Deck 8: Non-Cash Impacts on Financial Statements

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/17

Play

Full screen (f)

Deck 8: Non-Cash Impacts on Financial Statements

1

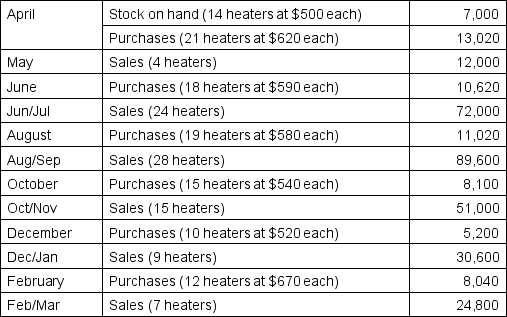

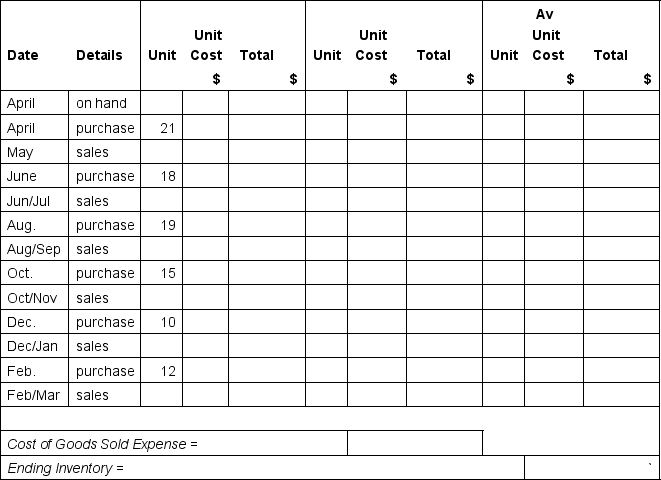

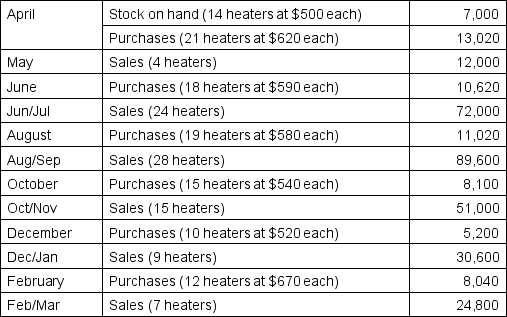

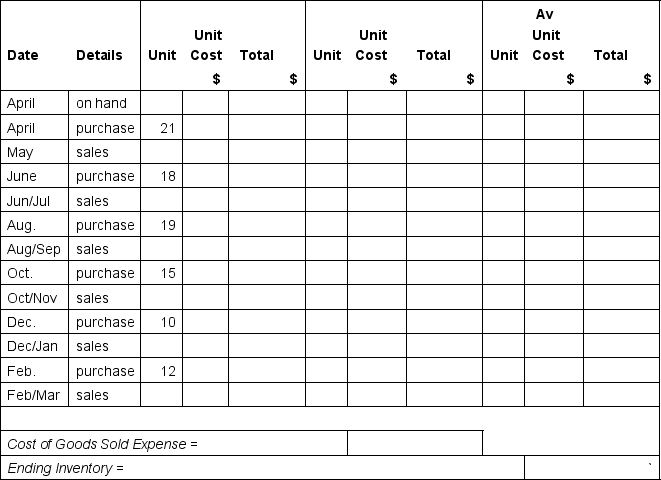

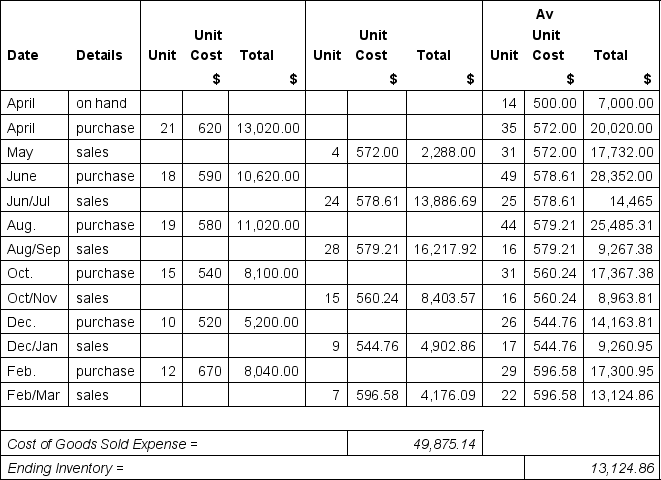

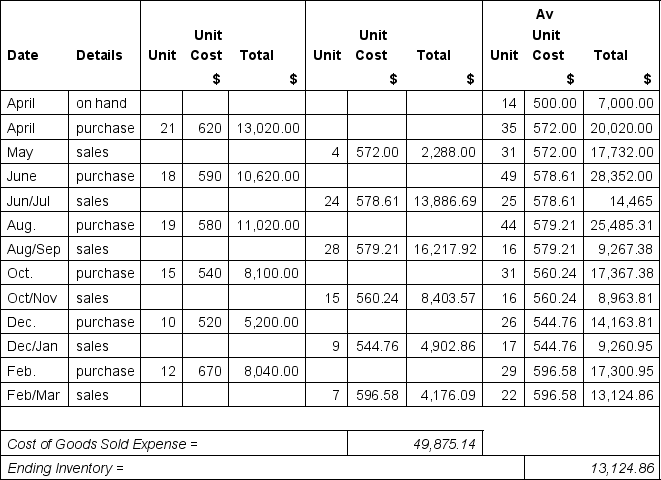

Tom Finger provides you with the following information in regard to his inventory for the 20X1 year (note that purchases are always made on the first day of the month before any sales):

a What would Tom's Cost of goods sold expense and Ending inventory value be if he used the perpetual inventory method,valuing his inventory at weighted average cost? (Complete the WAC inventory form given below - the first 3 columns have been completed for you. )

a What would Tom's Cost of goods sold expense and Ending inventory value be if he used the perpetual inventory method,valuing his inventory at weighted average cost? (Complete the WAC inventory form given below - the first 3 columns have been completed for you. )

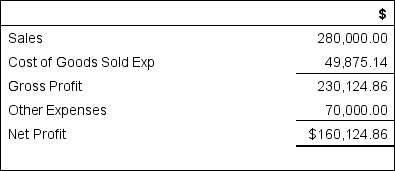

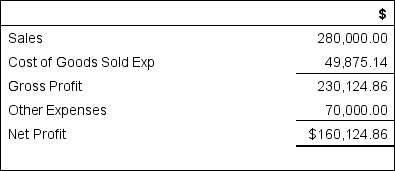

b Prepare an abbreviated Income Statement for 20X1 using the above weighted average cost figures,and assuming other expenses are $70,000.

c What would be 3 advantages in Tom's situation of using the:

i perpetual inventory weighted average cost for his business?

ii existing (periodic)system?

WAC inventory form

