Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

النسخة 10الرقم المعياري الدولي: 978-1285439396

Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

النسخة 10الرقم المعياري الدولي: 978-1285439396 تمرين 4

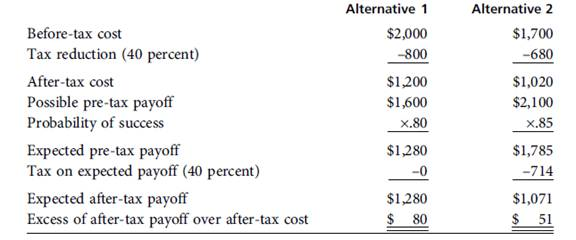

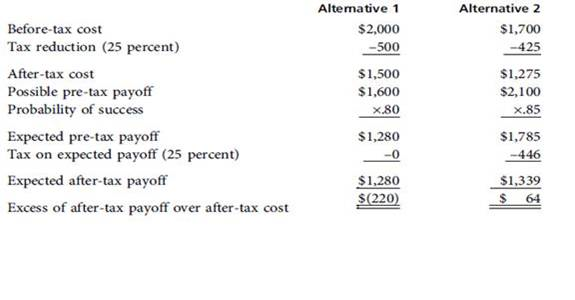

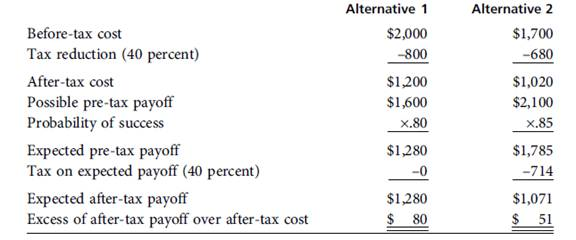

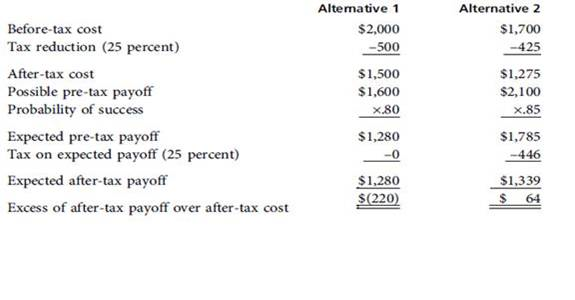

Examples 12-2 and 12-3 in this chapter concern a decision between the same two mutually exclusive alternatives under identical conditions, except for the corporation's marginal tax rate. In Example 12-2, in which the marginal tax rate was 40 percent, the conclusion was to accept Alternative 1. In Example 12-3, in which the marginal tax rate was 25 percent, the conclusion was to accept Alternative 2. Determine the marginal tax rate at which the two alternatives would be economic equivalents; i.e., they would "break even" and generate the same excess after-tax payoff over after-tax cost. Your answer should be based on all conditions and assumptions stated in Examples 12-2 and 12-3.

التوضيح

Economics of Tax Planning

The tax plann...

Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255