Deck 2: Gross Income and Exclusions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/120

Play

Full screen (f)

Deck 2: Gross Income and Exclusions

1

Jack is a lawyer and Jeri is a child psychologist. Jack prepares Jeri's estate planning at no charge and Jeri agrees to counsel Jack's daughter six times at no charge in return for the estate planning. The value of the estate planning is $1,000 and the value of the therapy sessions is $1,000.

a.How much income does Jack have? Why?

b.How much income does Jeri have? Why?

a.How much income does Jack have? Why?

b.How much income does Jeri have? Why?

a. $1,000. Taxable income includes "all income from whatever source derived." The value of the therapy for his child is income to him for the performances of services. There is no taxable income exception in the tax law for "barter income."

b. $1,000. Taxable income includes "all income from whatever source derived." The value of the estate planning is income to her for the performances of services. There is no taxable income exception in the tax law for "barter income."

b. $1,000. Taxable income includes "all income from whatever source derived." The value of the estate planning is income to her for the performances of services. There is no taxable income exception in the tax law for "barter income."

2

Barry has a successful methamphetamine laboratory. Producing methamphetamine is illegal under federal law. Is Barry required by law to report the income from his lab on his tax return? Why?

Yes. Illegal income is still taxable income since there is no exception excluding it in the tax code. When there is no explicit exception, taxable income is "all income from whatever source derived."

3

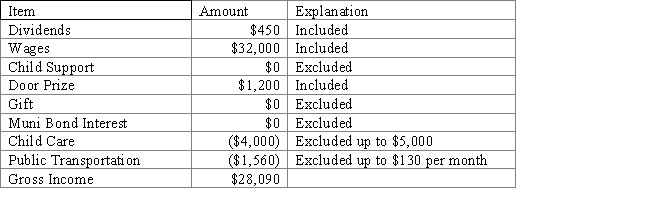

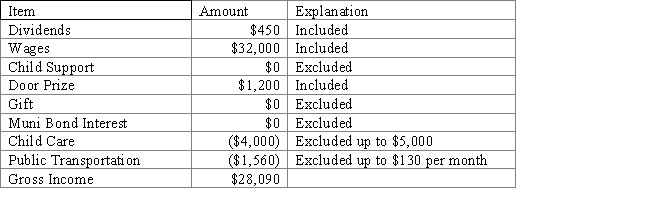

Craig, a single taxpayer, received the following items in 2015: dividends of $450, wages of $32,000, child support from his ex-spouse of $400 per month, a new television worth $1,200 from a door prize at a conference he attended, a gift of $3,000 from Craig's parents, and $200 of interest on bonds issued by the State of Arizona. Craig set aside $4,000 of his wages (the $4,000 has not been deducted from the $32,000 of wages listed previously) to cover childcare for his dependent children. He also receives a reimbursement of $270 per month to pay for public transportation passes each month (also not deducted from the $32,000 of wages reported previously). Based on the above, what is Craig's gross income in 2015?

Gross income equals

$28,090.

$28,090.

4

In the tax law, the definition of gross income is:

A)All cash payments received unless excluded by the tax code

B)All cash payments received for services performed

C)All income from whatever source derived

D)All income of any kind unless the income is earned illegally

A)All cash payments received unless excluded by the tax code

B)All cash payments received for services performed

C)All income from whatever source derived

D)All income of any kind unless the income is earned illegally

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following amounts must be included in the gross income of the recipient?

A)Child support payments

B)Welfare payments

C)Gifts

D)Royalties

E)All of the above are included in gross income

A)Child support payments

B)Welfare payments

C)Gifts

D)Royalties

E)All of the above are included in gross income

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

6

All of the following amounts are taxable income to the recipient except:

A)Prizes

B)Unemployment compensation

C)Salaries

D)Farm income

E)Gifts

A)Prizes

B)Unemployment compensation

C)Salaries

D)Farm income

E)Gifts

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

7

Noncash items received as income must be included in income at their fair market value.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not taxable income?