a What would Tom's Cost of goods sold expense and Ending inventory value be if he used the perpetual inventory method,valuing his inventory at weighted average cost? (Complete the WAC inventory form given below - the first 3 columns have been completed for you. )

a What would Tom's Cost of goods sold expense and Ending inventory value be if he used the perpetual inventory method,valuing his inventory at weighted average cost? (Complete the WAC inventory form given below - the first 3 columns have been completed for you. )b Prepare an abbreviated Income Statement for 20X1 using the above weighted average cost figures,and assuming other expenses are $70,000.

c What would be 3 advantages in Tom's situation of using the:

i perpetual inventory weighted average cost for his business?

ii existing (periodic)system?

WAC inventory form

a

b

b

c i Perpetual inventory weighted average cost.

c i Perpetual inventory weighted average cost.

Lower cost of goods sold,so higher gross profit and net profit.

Higher ending inventory,which makes the Balance Sheet look better.

Weighted average tends to smooth the effect of large price increases or decreases.

ii Existing (periodic).

Higher cost of goods sold,so lower gross profit and net profit,so lower taxes.

Less time and cost of recording each item in and out.

Previous years' results are more comparable if periodic has been used previously.

b

b c i Perpetual inventory weighted average cost.

c i Perpetual inventory weighted average cost.Lower cost of goods sold,so higher gross profit and net profit.

Higher ending inventory,which makes the Balance Sheet look better.

