Deck 11: Price Discrimination

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/175

Play

Full screen (f)

Deck 11: Price Discrimination

1

Price discrimination exists when a firm is able to sell the same good at more than one price to different groups of

A) producers.

B) firms.

C) consumers.

D) promoters.

E) commodities.

A) producers.

B) firms.

C) consumers.

D) promoters.

E) commodities.

consumers.

2

If a firm is unable to distinguish which of its buyers has inelastic demand and which has a relatively elastic demand,then the firm will be unable to price discriminate because it will

A) not know how much of the product to offer for sale.

B) not know enough about its customer base to prevent resale.

C) not know which price to charge which customer.

D) not know how many of its customers will buy the product when it is offered for sale.

E) be unable to predict how much of its sales will be retained as profit.

A) not know how much of the product to offer for sale.

B) not know enough about its customer base to prevent resale.

C) not know which price to charge which customer.

D) not know how many of its customers will buy the product when it is offered for sale.

E) be unable to predict how much of its sales will be retained as profit.

not know which price to charge which customer.

3

Which of the following statements is true?

A) Firms that can identify two types of consumers can price discriminate perfectly.

B) Firms can price discriminate only if there is zero competition in the market.

C) Firms that price discriminate will not reach higher profits.

D) Firms that can prevent reselling may be able to engage in price discrimination.

E) Firms can usually price discriminate if they are in a perfectly competitive market.

A) Firms that can identify two types of consumers can price discriminate perfectly.

B) Firms can price discriminate only if there is zero competition in the market.

C) Firms that price discriminate will not reach higher profits.

D) Firms that can prevent reselling may be able to engage in price discrimination.

E) Firms can usually price discriminate if they are in a perfectly competitive market.

Firms that can prevent reselling may be able to engage in price discrimination.

4

Use the following excerpt from a campus-wide announcement about a concert at the University of West Georgia (UWG)to answer the following questions:

The Band Perry [a Grammy-nominated country music act] will perform live at the University of West Georgia Coliseum on Sunday,April 22,as part of its Purveyors of Performance Tour 2012 ...Prices are $10 in advance or $15 on the day of the show for those with a UWG [Student] ID,and $20 in advance or $25 on the day of the show for the general public.

Source: "CAMPUS NEWS: The Band Perry Comes to UWG," UWG media (blog),UWG Center for Student Involvement,April 19,2012,http://uwgmedia.blogspot.com/2012/04/band-perry-comes-to-uwg_19.html.

Why would the Center for Student Involvement complicate the ticket-pricing scheme by using four different ticket prices?

A) to see how many students will support an on-campus event

B) to keep the general public out of the rowdier student section on the concert floor

C) to separate the concert attendees into distinct groups so that they can maximize profit

D) to ensure that enough people attend the concert so that they minimize any potential loss

E) to gauge student interest in case the concert must be canceled and rescheduled to maximize profit

The Band Perry [a Grammy-nominated country music act] will perform live at the University of West Georgia Coliseum on Sunday,April 22,as part of its Purveyors of Performance Tour 2012 ...Prices are $10 in advance or $15 on the day of the show for those with a UWG [Student] ID,and $20 in advance or $25 on the day of the show for the general public.

Source: "CAMPUS NEWS: The Band Perry Comes to UWG," UWG media (blog),UWG Center for Student Involvement,April 19,2012,http://uwgmedia.blogspot.com/2012/04/band-perry-comes-to-uwg_19.html.

Why would the Center for Student Involvement complicate the ticket-pricing scheme by using four different ticket prices?

A) to see how many students will support an on-campus event

B) to keep the general public out of the rowdier student section on the concert floor

C) to separate the concert attendees into distinct groups so that they can maximize profit

D) to ensure that enough people attend the concert so that they minimize any potential loss

E) to gauge student interest in case the concert must be canceled and rescheduled to maximize profit

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following conditions is a requirement for price discrimination?

A) There is no reselling allowed in the market.

B) People have homogenous preferences.

C) Firms face different costs of production.

D) There are multiple firms in the market.

E) There is only one firm in the market.

A) There is no reselling allowed in the market.

B) People have homogenous preferences.

C) Firms face different costs of production.

D) There are multiple firms in the market.

E) There is only one firm in the market.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

6

A price maker is a firm that

A) sets the prices that the market makes.

B) has a price that covers all of its costs.

C) sets prices that maximize consumer surplus.

D) sets prices equal to that of the market.

E) has some market power.

A) sets the prices that the market makes.

B) has a price that covers all of its costs.

C) sets prices that maximize consumer surplus.

D) sets prices equal to that of the market.

E) has some market power.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

7

Use the following excerpt from a campus-wide announcement about a concert at the University of West Georgia (UWG)to answer the following questions:

The Band Perry [a Grammy-nominated country music act] will perform live at the University of West Georgia Coliseum on Sunday,April 22,as part of its Purveyors of Performance Tour 2012 ...Prices are $10 in advance or $15 on the day of the show for those with a UWG [Student] ID,and $20 in advance or $25 on the day of the show for the general public.

Source: "CAMPUS NEWS: The Band Perry Comes to UWG," UWG media (blog),UWG Center for Student Involvement,April 19,2012,http://uwgmedia.blogspot.com/2012/04/band-perry-comes-to-uwg_19.html.

Which price discrimination condition was satisfied by requiring students to show an ID card for an initial ticket purchase?

A) The concert promoter was able to encourage the resale of the product or service to another student.

B) The concert promoter was able to distinguish easily among groups of buyers with different price elasticities of demand.

C) The concert promoter was able to prevent the resale of the product or service to another consumer who is willing to pay more.

D) The concert promoter was able to distinguish easily among groups of sellers with different price elasticities of supply.

E) The concert promoter was able to distinguish easily between true fans of the Band Perry and those who just wanted to see a cheap concert.

The Band Perry [a Grammy-nominated country music act] will perform live at the University of West Georgia Coliseum on Sunday,April 22,as part of its Purveyors of Performance Tour 2012 ...Prices are $10 in advance or $15 on the day of the show for those with a UWG [Student] ID,and $20 in advance or $25 on the day of the show for the general public.

Source: "CAMPUS NEWS: The Band Perry Comes to UWG," UWG media (blog),UWG Center for Student Involvement,April 19,2012,http://uwgmedia.blogspot.com/2012/04/band-perry-comes-to-uwg_19.html.

Which price discrimination condition was satisfied by requiring students to show an ID card for an initial ticket purchase?

A) The concert promoter was able to encourage the resale of the product or service to another student.

B) The concert promoter was able to distinguish easily among groups of buyers with different price elasticities of demand.

C) The concert promoter was able to prevent the resale of the product or service to another consumer who is willing to pay more.

