Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031 تمرين 10

Hein Oil Company, a successful efforts company, owns 100% of the working interest in

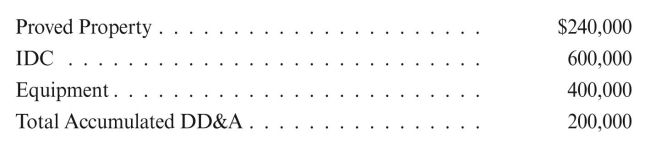

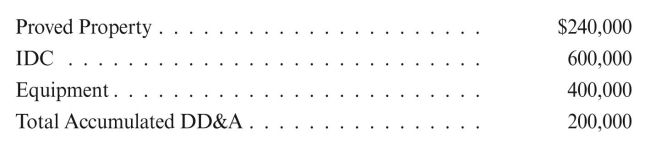

a proved property that has the following capitalized costs: A 1/8 royalty on the property is owned by Sammy Jones. Hein sells the working interest

A 1/8 royalty on the property is owned by Sammy Jones. Hein sells the working interest

for $1,200,000 and retains a production payment interest of $300,000. The production

payment interest is payable from the proceeds from 30% of the working interest

share of production. The fair market value of the entire original working interest is

$1,500,000.

Prepare the journal entry by Hein to record the above transaction, assuming that

payment of the production payment interest is not reasonably assured.

a proved property that has the following capitalized costs:

A 1/8 royalty on the property is owned by Sammy Jones. Hein sells the working interest

A 1/8 royalty on the property is owned by Sammy Jones. Hein sells the working interestfor $1,200,000 and retains a production payment interest of $300,000. The production

payment interest is payable from the proceeds from 30% of the working interest

share of production. The fair market value of the entire original working interest is

$1,500,000.

Prepare the journal entry by Hein to record the above transaction, assuming that

payment of the production payment interest is not reasonably assured.

التوضيح

Successful efforts method

The corporati...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255