Deck 11: Capital Budgeting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

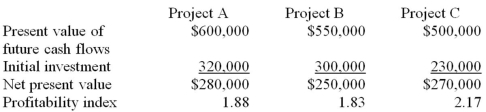

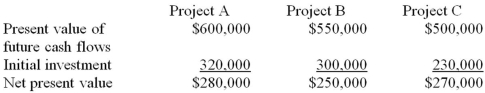

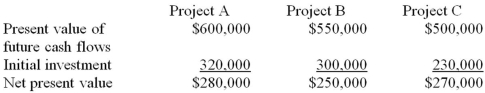

Question

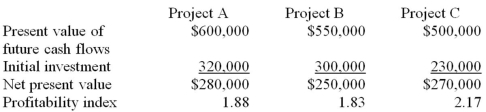

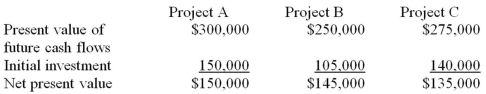

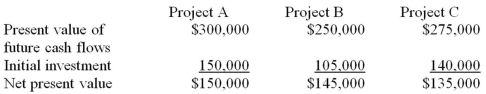

Question

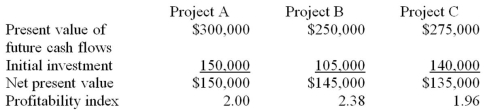

Question

Question

Question

Question

Question

Question

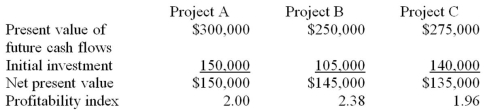

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/100

Play

Full screen (f)

Deck 11: Capital Budgeting

1

The net present value method is a discounted cash flow method.The net present value method incorporates the time value of money.

True

2

The net present value method compares a project's future net income to the initial investment.The net present value method compares the present value of a project's future cash flows to the initial investment.

False

3

To find the present value of a single amount,you only need to know the amount to be received in the future,the interest rate and the number of periods until the amount will be received.With these three elements you can compute present value.

True

4

Independent projects are unrelated to one another,so that investing in one project does not affect the choice about investing in another project.This is the definition of an independent project.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

5

The payback period is defined as the average net income divided by the initial investment.The payback period is the initial investment divided by the annual net cash flow,if cash flows are equal each year.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

6

The profitability index is calculated as the present value of future cash flows divided by the initial investment.This is the formula for the profitability index.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

7

The internal rate of return method uses cash flows rather than net income.The internal rate of return is calculated using cash flows.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

8

If a project has a positive net present value,it means the project is expected to provide returns that are greater than the cost of capital.If a project has a positive net present value,it means that the project is expected to provide returns that are greater than the cost of capital,creating economic value or wealth for the company and its shareholders.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

9

If the hurdle rate is greater than the internal rate of return,the net present value will be negative.The internal rate of return is the rate at which net present value is zero,so if internal rate of return is less than the hurdle rate,net present value will be negative.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

10

A profitability index greater than zero means that a project has a positive NPV.A profitability index greater than one means that a project has a positive NPV.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

11

The accounting rate of return is the only method that focuses on net income rather than cash flow.The accounting rate of return is net income as a percentage of investment,while payback period,net present value,and internal rate of return focus on cash flows.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

12

Sensitivity analysis helps determine whether changing the underlying assumptions would affect the decision.This is the purpose of sensitivity analysis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

13

When managers must choose among independent projects,they should prioritize projects according to their net present value.The net present value is ill-suited to compare projects of different size.Independent projects should be prioritized according to their profitability index.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

14

When deciding between mutually exclusive investments,a manager should choose the option with the lowest depreciation.When deciding between mutually exclusive investments,a manager should choose the option with the lowest cost on a net present value basis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

15

An example of a future value of a single amount problem would be finding how much the right to receive a certain amount in the future would be worth today.The future value of a single amount is how much money you will have in the future as a result of investing a certain amount in the present.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

16

The internal rate of return is the rate of return that yields a zero net present value.This is how internal rate of return is calculated.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

