Deck 29: Fiscal Policy

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

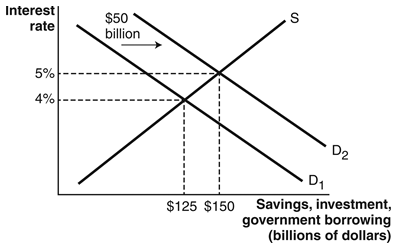

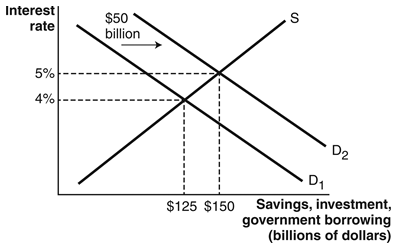

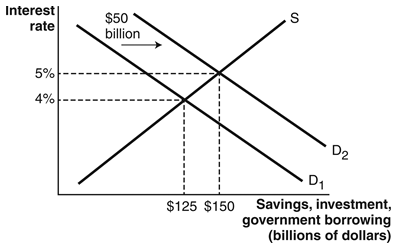

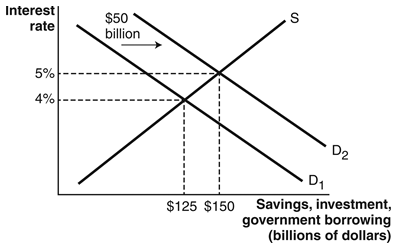

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/168

Play

Full screen (f)

Deck 29: Fiscal Policy

1

Congress and the president would conduct expansionary fiscal policy in order to

A) try to control inflation.

B) prevent the economy from expanding past its long-run capabilities.

C) control the money supply.

D) raise tax revenues.

E) try to stimulate the economy toward expansion.

A) try to control inflation.

B) prevent the economy from expanding past its long-run capabilities.

C) control the money supply.

D) raise tax revenues.

E) try to stimulate the economy toward expansion.

try to stimulate the economy toward expansion.

2

When the government increases spending or decreases taxes to stimulate the economy toward expansion,the government is conducting ________ policy.

A) expansionary monetary

B) expansionary fiscal

C) contractionary monetary

D) contractionary fiscal

E) neither monetary policy nor fiscal

A) expansionary monetary

B) expansionary fiscal

C) contractionary monetary

D) contractionary fiscal

E) neither monetary policy nor fiscal

expansionary fiscal

3

The first of two significant fiscal policy initiatives enacted by the government during the Great Recession,signed in February 2008 by President George W.Bush,was the

A) Economic Stimulus Act of 2008.

B) American Recovery and Reinvestment Act of 2008.

C) American Stimulus Act of 2008.

D) Economic Recovery and Reinvestment Act of 2008.

E) Economic Tax Rebate Act of 2008.

A) Economic Stimulus Act of 2008.

B) American Recovery and Reinvestment Act of 2008.

C) American Stimulus Act of 2008.

D) Economic Recovery and Reinvestment Act of 2008.

E) Economic Tax Rebate Act of 2008.

Economic Stimulus Act of 2008.

4

The use of the money supply to influence the economy is

A) called fiscal policy.

B) called countercyclical policy.

C) called monetary policy.

D) initiated through actions of Congress.

E) part of automatic stabilization.

A) called fiscal policy.

B) called countercyclical policy.

C) called monetary policy.

D) initiated through actions of Congress.

E) part of automatic stabilization.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

5

The use of government spending and taxes to influence the economy is

A) called fiscal policy.

B) called countercyclical policy.

C) called monetary policy.

D) initiated through actions of the Federal Reserve.

E) only done during times of recession.

A) called fiscal policy.

B) called countercyclical policy.

C) called monetary policy.

D) initiated through actions of the Federal Reserve.

E) only done during times of recession.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

6

When the economy falters,people often look to the government to help push the economy forward again.In fact,the government uses many different tools to try to affect the economy.Economists classify these tools on the basis of ________ policy and ________ policy.

A) tax; spending

B) monetary; fiscal

C) expansionary; countercyclical

D) tax; fiscal

E) monetary; spending

A) tax; spending

B) monetary; fiscal

C) expansionary; countercyclical

D) tax; fiscal

E) monetary; spending

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

7

Why would a government want to use expansionary fiscal policy to help stimulate aggregate demand if,in the long run,we would expect prices to adjust and the economy to return to its long-run equilibrium on its own?

A) Expansionary fiscal policy always works in stimulating aggregate demand.

B) It could take a long time for prices to adjust by market forces alone.

C) Expansionary fiscal policy has no adverse effects on the economy.

D) When prices adjust during a recession,we see increases in inflation.

E) Expansionary fiscal policy is easy to get approved by Congress and the president.

A) Expansionary fiscal policy always works in stimulating aggregate demand.

B) It could take a long time for prices to adjust by market forces alone.

C) Expansionary fiscal policy has no adverse effects on the economy.

D) When prices adjust during a recession,we see increases in inflation.

E) Expansionary fiscal policy is easy to get approved by Congress and the president.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

8

Expansionary fiscal policy occurs when the ________ to stimulate the economy toward expansion.

A) government decreases spending or increases taxes

B) government decreases spending or decreases taxes

C) government increases spending or increases taxes

D) government increases spending or decreases taxes

E) Federal Reserve increases money supply

A) government decreases spending or increases taxes

B) government decreases spending or decreases taxes

C) government increases spending or increases taxes

D) government increases spending or decreases taxes

E) Federal Reserve increases money supply

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

9

An example of expansionary fiscal policy is

A) lowering taxes.