D) The concert promoter was able to distinguish easily among groups of sellers with different price elasticities of supply.

E) The concert promoter was able to distinguish easily between true fans of the Band Perry and those who just wanted to see a cheap concert.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

8

Price discrimination exists when a firm sells ________ goods at more than one price to ________ groups of customers.

A) different; similar

B) existing; distinct

C) discounted; large

D) identical; different

E) limited; restricted

A) different; similar

B) existing; distinct

C) discounted; large

D) identical; different

E) limited; restricted

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following best describes price discrimination?

A) charging different prices to different people and the prices are perceived as unfair and harmful

B) a firm selling the same good at more than one price to different groups of customers

C) when differences in cost are reflected by differences in price

D) commission of an act that is always illegal and not beneficial to buyers or sellers

E) a practice available only to competitive,price-taking firms

A) charging different prices to different people and the prices are perceived as unfair and harmful

B) a firm selling the same good at more than one price to different groups of customers

C) when differences in cost are reflected by differences in price

D) commission of an act that is always illegal and not beneficial to buyers or sellers

E) a practice available only to competitive,price-taking firms

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

10

Hotwire.com,an online travel company specializing in cheap and discounted hotel rates and airfares,often asks customers if their travel dates are flexible when pricing potential bookings.This practice helps Hotwire.com practice price discrimination by allowing it to

A) easily distinguish between different groups of buyers.

B) book reservations for customers who are most likely to travel before those who are less likely to travel.

C) post higher prices initially and then lower the price based on room availability.

D) determine which customers are simply comparison shopping and which ones are ready to make a purchase.

E) offer high prices to customers with flexible travel dates and low prices to those who are on a fixed income.

A) easily distinguish between different groups of buyers.

B) book reservations for customers who are most likely to travel before those who are less likely to travel.

C) post higher prices initially and then lower the price based on room availability.

D) determine which customers are simply comparison shopping and which ones are ready to make a purchase.

E) offer high prices to customers with flexible travel dates and low prices to those who are on a fixed income.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

11

One reason that firms may be unable to utilize price discrimination as a viable strategy is because

A) it is always illegal to price discriminate.

B) firms are unwilling to maximize profits.

C) most consumers' reservation prices are well publicized.

D) firms are unable to prevent resale of the product they offer for sale.

E) firms are unlikely to increase profits after paying for increased marketing costs.

A) it is always illegal to price discriminate.

B) firms are unwilling to maximize profits.

C) most consumers' reservation prices are well publicized.

D) firms are unable to prevent resale of the product they offer for sale.

E) firms are unlikely to increase profits after paying for increased marketing costs.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

12

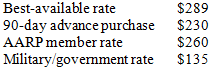

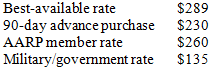

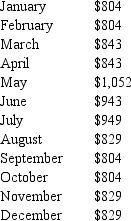

Reese Witherspoon plans to visit her hometown of New Orleans, Louisiana. When her assistant checked the hotel reservation website, there were four published rates available, which are summarized in the following table. Use this table to answer the following questions:

The hotel attempts to distinguish between groups of buyers in order to

A) attract buyers who wish to practice conspicuous consumption.

B) assign prices based on the differing price elasticities of demand.

C) control the rising costs of hotel ownership.

D) appear to offer choices to the consumer.

E) deter last-minute reservations.

The hotel attempts to distinguish between groups of buyers in order to

A) attract buyers who wish to practice conspicuous consumption.

B) assign prices based on the differing price elasticities of demand.

C) control the rising costs of hotel ownership.

D) appear to offer choices to the consumer.

E) deter last-minute reservations.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

13

Airlines require every passenger with a ticket to have a matching,government-issued photo identification.Price discrimination is made easier because

A) this practice prevents a passenger who purchased a discounted fare from reselling that ticket to another customer who is willing to pay more.

B) this practice allows airlines to determine the different personal characteristics of their buyers at a zero cost.

C) this type of price discrimination is mandated and supported by the federal government.

D) customers acknowledge that they are exchanging higher ticket prices for decreased safety regulations.

E) customers are then willing to divulge relevant information to the airline about their reservation price.

A) this practice prevents a passenger who purchased a discounted fare from reselling that ticket to another customer who is willing to pay more.

B) this practice allows airlines to determine the different personal characteristics of their buyers at a zero cost.

C) this type of price discrimination is mandated and supported by the federal government.

D) customers acknowledge that they are exchanging higher ticket prices for decreased safety regulations.

E) customers are then willing to divulge relevant information to the airline about their reservation price.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

14

For a firm to be able to practice price discrimination,it must be a

A) price maker.

B) cost producer.

C) price practitioner.

D) price taker.

E) profit maker.

A) price maker.

B) cost producer.

C) price practitioner.

D) price taker.

E) profit maker.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is necessary for price discrimination to occur?

A) The firm must be able to produce the good at a low cost.

B) The firm needs to decrease profits.

C) The market allows for reselling goods.

D) Consumers' preferences are hidden from the firm.

E) The firm is able to distinguish among groups of buyers easily.

A) The firm must be able to produce the good at a low cost.

B) The firm needs to decrease profits.

C) The market allows for reselling goods.

D) Consumers' preferences are hidden from the firm.

E) The firm is able to distinguish among groups of buyers easily.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

16

A firm cannot price discriminate if it

A) operates in a competitive environment.

B) has a downward-sloping demand curve.

C) has a business that is regulated.

D) has perfect information about market demand.

E) can prevent resale of its product.

A) operates in a competitive environment.

B) has a downward-sloping demand curve.

C) has a business that is regulated.

D) has perfect information about market demand.

E) can prevent resale of its product.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

17

A firm can be identified as practicing price discrimination when

A) consumers engage in comparison shopping to find the lowest advertised price.

B) firms behave as price takers,whereas consumers react with price-making behavior.

C) buyers in a perfectly competitive market are able to influence the prices that firms set.

D) producers pass on differences in costs to those price-conscious consumers willing to buy in bulk.

E) producers set different prices for distinct groups of consumers,despite selling identical products to each group.

A) consumers engage in comparison shopping to find the lowest advertised price.

B) firms behave as price takers,whereas consumers react with price-making behavior.

C) buyers in a perfectly competitive market are able to influence the prices that firms set.

D) producers pass on differences in costs to those price-conscious consumers willing to buy in bulk.

E) producers set different prices for distinct groups of consumers,despite selling identical products to each group.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

18

Price discrimination allows firms to make more money by partitioning their customers into at least two distinct groups,those who

A) the firm wants to retain as customers and those who will decide to buy elsewhere.

B) have a similar elasticity of demand and those who are unaware of their demand elasticity.

C) will get a discount and those who are willing to pay more.

D) differ from their usual customer type and those with characteristics common to their customer base.

