Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031 تمرين 9

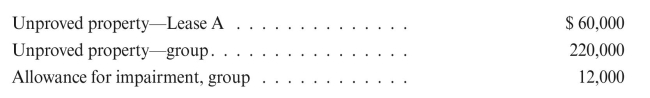

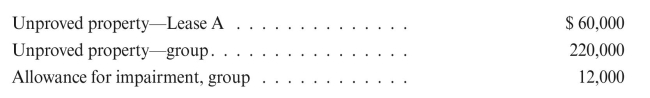

Aaron Energy Corporation has the following account balances at 12/31/15:  At 12/31/15, Lease A is considered to be 40% impaired. Aaron Energy's estimated

At 12/31/15, Lease A is considered to be 40% impaired. Aaron Energy's estimated

abandonment rate of insignificant unproved properties is 60% (i.e., the impairment

rate is 60%).

Prepare entries to record impairment.

At 12/31/15, Lease A is considered to be 40% impaired. Aaron Energy's estimated

At 12/31/15, Lease A is considered to be 40% impaired. Aaron Energy's estimatedabandonment rate of insignificant unproved properties is 60% (i.e., the impairment

rate is 60%).

Prepare entries to record impairment.

التوضيح

A Energy Corporation has the balances as...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255