B) increasing taxes on everyone in the economy.

C) decreasing the number of weeks an individual can receive unemployment.

D) increasing taxes only on the top earners in the economy.

E) increasing minimum wage.

A) lowering taxes.

B) increasing taxes on everyone in the economy.

C) decreasing the number of weeks an individual can receive unemployment.

D) increasing taxes only on the top earners in the economy.

E) increasing minimum wage.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

10

If the economy begins to fall into a recession,one would expect Congress and the president to conduct ________ policy.

A) expansionary fiscal

B) expansionary monetary

C) contractionary fiscal

D) contractionary monetary

E) countercyclical monetary

A) expansionary fiscal

B) expansionary monetary

C) contractionary fiscal

D) contractionary monetary

E) countercyclical monetary

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

11

Fiscal policy is

A) the use of the money supply to influence the economy.

B) actions taken by the Federal Reserve to influence the economy.

C) only used during times of recession.

D) only used during times of expansion.

E) the use of government spending and taxes to influence the economy.

A) the use of the money supply to influence the economy.

B) actions taken by the Federal Reserve to influence the economy.

C) only used during times of recession.

D) only used during times of expansion.

E) the use of government spending and taxes to influence the economy.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

12

The goal of expansionary fiscal policy is to shift the ________ curve to the ________.

A) aggregate demand; left

B) aggregate demand; right

C) short-run aggregate supply; right

D) short-run aggregate supply; left

E) long-run aggregate supply; left

A) aggregate demand; left

B) aggregate demand; right

C) short-run aggregate supply; right

D) short-run aggregate supply; left

E) long-run aggregate supply; left

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

13

During which of the following situations would the government most likely have an expansionary fiscal policy?

A) when current output is above full-employment output

B) when the economy is expanding at a rapid pace

C) when inflation is at 10 percent per year

D) when the current unemployment rate is below the natural rate of unemployment

E) when the current unemployment rate is above the natural rate of unemployment

A) when current output is above full-employment output

B) when the economy is expanding at a rapid pace

C) when inflation is at 10 percent per year

D) when the current unemployment rate is below the natural rate of unemployment

E) when the current unemployment rate is above the natural rate of unemployment

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

14

Monetary policy is conducted by the Federal Reserve.Fiscal policy is

A) also conducted by the Federal Reserve.

B) conducted by Congress and the president.

C) conducted by the Supreme Court.

D) conducted by the Department of Defense.

E) conducted only at the state level.

A) also conducted by the Federal Reserve.

B) conducted by Congress and the president.

C) conducted by the Supreme Court.

D) conducted by the Department of Defense.

E) conducted only at the state level.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

15

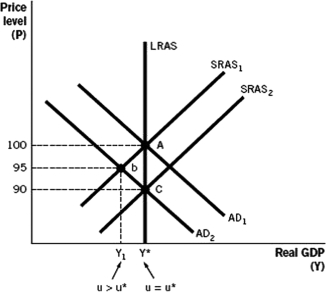

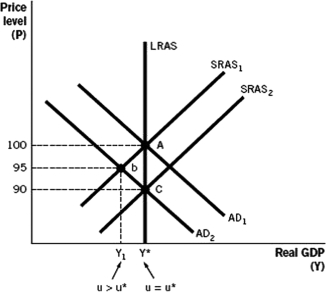

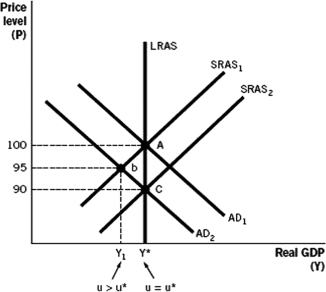

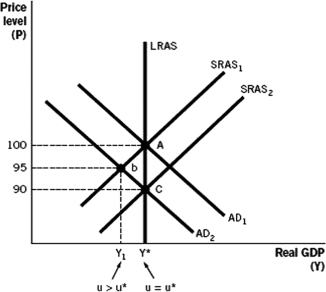

Which of the following would be the theoretical outcome of expansionary fiscal policy in the following aggregate demand-aggregate supply model?

A) The aggregate demand (AD)curve would shift from AD1 to AD2.

B) The short-run aggregate supply (SRAS)curve would shift from SRAS2 to SRAS1.

C) The short-run aggregate supply (SRAS)curve would shift from SRAS1 to SRAS2.

D) The aggregate demand (AD)curve would shift from AD1 to AD2 at the same time that the SRAS curve would shift from SRAS1 to SRAS2.

E) The aggregate demand (AD)curve would shift from AD2 to AD1.

A) The aggregate demand (AD)curve would shift from AD1 to AD2.

B) The short-run aggregate supply (SRAS)curve would shift from SRAS2 to SRAS1.

C) The short-run aggregate supply (SRAS)curve would shift from SRAS1 to SRAS2.

D) The aggregate demand (AD)curve would shift from AD1 to AD2 at the same time that the SRAS curve would shift from SRAS1 to SRAS2.

E) The aggregate demand (AD)curve would shift from AD2 to AD1.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

16

Fiscal policy includes

A) only increases and decreases to taxes.

B) only increases and decreases to government spending.

C) increases and decreases to both taxes and government spending.

D) only decreases in taxes and increases in government spending.