17

The payback period method ignores the time value of money.The payback period is calculated using undiscounted cash flows.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

18

Preference decisions compare an investment with some minimum criteria.Preference decisions require managers to choose among a set of alternative capital investment opportunities.Screening decisions compare an investment with some minimum criteria.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

19

An annuity is a series of consecutive payments that are equal in dollar amount,have interest periods of equal length,and earn an equal interest rate each period.This is the definition of an annuity.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

20

The accounting rate of return is calculated as initial investment divided by annual net income.Accounting rate of return is calculated as annual net income divided by initial investment.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

21

A decision that occurs when managers evaluate a proposed capital investment to determine whether it meets some minimum criteria is a(n)

A)preference decision.

B)capital decision.

C)screening decision.

D)incremental analysis.

A)preference decision.

B)capital decision.

C)screening decision.

D)incremental analysis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following is the formula for accounting rate of return?

A)Initial investment/net income

B)Annual net cash flow/Initial investment

C)Initial investment/Annual net cash flow

D)Net income/Initial investment

A)Initial investment/net income

B)Annual net cash flow/Initial investment

C)Initial investment/Annual net cash flow

D)Net income/Initial investment

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

23

When cash flows are equal each year,the payback period is calculated as:

A)Initial investment × Annual net cash flow

B)Initial investment/Annual net cash flow

C)Annual net cash flow/Initial investment

D)Annual net cash flow - Initial investment/Project life

A)Initial investment × Annual net cash flow

B)Initial investment/Annual net cash flow

C)Annual net cash flow/Initial investment

D)Annual net cash flow - Initial investment/Project life

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

24

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.What is the accounting rate of return? Ignore income taxes.

A)5.56%

B)16.67%

C)22.22%

D)44.44%

A)5.56%

B)16.67%

C)22.22%

D)44.44%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

25

Projects that are unrelated to one another,so that investing in one project does not preclude or affect the choice about investing in the other alternatives,are

A)Mutually exclusive projects.

B)Screening projects.

C)Independent projects.

D)Preference projects.

A)Mutually exclusive projects.

B)Screening projects.

C)Independent projects.

D)Preference projects.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

26

Belmont Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $200,000.The equipment will have an initial cost of $1,000,000 and have an 8 year life.If there is no salvage value of the equipment,what is the accounting rate of return?

A)12.5%

B)20%

C)40%

D)15%

A)12.5%

B)20%

C)40%

D)15%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following capital budgeting methods focuses on net income rather than cash flows?

A)Payback period

B)Accounting rate of return

C)Net present value

D)Internal rate of return

A)Payback period

B)Accounting rate of return

C)Net present value

D)Internal rate of return

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following would be included in net income but not in annual cash flows?

A)Sales revenue

B)Depreciation

C)Initial investment

D)Direct labor

A)Sales revenue

B)Depreciation

C)Initial investment

D)Direct labor

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

29

Fletcher Corp is considering the purchase of a new piece of equipment.The equipment will have an initial cost of $400,000,a 5 year life,and a salvage value of $75,000.If the accounting rate of return for the project is 10%,what is the annual increase in net cash flow? Ignore income taxes.

A)$25,000

B)$40,000

C)$65,000

D)$105,000

A)$25,000

B)$40,000

C)$65,000

D)$105,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

30

The total time to recover an original investment is the

A)net present value.

B)internal rate of return.

C)accounting rate of return.

D)payback perioD.The payback period is the amount of time needed for a capital investment to pay for itself.

A)net present value.

B)internal rate of return.

C)accounting rate of return.

D)payback perioD.The payback period is the amount of time needed for a capital investment to pay for itself.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

31

A decision that requires managers to choose from among a set of alternative capital investment opportunities is a(n)

A)preference decision.

B)capital decision.

C)screening decision.

D)incremental analysis.

A)preference decision.

B)capital decision.

C)screening decision.

D)incremental analysis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

32

Nelson Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.If the salvage value of the equipment is estimated to be $75,000,what is the payback period? Ignore income taxes.