A)Dividends

B)Income from relief of debt

C)Interest

D)Royalties

E)Welfare benefits

A)Dividends

B)Income from relief of debt

C)Interest

D)Royalties

E)Welfare benefits

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

9

As a Christmas thank you for being a good employee, Ed's TV Repair gave 62-year-old Edwina three shares of its stock worth $20 per share. Edwina then received dividends of $1 per share related to the stock. How much should be included in Edwina's gross income?

A)$0

B)$3

C)$60

D)$63

E)None of the above

A)$0

B)$3

C)$60

D)$63

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

10

Andy landscaped his friend's house in return for a couch set and an HD television worth $8,000. How much income must Andy report on his tax return for his services?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is classified as nontaxable income?

A)Unemployment compensation

B)Dividend income

C)Income from real estate rental property

D)Welfare payments

E)None of the above

A)Unemployment compensation

B)Dividend income

C)Income from real estate rental property

D)Welfare payments

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

12

All of the following amounts are excluded from gross income, except:

A)Tips and gratuities

B)Child support payments

C)Scholarship grants for tuition

D)Gifts

E)Veterans' benefits

A)Tips and gratuities

B)Child support payments

C)Scholarship grants for tuition

D)Gifts

E)Veterans' benefits

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

13

Disability benefits are generally taxable to the individual receiving the amounts.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is excluded from gross income?

A)Prizes

B)Scholarships for tuition

C)Hobby income

D)Rental income

E)All of the above are included in gross income

A)Prizes

B)Scholarships for tuition

C)Hobby income

D)Rental income

E)All of the above are included in gross income

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

15

All of the following amounts must be included in gross income, except:

A)Gambling winnings

B)Partnership income

C)Accident insurance proceeds

D)Dividends

E)Jury duty fees

A)Gambling winnings

B)Partnership income

C)Accident insurance proceeds

D)Dividends

E)Jury duty fees

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

16

Bonnie receives salary income of $32,000, unemployment compensation of $4,400, and interest income of $1,200 and a gift of $7,000 in cash from her aunt. How much total income does Bonnie have?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is nontaxable income to the recipient for tax purposes?

A)Salary income

B)Income from real estate rental property

C)Income from tips

D)Inheritances

E)None of the above

A)Salary income

B)Income from real estate rental property

C)Income from tips

D)Inheritances

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

18

Awards, bonuses, and gifts are all included in gross income.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is generally excluded from gross income?

A)Dividends

B)Rewards

C)Disability benefits

D)Passive income

E)None of the above

A)Dividends

B)Rewards

C)Disability benefits

D)Passive income

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

20

Mary received the following items during 2015: What is the total amount of the above items that must be included in Mary's 2015 gross income?

A)$0

B)$100

C)$135

D)$600

E)$635

A)$0

B)$100

C)$135

D)$600

E)$635

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

21

Arthur, age 19, is a full-time student at Gordon College and is a candidate for a bachelor's degree. During 2015, he received the following amounts: What is his adjusted gross income for 2015?

A)$300

B)$500

C)$2,300

D)$2,500

E)None of the above

A)$300

B)$500

C)$2,300

D)$2,500

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

22

Taxpayers must report interest income on Series EE savings bonds as the interest accrues.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

23

Jerry and Sally were divorced under an agreement executed July 1, 2015. The terms of the agreement provide that Jerry will transfer to Sally his interest in a rental house worth $250,000 with a tax basis to Jerry of $80,000. What is the amount of the gain that must be recognized by Jerry on the transfer of the property and what is Sally's tax basis in the property after the transfer, respectively?