E) only increases in taxes and decreases in government spending.

A) only increases and decreases to taxes.

B) only increases and decreases to government spending.

C) increases and decreases to both taxes and government spending.

D) only decreases in taxes and increases in government spending.

E) only increases in taxes and decreases in government spending.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

17

Monetary policy is

A) the use of the money supply to influence the economy.

B) action taken by Congress to influence the economy.

C) only used during times of recession.

D) only used during times of expansion.

E) the use of government spending and taxes to influence the economy.

A) the use of the money supply to influence the economy.

B) action taken by Congress to influence the economy.

C) only used during times of recession.

D) only used during times of expansion.

E) the use of government spending and taxes to influence the economy.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

18

When aggregate demand is low enough to drive unemployment above the natural rate,

A) there is downward pressure on the price level,and the government may want to conduct contractionary fiscal policy.

B) the economy is entering into an expansion,and the government may want to conduct contractionary fiscal policy.

C) there is upward pressure on the price level,and the government may want to conduct contractionary fiscal policy.

D) there is upward pressure on the price level,and the government may want to conduct expansionary fiscal policy.

E) there is downward pressure on the price level,and the government may want to conduct expansionary fiscal policy.

A) there is downward pressure on the price level,and the government may want to conduct contractionary fiscal policy.

B) the economy is entering into an expansion,and the government may want to conduct contractionary fiscal policy.

C) there is upward pressure on the price level,and the government may want to conduct contractionary fiscal policy.

D) there is upward pressure on the price level,and the government may want to conduct expansionary fiscal policy.

E) there is downward pressure on the price level,and the government may want to conduct expansionary fiscal policy.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

19

As part of the Economic Stimulus Act of 2008,the typical family of four received

A) an extension on unemployment benefits.

B) an increase in pay.

C) food stamps to buy basic necessities.

D) free job training.

E) a rebate check for $1,800.

A) an extension on unemployment benefits.

B) an increase in pay.

C) food stamps to buy basic necessities.

D) free job training.

E) a rebate check for $1,800.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

20

The second of two significant fiscal policy initiatives enacted by the government during the Great Recession,signed in February 2009 by President Barack Obama,was the

A) Economic Stimulus Act of 2009.

B) American Recovery and Reinvestment Act of 2009.

C) American Stimulus Act of 2009.

D) Economic Recovery and Reinvestment Act of 2009.

E) Economic Tax Rebate Act of 2009.

A) Economic Stimulus Act of 2009.

B) American Recovery and Reinvestment Act of 2009.

C) American Stimulus Act of 2009.

D) Economic Recovery and Reinvestment Act of 2009.

E) Economic Tax Rebate Act of 2009.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

21

Contractionary fiscal policy occurs when the

A) government decreases spending or increases taxes to slow economic expansion.

B) government decreases spending or decreases taxes to slow economic expansion.

C) government increases spending or increases taxes to slow economic expansion.

D) government increases spending or decreases taxes to stimulate the economy toward expansion.

E) Federal Reserve decreases money supply to stimulate the economy toward expansion.

A) government decreases spending or increases taxes to slow economic expansion.

B) government decreases spending or decreases taxes to slow economic expansion.

C) government increases spending or increases taxes to slow economic expansion.

D) government increases spending or decreases taxes to stimulate the economy toward expansion.

E) Federal Reserve decreases money supply to stimulate the economy toward expansion.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

22

Expansionary fiscal policy leads to

A) decreases in budget deficits and the national debt during economic downturns.

B) contractionary fiscal policy the following year.

C) increases in budget deficits and the national debt during economic downturns.

D) increases in budget surpluses and decreases in the national debt during economic downturns.

E) contractionary monetary policy the following year.

A) decreases in budget deficits and the national debt during economic downturns.

B) contractionary fiscal policy the following year.

C) increases in budget deficits and the national debt during economic downturns.

D) increases in budget surpluses and decreases in the national debt during economic downturns.

E) contractionary monetary policy the following year.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

23

If the unemployment rate falls below the natural rate of unemployment (u*),

A) the government will want to conduct expansionary fiscal policy.

B) the Federal Reserve will want to conduct expansionary monetary policy.

C) the economy is in a recession.

D) there will be no worries about inflation.

E) the government will want to conduct contractionary fiscal policy.

A) the government will want to conduct expansionary fiscal policy.

B) the Federal Reserve will want to conduct expansionary monetary policy.

C) the economy is in a recession.

D) there will be no worries about inflation.

E) the government will want to conduct contractionary fiscal policy.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

24

Assume that the government is currently balancing the national budget so that outlays equal tax revenue.Then the economy starts into an expansion,and the government decides to decrease government spending by $50 billion.As a result,the federal budget will

A) be in deficit by $50 billion.

B) be in surplus by at least $50 billion.

C) remain balanced.

D) be in surplus by less than $50 billion.

E) be in deficit by at least $50 billion.

A) be in deficit by $50 billion.

B) be in surplus by at least $50 billion.

C) remain balanced.

D) be in surplus by less than $50 billion.

E) be in deficit by at least $50 billion.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

25

A government might want to reduce aggregate demand if it believes that the economy is

A) in long-run equilibrium.

B) above the natural rate of unemployment.

C) producing below full-employment output.

D) expanding past its long-run capabilities.

E) in a recession.

A) in long-run equilibrium.

B) above the natural rate of unemployment.

C) producing below full-employment output.

D) expanding past its long-run capabilities.

