Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031 تمرين 1

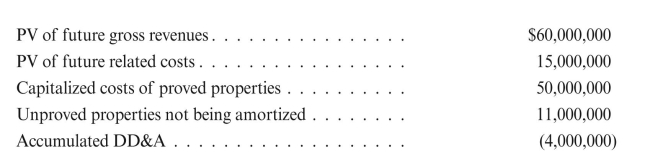

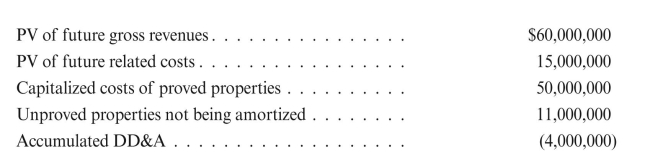

The Clarence Oil Company provides the following information for the year ended

December 31, 2017: REqUIRED:

REqUIRED:

a. Prepare a ceiling test and an entry, if necessary, for the write-off of capitalized

costs. Ignore income taxes.

b. Assuming the PV of future gross revenues is $70,000,000, repeat the requirements

for part a.

December 31, 2017:

REqUIRED:

REqUIRED:a. Prepare a ceiling test and an entry, if necessary, for the write-off of capitalized

costs. Ignore income taxes.

b. Assuming the PV of future gross revenues is $70,000,000, repeat the requirements

for part a.

التوضيح

The C Oil Company provide following deta...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255