E) are willing to pay more and those who buy whenever they see the word 'discount.'

A) the firm wants to retain as customers and those who will decide to buy elsewhere.

B) have a similar elasticity of demand and those who are unaware of their demand elasticity.

C) will get a discount and those who are willing to pay more.

D) differ from their usual customer type and those with characteristics common to their customer base.

E) are willing to pay more and those who buy whenever they see the word 'discount.'

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

19

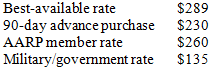

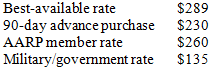

Reese Witherspoon plans to visit her hometown of New Orleans, Louisiana. When her assistant checked the hotel reservation website, there were four published rates available, which are summarized in the following table. Use this table to answer the following questions:

Why would the hotel require a guest to provide appropriate identification to receive the American Association of Retired Persons (AARP)member rate,the military rate,or the government rate?

A) to prevent resale of discounted rooms to other buyers who are not eligible for the discounted price

B) to honor those who serve in the military and offer support to the troops

C) to encourage active membership in AARP

D) to ensure that distinguished government guests are assigned the appropriate costs

E) to limit the number of patrons who receive each type of rate

Why would the hotel require a guest to provide appropriate identification to receive the American Association of Retired Persons (AARP)member rate,the military rate,or the government rate?

A) to prevent resale of discounted rooms to other buyers who are not eligible for the discounted price

B) to honor those who serve in the military and offer support to the troops

C) to encourage active membership in AARP

D) to ensure that distinguished government guests are assigned the appropriate costs

E) to limit the number of patrons who receive each type of rate

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

20

In 1996,Victoria's Secret shipped different catalogs to customers based on their buying habits.Frequent customers received catalogs with lower prices,whereas new customers received catalogs with higher prices for those same items.Victoria's Secret was practicing

A) monopolistic competition.

B) reservation pricing.

C) price retention.

D) efficient pricing.

E) price discrimination.

A) monopolistic competition.

B) reservation pricing.

C) price retention.

D) efficient pricing.

E) price discrimination.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

21

In New York City's Chinatown,tourists flock to shops to buy souvenirs from local retailers.Each store sells similar items,but each salesperson tries to determine a customer's reservation price before reaching a deal.In this scenario,the salesperson is attempting

A) perfect price discrimination.

B) to minimize producer loss.

C) to minimize consumer loss.

D) to maximize buyer behavior.

E) price-taking discrimination.

A) perfect price discrimination.

B) to minimize producer loss.

C) to minimize consumer loss.

D) to maximize buyer behavior.

E) price-taking discrimination.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

22

Reflect on the following excerpt from a Washington Post article about dynamic pricing by online retail giant Amazon.com and answer the following questions:

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

For the consumer who might have to pay based on "where you live and who you are," perfect price discrimination may feel unfair because it results in a

A) decrease in total welfare.

B) loss of consumer surplus.

C) loss of producer surplus.

D) decrease in deadweight loss.

E) loss of market efficiency.

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

For the consumer who might have to pay based on "where you live and who you are," perfect price discrimination may feel unfair because it results in a

A) decrease in total welfare.

B) loss of consumer surplus.

C) loss of producer surplus.

D) decrease in deadweight loss.

E) loss of market efficiency.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

23

Reflect on the following excerpt from a Washington Post article about dynamic pricing by online retail giant Amazon.com and answer the following questions:

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

One benefit of price discrimination is that

A) firms are able to provide goods to consumers at a consistent price.

B) some consumers are able to buy the product at a lower price than would otherwise exist.

C) all consumers are able to gain monopsony power.

D) most firms minimize revenue.

E) it exists only in theory,not in the real world.

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

One benefit of price discrimination is that

A) firms are able to provide goods to consumers at a consistent price.

B) some consumers are able to buy the product at a lower price than would otherwise exist.

C) all consumers are able to gain monopsony power.

D) most firms minimize revenue.

E) it exists only in theory,not in the real world.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

24

Reflect on the following excerpt from a Washington Post article about dynamic pricing by online retail giant Amazon.com and answer the following questions:

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

Firms engage in price discrimination primarily to

A) avoid a harmful activity.

B) retain monopoly power.

C) use customers efficiently.

D) keep prices hidden.

E) make additional profits.

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

Firms engage in price discrimination primarily to

A) avoid a harmful activity.

B) retain monopoly power.

C) use customers efficiently.

D) keep prices hidden.

E) make additional profits.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

25

The main reason firms cannot price discriminate under perfect competition is because

A) firms are price takers and cannot set prices for their goods.

B) firms cannot identify different kinds of consumers perfectly.

C) some goods are being resold in the market.

D) there is a lot of heterogeneity among consumers' tastes.

E) all firms share the same production technology.

A) firms are price takers and cannot set prices for their goods.

B) firms cannot identify different kinds of consumers perfectly.

C) some goods are being resold in the market.

D) there is a lot of heterogeneity among consumers' tastes.

E) all firms share the same production technology.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

26

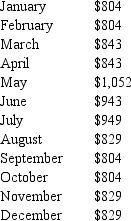

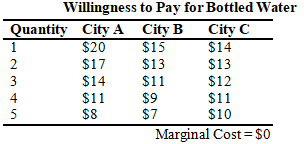

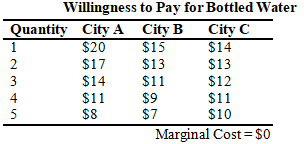

An executive,a surfer,and a schoolteacher each decide to fly from Atlanta,Georgia,to Honolulu,Hawaii.The schoolteacher can travel only during the months of June and July.The executive must travel in May for a meeting with her overseas board of directors.The surfer can travel anytime during the calendar year,but he faces a limited budget.The lowest airfare for each month is summarized in the following table.Assuming that the airline faces a constant cost of production each month for a flight,why is it beneficial for the airline to charge different prices each month?

A) The airline wants to attract more business executives as customers.

B) Because the airline is able to separate its customers into distinct groups-those who must travel during the summer months and those who can travel any time of the year-it is able to price discriminate and enjoy higher profits.

C) The airline wants to restrict the number of customers who fly on a limited budget because it makes less profit on those ticket sales.

D) Many schoolteachers travel with their families,so airlines prefer to make ticket prices reasonable for them.

E) Because surfers often travel with oversized luggage,airlines want to make ticket prices attractive to these customers so that the airline can claim the extra baggage fees.

A) The airline wants to attract more business executives as customers.

B) Because the airline is able to separate its customers into distinct groups-those who must travel during the summer months and those who can travel any time of the year-it is able to price discriminate and enjoy higher profits.

C) The airline wants to restrict the number of customers who fly on a limited budget because it makes less profit on those ticket sales.