Weighted average tends to smooth the effect of large price increases or decreases.

ii Existing (periodic).

Higher cost of goods sold,so lower gross profit and net profit,so lower taxes.

Less time and cost of recording each item in and out.

Previous years' results are more comparable if periodic has been used previously.

2

Which inventory system,periodic or perpetual,would you use for:

a a large supermarket such as Pak'nSave

b a small corner dairy.

State 3 reasons why for each.

a a large supermarket such as Pak'nSave

b a small corner dairy.

State 3 reasons why for each.

a Perpetual system.

• The large volume of sales would justify and offset the cost of setting up barcode scanners and electronically linked tills.

• The manager cannot physically keep an eye on all stock and monitor the various stock levels,so would rely on computer-generated reports.

• The computer records could be compared with physical counts of inventory to determine if any stock is lost,damaged or missing.

b Periodic system.

• The cost of setting up barcode scanners etc.would not be justified by the level of sales.

• The manager does not need a computer to tell him/her what his/her stock levels are - the manager can walk around the dairy and count them.

• Likewise,the manager can probably tell if stock is lost,damaged or missing,as he/she views it all each day.

• The large volume of sales would justify and offset the cost of setting up barcode scanners and electronically linked tills.

• The manager cannot physically keep an eye on all stock and monitor the various stock levels,so would rely on computer-generated reports.

• The computer records could be compared with physical counts of inventory to determine if any stock is lost,damaged or missing.

b Periodic system.

• The cost of setting up barcode scanners etc.would not be justified by the level of sales.

• The manager does not need a computer to tell him/her what his/her stock levels are - the manager can walk around the dairy and count them.

• Likewise,the manager can probably tell if stock is lost,damaged or missing,as he/she views it all each day.

3

Gary Gilmour began business on 1 January 20X1,with a 31 December balance date.All figures are GST-exclusive.

On that day he purchased a new factory machine for making canned soup for $42,000 from McWaters Ltd.

Freight of $900 and installation expenses of $1,100 were paid to get the machine into Gary's factory and ready for use.

Gary had to employ a repairman to get the machine operating correctly,as it was found to have been dropped accidentally by one of his employees on delivery,and needed a few things fixing and replaced as a result.The repairs and parts replaced cost $1,000.

The machinery has an estimated life of 20,000 hours.

The hours the machinery is estimated to be used annually are:

Year 1 2,000 hours

Year 2 2,500 hours

Year 3 3,000 hours

Year 4 4,500 hours

Year 5 4,000 hours

Gary also had a Nissan Maxima turbo vehicle,which he decided to register as a business vehicle,at a cost of $40,000 on 1 January 20X1.

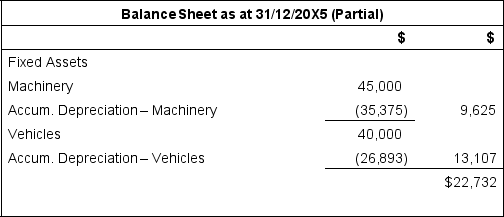

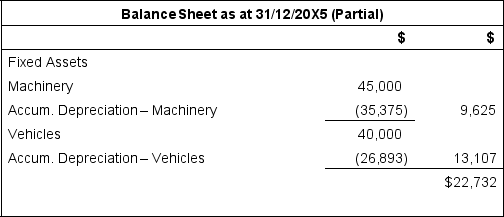

a Show the appearance of the Fixed assets section of the Balance Sheet as at 31 December 20X5,assuming:

• actual usage equals estimated usage for the machine

• the units of use method is used

• the vehicle is depreciated at 20% diminishing value.

Round all amounts to the nearest whole dollar.Include any relevant subtotals.

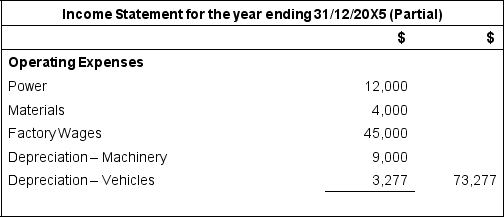

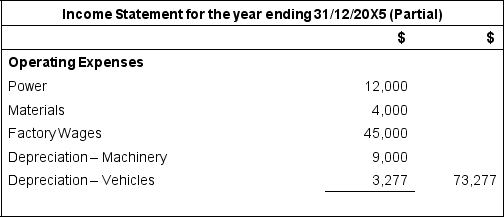

b Show the appearance of the relevant section of the Income Statement for 31 December 20X5,assuming that:

• actual usage equals estimated usage

• Gary uses only one 'Operating expenses' section for all depreciation amounts

• other operating expenses are: Power $12,000,Materials $4,000,and Factory wages $45,000,which remain constant each year.