E) in a recession.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

26

Congress and the president would conduct contractionary fiscal policy in order to

A) try to control inflation.

B) prevent the economy from falling into a recession.

C) control the money supply.

D) raise the budget deficit.

E) try to stimulate the economy toward expansion.

A) try to control inflation.

B) prevent the economy from falling into a recession.

C) control the money supply.

D) raise the budget deficit.

E) try to stimulate the economy toward expansion.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

27

The Economic Stimulus Act of 2008 focused on ________,whereas the American Recovery and Reinvestment Act of 2009 focused on ________.

A) monetary policy; fiscal policy

B) fiscal policy; monetary policy

C) taxes; government spending

D) government spending; taxes

E) contractionary fiscal policy; expansionary fiscal policy

A) monetary policy; fiscal policy

B) fiscal policy; monetary policy

C) taxes; government spending

D) government spending; taxes

E) contractionary fiscal policy; expansionary fiscal policy

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following would be the theoretical outcome of contractionary fiscal policy in the following aggregate demand-aggregate supply model,where LRAS is long-run aggregate supply and SRAS is short-run aggregate supply?

A) The aggregate demand (AD)curve would shift from AD1 to AD2.

B) The short-run aggregate supply (SRAS)curve would shift from SRAS2 to SRAS1.

C) The short-run aggregate supply (SRAS)curve would shift from SRAS1 to SRAS2.

D) The aggregate demand (AD)curve would shift from AD1 to AD2 at the same time that the SRAS curve would shift from SRAS1 to SRAS2.

E) The aggregate demand (AD)curve would shift from AD2 to AD1.

A) The aggregate demand (AD)curve would shift from AD1 to AD2.

B) The short-run aggregate supply (SRAS)curve would shift from SRAS2 to SRAS1.

C) The short-run aggregate supply (SRAS)curve would shift from SRAS1 to SRAS2.

D) The aggregate demand (AD)curve would shift from AD1 to AD2 at the same time that the SRAS curve would shift from SRAS1 to SRAS2.

E) The aggregate demand (AD)curve would shift from AD2 to AD1.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

29

The goal of contractionary fiscal policy is to shift the ________ curve to the ________.

A) aggregate demand; left

B) aggregate demand; right

C) short-run aggregate supply; right

D) short-run aggregate supply; left

E) long-run aggregate supply; left

A) aggregate demand; left

B) aggregate demand; right

C) short-run aggregate supply; right

D) short-run aggregate supply; left

E) long-run aggregate supply; left

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

30

An increase in taxes or a decrease in spending during an economic expansion can

A) increase the budget deficit but pay off some of the government debt.

B) work to decrease the budget deficit and pay off some of the government debt.

C) work to decrease the budget deficit but will not pay off any of the government debt.

D) increase the budget deficit and increase the size of the government debt.

E) work to decrease the budget deficit and increase the government debt.

A) increase the budget deficit but pay off some of the government debt.

B) work to decrease the budget deficit and pay off some of the government debt.

C) work to decrease the budget deficit but will not pay off any of the government debt.

D) increase the budget deficit and increase the size of the government debt.

E) work to decrease the budget deficit and increase the government debt.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

31

Fiscal policy that seeks to counteract business-cycle fluctuations is ________ fiscal policy.

A) pro-cyclical

B) expansionary

C) contractionary

D) discretionary

E) countercyclical

A) pro-cyclical

B) expansionary

C) contractionary

D) discretionary

E) countercyclical

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

32

Assume that the government is currently balancing the national budget so that outlays equal tax revenue.Then the economy slips into recession,and the government decides to increase government spending by $50 billion.The government must pay for this by borrowing; it must sell $50 billion worth of Treasury bonds.As a result,the federal budget will

A) be in deficit by less than $50 billion.

B) be in surplus by at least $50 billion.

C) remain balanced.

D) be in surplus by $50 billion.

E) be in deficit by at least $50 billion.

A) be in deficit by less than $50 billion.

B) be in surplus by at least $50 billion.

C) remain balanced.

D) be in surplus by $50 billion.

E) be in deficit by at least $50 billion.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

33

When the government decreases spending or increases taxes to slow economic expansion,the government is conducting ________ policy.

A) expansionary monetary

B) expansionary fiscal

C) contractionary monetary

D) contractionary fiscal

E) neither monetary policy nor fiscal

A) expansionary monetary

B) expansionary fiscal

C) contractionary monetary

D) contractionary fiscal

E) neither monetary policy nor fiscal

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

34

If the economy starting at full-employment output begins to enter into an expansion,one would expect Congress and the president to conduct ________ policy.

A) expansionary fiscal

B) expansionary monetary

C) contractionary fiscal

D) contractionary monetary

E) countercyclical monetary

A) expansionary fiscal

B) expansionary monetary

C) contractionary fiscal

D) contractionary monetary

E) countercyclical monetary

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

35

During recessionary periods,

A) outlays increase and tax revenue falls.

B) outlays increase and tax revenue increases.

C) outlays decrease and tax revenue increases.

D) outlays decrease and tax revenue falls.

E) outlays and tax revenue stay the same.

A) outlays increase and tax revenue falls.

B) outlays increase and tax revenue increases.

C) outlays decrease and tax revenue increases.

D) outlays decrease and tax revenue falls.

E) outlays and tax revenue stay the same.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

36

The Economic Stimulus Act of 2008 and the American Recovery and Reinvestment Act of 2009 are both examples of ________ policy.