A)$170,000 and $250,000

B)$0 and $250,000

C)$170,000 and $170,000

D)$0 and $80,000

E)None of the above

A)$170,000 and $250,000

B)$0 and $250,000

C)$170,000 and $170,000

D)$0 and $80,000

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

24

In 2015, what rate would a taxpayer pay on qualified dividend income:

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

25

Interest income received by a cash basis taxpayer is generally reported in the tax year it is received.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

26

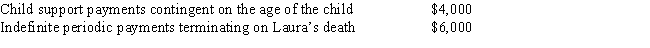

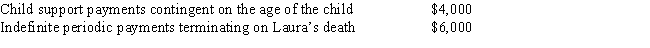

Laura and Leon were granted a divorce in 2006. In accordance with the decree, Leon made the following payments to Laura in 2015: How much of the payments can he deduct as alimony in 2015?

A)$0

B)$6,000

C)$10,000

D)$4,000

E)None of the above

A)$0

B)$6,000

C)$10,000

D)$4,000

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

27

Roger is required under a 2005 divorce decree to pay $500 of alimony and $200 of child support per month for 12 years. In addition, Roger makes a voluntary payment of $100 per month. How much of the total monthly payment is deductible by Roger?

A)$0

B)$200

C)$500

D)$600

E)None of the above

A)$0

B)$200

C)$500

D)$600

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

28

A gift received from a financial institution for opening a bank account is not taxable income to the recipient.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

29

If a taxpayer holding EE bonds makes an election with respect to the taxation of the bonds, how is the interest which accrues on the bonds, but is not paid, taxed each year?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

30

In 2015, Uriah received the following interest payments:

Interest of $300 on an overpayment of 2014 Federal income taxes

Interest of $400 from his bank certificate of deposit.

Interest of $1,000 on municipal bonds

Interest of $1,500 on United States savings bonds (Series HH)

What amount, if any, should Uriah report as taxable interest income on his 2015 individual income tax return?

A)$0

B)$700

C)$2,200

D)$3,200

E)None of the above

Interest of $300 on an overpayment of 2014 Federal income taxes

Interest of $400 from his bank certificate of deposit.

Interest of $1,000 on municipal bonds

Interest of $1,500 on United States savings bonds (Series HH)

What amount, if any, should Uriah report as taxable interest income on his 2015 individual income tax return?

A)$0

B)$700

C)$2,200

D)$3,200

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

31

Tim receives $500 of qualified dividends from Exxon in 2015. He is in the 10 percent ordinary tax bracket. Tim's tax on the dividends will be:

A)$0

B)$25

C)$50

D)$75

E)$100

A)$0

B)$25

C)$50

D)$75

E)$100

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

32

Steve and Laura were divorced in 2009. Laura pays Steve alimony of $1,200 a month. The payment amount was agreed upon in the decree of divorce. To save money, Steve and Laura still live together. Are the alimony payments that Steve receives in 2015 includable in his income? Can Laura take a deduction for alimony paid?

A)Yes, the payments meet all alimony payment requirements.

B)Yes, alimony is always taxable.

C)No, only some of it is tax-exempt because Laura pays Steve too much alimony.

D)No, since Steve and Laura still live together, the payments are not considered alimony.

E)Yes, alimony payments are not tax-exempt.

A)Yes, the payments meet all alimony payment requirements.

B)Yes, alimony is always taxable.

C)No, only some of it is tax-exempt because Laura pays Steve too much alimony.

D)No, since Steve and Laura still live together, the payments are not considered alimony.

E)Yes, alimony payments are not tax-exempt.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

33

Richard and Alice are divorced and under the terms of their written divorce agreement signed on December 30, 2008, Richard was required to pay Alice $1,500 per month of which $600 was designated as child support. He made 12 such payments in 2015. Additionally, Richard voluntarily paid Alice $1,200 per month for 12 months of 2015, no portion of which was designated as child support. Assuming that Alice has no other income, her tax return for 2015 should show gross income of:

A)$0

B)$9,600

C)$10,800

D)$18,000

E)None of the above

A)$0

B)$9,600

C)$10,800

D)$18,000

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

34

Under a divorce agreement executed in the current year, periodic payments of either cash or property must be made at regular intervals to be deductible as alimony.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

35

If a divorce agreement executed in the current year specifies that a portion of the amount of an alimony payment is contingent upon the status of a child, that portion is considered to be a child support payment.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

36

Child support payments are deductible by the spouse making the payments.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

37

Qualified dividends are given special tax treatment. Describe how they are taxed.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

38

Interest on U.S. Treasury Bonds is not taxable.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

39

Elmer received the following distributions from Virginiana Mutual Fund for the calendar year 2015: Elsie, Elmer's wife, did not own any of the Virginiana Mutual Fund shares, but she did receive $1,475 in interest on a savings account at the Moss National Bank and $175 in interest on California Municipal Bonds. Elmer and Elsie filed a joint income tax return for 2015. What amount is reportable as taxable interest income?