D) Many schoolteachers travel with their families,so airlines prefer to make ticket prices reasonable for them.

E) Because surfers often travel with oversized luggage,airlines want to make ticket prices attractive to these customers so that the airline can claim the extra baggage fees.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

27

Reflect on the following excerpt from a Washington Post article about dynamic pricing by online retail giant Amazon.com and answer the following questions:

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

Perfect price discrimination exists when a firm sells ________ good at a unique price to ________.

A) a complementary; each group of buyers

B) a similar; most of its customers

C) a substitute; different customers

D) a discounted; a few of its customers

E) the same; each customer

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

Perfect price discrimination exists when a firm sells ________ good at a unique price to ________.

A) a complementary; each group of buyers

B) a similar; most of its customers

C) a substitute; different customers

D) a discounted; a few of its customers

E) the same; each customer

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

28

In the past,the University of Georgia (UGA)sold enrolled students a pack of paper tickets that granted them discounted access to all home football games.Recently,the university changed its policy to the following: "Student tickets will be inscribed on your valid UGA ID.There will be no physical tickets for home games." This rule change was most likely implemented to

A) encourage greater student attendance at home football games and thus gain higher profits.

B) keep students from actively practicing price discrimination at sporting events.

C) prevent students from reselling their discounted tickets to other buyers who are willing to pay full price for their tickets.

D) prevent ticket scalpers from being less willing to engage in price discrimination or other illegal activities near college campuses.

E) promote the use of a technological advance in card inscribing in order to avoid the negative externalities associated with the overprinting of paper materials.

A) encourage greater student attendance at home football games and thus gain higher profits.

B) keep students from actively practicing price discrimination at sporting events.

C) prevent students from reselling their discounted tickets to other buyers who are willing to pay full price for their tickets.

D) prevent ticket scalpers from being less willing to engage in price discrimination or other illegal activities near college campuses.

E) promote the use of a technological advance in card inscribing in order to avoid the negative externalities associated with the overprinting of paper materials.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

29

Firms engage in legal price discrimination if they

A) charge different prices for the same good based on tastes.

B) charge different prices for the same good based on race.

C) charge different prices for the same good based on the locational costs associated with producing the good.

D) charge the same prices to all.

E) never reveal their pricing plan to ineligible customers.

A) charge different prices for the same good based on tastes.

B) charge different prices for the same good based on race.

C) charge different prices for the same good based on the locational costs associated with producing the good.

D) charge the same prices to all.

E) never reveal their pricing plan to ineligible customers.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

30

Cart Vader is a new business venture aimed toward selling golf carts to be used as neighborhood recreational vehicles.The new Cart Vader business owner is uncertain about what price to charge for the golf carts.After consulting with multiple sources,the owner has decided to set a high sticker price,but to allow potential buyers to negotiate down to their individual reservation price.The business owner is attempting to practice

A) reservation price discrimination.

B) perfect price maximization.

C) potential price segmentation.

D) perfect price discrimination.

E) consumer price preservation.

A) reservation price discrimination.

B) perfect price maximization.

C) potential price segmentation.

D) perfect price discrimination.

E) consumer price preservation.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

31

Reflect on the following excerpt from a Washington Post article about dynamic pricing by online retail giant Amazon.com and answer the following questions:

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

The producer,who can charge each customer according to his or her willingness to pay for a product,can

A) minimize producer surplus by using price discrimination.

B) maximize consumer surplus by using perfect price prejudice.

C) minimize market efficiency by using two-tiered price discrimination.

D) maximize profits by using perfect price discrimination.

E) minimize loss by using perfect price determination.

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

The producer,who can charge each customer according to his or her willingness to pay for a product,can

A) minimize producer surplus by using price discrimination.

B) maximize consumer surplus by using perfect price prejudice.

C) minimize market efficiency by using two-tiered price discrimination.

D) maximize profits by using perfect price discrimination.

E) minimize loss by using perfect price determination.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

32

Price discrimination can help improve efficiency in the market because goods are sold to more people,thus increasing profits.If all consumers have the same tastes,will a firm be able to price discriminate?

A) yes,because the market is homogeneous

B) yes,as long as reselling is prohibited in the market

C) no,because the firm will not be able to distinguish among groups of consumers

D) no,because the similarities among consumers will lead to collusion among buyers

E) yes,because there will be a monopoly in the market (because all consumers want to purchase the same goods and services)

A) yes,because the market is homogeneous

B) yes,as long as reselling is prohibited in the market

C) no,because the firm will not be able to distinguish among groups of consumers

D) no,because the similarities among consumers will lead to collusion among buyers

E) yes,because there will be a monopoly in the market (because all consumers want to purchase the same goods and services)

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

33

Suppose two brothers own identical skydiving companies but have decided to experiment with different pricing structures.The older brother's company,Air Adventures,sets its prices using the profit-maximizing rule,while the younger brother's company,Sky Warriors,sets its prices using a two-tiered,price-discrimination model.Assuming that both companies face the same market demand curves,marginal costs,and costs of production,and wield significant market power for their service area,which of the following is most likely to occur?

A) Air Adventures will generate a similar net revenue to Sky Warriors.

B) Sky Warriors will generate a higher net revenue than Air Adventures.

C) Sky Warriors will generate a lower net revenue than Air Adventures.

D) Air Adventures will generate a higher net revenue than Sky Warriors.

E) Sky Warriors will eventually switch to the Air Adventures model.

A) Air Adventures will generate a similar net revenue to Sky Warriors.

B) Sky Warriors will generate a higher net revenue than Air Adventures.

C) Sky Warriors will generate a lower net revenue than Air Adventures.

D) Air Adventures will generate a higher net revenue than Sky Warriors.

E) Sky Warriors will eventually switch to the Air Adventures model.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

34

Reflect on the following excerpt from a Washington Post article about dynamic pricing by online retail giant Amazon.com and answer the following questions:

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

Perfect price discrimination occurs when a firm is able to

A) charge each buyer the highest price that he or she is willing to pay for the good.

B) identify at least two different groups of buyers.

C) determine the difference between a seller's reservation price and the buyer's reserve price.

D) prevent frequent reselling of its product.

E) determine the prices that should be charged to generate the largest amount of consumer surplus.

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

Perfect price discrimination occurs when a firm is able to

A) charge each buyer the highest price that he or she is willing to pay for the good.

B) identify at least two different groups of buyers.

C) determine the difference between a seller's reservation price and the buyer's reserve price.

D) prevent frequent reselling of its product.

E) determine the prices that should be charged to generate the largest amount of consumer surplus.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

35

Internet service providers such as Comcast are able to price discriminate easily for many reasons.Which of the following is a reason for them to price discriminate?

A) They offer better services than the competition.

B) They can easily identify new customers from old customers.

C) They let the customers choose from different packages based on income.

