Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031 تمرين 16

Kyle Company's production from each well on Lease C and Lease D is estimated

based on a 24-hour test. Oil produced from each well on each lease is commingled

and measured before leaving each lease. The oil produced from each lease is then

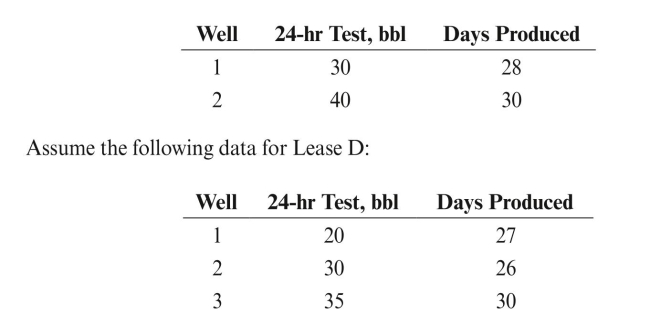

commingled and delivered to a central tank battery. Assume the following data

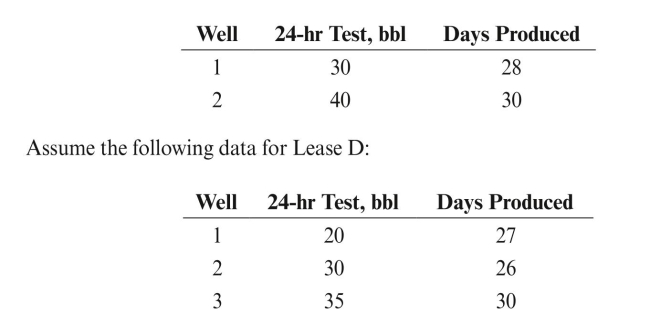

for Lease C: Measured production is 2,000 barrels from Lease C and 2,280 barrels from Lease D.

Measured production is 2,000 barrels from Lease C and 2,280 barrels from Lease D.

After treatment at the central tank battery, 4,100 barrels are sold.

REqUIRED: Allocate the 4,100 barrels sold to each lease and then to each well in a

two-stage allocation. Round the ratios to three decimal places.

based on a 24-hour test. Oil produced from each well on each lease is commingled

and measured before leaving each lease. The oil produced from each lease is then

commingled and delivered to a central tank battery. Assume the following data

for Lease C:

Measured production is 2,000 barrels from Lease C and 2,280 barrels from Lease D.

Measured production is 2,000 barrels from Lease C and 2,280 barrels from Lease D.After treatment at the central tank battery, 4,100 barrels are sold.

REqUIRED: Allocate the 4,100 barrels sold to each lease and then to each well in a

two-stage allocation. Round the ratios to three decimal places.

التوضيح

Step 1:

Allocate sales from tank batter...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255