A)$0

B)$175

C)$1,475

D)$1,650

E)None of the above

A)$0

B)$175

C)$1,475

D)$1,650

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

40

Elsie received the following distributions from Virginiana Mutual Fund for the calendar year 2015: Elmer, Elsie's husband, did not own any of the Virginiana Mutual Fund shares, but he did receive $1,600 in interest on a savings account at the Moss National Bank. Elmer and Elsie filed a joint income tax return for 2015. What portion of the distributions from Virginiana Mutual Fund is taxable as ordinary income on their 2015 individual income tax return?

A)$0

B)$250

C)$420

D)$500

E)None of the above

A)$0

B)$250

C)$420

D)$500

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following gifts or prizes would be considered taxable income to the person receiving the gift?

A)$5,000 given to the taxpayer by his friend

B)A mobile home given to the taxpayer by his mother

C)A ski boat won by the taxpayer on the Price is Right game show

D)A Mustang GT given to the taxpayer by his brother

E)None of the above would be considered taxable

A)$5,000 given to the taxpayer by his friend

B)A mobile home given to the taxpayer by his mother

C)A ski boat won by the taxpayer on the Price is Right game show

D)A Mustang GT given to the taxpayer by his brother

E)None of the above would be considered taxable

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

42

Martin retired in May 2015. His pension is $1,000 per month from a qualified retirement plan to which he contributed $42,000, and to which his employer contributed $12,000. Martin was 67 when the plan payments started. During 2015, he received 8 months of payment for a total of $8,000 from the plan.

a.Using the simplified method, calculate Martin's taxable income for 2015 from the retirement plan distributions.

b.

If Martin's contributions to the plan had been $25,200, instead of $42,000, using the simplified method, how much taxable income would he have to report in 2015 from the plan distributions?

a.Using the simplified method, calculate Martin's taxable income for 2015 from the retirement plan distributions.

b.

If Martin's contributions to the plan had been $25,200, instead of $42,000, using the simplified method, how much taxable income would he have to report in 2015 from the plan distributions?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

43

State whether each of the following is taxable or nontaxable.

a.Susan won a jackpot of $50,000 gambling at a casino.

b.Sarah received a Christmas ham from her employer.

c.Jonathan won a car in a supermarket raffle valued at $25,000.

d.Gary received a scholarship for tuition of $5,000 a year.

e.Eric is given lodging valued at $1,000 a month on the oil rig where he is employed since it is impossible for Eric to go home during the period of time he is assigned to work on the rig.

a.Susan won a jackpot of $50,000 gambling at a casino.

b.Sarah received a Christmas ham from her employer.

c.Jonathan won a car in a supermarket raffle valued at $25,000.

d.Gary received a scholarship for tuition of $5,000 a year.

e.Eric is given lodging valued at $1,000 a month on the oil rig where he is employed since it is impossible for Eric to go home during the period of time he is assigned to work on the rig.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

44

Under the terms of a property settlement executed during the current year, Cindy transferred a house worth $350,000 to her ex-husband, Carl. The property has a tax basis to Cindy of $300,000.

a.How much taxable gain or loss must be recognized by Cindy at the time of the transfer?

b.What is Carl's tax basis in the property he received from Cindy?

a.How much taxable gain or loss must be recognized by Cindy at the time of the transfer?

b.What is Carl's tax basis in the property he received from Cindy?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

45

For divorces after 1984, which of the following statements about alimony payments is not correct?

