Introductory Econometrics 4th Edition by Jeffrey Wooldridge

النسخة 4الرقم المعياري الدولي: 978-0324660609

Introductory Econometrics 4th Edition by Jeffrey Wooldridge

النسخة 4الرقم المعياري الدولي: 978-0324660609 تمرين 13

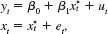

Consider a simple time series model where the explanatory variable has classical measurement error:

y t = 0 + 1 x t * + u t

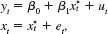

x t = x t * + e t ,

where u t has zero mean and is uncorrelated with x t * and e t. We observe y t and x t only. Assume that e t has zero mean and is uncorrelated with x t * and that x t * also has a zero mean (this last assumption is only to simplify the algebra).

(i) Write x t * = x t - e t and plug this into . Show that the error term in the new equation, say, t , is negatively correlated with x t if 1 0. What does this imply about the OLS estimator of 1 from the regression of y t on x t

. Show that the error term in the new equation, say, t , is negatively correlated with x t if 1 0. What does this imply about the OLS estimator of 1 from the regression of y t on x t

(ii) In addition to the previous assumptions, assume that u and e are uncorrelated with all past values of x t * and e t ; in particular, with x t-1 * and e t-1. Show that E(x t-1 v t ) = 0, where v t is the error term in the model from part (i).

(iii) Are x t and x t-1 likely to be correlated Explain.

(iv) What do parts (ii) and (iii) suggest as a useful strategy for consistently estimating

0 and 1

y t = 0 + 1 x t * + u t

x t = x t * + e t ,

where u t has zero mean and is uncorrelated with x t * and e t. We observe y t and x t only. Assume that e t has zero mean and is uncorrelated with x t * and that x t * also has a zero mean (this last assumption is only to simplify the algebra).

(i) Write x t * = x t - e t and plug this into

. Show that the error term in the new equation, say, t , is negatively correlated with x t if 1 0. What does this imply about the OLS estimator of 1 from the regression of y t on x t

. Show that the error term in the new equation, say, t , is negatively correlated with x t if 1 0. What does this imply about the OLS estimator of 1 from the regression of y t on x t (ii) In addition to the previous assumptions, assume that u and e are uncorrelated with all past values of x t * and e t ; in particular, with x t-1 * and e t-1. Show that E(x t-1 v t ) = 0, where v t is the error term in the model from part (i).

(iii) Are x t and x t-1 likely to be correlated Explain.

(iv) What do parts (ii) and (iii) suggest as a useful strategy for consistently estimating

0 and 1

التوضيح

(i). When is plugged into

Where,

Gi...

Introductory Econometrics 4th Edition by Jeffrey Wooldridge

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255