D) There are many competitors providing Internet services.

E) Some companies offer additional services such as cable and phone.

A) They offer better services than the competition.

B) They can easily identify new customers from old customers.

C) They let the customers choose from different packages based on income.

D) There are many competitors providing Internet services.

E) Some companies offer additional services such as cable and phone.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

36

Despite the gain from higher profits,firms are not always able to price discriminate because

A) they are unable to partition their customers into distinct groups.

B) it is always illegal to price discriminate in the United States.

C) they already hold a large degree of market power.

D) they already provide their goods at the lowest-possible prices.

E) they can easily determine each customer's reservation price.

A) they are unable to partition their customers into distinct groups.

B) it is always illegal to price discriminate in the United States.

C) they already hold a large degree of market power.

D) they already provide their goods at the lowest-possible prices.

E) they can easily determine each customer's reservation price.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

37

Reflect on the following excerpt from a Washington Post article about dynamic pricing by online retail giant Amazon.com and answer the following questions:

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

Price discrimination allows businesses to make additional profits and allows markets to work more

A) equitably.

B) efficiently.

C) independently.

D) realistically.

E) unfairly.

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

Price discrimination allows businesses to make additional profits and allows markets to work more

A) equitably.

B) efficiently.

C) independently.

D) realistically.

E) unfairly.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following is a real-world example of an attempt at perfect price discrimination?

A) a restaurant's blue plate special

B) a discount on preinstalled computer software

C) a car dealership selling an automobile

D) a college's varying tuition rates,depending on state of residence

E) an advertisement for "buy one,get one free" pizza before 3:00 P.M.

A) a restaurant's blue plate special

B) a discount on preinstalled computer software

C) a car dealership selling an automobile

D) a college's varying tuition rates,depending on state of residence

E) an advertisement for "buy one,get one free" pizza before 3:00 P.M.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

39

Firms are most likely to engage in price discrimination if

A) the goods can be resold in the market without any loss in value or quality.

B) the goods can be resold in the market,but there is a large loss in the value or quality of the product.

C) the goods cannot be resold in the market.

D) consumers all have a similar reservation price for the goods produced.

E) consumers of all ages have similar preferences for the goods produced.

A) the goods can be resold in the market without any loss in value or quality.

B) the goods can be resold in the market,but there is a large loss in the value or quality of the product.

C) the goods cannot be resold in the market.

D) consumers all have a similar reservation price for the goods produced.

E) consumers of all ages have similar preferences for the goods produced.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

40

Reflect on the following excerpt from a Washington Post article about dynamic pricing by online retail giant Amazon.com and answer the following questions:

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

A firm that is able to differentiate between each of its customers by selling the same good at a unique price to each customer is practicing ________ discrimination.

A) reservation price

B) perfect price

C) inelastic demand

D) idealized price

E) exclusive price

Few things stir up a consumer revolt quicker than the notion that someone else is getting a better deal. That’s a lesson Amazon.com has just learned. Amazon, the largest and most potent force in e-commerce, was recently revealed to be selling the same DVD movies for different prices to different customers. It was the first major Web test of a strategy called “dynamic pricing,” which gauges a shopper’s desire, measures his means and then charges accordingly. The Internet was supposed to empower consumers, letting them compare deals with the click of a mouse. But it is also supplying retailers with information about their customers that they never had before, along with the technology to use all this accumulated data. While prices have always varied by geography, local competition and whim, retailers were never able to effectively target individuals until the Web. “Dynamic pricing is the new reality, and it’s going to be used by more and more retailers,” said Vernon Keenan, a San Francisco Internet consultant. “In the future, what you pay will be determined by where you live and who you are. It’s unfair, but that doesn’t mean it’s not going to happen.”

Source: David Streitfeld, “On the Web, Price Tags Blur: What You Pay Could Depend on Who You Are,” Washington Post, September 27, 2000, A1.

A firm that is able to differentiate between each of its customers by selling the same good at a unique price to each customer is practicing ________ discrimination.