A)3.25 years

B)4.00 years

C)4.75 years

D)7.00 years

A)3.25 years

B)4.00 years

C)4.75 years

D)7.00 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

33

Projects that involve a choice among competing alternatives,where selection of one project implies rejection of all the other alternatives,are

A)Mutually exclusive projects.

B)Screening projects.

C)Independent projects.

D)Preference projects.

A)Mutually exclusive projects.

B)Screening projects.

C)Independent projects.

D)Preference projects.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

34

Addison Corp is considering the purchase of a new piece of equipment.The equipment will have an initial cost of $900,000,a 6 year life,and no salvage value.If the accounting rate of return for the project is 5%,what is the annual increase in net cash flow? Ignore income taxes.

A)$45,000

B)$105,000

C)$150,000

D)$195,000

A)$45,000

B)$105,000

C)$150,000

D)$195,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

35

Homer Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.If the salvage value of the equipment is estimated to be $75,000,what is the annual net cash flow?

A)$25,000

B)$35,000

C)$165,000

D)$175,000

A)$25,000

B)$35,000

C)$165,000

D)$175,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following methods is calculated as annual net income as a percentage of the original investment in assets?

A)Accounting rate of return

B)Payback period

C)Net present value

D)Internal rate of return

A)Accounting rate of return

B)Payback period

C)Net present value

D)Internal rate of return

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

37

Nelson Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.If the salvage value of the equipment is estimated to be $75,000,what is the accounting rate of return? Ignore income taxes.

A)6.25%

B)8.75%

C)25.00%

D)26.67%

A)6.25%

B)8.75%

C)25.00%

D)26.67%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

38

If cash flows are not equal each year,the payback period

A)cannot be calculated.

B)is calculated by dividing the initial investment by the average cash flows.

C)is calculated by subtracting each year's cash flows from the initial investment until zero is reached.

D)is calculated by dividing the total years in the project by two.

A)cannot be calculated.

B)is calculated by dividing the initial investment by the average cash flows.

C)is calculated by subtracting each year's cash flows from the initial investment until zero is reached.

D)is calculated by dividing the total years in the project by two.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

39

Palmer Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $100,000.The equipment will have an initial cost of $400,000 and have a 7 year life.If the salvage value of the equipment is estimated to be $75,000,what is the accounting rate of return?

A)14.28%

B)25.00%

C)42.11%

D)147.37%

A)14.28%

B)25.00%

C)42.11%

D)147.37%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

40

Cortland Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net cash flows of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.If the salvage value of the equipment is estimated to be $75,000,what is the annual net income? Ignore income taxes.

A)$25,000

B)$35,000

C)$165,000

D)$175,000

A)$25,000

B)$35,000

C)$165,000

D)$175,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

41

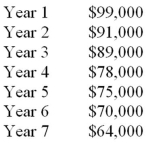

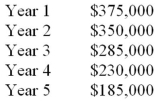

Patterson Corp is considering the purchase of a new piece of equipment,which would have an initial cost of $500,000,a 7 year life,and $150,000 salvage value.The increase in net income each year of the equipment's life would be as follows: What is the payback period?

A)3.55 years

B)3.82 years

C)5.97 years

D)6.18 years

A)3.55 years

B)3.82 years

C)5.97 years

D)6.18 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

42

Belmont Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $200,000.The equipment will have an initial cost of $1,000,000 and have an 8 year life.If there is no salvage value of the equipment,what is the payback period?

A)1.6 years

B)3.08 years

C)5 years

D)8 years

A)1.6 years

B)3.08 years

C)5 years

D)8 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

43

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.If the hurdle rate is 8%,what is the approximate net present value? Ignore income taxes.

A)$924,580

B)$24,580

C)$900,000

D)$300,000

A)$924,580

B)$24,580

C)$900,000

D)$300,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

44

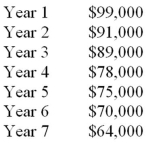

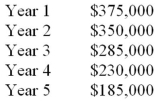

Patterson Corp is considering the purchase of a new piece of equipment,which would have an initial cost of $500,000,a 7 year life,and $150,000 salvage value.The increase in cash flow each year of the equipment's life would be as follows: What is the payback period?