A)The payments must be in cash and must be received by the spouse (or former spouse)

B)Divorced or legally separated parties can be members of the same household at the time the payments are made

C)The payor must have no liability to make payments for any period following the death of the spouse receiving the payments

D)The payments must not be designated in the written agreement as anything other than alimony

A)The payments must be in cash and must be received by the spouse (or former spouse)

B)Divorced or legally separated parties can be members of the same household at the time the payments are made

C)The payor must have no liability to make payments for any period following the death of the spouse receiving the payments

D)The payments must not be designated in the written agreement as anything other than alimony

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

46

When calculating the exclusion ratio for an annuity, the ratio should be revised when there is a significant change in the taxpayer's status or health.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

47

An auto that is received as a prize should be included in the taxpayer's income at its list price rather than its fair market value.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

48

As part of the property settlement related to their divorce, Stella must give Peter the house that they have been living in, while she gets 100 percent of their savings accounts. The house was purchased in Texas 15 years ago for $100,000 and is now worth $110,000. How much gain must Stella recognize on the transfer of the house to Peter? What is Peter's tax basis in the house for calculating any future sale of the house?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

49

Sam died on January 15, 2005 and left his wife, Terry, an insurance policy with a face value of $100,000. Terry elected to receive the proceeds over a 10-year period ($10,000 plus interest each year). This year Terry receives $11,500 ($10,000 proceeds plus $1,500 interest) from the insurance company. How much income must Terry report from this payment?

A)$0

B)$500

C)$1,500

D)$11,500

E)None of the above

A)$0

B)$500

C)$1,500

D)$11,500

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

50

Rob is 8 years old and won a sports car valued at $30,000 in a drawing at Disneyland. How much income, if any, must Rob report on his 2015 tax return? Why?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

51

Richard, who retired on April 30, 2015, receives a monthly employee annuity benefit of $1,400 payable for life, beginning May 1, 2015. During his years of employment, Richard contributed $29,400 to the company's plan. Richard's age on May 1 is 66. Using the simplified method, how much of the annuity payment amounts received during 2015 ($11,200) may Richard exclude from gross income?

a.$427

b.$1,120

c.$1,680

d.$11,200

e.None of the above

a.$427

b.$1,120

c.$1,680

d.$11,200

e.None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

52

Under a divorce agreement executed in 2013, Bob is required to pay his ex-wife, Carol, $3,000 a month until their youngest daughter is 21 years of age. At that time, the required payments are reduced to $2,000 per month.

a.How much of each $3,000 payment may be deducted as alimony by Bob?

b.How much of each $3,000 payment must be included in Carol's taxable income?

a.How much of each $3,000 payment may be deducted as alimony by Bob?

b.How much of each $3,000 payment must be included in Carol's taxable income?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

53

Marie had a good year. She received the following prizes and awards: - an iPad from The Oprah Show with a fair market value of $500

- lottery winnings of $1,000 received in cash

- a plaque worth $25 plus $100 of Godiva chocolate in recognition for 100 days on the job without an accident

- a $10,000 cash prize from American Idol

How much of her prizes and awards should Marie report on her tax return?

A)None, they are all excluded from income

B)$11,000; only cash prizes and awards are included

C)$11,500; the award from her job is excluded

D)$11,700; the plaque may be excluded

E)$11,725; everything is included at the highest amount

- lottery winnings of $1,000 received in cash

- a plaque worth $25 plus $100 of Godiva chocolate in recognition for 100 days on the job without an accident

- a $10,000 cash prize from American Idol

How much of her prizes and awards should Marie report on her tax return?

A)None, they are all excluded from income

B)$11,000; only cash prizes and awards are included

C)$11,500; the award from her job is excluded

D)$11,700; the plaque may be excluded

E)$11,725; everything is included at the highest amount

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

54

Cynthia, age 64, retired in June. Starting in July, Cynthia received $2,000 per month from an annuity. She has contributed $260,000 to the annuity. Her life expectancy is 20 years. How much is excluded from income using the simplified method? Use 260 as the factor to divide by.