A) reservation price

B) perfect price

C) inelastic demand

D) idealized price

E) exclusive price

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

41

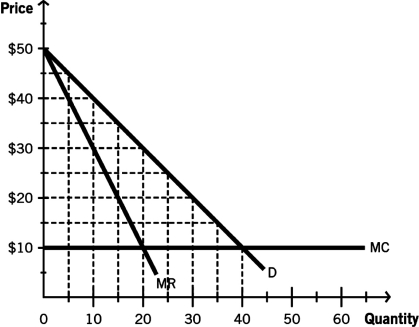

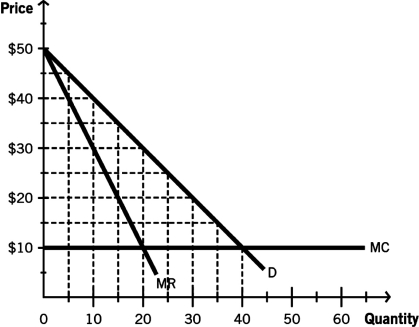

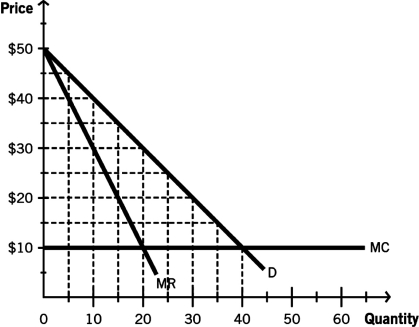

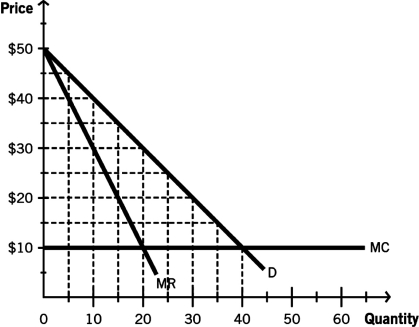

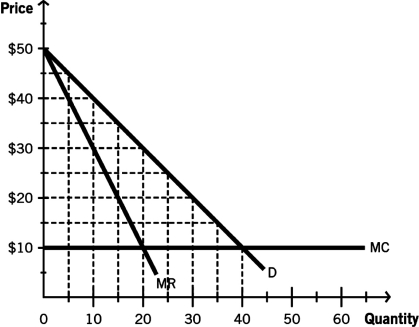

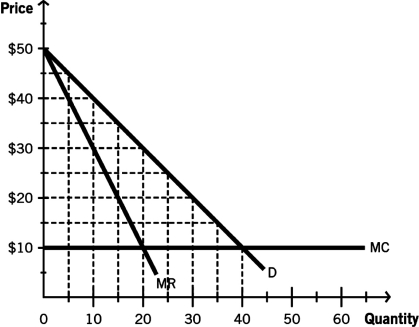

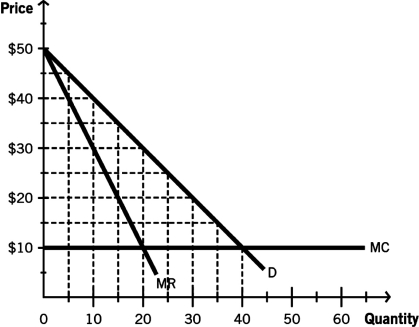

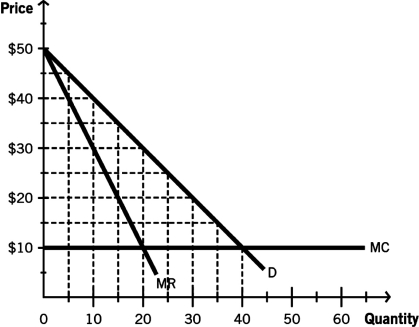

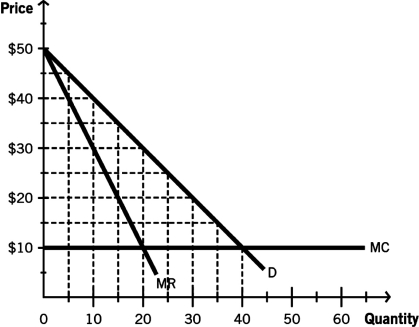

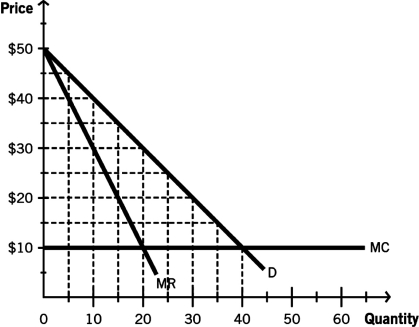

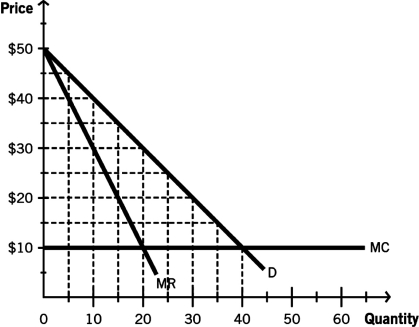

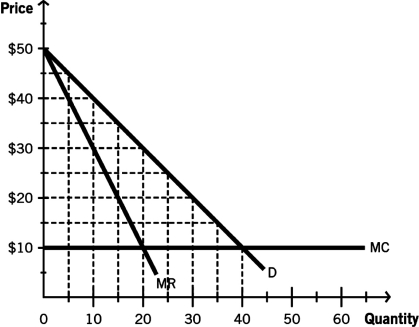

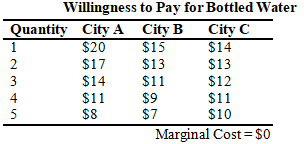

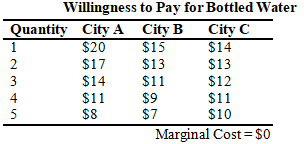

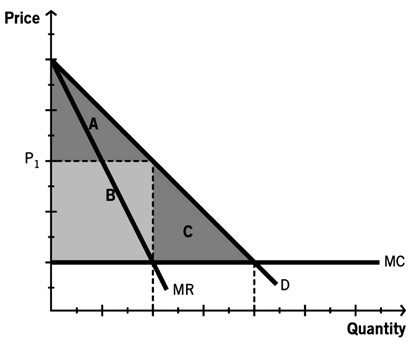

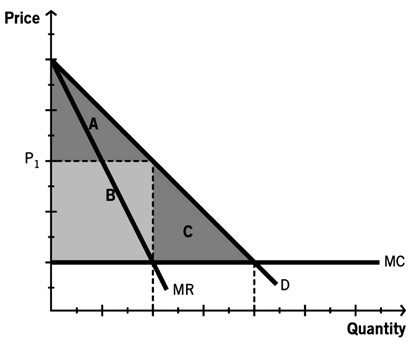

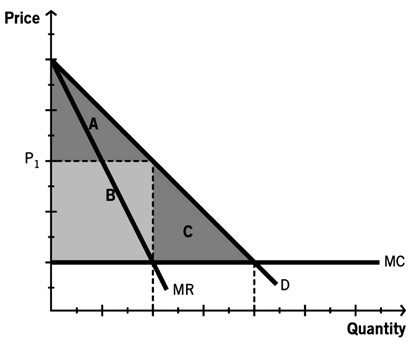

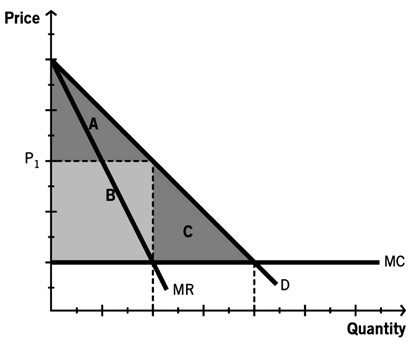

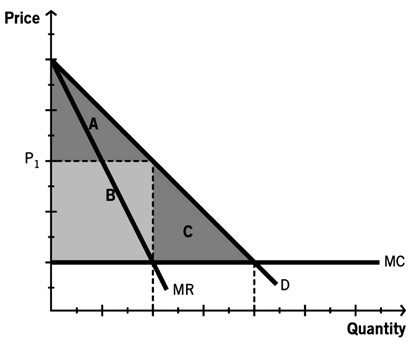

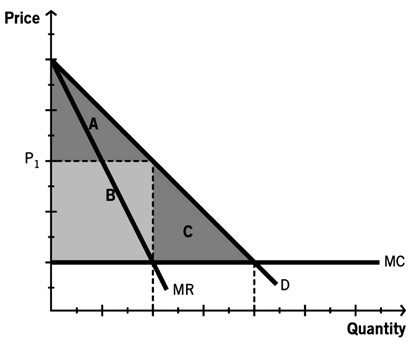

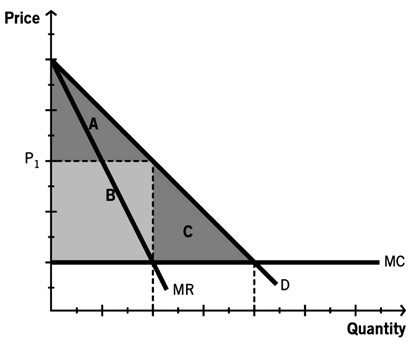

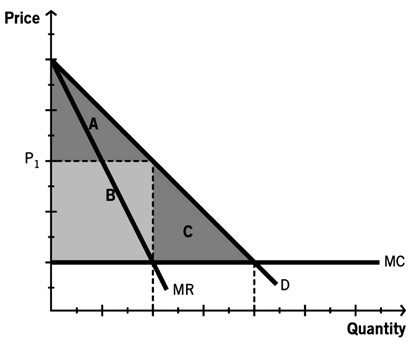

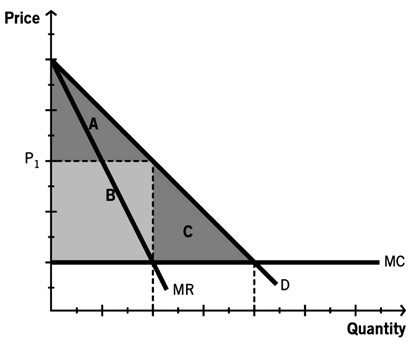

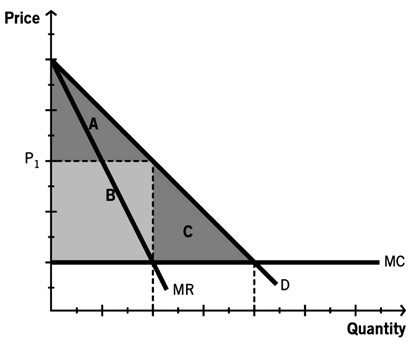

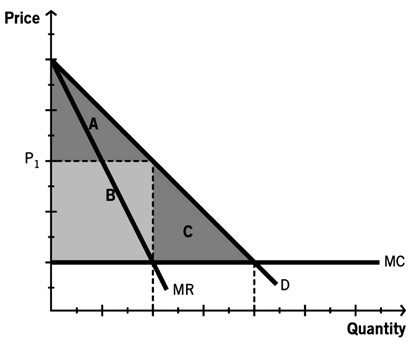

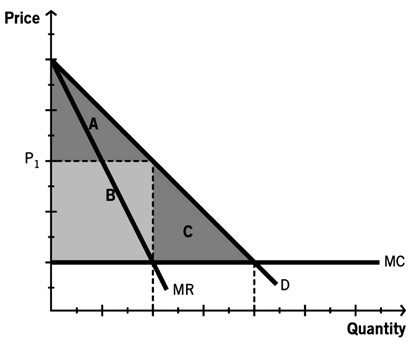

Use the following information to answer the following questions: The accompanying figure depicts the demand (D)curve for general admission concert tickets to see ECON-Jammin',the world's first economics rock band,which is scheduled to visit your city next month.The concert venue can accommodate 100 fans with a marginal cost (MC)of $10 per person.

If ECON-Jammin' charges a single price to see the band in concert and follows the profit-maximizing rule for a monopoly,how many people will attend the concert?

A) 50

B) 40

C) 30

D) 20

E) 10

If ECON-Jammin' charges a single price to see the band in concert and follows the profit-maximizing rule for a monopoly,how many people will attend the concert?

A) 50

B) 40

C) 30

D) 20

E) 10

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

42

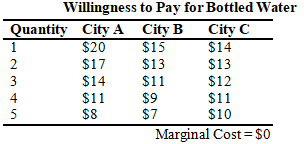

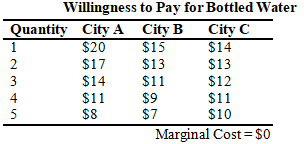

Consider the following scenario to answer the following questions: EJH Cinemas, a movie theater next to your university, attracts two types of customers—those who are associated with the university (students, faculty, and staff) and locals who live in the surrounding area. There are 10,000 university customers interested in purchasing movie tickets from EJH Cinemas, with a maximum willingness to pay of $7 per ticket. There are 20,000 local customers interested in purchasing tickets, with a maximum willingness to pay of $9 per ticket. The movie theater incurs a constant marginal cost of $4 per ticket. For simplicity, assume each customer purchases, at most, one ticket.

What is the amount of consumer surplus if the price is $9 per ticket?

A) $120,000

B) $90,000

C) $80,000

D) $40,000

E) $0

What is the amount of consumer surplus if the price is $9 per ticket?

A) $120,000

B) $90,000

C) $80,000

D) $40,000

E) $0

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

43