A)5.51 years

B)5.97 years

C)6.00 years

D)6.18 years

A)5.51 years

B)5.97 years

C)6.00 years

D)6.18 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

45

Byron Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.The salvage value of the equipment is estimated to be $75,000.If the hurdle rate is 15%,what is the approximate net present value? Ignore income taxes.

A)negative $27,490

B)zero

C)positive $400,000

D)positive $75,000

A)negative $27,490

B)zero

C)positive $400,000

D)positive $75,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

46

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.What is the payback period?

A)1.33 years

B)2.57 years

C)4.50 years

D)6.00 years

A)1.33 years

B)2.57 years

C)4.50 years

D)6.00 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

47

Wilson Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $50,000.The equipment will have an initial cost of $600,000 and have an 8 year life.The salvage value of the equipment is estimated to be $100,000.If the hurdle rate is 10%,what is the approximate net present value?

A)less than zero

B)$100,000

C)$500,000

D)$46,826

A)less than zero

B)$100,000

C)$500,000

D)$46,826

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

48

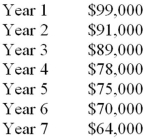

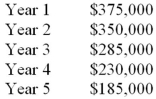

Wright Corp is considering the purchase of a new piece of equipment,which would have an initial cost of $1,000,000 and a 5 year life.There is no salvage value for the equipment.The increase in cash flow each year of the equipment's life would be as follows: What is the payback period?

A)2.39 years

B)2.96 years

C)3.00 years

D)3.51 years

A)2.39 years

B)2.96 years

C)3.00 years

D)3.51 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

49

The internal rate of return is a measure of

A)the rate actually earned by the project,considering the time value of money.

B)the rate actually earned by the project,based on accounting income.

C)the rate used to discount the future cash flows to reflect the time value of money.

D)the firm's cost of capital.

A)the rate actually earned by the project,considering the time value of money.

B)the rate actually earned by the project,based on accounting income.

C)the rate used to discount the future cash flows to reflect the time value of money.

D)the firm's cost of capital.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

50

A positive net present value indicates that a project will

A)generate a return in excess of the firm's cost of capital.

B)generate more cash than is initially invested.

C)generate more cash than alternative projects.

D)generate a return in excess of alternative projects.

A)generate a return in excess of the firm's cost of capital.

B)generate more cash than is initially invested.

C)generate more cash than alternative projects.

D)generate a return in excess of alternative projects.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

51

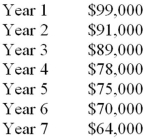

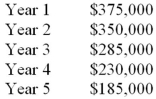

Wright Corp is considering the purchase of a new piece of equipment,which would have an initial cost of $1,000,000 and a 5 year life.There is no salvage value for the equipment.The increase in net income each year of the equipment's life would be as follows: What is the payback period?

A)1.77 years

B)2.06 years

C)2.96 years

D)3.51 years

A)1.77 years

B)2.06 years

C)2.96 years

D)3.51 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

52

The method that compares the present value of a project's future cash flows to the initial investment is

A)Accounting rate of return.

B)Payback period.

C)Net present value.

D)Internal rate of return.

A)Accounting rate of return.

B)Payback period.

C)Net present value.

D)Internal rate of return.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statement regarding the payback method is incorrect?

A)The payback period is the amount of time it takes for a capital investment to "pay for itself."

B)In general,projects with longer payback periods are safer investments than those with shorter payback periods.

C)When cash flows are equal each year,the payback period is calculated by dividing the initial investment in the project by its annual cash flow.

D)The payback method is often used as a screening tool for potential investments.

A)The payback period is the amount of time it takes for a capital investment to "pay for itself."

B)In general,projects with longer payback periods are safer investments than those with shorter payback periods.

C)When cash flows are equal each year,the payback period is calculated by dividing the initial investment in the project by its annual cash flow.

