Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031 تمرين 21

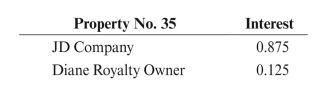

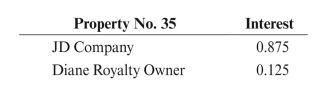

Big John Oil Company purchased 100 barrels of oil from JD Operator. The gross value

of the oil was $5,000. The severance tax rate was 4%. Give the entry to record revenue

for JD, assuming Big John disbursed the royalty and remitted all taxes, and assuming a

division order as follows:

of the oil was $5,000. The severance tax rate was 4%. Give the entry to record revenue

for JD, assuming Big John disbursed the royalty and remitted all taxes, and assuming a

division order as follows:

التوضيح

BJOC purchased 100 barrels of ...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255