Qcue is a software-based dynamic pricing management company that has developed software to assist professional and collegiate sports teams in increasing their ticket sales by practicing near-perfect price discrimination.Use the following excerpt from a Forbes article about the company to answer the following questions:

Dynamic pricing will become much more prevalent in both professional and collegiate sports over the next few years....In an industry where the demand across games tends to be dissimilar for a plethora of reasons-some predictable,yet some spurious-it only makes sense that the pricing of sports tickets should allow teams the ability to price their inventory in the most efficient way possible...."Accurately pricing tickets is a very difficult process," says Barry Kahn,the CEO of Qcue."In the initial stages,we had both technical and emotional barriers to overcome.We were changing the way things had been done for so many years,moving from pricing tickets 9 months out and keeping them static,to allowing the price to flex right up until the first pitch.That meant educating those in charge of ticketing operations as well as the fans." ...In 2009,Qcue had one client.In 2010,they were working with three teams.Today their roster includes 30+ teams across MLB,MLS,NHL and NBA.

Source: Patrick Rishe,"Dynamic Pricing: The Future of Ticket Pricing in Sports," Forbes,January 6,2012,http://www.forbes.com/sites/prishe/2012/01/06/dynamic-pricing-the-future-of-ticket-pricing-in- sports/.

When teams are able to change ticket prices minute to minute based on demand,they are attempting to

A) discount tickets to their most loyal fans.

B) transfer surplus from consumers to producers.

C) prevent the resale of tickets through ticket reselling websites like StubHub.

D) confuse the fans of their rivals in order to gain a home-field advantage.

E) break down the technical and emotional barriers that exist between fans and team owners.

Dynamic pricing will become much more prevalent in both professional and collegiate sports over the next few years....In an industry where the demand across games tends to be dissimilar for a plethora of reasons-some predictable,yet some spurious-it only makes sense that the pricing of sports tickets should allow teams the ability to price their inventory in the most efficient way possible...."Accurately pricing tickets is a very difficult process," says Barry Kahn,the CEO of Qcue."In the initial stages,we had both technical and emotional barriers to overcome.We were changing the way things had been done for so many years,moving from pricing tickets 9 months out and keeping them static,to allowing the price to flex right up until the first pitch.That meant educating those in charge of ticketing operations as well as the fans." ...In 2009,Qcue had one client.In 2010,they were working with three teams.Today their roster includes 30+ teams across MLB,MLS,NHL and NBA.

Source: Patrick Rishe,"Dynamic Pricing: The Future of Ticket Pricing in Sports," Forbes,January 6,2012,http://www.forbes.com/sites/prishe/2012/01/06/dynamic-pricing-the-future-of-ticket-pricing-in- sports/.