Include any relevant subtotals.

c Suppose Gary had the option of choosing the diminishing value method for the machinery depreciation at a rate of 20%,or straight line depreciation with an estimated residual value of $5,000 and a useful life of 10 years.Recalculate annual depreciation for years 20X1-20X5,and the accumulated depreciation as at the end of year 31/12/20X5.

d Assuming that any of the 3 depreciation methods (units of use,diminishing value,and straight line)as above are acceptable for tax purposes,state 1 advantage of using each of the 3 methods.

On that day he purchased a new factory machine for making canned soup for $42,000 from McWaters Ltd.

Freight of $900 and installation expenses of $1,100 were paid to get the machine into Gary's factory and ready for use.

Gary had to employ a repairman to get the machine operating correctly,as it was found to have been dropped accidentally by one of his employees on delivery,and needed a few things fixing and replaced as a result.The repairs and parts replaced cost $1,000.

The machinery has an estimated life of 20,000 hours.

The hours the machinery is estimated to be used annually are:

Year 1 2,000 hours

Year 2 2,500 hours

Year 3 3,000 hours

Year 4 4,500 hours

Year 5 4,000 hours

Gary also had a Nissan Maxima turbo vehicle,which he decided to register as a business vehicle,at a cost of $40,000 on 1 January 20X1.

a Show the appearance of the Fixed assets section of the Balance Sheet as at 31 December 20X5,assuming:

• actual usage equals estimated usage for the machine

• the units of use method is used

• the vehicle is depreciated at 20% diminishing value.

Round all amounts to the nearest whole dollar.Include any relevant subtotals.

b Show the appearance of the relevant section of the Income Statement for 31 December 20X5,assuming that:

• actual usage equals estimated usage

• Gary uses only one 'Operating expenses' section for all depreciation amounts

• other operating expenses are: Power $12,000,Materials $4,000,and Factory wages $45,000,which remain constant each year.

Include any relevant subtotals.

c Suppose Gary had the option of choosing the diminishing value method for the machinery depreciation at a rate of 20%,or straight line depreciation with an estimated residual value of $5,000 and a useful life of 10 years.Recalculate annual depreciation for years 20X1-20X5,and the accumulated depreciation as at the end of year 31/12/20X5.

d Assuming that any of the 3 depreciation methods (units of use,diminishing value,and straight line)as above are acceptable for tax purposes,state 1 advantage of using each of the 3 methods.

a

Machinery (42,000 + 900 + 1,100 + 1,000)/ 20,000 hours = $2.25 per hour

20X1 2,000 hours x 2.25 = $4,500

20X2 2,500 hours x 2.25 = $5,000

20X3 3,000 hours x 2.25 = $6,750

20X4 4,500 hours x 2.25 = $10,125

20X5 4,000 hours x 2.25 = $9,000

Accumulated depreciation $35,375

Vehicle

20X1 (40,000 - 0)x 20% = $8,000

20X2 (40,000 - 8,000)x 20% = $6,400

20X3 (40,000 - 14,400)x 20% = $5,120

20X4 (40,000 - 19,520)x 20% = $4,096

20X5 (40,000 - 23,616)x 20% = $3,277

Accumulated depreciation $26,893

b

b

c

c

Machinery - Diminishing value of 20%

31/12/20X1 (45,000 - 0)x 20% = $9,000

31/12/20X2 (45,000 - 9000)x 20% = $7,200

31/12/20X3 (45,000 - 16200)x 20% = $5,760

31/12/20X4 (45,000 - 21960)x 20% = $4,608

31/12/20X5 (45,000 - 26568)x 20% = $3,686

Accumulated depreciation $30,254

Machinery - Units of use

31/12/20X1 2,000 hours x 2.25 = $4,500

31/12/20X2 2,500 hours x 2.25 = $5,000

31/12/20X3 3,000 hours x 2.25 = $6,750

31/12/20X4 4,500 hours x 2.25 = $10,125

31/12/20X5 4,000 hours x 2.25 = $9,000

Accumulated depreciation $35,375

Machinery - Straight line of 10% ($5,000 residual value,useful life 10 years)

