Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

النسخة 10الرقم المعياري الدولي: 978-1285439396

Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

النسخة 10الرقم المعياري الدولي: 978-1285439396 تمرين 22

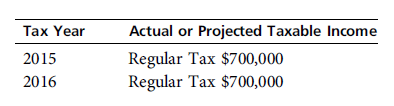

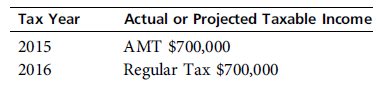

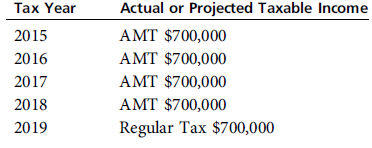

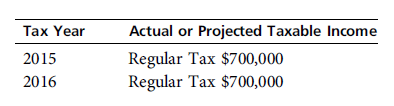

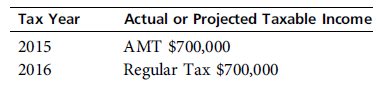

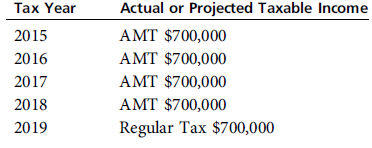

Should Harris Corporation accelerate $100,000 of gross income into 2014, its first year subject to the AMT Harris is subject to a 14 percent cost of capital. The corporate AMT rate is a flat 20 percent, and Harris Corporation exceeds the annual AMT exemption phase-out level of income.

a.

b.

.

a.

b.

.

التوضيح

Alternate minimum tax

When property is ...

Federal Tax Research 10th Edition by Roby Sawyers,William Raabe,Gerald Whittenburg,Steven Gill

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255