D)The payback method is often used as a screening tool for potential investments.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

54

Byron Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.The salvage value of the equipment is estimated to be $75,000.If the hurdle rate is 10%,what is the approximate net present value? Ignore income taxes.

A)$25,648

B)$100,000

C)$175,000

D)($20,291)

A)$25,648

B)$100,000

C)$175,000

D)($20,291)

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

55

Palmer Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $100,000.The equipment will have an initial cost of $400,000 and have a 7 year life.If the salvage value of the equipment is estimated to be $75,000,what is the payback period?

A)2.73 years

B)4.00 years

C)4.75 years

D)7.00 years

A)2.73 years

B)4.00 years

C)4.75 years

D)7.00 years

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

56

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.If the hurdle rate is 10%,what is the approximate net present value? Ignore income taxes.

A)negative $28,940

B)positive $28,940

C)zero

D)positive $300,000

A)negative $28,940

B)positive $28,940

C)zero

D)positive $300,000

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

57

The discount rate that would return a net present value equal to zero is the

A)Annual rate of return.

B)Accounting rate of return.

C)Hurdle rate.

D)Internal rate of return.

A)Annual rate of return.

B)Accounting rate of return.

C)Hurdle rate.

D)Internal rate of return.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

58

The payback method

A)is a complex method of analysis.

B)is infrequently used.

C)incorporates the time value of money.

D)ignores benefits and costs that occur after the project has paid for itself.

A)is a complex method of analysis.

B)is infrequently used.

C)incorporates the time value of money.

D)ignores benefits and costs that occur after the project has paid for itself.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

59

The minimum required rate of return for a project is the

A)Annual rate of return.

B)Accounting rate of return.

C)Hurdle rate.

D)Internal rate of return.

A)Annual rate of return.

B)Accounting rate of return.

C)Hurdle rate.

D)Internal rate of return.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

60

When making screening decisions using the net present value method,a project is acceptable if

A)the NPV is greater than the hurdle rate.

B)the NPV is greater than the IRR.

C)the NPV is positive.

D)the NPV is negative.

A)the NPV is greater than the hurdle rate.

B)the NPV is greater than the IRR.

C)the NPV is positive.

D)the NPV is negative.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

61

Independent projects should be prioritized according to their

A)profitability index.

B)net present value.

C)payback period.

D)total cash flows.

A)profitability index.

B)net present value.

C)payback period.

D)total cash flows.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

62

Newport Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $200,000.The equipment will have an initial cost of $900,000 and have a 6 year life.There is no salvage value for the equipment.If the hurdle rate is 10%,what is the internal rate of return? Ignore income taxes.

A)between 6% and 8%

B)between 8% and 10%

C)between 10% and 12%

D)less than zero

A)between 6% and 8%

B)between 8% and 10%

C)between 10% and 12%

D)less than zero

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

63

Frank Inc.is trying to decide whether to lease or purchase a piece of equipment needed for the next ten years.The equipment would cost $45,000 to purchase,and maintenance costs would be $5,000 per year.After ten years,Frank estimates it could sell the equipment for $20,000.If Frank leased the equipment,it would pay a set annual fee that would include all maintenance costs.Frank has determined after a net present value analysis that at its hurdle rate of 10%,it would be better off by $5,700 if it buys the equipment.What would the approximate annual cost be if Frank were to lease the equipment?

A)$9,000

B)$7,000

C)$12,000

D)$13,250

A)$9,000

B)$7,000

C)$12,000

D)$13,250

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

64

When a project has a positive net present value,it has a profitability index

A)greater than zero.

B)less than zero.

C)greater than one.

D)less than one.

A)greater than zero.

B)less than zero.

C)greater than one.

D)less than one.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

65

Heidi Inc.is considering whether to lease or purchase a piece of equipment.The total cost to lease the equipment will be $120,000 over its estimated life,while the total cost to buy the equipment will be $75,000 over its estimated life.At Heidi's required rate of return,the net present value of the cost of leasing the equipment is $73,700 and the net present value of the cost of buying the equipment is $68,000.Based on financial factors,Heidi should

A)lease the equipment,saving $45,000 over buying.

