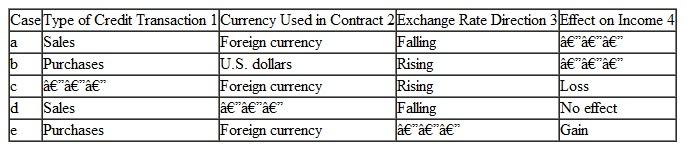

The following table summarizes the facts of five independent cases (labeled a through e) of U.S.ompanies engaging in credit transactions with foreign corporations while the foreign exchange rate is fluctuating:

Column

You are to fill in each blank space after evaluating the information about the case provided in the other three columns.he content of each column and the word or words that you should enter in the blank spaces are described as follows:

Column 1 indicates the type of credit transaction in which the U.S.ompany engaged with the foreign corporations.he answer entered in this column should be either Sales or Purchases.Column 2 indicates the currency in which the invoice price is stated.he answer may be either U.S.ollars or Foreign currency.Column 3 indicates the direction in which the foreign currency exchange rate has moved between the date of the credit transaction and the date of settlement.he answer entered in this column may be either Rising or Falling.Column 4 indicates the effect of the exchange rate fluctuation on the income of the American company.he answers entered in this column are to be selected from the following: Gain, Loss, or No effect.

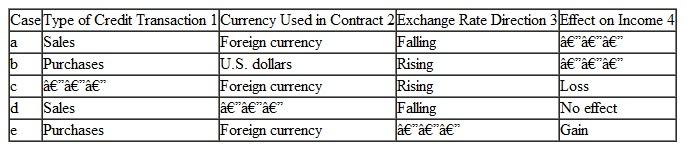

The following table summarizes the facts of five independent cases (labeled a through e) of U.S.ompanies engaging in credit transactions with foreign corporations while the foreign exchange rate is fluctuating:

Column

You are to fill in each blank space after evaluating the information about the case provided in the other three columns.he content of each column and the word or words that you should enter in the blank spaces are described as follows:

Column 1 indicates the type of credit transaction in which the U.S.ompany engaged with the foreign corporations.he answer entered in this column should be either Sales or Purchases.Column 2 indicates the currency in which the invoice price is stated.he answer may be either U.S.ollars or Foreign currency.Column 3 indicates the direction in which the foreign currency exchange rate has moved between the date of the credit transaction and the date of settlement.he answer entered in this column may be either Rising or Falling.Column 4 indicates the effect of the exchange rate fluctuation on the income of the American company.he answers entered in this column are to be selected from the following: Gain, Loss, or No effect.

التوضيح

Financial accounting 16th Edition by Jan Williams,Susan Haka,Mark Bettner ,Joseph Carcello

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255