Contemporary Business 14th Edition by Louis Boone, David Kurtz

النسخة 14الرقم المعياري الدولي: 9780470531297

Contemporary Business 14th Edition by Louis Boone, David Kurtz

النسخة 14الرقم المعياري الدولي: 9780470531297 تمرين 6

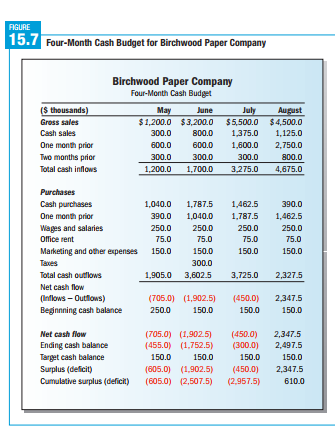

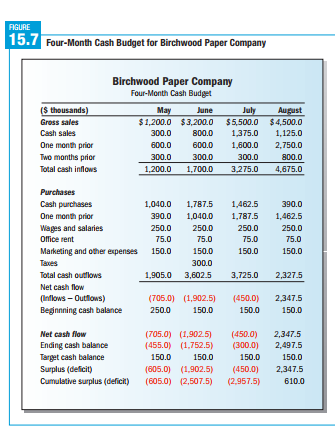

Adapting the format of Figure 15.7, prepare on a sheet of paper your personal cash budget for next month. Keep in mind the following suggestions as you prepare your budget:

a. Cash inflows. Your sources of cash would include your payroll earnings, if any; gifts; scholarship monies; tax refunds; dividends and interest; and income from self-

b. Cash outflows. When estimating next month's cash outflows, include any of the following that may apply to your situation:

i. Household expenses (rent or mortgage, utilities, maintenance, home furnishings, telephone/cell phone, cable TV, household supplies, groceries)

ii. Education (tuition, fees, textbooks, supplies)

iii. Work (transportation, clothing)

iv. Clothing (purchases, cleaning, laundry)

v. Automobile (auto payments, fuel, repairs) or other transportation (bus, train)

vi. Insurance premiums

• Renters (or homeowners)

• Auto

• Health

• Life

vii. Taxes (income, real estate, Social Security, Medicare)

viii. Savings and investments

ix. Entertainment/recreation (health club, vacation/travel, dining, movies)

x. Debt (credit cards, installment loans)

xi. Miscellaneous (charitable contributions, child care, gifts, medical expenses)

c. Beginning cash balance. This amount could be based on a minimum cash balance you keep in your checking account and should include only the cash available for your use; therefore, money such as that invested in retirement plans should not be included.employment.

a. Cash inflows. Your sources of cash would include your payroll earnings, if any; gifts; scholarship monies; tax refunds; dividends and interest; and income from self-

b. Cash outflows. When estimating next month's cash outflows, include any of the following that may apply to your situation:

i. Household expenses (rent or mortgage, utilities, maintenance, home furnishings, telephone/cell phone, cable TV, household supplies, groceries)

ii. Education (tuition, fees, textbooks, supplies)

iii. Work (transportation, clothing)

iv. Clothing (purchases, cleaning, laundry)

v. Automobile (auto payments, fuel, repairs) or other transportation (bus, train)

vi. Insurance premiums

• Renters (or homeowners)

• Auto

• Health

• Life

vii. Taxes (income, real estate, Social Security, Medicare)

viii. Savings and investments

ix. Entertainment/recreation (health club, vacation/travel, dining, movies)

x. Debt (credit cards, installment loans)

xi. Miscellaneous (charitable contributions, child care, gifts, medical expenses)

c. Beginning cash balance. This amount could be based on a minimum cash balance you keep in your checking account and should include only the cash available for your use; therefore, money such as that invested in retirement plans should not be included.employment.

التوضيح

Following is the cas...

Contemporary Business 14th Edition by Louis Boone, David Kurtz

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255