B)buy the equipment,saving $45,000 over leasing.

C)lease the equipment,saving $5,700 over buying.

D)buy the equipment,saving $5,700 over leasing.

A)lease the equipment,saving $45,000 over buying.

B)buy the equipment,saving $45,000 over leasing.

C)lease the equipment,saving $5,700 over buying.

D)buy the equipment,saving $5,700 over leasing.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

66

Grace Corp,whose required rate of return is10%,is considering the purchase of a new piece of equipment.The internal rate of return of the project,which has a life of 8 years,is 12%.The project would have

A)an accounting rate of return greater than 10%.

B)a payback period more than 8 years.

C)a net present value of zero.

D)a net present value greater than zero.

A)an accounting rate of return greater than 10%.

B)a payback period more than 8 years.

C)a net present value of zero.

D)a net present value greater than zero.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

67

Lawrence Corp is considering the purchase of a new piece of equipment.When discounted at a hurdle rate of 8%,the project has a net present value of $24,580.When discounted at a hurdle rate of 10%,the project has a net present value of ($28,940).The internal rate of return of the project is

A)zero.

B)between zero and 8%.

C)between 8% and 10%.

D)greater than 10%.

A)zero.

B)between zero and 8%.

C)between 8% and 10%.

D)greater than 10%.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

68

Norwood,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,net present value,and profitability index for each of the projects are as follows: In what order should Norwood prioritize investment in the projects?

A)A,B,C

B)C,B,A

C)A,C,B

D)C,A,B

A)A,B,C

B)C,B,A

C)A,C,B

D)C,A,B

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

69

Carmen,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,net present value,and profitability index for each of the projects are as follows: In what order should Carmen prioritize investment in the projects?

A)A,C,B

B)B,C,A

C)A,B,C

D)B,A,C

A)A,C,B

B)B,C,A

C)A,B,C

D)B,A,C

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

70

Boxwood,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,and net present value for each of the projects are as follows: In what order should Boxwood prioritize investment in the projects?

A)A,B,C

B)C,B,A

C)A,C,B

D)C,A,B

A)A,B,C

B)C,B,A

C)A,C,B

D)C,A,B

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

71

Byron Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $100,000.The equipment will have an initial cost of $400,000 and have a 5 year life.The salvage value of the equipment is estimated to be $75,000.If the hurdle rate is 10%,what is the internal rate of return?

A)between 6% and 8%

B)between 8% and 10%

C)between 10% and 12%

D)between 12% and 14%

A)between 6% and 8%

B)between 8% and 10%

C)between 10% and 12%

D)between 12% and 14%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

72

Devon Corp is trying to decide whether to lease or purchase a piece of equipment.The total cost lease the equipment will be $150,000 over its estimated life,while the total cost to buy the equipment will be $120,000 over its estimated life.At Devon's required rate of return,the net present value of the cost of leasing the equipment is $108,000 and the net present value of the cost of buying the equipment is $119,000.Based on financial factors,Devon should

A)lease the equipment,saving $30,000 over buying.

B)buy the equipment,saving $30,000 over leasing.

C)lease the equipment,saving $11,000 over buying.

D)buy the equipment,saving $11,000 over leasing.

A)lease the equipment,saving $30,000 over buying.

B)buy the equipment,saving $30,000 over leasing.

C)lease the equipment,saving $11,000 over buying.

D)buy the equipment,saving $11,000 over leasing.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

73

Randall Corp is trying to decide whether to lease or purchase a piece of equipment needed for the next five years.The equipment would cost $100,000 to purchase,and maintenance costs would be $10,000 per year.After five years,Randall estimates it could sell the equipment for $30,000.If Randall leases the equipment,it would pay $30,000 each year,which would include all maintenance costs.If the hurdle rate for Randall is 12%,Randall should

A)lease the equipment,as net present value of cost is about $11,000 less.

B)buy the equipment,as net present value of cost is about $11,000 less.

C)lease the equipment,as net present value of cost is about $30,000 less.

