Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

النسخة 5الرقم المعياري الدولي: 9781630181031 تمرين 7

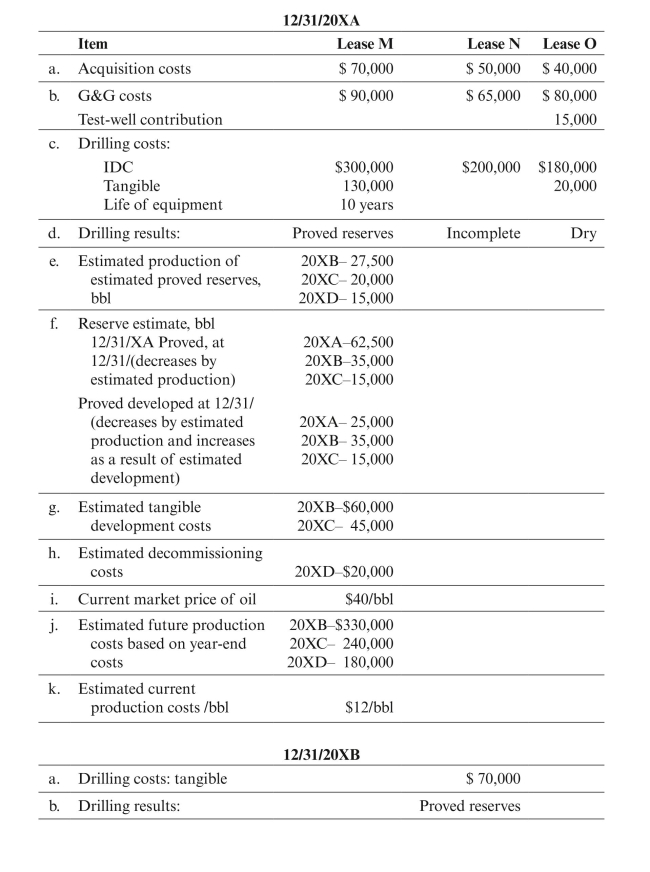

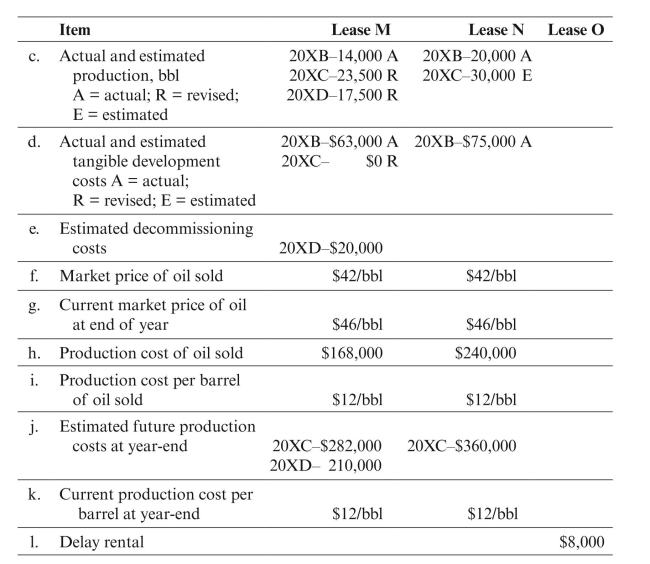

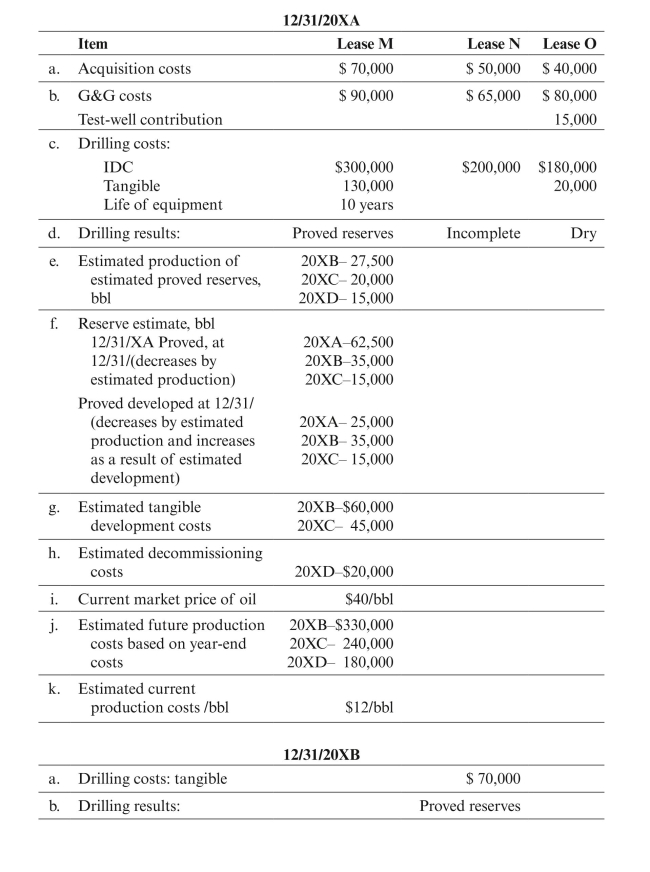

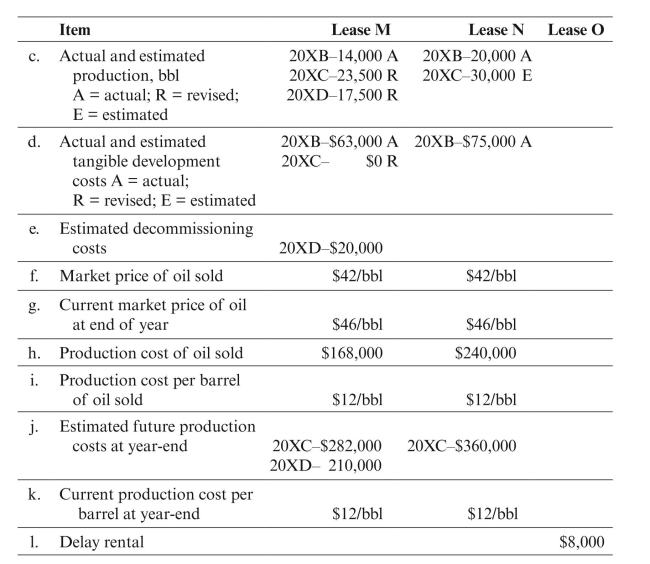

Tiger Oil began operations on January 1, 20XA. Assume the following facts about

Tiger's first two years of operations. All reserve and production quantities apply only to

Tiger Oil's interest. Ignore the computations for future income tax.

Assume a tax rate of 40% and that Tiger does not qualify for percentage depletion

Assume a tax rate of 40% and that Tiger does not qualify for percentage depletion

because it is an integrated producer. Ignore deferred taxes and the alternative

minimum tax.

a. Prepare the required disclosures under SFAS No. 69, assuming Tiger is a successful

efforts company.

b. Assume instead that Tiger is a full cost company that amortizes all possible costs.

Prepare only those disclosures that would differ under full cost compared to

successful efforts.

Tiger's first two years of operations. All reserve and production quantities apply only to

Tiger Oil's interest. Ignore the computations for future income tax.

Assume a tax rate of 40% and that Tiger does not qualify for percentage depletion

Assume a tax rate of 40% and that Tiger does not qualify for percentage depletionbecause it is an integrated producer. Ignore deferred taxes and the alternative

minimum tax.

a. Prepare the required disclosures under SFAS No. 69, assuming Tiger is a successful

efforts company.

b. Assume instead that Tiger is a full cost company that amortizes all possible costs.

Prepare only those disclosures that would differ under full cost compared to

successful efforts.

التوضيح

T Oil began operations on January 1, 20X...

Fundamentals of Oil & Gas Accounting 5th Edition by Rebecca Gallun, Charlotte Wright

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255