A) contractionary fiscal

B) expansionary monetary

C) contractionary monetary

D) expansionary fiscal

E) countercyclical monetary

A) contractionary fiscal

B) expansionary monetary

C) contractionary monetary

D) expansionary fiscal

E) countercyclical monetary

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

37

When aggregate demand is high enough to drive unemployment below the natural rate,

A) there is downward pressure on the price level,and the government may want to conduct contractionary fiscal policy.

B) the economy is slipping into a recession,and the government may want to conduct expansionary fiscal policy.

C) there is upward pressure on the price level,and the government may want to conduct contractionary fiscal policy.

D) there is upward pressure on the price level,and the government may want to conduct expansionary fiscal policy.

E) there is downward pressure on the price level,and the government may want to conduct expansionary fiscal policy.

A) there is downward pressure on the price level,and the government may want to conduct contractionary fiscal policy.

B) the economy is slipping into a recession,and the government may want to conduct expansionary fiscal policy.

C) there is upward pressure on the price level,and the government may want to conduct contractionary fiscal policy.

D) there is upward pressure on the price level,and the government may want to conduct expansionary fiscal policy.

E) there is downward pressure on the price level,and the government may want to conduct expansionary fiscal policy.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

38

During economic expansions,

A) outlays increase and tax revenue falls.

B) outlays increase and tax revenue increases.

C) outlays decrease and tax revenue increases.

D) outlays decrease and tax revenue falls.

E) outlays and tax revenue stay the same.

A) outlays increase and tax revenue falls.

B) outlays increase and tax revenue increases.

C) outlays decrease and tax revenue increases.

D) outlays decrease and tax revenue falls.

E) outlays and tax revenue stay the same.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

39

All else being equal,people generally prefer ________ in their financial affairs.

A) volatility

B) smoothness and predictability

C) uncertainty

D) government intervention

E) ups and downs

A) volatility

B) smoothness and predictability

C) uncertainty

D) government intervention

E) ups and downs

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

40

Countercyclical fiscal policy

A) is fiscal policy that seeks to counteract business-cycle fluctuations.

B) only includes expansionary fiscal policy.

C) only includes contractionary fiscal policy.

D) attempts to counteract pro-cyclical fiscal policy.

E) is no longer used by the government.

A) is fiscal policy that seeks to counteract business-cycle fluctuations.

B) only includes expansionary fiscal policy.

C) only includes contractionary fiscal policy.

D) attempts to counteract pro-cyclical fiscal policy.

E) is no longer used by the government.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

41

Marginal propensity to consume is the portion of

A) additional income that is saved.

B) total income that is spent on consumption.

C) additional income that is spent on consumption.

D) total income that is saved.

E) additional income that is taxed.

A) additional income that is saved.

B) total income that is spent on consumption.

C) additional income that is spent on consumption.

D) total income that is saved.

E) additional income that is taxed.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

42

An initial increase in government spending of $100 billion can create more than $100 billion through what economists call a(n)________ effect.

A) multiplier

B) enhancement

C) interest rate

D) aggregate supply

E) wealth

A) multiplier

B) enhancement

C) interest rate

D) aggregate supply

E) wealth

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

43

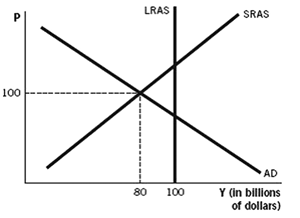

Refer to the following figure to answer the following questions.

According to the figure,and assuming the marginal propensity to consume is 0.75,to shift aggregate demand enough to be back at long-run equilibrium,the government would have to increase government spending by

A) $20 billion.

B) $10 billion.

C) $5 billion.

D) $1 billion.

E) $500 million.

According to the figure,and assuming the marginal propensity to consume is 0.75,to shift aggregate demand enough to be back at long-run equilibrium,the government would have to increase government spending by

A) $20 billion.

B) $10 billion.

C) $5 billion.

D) $1 billion.

E) $500 million.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

44

If your marginal propensity to consume is 0.75 and you get an additional $400 in income,you would spend ________ on consumption.

A) $400.00

B) $200.00

C) $533.33

D) $300.00

E) $1,600.00

A) $400.00

B) $200.00

C) $533.33

D) $300.00

E) $1,600.00

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

45

Countercyclical fiscal policy consists of using expansionary fiscal policy

A) during times of expansion and contractionary fiscal policy during times of recession.

B) during times of recession and contractionary fiscal policy during times of recession.

C) during times of expansion and contractionary fiscal policy during times of expansion.

D) during times of recession and contractionary fiscal policy during times of expansion.

E) and contractionary fiscal policy at the same time.

A) during times of expansion and contractionary fiscal policy during times of recession.

B) during times of recession and contractionary fiscal policy during times of recession.

C) during times of expansion and contractionary fiscal policy during times of expansion.

D) during times of recession and contractionary fiscal policy during times of expansion.

E) and contractionary fiscal policy at the same time.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

46

If an initial increase in government spending of $100 billion leads to a total increase of $400 billion in income,the marginal propensity to consume in the economy is

A) 0.4.

B) -0.8.

C) 0.5.

D) 0.75.

E) 0.8.

A) 0.4.

B) -0.8.

C) 0.5.

D) 0.75.

E) 0.8.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

47

An implementation lag happens because

A) it is easy to implement fiscal policy.

B) it is difficult to determine when the economy is turning up or down.