1. Enter total amount received this year

2. Enter cost in plan at the annuity starting date

3. Factor at annuity starting date 260

4. Divide line 2 by line 3

5. Multiply line 4 by the number of monthly payments this year

6. Amount, if any, recovered tax free in prior years

7. Subtract line 6 from line 2

8. Enter the smaller of line 5 or 7

9. Taxable amount this year. Subtract line 8 from line 1

1. Enter total amount received this year

2. Enter cost in plan at the annuity starting date

3. Factor at annuity starting date 260

4. Divide line 2 by line 3

5. Multiply line 4 by the number of monthly payments this year

6. Amount, if any, recovered tax free in prior years

7. Subtract line 6 from line 2

8. Enter the smaller of line 5 or 7

9. Taxable amount this year. Subtract line 8 from line 1

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

55

Payments made to a qualified retirement plan by an employer are considered part of the employee's investment in the contract for calculation of the annuity exclusion ratio.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

56

Dr. J's outstanding player award is not includible in income, since the award is in recognition of his outstanding performance.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

57

If a life insurance policy is transferred to the insured's partnership for valuable consideration, the insurance proceeds are taxable when received by the partnership.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

58

If an annuitant, whose annuity starting date was January 1, 2001, dies before recovering his or her investment in the annuity, any unrecovered investment is recognized as a loss on the annuitant's tax return for the year of death.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

59

Peter is required by his divorce agreement to pay alimony of $4,000 a month and child support of $6,000 a month to his ex-wife Stella. What is the tax treatment of these two payments?

To Peter?

To Stella?

To Peter?

To Stella?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

60

Laura and Leon were granted a divorce in 2006. In accordance with the decree, Leon made the following payments to Laura in 2015: How much should Laura include in her 2015 taxable income as alimony?

A)$0

B)$4,000

C)$6,000

D)$10,000

E)None of the above

A)$0

B)$4,000

C)$6,000

D)$10,000

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

61

In June of the current year, Rob's wealthy stepmother died and left him a stock portfolio worth $600,000. Before she died, she gave him a gift of $20,000 in cash. How much of these amounts, if any, are taxable to Rob? Why?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

62

Toby transfers to Jim a life insurance policy with a face value of $25,000 and a cash value of $5,000 in payment of a personal debt. Jim continues to make premium payments on the policy until Toby's death. At that time, Jim had paid $1,500 in premiums.

a.How much income must Jim report when he receives the $25,000 in proceeds?

b.Would your answer be different if Toby and Jim were partners in a partnership? Why?

a.How much income must Jim report when he receives the $25,000 in proceeds?

b.Would your answer be different if Toby and Jim were partners in a partnership? Why?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

63

Helga receives a $300,000 life insurance payment when her boyfriend Andy dies. How much of the payment is taxable to Helga?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

64

Ordinarily life insurance proceeds are excluded from gross income. Why would they be taxable if the policy had been transferred for valuable consideration, prior to the death of the insured?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

65

Geoff is a company president who has had a very good year at work. The owner of the company is pleased and gives him a gift of $50,000 at the end of the year. The owner writes "gift" in the memo section of the check. How much of the gift is taxable to Geoff?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following would result in life insurance proceeds that are taxable to the recipient?

A)A life insurance policy transferred to a creditor in payment of a debt

B)A life insurance policy in which the insured is the daughter of the taxpayer and the beneficiary is the taxpayer

C)A life insurance policy transferred by a shareholder to a corporation

D)A life insurance policy purchased by a taxpayer insuring his or her business partner

E)A life insurance policy purchased by a corporation insuring an officer.

