Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

النسخة 10الرقم المعياري الدولي: 9781285439396

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

النسخة 10الرقم المعياري الدولي: 9781285439396 تمرين 30

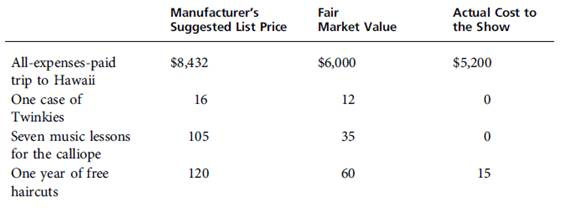

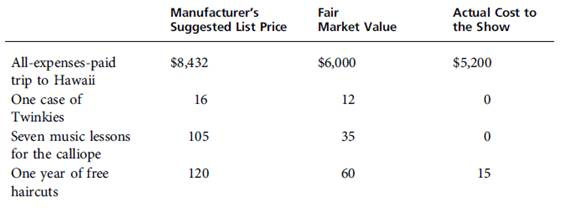

Edna is a well-paid executive with ADley, a firm that uses stock options and deferred compensation as well as high salaries to compensate its most successful employees. When Edna and Ron were divorced, Ron received the rights to a bundle of these deferred-compensation rights. Complete the following table, indicating the required tax results:

التوضيح

In this case, stock option also stands t...

Federal Tax Research 10th Edition by Steven Gill, Gerald Whittenburg, Roby Sawyers, Debra Sanders, William Raabe

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255