C) in most nations,one or more governing bodies must approve government spending or new tax policies.

D) it takes time for the complete effects of monetary and fiscal policy to materialize.

E) it is impossible to implement fiscal policy with a divided House of Representatives and Senate.

A) it is easy to implement fiscal policy.

B) it is difficult to determine when the economy is turning up or down.

C) in most nations,one or more governing bodies must approve government spending or new tax policies.

D) it takes time for the complete effects of monetary and fiscal policy to materialize.

E) it is impossible to implement fiscal policy with a divided House of Representatives and Senate.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

48

If the spending multiplier is 5,what is the marginal propensity to consume in the economy?

A) 0.4

B) -0.8

C) 0.5

D) 0.75

E) 0.8

A) 0.4

B) -0.8

C) 0.5

D) 0.75

E) 0.8

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

49

An example of the multiplier effect is when

A) the government increases government spending initially by $100 billion,and total income in the economy increases by less than $100 billion.

B) an increase in the price level leads to a shift in the aggregate demand curve.

C) the government increases government spending initially by $100 billion,and total income in the economy increases by more than $100 billion.

D) an increase in government spending leads to a decrease in private investment.

E) short-run aggregate supply shifts in a response to fiscal policy.

A) the government increases government spending initially by $100 billion,and total income in the economy increases by less than $100 billion.

B) an increase in the price level leads to a shift in the aggregate demand curve.

C) the government increases government spending initially by $100 billion,and total income in the economy increases by more than $100 billion.

D) an increase in government spending leads to a decrease in private investment.

E) short-run aggregate supply shifts in a response to fiscal policy.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

50

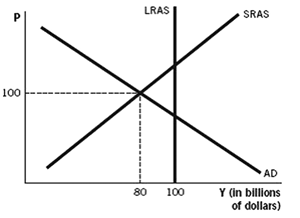

Refer to the following figure to answer the following questions.

According to the figure,if the government increases spending by only $4 billion in an effort to shift aggregate demand enough to return to long-run equilibrium,the marginal propensity to consume must be equal to

A) 0.75.

B) 0.8.

C) 1.33.

D) 1.57.

E) 0.6.

According to the figure,if the government increases spending by only $4 billion in an effort to shift aggregate demand enough to return to long-run equilibrium,the marginal propensity to consume must be equal to

A) 0.75.

B) 0.8.

C) 1.33.

D) 1.57.

E) 0.6.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

51

The portion of additional income that is spent on consumption is

A) average propensity to consume (APC).

B) marginal propensity to consume (MPC).

C) marginal propensity to save (MPS).

D) average propensity to save (APS).

E) 1 minus marginal propensity to consume

A) average propensity to consume (APC).

B) marginal propensity to consume (MPC).

C) marginal propensity to save (MPS).

D) average propensity to save (APS).

E) 1 minus marginal propensity to consume

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

52

The three time lags that accompany policy decisions are

A) recognition lag,implementation lag,and impact lag.

B) crowding-out lag,implementation lag,and impact lag.

C) recognition lag,implementation lag,and countercyclical lag.

D) crowding-out lag,implementation lag,and countercyclical lag.

E) crowding-out lag,stabilizing lag,and countercyclical lag.

A) recognition lag,implementation lag,and impact lag.

B) crowding-out lag,implementation lag,and impact lag.

C) recognition lag,implementation lag,and countercyclical lag.

D) crowding-out lag,implementation lag,and countercyclical lag.

E) crowding-out lag,stabilizing lag,and countercyclical lag.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

53

If the marginal propensity to consume is equal to 0.75,the spending multiplier is equal to

A) 4.0.

B) 1.75.

C) 0.25.

D) 0.57.

E) 1.33.

A) 4.0.

B) 1.75.

C) 0.25.

D) 0.57.

E) 1.33.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

54

Recognition lag,implementation lag,and impact lag are all examples of

A) crowding-out.

B) savings shifts.

C) time lags that accompany policy decisions.

D) automatic stabilizers.

E) fiscal policies.

A) crowding-out.

B) savings shifts.

C) time lags that accompany policy decisions.

D) automatic stabilizers.

E) fiscal policies.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

55

Time lags,crowding-out,and savings shifts are all

A) examples of automatic stabilizers.

B) issues that arise in the application of activist fiscal policy.

C) examples of countercyclical fiscal policy.

D) types of governmental policy.

E) arguments in favor of fiscal policy.

A) examples of automatic stabilizers.

B) issues that arise in the application of activist fiscal policy.

C) examples of countercyclical fiscal policy.

D) types of governmental policy.

E) arguments in favor of fiscal policy.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

56

The spending multiplier is

A) a formula to determine the total impact on savings from an initial change of a given amount.

B) a formula to determine the total impact on consumption from an initial change of a given amount.

C) only used when government spending increases.

D) a formula to determine the total impact on spending from an initial change of a given amount.

E) only used when government spending decreases.

A) a formula to determine the total impact on savings from an initial change of a given amount.

B) a formula to determine the total impact on consumption from an initial change of a given amount.

C) only used when government spending increases.

D) a formula to determine the total impact on spending from an initial change of a given amount.

E) only used when government spending decreases.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

57

To determine the total impact on spending from an initial change of a given amount,you could use

A) the Laffer curve.

B) the spending multiplier.

C) monetary policy.

D) fiscal policy.

E) automatic stabilizers.

A) the Laffer curve.

B) the spending multiplier.

C) monetary policy.

