Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031 تمرين 16

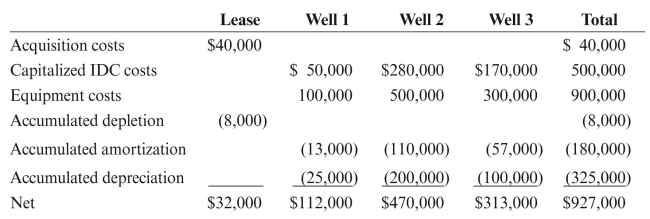

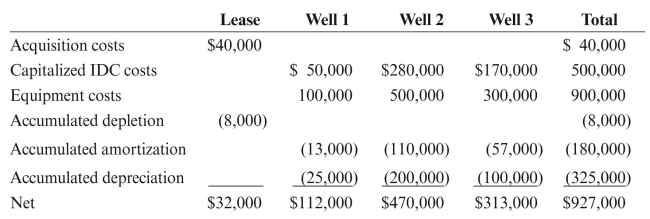

Cowboy Oil Company, an integrated producer, has an unproved property with

acquisition and capitalized G&G costs of $35,000. Cowboy also has a proved property

with the following costs: Determine the amount of the tax loss in each of the following situations:

Determine the amount of the tax loss in each of the following situations:

a. Cowboy drilled a dry hole on the unproved property costing $250,000 for IDC and

$60,000 for equipment. Equipment worth $10,000 was salvaged.

b. As a result of the dry hole, Cowboy decided to abandon the unproved property.

c. Cowboy abandoned Well 1 on the proved property. Wells 2 and 3 are still

producing. Assume that the wells had been depreciated separately.

d. Assume that instead of the circumstances in part c, Cowboy abandoned the entire

lease, and that equipment worth $27,000 was salvaged.

acquisition and capitalized G&G costs of $35,000. Cowboy also has a proved property

with the following costs:

Determine the amount of the tax loss in each of the following situations:

Determine the amount of the tax loss in each of the following situations:a. Cowboy drilled a dry hole on the unproved property costing $250,000 for IDC and

$60,000 for equipment. Equipment worth $10,000 was salvaged.

b. As a result of the dry hole, Cowboy decided to abandon the unproved property.

c. Cowboy abandoned Well 1 on the proved property. Wells 2 and 3 are still

producing. Assume that the wells had been depreciated separately.

d. Assume that instead of the circumstances in part c, Cowboy abandoned the entire

lease, and that equipment worth $27,000 was salvaged.

التوضيح

C an integrated producer has the followi...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255