D)buy the equipment,as net present value of cost is about $30,000 less.

A)lease the equipment,as net present value of cost is about $11,000 less.

B)buy the equipment,as net present value of cost is about $11,000 less.

C)lease the equipment,as net present value of cost is about $30,000 less.

D)buy the equipment,as net present value of cost is about $30,000 less.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

74

An analysis that reveals whether changing the underlying assumptions would affect the decision is a

A)net present value analysis.

B)internal rate of return analysis.

C)payback period analysis.

D)sensitivity analysis.

A)net present value analysis.

B)internal rate of return analysis.

C)payback period analysis.

D)sensitivity analysis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

75

Foster Inc.is trying to decide whether to lease or purchase a piece of equipment needed for the next ten years.The equipment would cost $45,000 to purchase,and maintenance costs would be $5,000 per year.After ten years,Foster estimates it could sell the equipment for $20,000.If Foster leases the equipment,it would pay $12,000 each year,which would include all maintenance costs.If the hurdle rate for Foster is 10%,Foster should

A)lease the equipment,as net present value of cost is about $5,700 less.

B)buy the equipment,as net present value of cost is about $5,700 less.

C)lease the equipment,as net present value of cost is about $2,000 less.

D)buy the equipment,as net present value of cost is about $45,000 less.

A)lease the equipment,as net present value of cost is about $5,700 less.

B)buy the equipment,as net present value of cost is about $5,700 less.

C)lease the equipment,as net present value of cost is about $2,000 less.

D)buy the equipment,as net present value of cost is about $45,000 less.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

76

Carol,Inc.is considering three different independent investment opportunities.The present value of future cash flows,initial investment,and net present value for each of the projects are as follows: In what order should Carol prioritize investment in the projects?

A)A,C,B

B)B,C,A

C)A,B,C

D)B,A,C

A)A,C,B

B)B,C,A

C)A,B,C

D)B,A,C

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

77

Wilson Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in net income after tax of $50,000.The equipment will have an initial cost of $600,000 and have an 8 year life.The salvage value of the equipment is estimated to be $100,000.If the hurdle rate is 10%,what is the internal rate of return?

A)less than zero

B)between zero and 10%

C)between 10% and 15%

D)more than 15%

A)less than zero

B)between zero and 10%

C)between 10% and 15%

D)more than 15%

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

78

Dallas Corp is trying to decide whether to lease or purchase a piece of equipment needed for the next five years.The equipment would cost $100,000 to purchase,and maintenance costs would be $10,000 per year.After five years,Dallas estimates it could sell the equipment for $30,000.If Dallas leased the equipment,it would pay a set annual fee that would include all maintenance costs.Dallas has determined after a net present value analysis that at its hurdle rate of 12%,it would be better off by $11,000 if it leases the equipment.What would the approximate annual cost be if Dallas were to lease the equipment?

A)$21,800

B)$27,800

C)$30,000

D)$34,700

A)$21,800

B)$27,800

C)$30,000

D)$34,700

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

79

Olive Corp is considering the purchase of a new piece of equipment.The cost savings from the equipment would result in an annual increase in cash flow of $250,000.The equipment will have an initial cost of $1,300,000 and have an 8 year life.There is no salvage value for the equipment.If the hurdle rate is 10%,what is the internal rate of return? Ignore income taxes.

A)between 6% and 8%

B)between 8% and 10%

C)between 10% and 12%

D)less than zero

A)between 6% and 8%

B)between 8% and 10%

C)between 10% and 12%

D)less than zero

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck

80

When comparing mutually exclusive capital investments,managers should

A)choose the option with the lowest cost on a net present value basis.

B)choose the option with the lowest undiscounted cost.

C)not use net present value because it cannot be used to compare investments.

D)not use sensitivity analysis.

A)choose the option with the lowest cost on a net present value basis.

B)choose the option with the lowest undiscounted cost.

C)not use net present value because it cannot be used to compare investments.

D)not use sensitivity analysis.

Unlock Deck

Unlock for access to all 100 flashcards in this deck.

Unlock Deck

k this deck