31/12/20X1 (45,000 - 5000)x 10% = $4,000

31/12/20X2 (45,000 - 5000)x 10% = $4,000

31/12/20X3 (45,000 - 5000)x 10% = $4,000

31/12/20X4 (45,000 - 5000)x 10% = $4,000

31/12/20X5 (45,000 - 5000)x 10% = $4,000

Accumulated depreciation $20,000

d The diminishing value method will give the lowest net profit,and therefore the lowest tax expense,in the early years of the asset's life.

The units of use method will give a depreciation expense each year most closely related to the usage of the asset (and presumably the benefits of its use).

The straight line method will give the highest net profit figures,as it will give the lowest depreciation expense each year;it is also the easiest to calculate.

Machinery (42,000 + 900 + 1,100 + 1,000)/ 20,000 hours = $2.25 per hour

20X1 2,000 hours x 2.25 = $4,500

20X2 2,500 hours x 2.25 = $5,000

20X3 3,000 hours x 2.25 = $6,750

20X4 4,500 hours x 2.25 = $10,125

20X5 4,000 hours x 2.25 = $9,000

Accumulated depreciation $35,375

Vehicle

20X1 (40,000 - 0)x 20% = $8,000

20X2 (40,000 - 8,000)x 20% = $6,400

20X3 (40,000 - 14,400)x 20% = $5,120

20X4 (40,000 - 19,520)x 20% = $4,096

20X5 (40,000 - 23,616)x 20% = $3,277

Accumulated depreciation $26,893

b

b c

cMachinery - Diminishing value of 20%

31/12/20X1 (45,000 - 0)x 20% = $9,000

31/12/20X2 (45,000 - 9000)x 20% = $7,200

31/12/20X3 (45,000 - 16200)x 20% = $5,760

31/12/20X4 (45,000 - 21960)x 20% = $4,608

31/12/20X5 (45,000 - 26568)x 20% = $3,686

Accumulated depreciation $30,254

Machinery - Units of use

31/12/20X1 2,000 hours x 2.25 = $4,500

31/12/20X2 2,500 hours x 2.25 = $5,000

31/12/20X3 3,000 hours x 2.25 = $6,750

31/12/20X4 4,500 hours x 2.25 = $10,125

31/12/20X5 4,000 hours x 2.25 = $9,000

Accumulated depreciation $35,375

Machinery - Straight line of 10% ($5,000 residual value,useful life 10 years)

31/12/20X1 (45,000 - 5000)x 10% = $4,000

31/12/20X2 (45,000 - 5000)x 10% = $4,000

31/12/20X3 (45,000 - 5000)x 10% = $4,000

31/12/20X4 (45,000 - 5000)x 10% = $4,000

31/12/20X5 (45,000 - 5000)x 10% = $4,000

Accumulated depreciation $20,000

d The diminishing value method will give the lowest net profit,and therefore the lowest tax expense,in the early years of the asset's life.

The units of use method will give a depreciation expense each year most closely related to the usage of the asset (and presumably the benefits of its use).

The straight line method will give the highest net profit figures,as it will give the lowest depreciation expense each year;it is also the easiest to calculate.

4

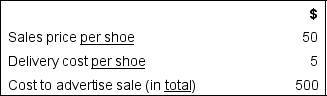

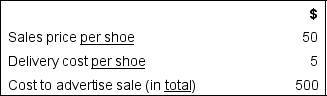

Suppose by the end of the year,there are 100 shoes remaining unsold at Jax Shoes.Jax estimates the following figures in relation to their sale:

Assume that Jax can only sell the remaining shoes delivery-free to the customer.

Assume that Jax can only sell the remaining shoes delivery-free to the customer.

At what amount should the shoes be valued on Jax's Balance Sheet,and why? (Calculate the amount and state the accounting rule or standard that applies. )

Assume that Jax can only sell the remaining shoes delivery-free to the customer.

