Essentials of Business Analytics 1st Edition by Jeffrey Camm,James Cochran,Michael Fry,Jeffrey Ohlmann ,David Anderson

النسخة 1الرقم المعياري الدولي: 978-1285187273

Essentials of Business Analytics 1st Edition by Jeffrey Camm,James Cochran,Michael Fry,Jeffrey Ohlmann ,David Anderson

النسخة 1الرقم المعياري الدولي: 978-1285187273 تمرين 17

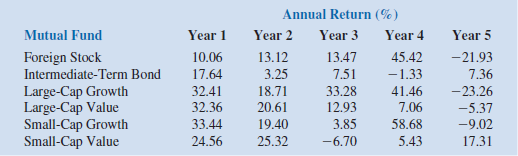

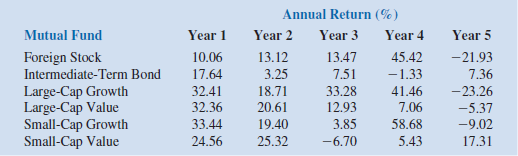

A second version of the Markowitz portfolio model maximizes expected return subject to a constraint that the variance of the portfolio must be less than or equal to some specified amount. Consider again the Hauck Financial Service data given in Section 10.4.

a. Construct this version of the Markowitz model for a maximum variance of 30.

b. Solve the model developed in part a.

a. Construct this version of the Markowitz model for a maximum variance of 30.

b. Solve the model developed in part a.

التوضيح

a.

The model can be represented as:

...

Essentials of Business Analytics 1st Edition by Jeffrey Camm,James Cochran,Michael Fry,Jeffrey Ohlmann ,David Anderson

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255