Essentials of Strategic Management: The Quest for Competitive Advantage 4th Edition by John Gamble, Arthur Thompson, Margaret Peteraf

النسخة 4الرقم المعياري الدولي: 978-0078112898

Essentials of Strategic Management: The Quest for Competitive Advantage 4th Edition by John Gamble, Arthur Thompson, Margaret Peteraf

النسخة 4الرقم المعياري الدولي: 978-0078112898 تمرين 6

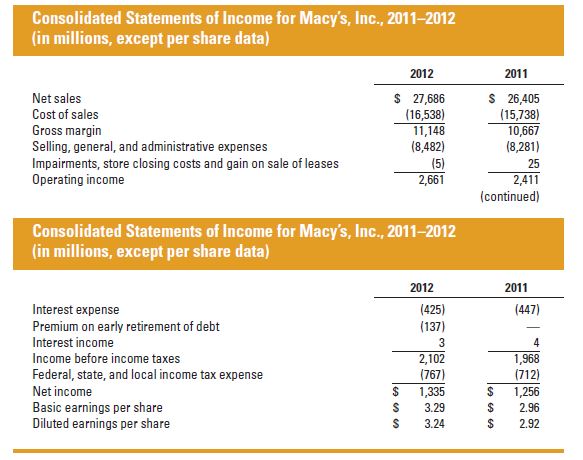

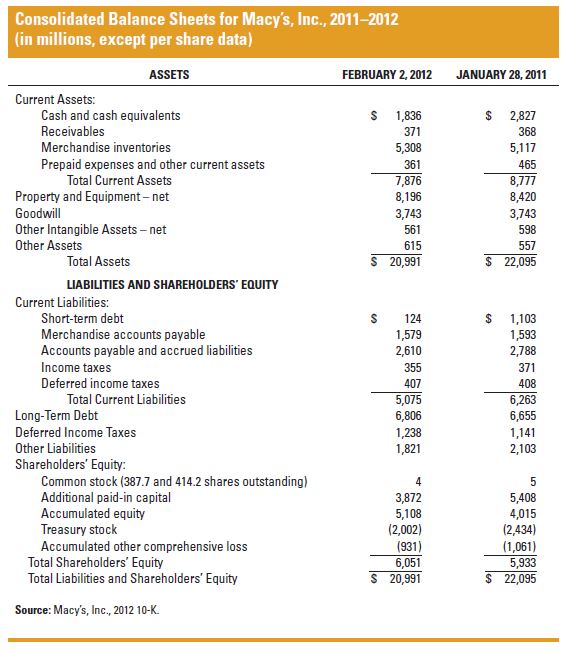

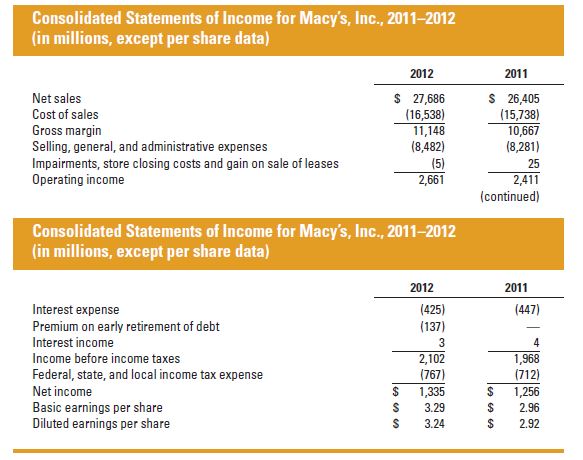

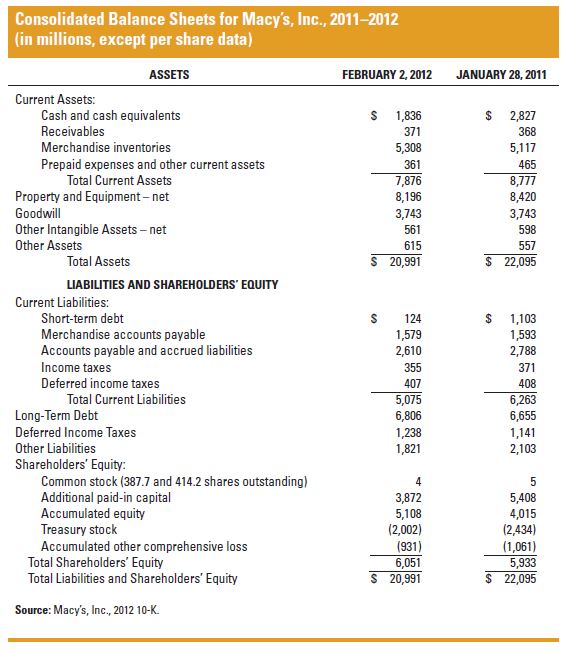

Using the financial ratios provided in the Appendix and the financial statement information for Macy's, Inc., below, calculate the following ratios for Macy's for both 2011 and 2012.

a. Gross profit margin.

b. Operating profit margin.

c. Net profit margin.

d. Times interest earned coverage.

e. Return on shareholders' equity.

f. Return on assets.

g. Debt-to-equity ratio.

h. Days of inventory.

i. Inventory turnover ratio.

j. Average collection period.

Based on these ratios, did Macy's financial performance improve, weaken, or remain about the same from 2011 to 2012?

a. Gross profit margin.

b. Operating profit margin.

c. Net profit margin.

d. Times interest earned coverage.

e. Return on shareholders' equity.

f. Return on assets.

g. Debt-to-equity ratio.

h. Days of inventory.

i. Inventory turnover ratio.

j. Average collection period.

Based on these ratios, did Macy's financial performance improve, weaken, or remain about the same from 2011 to 2012?

التوضيح

The financial soundness of a company can...

Essentials of Strategic Management: The Quest for Competitive Advantage 4th Edition by John Gamble, Arthur Thompson, Margaret Peteraf

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255