A)A life insurance policy transferred to a creditor in payment of a debt

B)A life insurance policy in which the insured is the daughter of the taxpayer and the beneficiary is the taxpayer

C)A life insurance policy transferred by a shareholder to a corporation

D)A life insurance policy purchased by a taxpayer insuring his or her business partner

E)A life insurance policy purchased by a corporation insuring an officer.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

67

In June of the current year, a wealthy aunt gave Janie a stock portfolio worth $150,000. During the year, she collects $4,000 in dividends. How much of these amounts, if any, should Janie include in gross income for the current year? Why?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

68

Dividend income arising from stock received as a gift is excluded from gross income since the dividends are considered part of the gift.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

69

Nicole is a student at USB Law; she receives a $52,000 scholarship for 2015. Of the $52,000, $40,000 is used for tuition, $5,000 is used for books, and $7,000 is used for room and board. How much of the scholarship is excluded from taxable income for Nicole in 2015?

A)$5,000

B)$7,000

C)$45,000

D)$47,000

E)$52,000

A)$5,000

B)$7,000

C)$45,000

D)$47,000

E)$52,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

70

The receipt of an inheritance is excluded from the taxable income of the recipients.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

71

Karina receives a scholarship of $10,000 to a college. She is also given a job which pays $5,000 a year to help with her expenses. $7,000 of the scholarship is earmarked for tuition and $3,000 is for room and board. How much of the money from the scholarship and the job are taxable to Karina?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

72

Tracy transfers to Glen a life insurance policy with a face value of $40,000 and a cash value of $8,000 in payment of a personal debt. Glen continues to make premium payments on the policy until Tracy's death. At that time, Glen had paid $3,500 in premiums.

a.How much income must Glen report when he receives the $40,000 in proceeds?

b.Would your answer be different if Tracy were a shareholder and CEO of a corporation to which the policy was transferred? Why?

a.How much income must Glen report when he receives the $40,000 in proceeds?

b.Would your answer be different if Tracy were a shareholder and CEO of a corporation to which the policy was transferred? Why?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

73

A scholarship for room and board granted in 2015 is fully taxable to the recipient.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

74

Tim receives a $25,000 gift from his parents for a down payment on a house. They know he can not buy a house without their help. They write "gift" in the memo line of the check. How much of the gift is taxable to Tim?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

75

Van is sick and tired of his job. His doctor certifies that his health may be compromised if he continues to work at his current job. He sells his life insurance policy to Life Settlements, Inc. for $50,000 so he can take a break from work. He has paid $10,000 so far for the policy. How much of the $50,000 must Van include in his taxable income?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

76

Elmore receives a rental property as an inheritance from his grandmother. The rental is worth $500,000 and Elmore collected rental income of $24,000 during the year.

For the year, how much is Elmore's gross income as a result of the inheritance?

For the year, how much is Elmore's gross income as a result of the inheritance?

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

77

To promote business activity, the tax rules generally are very liberal in treating business gifts as tax-free income to the recipient.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

78

Amounts received as scholarships for books and tuition may be excluded from the recipient's taxable income.

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

79

To pay for college, Henry received the following: $1,000 scholarship from the Thespian Club to pay for books

$4,000 scholarship from the Elks Lodge for tuition

$5,000 worth of room and board as a dorm supervisor through a work-study program

How much income must Henry report on his tax return?

A)$0

B)$4,000

C)$5,000

D)$6,000

E)$10,000

$4,000 scholarship from the Elks Lodge for tuition

$5,000 worth of room and board as a dorm supervisor through a work-study program

How much income must Henry report on his tax return?

A)$0

B)$4,000

C)$5,000

D)$6,000

E)$10,000

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck

80

Seymore named his wife, Penelope, the beneficiary of a $100,000 insurance policy on his life. The policy provided that, upon his death, the proceeds would be paid at a rate of $4,000 per year plus interest over a 25-year period. Seymore died June 25, 2014, and in 2015 Penelope received a payment of $5,200 from the insurance company. What amount should she include in her gross income for 2015?

A)$200

B)$1,200

C)$4,000

D)$5,200

E)None of the above

A)$200

B)$1,200

C)$4,000

D)$5,200

E)None of the above

Unlock Deck

Unlock for access to all 120 flashcards in this deck.

Unlock Deck

k this deck