D) fiscal policy.

E) automatic stabilizers.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

58

Countercyclical fiscal policy attempts to

A) smooth out expansions and recessions in the business cycle.

B) prevent economies from falling into recession.

C) prevent economies from entering into expansion.

D) maximize expansions and minimize recessions.

E) maximize expansions and maximize recessions.

A) smooth out expansions and recessions in the business cycle.

B) prevent economies from falling into recession.

C) prevent economies from entering into expansion.

D) maximize expansions and minimize recessions.

E) maximize expansions and maximize recessions.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

59

Three issues that arise in the application of activist fiscal policy are

A) time lags,outsourcing,and government debt.

B) government debt,crowding-out,and savings shifts.

C) time lags,crowding-out,and government debt.

D) outsourcing,crowding-out,and government debt.

E) time lags,crowding-out,and savings shifts.

A) time lags,outsourcing,and government debt.

B) government debt,crowding-out,and savings shifts.

C) time lags,crowding-out,and government debt.

D) outsourcing,crowding-out,and government debt.

E) time lags,crowding-out,and savings shifts.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

60

If your income increases by $1,500 and you only consume $900 of it,your marginal propensity to consume would be equal to

A) 600.00.

B) 0.50.

C) 0.75.

D) 0.40.

E) 0.60.

A) 600.00.

B) 0.50.

C) 0.75.

D) 0.40.

E) 0.60.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

61

Government programs that automatically implement countercyclical fiscal policy in response to economic conditions are called automatic

A) stabilizers.

B) policies.

C) balancers.

D) equalizers.

E) holders.

A) stabilizers.

B) policies.

C) balancers.

D) equalizers.

E) holders.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

62

If the effects of expansionary fiscal policy hit when the economy is already expanding,

A) the effects could lead to even deeper recession.

B) the policy will have no effect.

C) the policy is called an automatic stabilizer.

D) it may lead to excessive aggregate demand and inflation.

E) it will lead to high rates of unemployment along with high rates of inflation,known as stagflation.

A) the effects could lead to even deeper recession.

B) the policy will have no effect.

C) the policy is called an automatic stabilizer.

D) it may lead to excessive aggregate demand and inflation.

E) it will lead to high rates of unemployment along with high rates of inflation,known as stagflation.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

63

________ can eliminate recognition lags and implementation lags and thereby alleviate some concerns of destabilizing fiscal policy.

A) Automatic stabilizers

B) Discretionary fiscal policy

C) Monetary policy

D) Expansions

E) Recession

A) Automatic stabilizers

B) Discretionary fiscal policy

C) Monetary policy

D) Expansions

E) Recession

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

64

If the effects of contractionary fiscal policy hit when the economy is already contracting,

A) the effects could lead to even deeper recession.

B) the policy will have no effect.

C) the policy is called an automatic stabilizer.

D) it may lead to excessive aggregate demand and inflation.

E) it will lead to stagflation.

A) the effects could lead to even deeper recession.

B) the policy will have no effect.

C) the policy is called an automatic stabilizer.

D) it may lead to excessive aggregate demand and inflation.

E) it will lead to stagflation.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

65

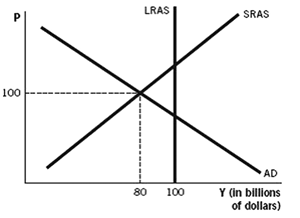

Refer to the following figure to answer the following questions.

According to the figure,the amount of private investment after government borrowing is ________ billion.

A) $50

B) $25

C) $100

D) $150

E) $275

According to the figure,the amount of private investment after government borrowing is ________ billion.

A) $50

B) $25

C) $100

D) $150

E) $275

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

66

Complete crowding-out is when every dollar of

A) government spending crowds out one dollar of tax revenue.

B) government spending crowds out one dollar of private spending.

C) private spending crowds out one dollar of government spending.

D) private spending crowds out one dollar of tax revenue.

E) tax revenue crowds out one dollar of government spending.

A) government spending crowds out one dollar of tax revenue.

B) government spending crowds out one dollar of private spending.

C) private spending crowds out one dollar of government spending.

D) private spending crowds out one dollar of tax revenue.

E) tax revenue crowds out one dollar of government spending.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

67

Crowding-out occurs when

A) supply-side fiscal policy does not increase total output.

B) consumption increases when government spending increases.

C) private spending falls in response to increases in government spending.

D) time lags crowd out the effects of fiscal policy.

E) increases in government spending and decreases in taxes are offset by increases in savings.

A) supply-side fiscal policy does not increase total output.

B) consumption increases when government spending increases.

C) private spending falls in response to increases in government spending.

D) time lags crowd out the effects of fiscal policy.

E) increases in government spending and decreases in taxes are offset by increases in savings.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

68

Automatic stabilizers try to solve the problem of

A) the multiplier effect.

B) recognition lags and implementation lags.

C) crowding-out.

D) impact lags.

E) saving ,shifts.

A) the multiplier effect.

B) recognition lags and implementation lags.

C) crowding-out.

D) impact lags.

E) saving ,shifts.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

69

________ is an example of an automatic stabilizer.

A) The fiscal multiplier

B) The spending multiplier

C) The Keynesian multiplier

D) Unemployment compensation

E) The American Recovery and Reinvestment Act of 2009

A) The fiscal multiplier

B) The spending multiplier

C) The Keynesian multiplier

D) Unemployment compensation

E) The American Recovery and Reinvestment Act of 2009

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

70

The "crowding-out" critique is based on the idea that

A) consumption increases when government spending increases.