Assume that Jax can only sell the remaining shoes delivery-free to the customer.At what amount should the shoes be valued on Jax's Balance Sheet,and why? (Calculate the amount and state the accounting rule or standard that applies. )

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

5

Explain the distinction between capital expenditure and revenue expenditure,giving 3 examples of each type.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

6

a Briefly define a 'contingency'.

b What are the main requirements of NZ IAS 37 in regard to disclosure of contingencies,and why are they disclosed?

b What are the main requirements of NZ IAS 37 in regard to disclosure of contingencies,and why are they disclosed?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

7

According to NZ IAS 36,how often should impairment tests be carried out,where should impairment write-downs be shown (in which financial statement)and how should they be described?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

8

Define 'amortisation' and distinguish it from 'depreciation'.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

9

Define and explain the disclosure,if relevant,of each of the following:

a Accumulated depreciation

b Book value

c Depreciable amount

d Depreciation expense

e Useful life

f Residual value

a Accumulated depreciation

b Book value

c Depreciable amount

d Depreciation expense

e Useful life

f Residual value

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

10

Dennis and Margaret operate a large petrol station,which runs 24 hours a day,employs 30 people and is the busiest petrol station in the Wellington region.

They have installed a computerised perpetual inventory accounting system,but are unsure as to the difference between FIFO and WAC.

Explain the difference between FIFO and WAC,and recommend which is best for Dennis and Margaret and why.

They have installed a computerised perpetual inventory accounting system,but are unsure as to the difference between FIFO and WAC.

Explain the difference between FIFO and WAC,and recommend which is best for Dennis and Margaret and why.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

11

a What are the 3 requirements from NZ IAS 37 for the recognition of a provision?

b How does this differ from the requirements for a liability?

c Do the following traditionally-named provisions fit this definition?

• Provision for doubtful debts.

• Provision for depreciation.

d Given the answer to question c,are the terms in c valid?

b How does this differ from the requirements for a liability?

c Do the following traditionally-named provisions fit this definition?

• Provision for doubtful debts.

• Provision for depreciation.

d Given the answer to question c,are the terms in c valid?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

12

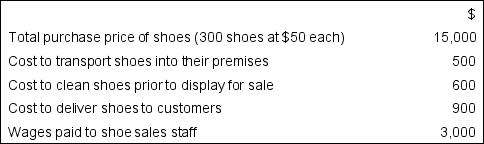

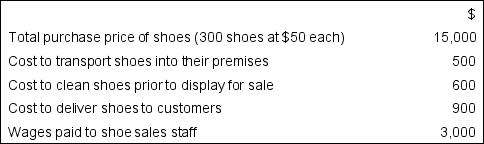

Jax Shoes had the following costs relating to their inventory and sales:

Calculate the cost of their inventory (shoes)according to NZ IAS 2.

Calculate the cost of their inventory (shoes)according to NZ IAS 2.

Calculate the cost of their inventory (shoes)according to NZ IAS 2.

Calculate the cost of their inventory (shoes)according to NZ IAS 2.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

13

The cost of inventories includes:

A the cost to purchase them

B the costs to deliver them into the purchaser's factory

C the costs to get the inventory ready for sale

D all of the above

A the cost to purchase them

B the costs to deliver them into the purchaser's factory

C the costs to get the inventory ready for sale

D all of the above

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

14

Depreciation measures: A the drop in market value of an asset

B funds set aside for future replacement of an asset

C the spreading of the cost of an asset as an expense over each year of its useful life

D all the above

B funds set aside for future replacement of an asset

C the spreading of the cost of an asset as an expense over each year of its useful life

D all the above

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

15

If the choice exists,inventory should be valued at:

A the lower of cost and net realisable value

B the lower of cost and current replacement cost

C the higher of cost and net realisable value

D the higher of cost and current replacement cost

A the lower of cost and net realisable value

B the lower of cost and current replacement cost

C the higher of cost and net realisable value

D the higher of cost and current replacement cost

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

16

What are the 2 main rules for revaluing non-current assets according to NZ IAS 16?

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck

17

Define 'depreciation',including an explanation of why the recognition of depreciation is necessary,and reference to the 'period' and 'matching' accounting principles.

Unlock Deck

Unlock for access to all 17 flashcards in this deck.

Unlock Deck

k this deck