When teams are able to change ticket prices minute to minute based on demand,they are attempting to

A) discount tickets to their most loyal fans.

B) transfer surplus from consumers to producers.

C) prevent the resale of tickets through ticket reselling websites like StubHub.

D) confuse the fans of their rivals in order to gain a home-field advantage.

E) break down the technical and emotional barriers that exist between fans and team owners.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

44

Consider the following scenario to answer the following questions: EJH Cinemas, a movie theater next to your university, attracts two types of customers—those who are associated with the university (students, faculty, and staff) and locals who live in the surrounding area. There are 10,000 university customers interested in purchasing movie tickets from EJH Cinemas, with a maximum willingness to pay of $7 per ticket. There are 20,000 local customers interested in purchasing tickets, with a maximum willingness to pay of $9 per ticket. The movie theater incurs a constant marginal cost of $4 per ticket. For simplicity, assume each customer purchases, at most, one ticket.

If EJH Cinemas decides to practice price discrimination,charging $9 for a standard ticket available to everyone,but only $7 for a ticket if you show your university identification (students,faculty,and staff),what will be the movie theater's total revenue?

A) $250,000

B) $200,000

C) $180,000

D) $170,000

E) $150,000

If EJH Cinemas decides to practice price discrimination,charging $9 for a standard ticket available to everyone,but only $7 for a ticket if you show your university identification (students,faculty,and staff),what will be the movie theater's total revenue?

A) $250,000

B) $200,000

C) $180,000

D) $170,000

E) $150,000

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

45

Use the following information to answer the following questions: The accompanying figure depicts the demand (D)curve for general admission concert tickets to see ECON-Jammin',the world's first economics rock band,which is scheduled to visit your city next month.The concert venue can accommodate 100 fans with a marginal cost (MC)of $10 per person.

ECON-Jammin' has recently discovered that its fans are made up of two distinct groups that can be easily distinguished.The band has decided to utilize its economic knowledge and offer a high-priced ticket of $40 per person and a low-priced ticket of $20 per person.Based on this information,what is the net revenue earned by the sales of the high-priced ticket?

A) $500

B) $300

C) $250

D) $200

E) $150

ECON-Jammin' has recently discovered that its fans are made up of two distinct groups that can be easily distinguished.The band has decided to utilize its economic knowledge and offer a high-priced ticket of $40 per person and a low-priced ticket of $20 per person.Based on this information,what is the net revenue earned by the sales of the high-priced ticket?

A) $500

B) $300

C) $250

D) $200

E) $150

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

46

Qcue is a software-based dynamic pricing management company that has developed software to assist professional and collegiate sports teams in increasing their ticket sales by practicing near-perfect price discrimination.Use the following excerpt from a Forbes article about the company to answer the following questions:

Dynamic pricing will become much more prevalent in both professional and collegiate sports over the next few years....In an industry where the demand across games tends to be dissimilar for a plethora of reasons-some predictable,yet some spurious-it only makes sense that the pricing of sports tickets should allow teams the ability to price their inventory in the most efficient way possible...."Accurately pricing tickets is a very difficult process," says Barry Kahn,the CEO of Qcue."In the initial stages,we had both technical and emotional barriers to overcome.We were changing the way things had been done for so many years,moving from pricing tickets 9 months out and keeping them static,to allowing the price to flex right up until the first pitch.That meant educating those in charge of ticketing operations as well as the fans." ...In 2009,Qcue had one client.In 2010,they were working with three teams.Today their roster includes 30+ teams across MLB,MLS,NHL and NBA.

Source: Patrick Rishe,"Dynamic Pricing: The Future of Ticket Pricing in Sports," Forbes,January 6,2012,http://www.forbes.com/sites/prishe/2012/01/06/dynamic-pricing-the-future-of-ticket-pricing-in- sports/.

Another market that is well-known for this practice is the market for

A) airline tickets.

B) secondary education.

C) online music.

D) economics textbooks.

E) college dorm rooms.

Dynamic pricing will become much more prevalent in both professional and collegiate sports over the next few years....In an industry where the demand across games tends to be dissimilar for a plethora of reasons-some predictable,yet some spurious-it only makes sense that the pricing of sports tickets should allow teams the ability to price their inventory in the most efficient way possible...."Accurately pricing tickets is a very difficult process," says Barry Kahn,the CEO of Qcue."In the initial stages,we had both technical and emotional barriers to overcome.We were changing the way things had been done for so many years,moving from pricing tickets 9 months out and keeping them static,to allowing the price to flex right up until the first pitch.That meant educating those in charge of ticketing operations as well as the fans." ...In 2009,Qcue had one client.In 2010,they were working with three teams.Today their roster includes 30+ teams across MLB,MLS,NHL and NBA.

Source: Patrick Rishe,"Dynamic Pricing: The Future of Ticket Pricing in Sports," Forbes,January 6,2012,http://www.forbes.com/sites/prishe/2012/01/06/dynamic-pricing-the-future-of-ticket-pricing-in- sports/.

Another market that is well-known for this practice is the market for

A) airline tickets.

B) secondary education.

C) online music.

D) economics textbooks.

E) college dorm rooms.

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

47

Use the following information to answer the following questions: The accompanying figure depicts the demand (D)curve for general admission concert tickets to see ECON-Jammin',the world's first economics rock band,which is scheduled to visit your city next month.The concert venue can accommodate 100 fans with a marginal cost (MC)of $10 per person.

ECON-Jammin' has recently discovered that its fans are made up of two distinct groups that can be easily distinguished.The band has decided to utilize its economic knowledge and offer a high-priced ticket of $40 per person and a low-priced ticket of $20 per person.Based on this information,what is the profit earned by the sales of the low-priced ticket?

A) $200

B) $300

C) $400

D) $500

E) $600

ECON-Jammin' has recently discovered that its fans are made up of two distinct groups that can be easily distinguished.The band has decided to utilize its economic knowledge and offer a high-priced ticket of $40 per person and a low-priced ticket of $20 per person.Based on this information,what is the profit earned by the sales of the low-priced ticket?

A) $200

B) $300

C) $400

D) $500

E) $600

Unlock Deck

Unlock for access to all 175 flashcards in this deck.

Unlock Deck

k this deck

48

Use the following information to answer the following questions: The accompanying figure depicts the demand (D)curve for general admission concert tickets to see ECON-Jammin',the world's first economics rock band,which is scheduled to visit your city next month.The concert venue can accommodate 100 fans with a marginal cost (MC)of $10 per person.

If ECON-Jammin' charges a single price for its concert tickets and follows the profit-maximizing rule for a monopoly,what will be the price that is charged per ticket?

A) $50

B) $45

C) $40

D) $35

E) $30