B) government spending may be a substitute for private spending.

C) time lags crowd out the effects of fiscal policy.

D) supply-side fiscal policy does not increase total output.

E) increases in government spending and decreases in taxes are offset by increases in savings.

A) consumption increases when government spending increases.

B) government spending may be a substitute for private spending.

C) time lags crowd out the effects of fiscal policy.

D) supply-side fiscal policy does not increase total output.

E) increases in government spending and decreases in taxes are offset by increases in savings.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

71

It is difficult to determine when the economy is turning up or down.This is because there is a(n)________ lag.

A) recognition

B) implementation

C) impact

D) countercyclical

E) automatic

A) recognition

B) implementation

C) impact

D) countercyclical

E) automatic

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

72

When the government borrows,the ________ loanable funds shifts to the right,causing the interest rate to ________,which causes private investment to ________.

A) demand for; rise; fall

B) demand for; fall; rise

C) supply of; rise; fall

D) supply of; fall; rise

E) demand for; rise; rise

A) demand for; rise; fall

B) demand for; fall; rise

C) supply of; rise; fall

D) supply of; fall; rise

E) demand for; rise; rise

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

73

An impact lag happens because

A) the impacts of recessions are felt sooner than the impacts of expansions.

B) it is difficult to determine when the economy is turning up or down.

C) in most nations,one or more governing bodies must approve government spending or new tax policies.

D) it takes time for the complete effects of monetary and fiscal policy to materialize.

A) the impacts of recessions are felt sooner than the impacts of expansions.

B) it is difficult to determine when the economy is turning up or down.

C) in most nations,one or more governing bodies must approve government spending or new tax policies.

D) it takes time for the complete effects of monetary and fiscal policy to materialize.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

74

Automatic stabilizers

A) are government programs that automatically implement countercyclical monetary policy in response to economic conditions.

B) must be approved by Congress every time they are to be implemented.

C) experience recognition lags.

D) experience implementation lags.

E) are government programs that automatically implement countercyclical fiscal policy in response to economic conditions.

A) are government programs that automatically implement countercyclical monetary policy in response to economic conditions.

B) must be approved by Congress every time they are to be implemented.

C) experience recognition lags.

D) experience implementation lags.

E) are government programs that automatically implement countercyclical fiscal policy in response to economic conditions.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

75

It takes time for the complete effects of monetary and fiscal policy to materialize.This is because there is a(n)________ lag between setting fiscal policy and seeing its effects.

A) recognition

B) implementation

C) impact

D) countercyclical

E) automatic

A) recognition

B) implementation

C) impact

D) countercyclical

E) automatic

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

76

If lags cause the effects of fiscal policy to be delayed for a long period of time,

A) the policy will magnify recessions and eliminate expansion.

B) there is no way the policy can smooth out the business cycle.

C) the policy will magnify expansions and eliminate recessions.

D) fiscal policy will do nothing to the economy.

E) there is a risk that the policy can actually magnify the business cycle.

A) the policy will magnify recessions and eliminate expansion.

B) there is no way the policy can smooth out the business cycle.

C) the policy will magnify expansions and eliminate recessions.

D) fiscal policy will do nothing to the economy.

E) there is a risk that the policy can actually magnify the business cycle.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

77

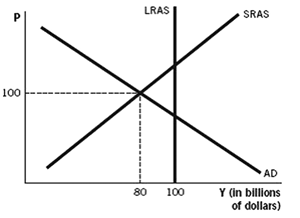

Refer to the following figure to answer the following questions.

According to the figure,the amount of private savings after government borrowing is

A) $50 billion.

B) $25 billion.

C) $100 billion.

D) $150 billion.

E) $275 billion.

According to the figure,the amount of private savings after government borrowing is

A) $50 billion.

B) $25 billion.

C) $100 billion.

D) $150 billion.

E) $275 billion.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

78

Progressive tax rates,taxes on corporate profits,unemployment compensation,and welfare programs are all examples of

A) monetary policies.

B) automatic stabilizers.

C) discretionary fiscal policies.

D) automatic balancers.

E) pro-cyclical fiscal policies.

A) monetary policies.

B) automatic stabilizers.

C) discretionary fiscal policies.

D) automatic balancers.

E) pro-cyclical fiscal policies.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

79

In most nations,one or more governing bodies must approve government spending or new tax policies.This causes a(n)________ lag between setting fiscal policy and seeing its effects.

A) recognition

B) implementation

C) impact

D) countercyclical

E) automatic

A) recognition

B) implementation

C) impact

D) countercyclical

E) automatic

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck

80

A recognition lag happens because

A) it takes time to recognize the true long-run growth rate in the economy.

B) it is difficult to determine when the economy is turning up or down.

C) in most nations,one or more governing bodies must approve government spending or new tax policies.

D) it takes time for the complete effects of monetary and fiscal policy to materialize.

E) it is difficult to recognize what the unemployment rate is.

A) it takes time to recognize the true long-run growth rate in the economy.

B) it is difficult to determine when the economy is turning up or down.

C) in most nations,one or more governing bodies must approve government spending or new tax policies.

D) it takes time for the complete effects of monetary and fiscal policy to materialize.

E) it is difficult to recognize what the unemployment rate is.

Unlock Deck

Unlock for access to all 168 flashcards in this deck.

Unlock Deck

k this deck