Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031 تمرين 14

Exron Oil and Gas Company constructs a natural gas treatment facility in three

phases. The first phase was completed and placed into service on December 31, 2017.

The second phase was completed and placed into service on December 31, 2018,

and the third phase was completed and placed into service on December 31, 2019.

Exron is legally required to decommission the plant at the end of its useful life, which

is estimated to be 20 years from the date that the first phase went into service. The

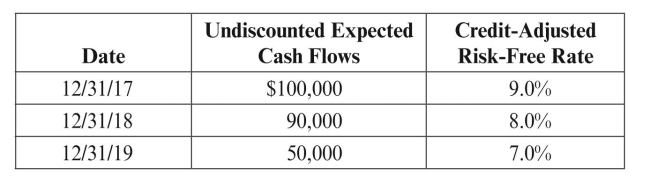

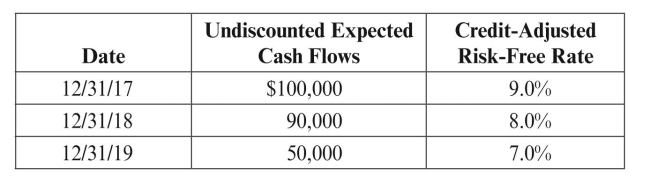

following schedule reflects the undiscounted expected cash flows and respective credit-

adjusted risk-free rates used to measure each portion of the liability through December

31, 2019. (The undiscounted cash flows below have already been adjusted for market

risk premium and inflation and already incorporate labor costs, overhead, and a profit

margin. They have not been discounted.) On December 31, 2019, the entity increases by 10% its estimate of undiscounted

On December 31, 2019, the entity increases by 10% its estimate of undiscounted

expected cash flows that were used to measure those portions of the liability recognized

on December 31, 2017 and December 31, 2018.

REqUIRED: Make the journal entries necessary to record the asset retirement

obligation under SFAS No. 143 and any DD&A expense related to the ARO and

accretion expense for the following dates:

a. December 31, 2017

b. December 31, 2018

c. December 31, 2019

phases. The first phase was completed and placed into service on December 31, 2017.

The second phase was completed and placed into service on December 31, 2018,

and the third phase was completed and placed into service on December 31, 2019.

Exron is legally required to decommission the plant at the end of its useful life, which

is estimated to be 20 years from the date that the first phase went into service. The

following schedule reflects the undiscounted expected cash flows and respective credit-

adjusted risk-free rates used to measure each portion of the liability through December

31, 2019. (The undiscounted cash flows below have already been adjusted for market

risk premium and inflation and already incorporate labor costs, overhead, and a profit

margin. They have not been discounted.)

On December 31, 2019, the entity increases by 10% its estimate of undiscounted

On December 31, 2019, the entity increases by 10% its estimate of undiscountedexpected cash flows that were used to measure those portions of the liability recognized

on December 31, 2017 and December 31, 2018.

REqUIRED: Make the journal entries necessary to record the asset retirement

obligation under SFAS No. 143 and any DD&A expense related to the ARO and

accretion expense for the following dates:

a. December 31, 2017

b. December 31, 2018

c. December 31, 2019

التوضيح

Interpreting of Cash flows:-

The balanc...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255