Deck 9: Prospective Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/73

Play

Full screen (f)

Deck 9: Prospective Analysis

1

If a company's cost of capital increases unexpectedly, which of the following actions will help it maintain or increase its stock price? I. Decrease its asset turnover

II) Increase its inventory

III) Increase its gross margin

IV) Issue a stock dividend

A)I and IV

B)II and III

C)III

D)I

II) Increase its inventory

III) Increase its gross margin

IV) Issue a stock dividend

A)I and IV

B)II and III

C)III

D)I

C

2

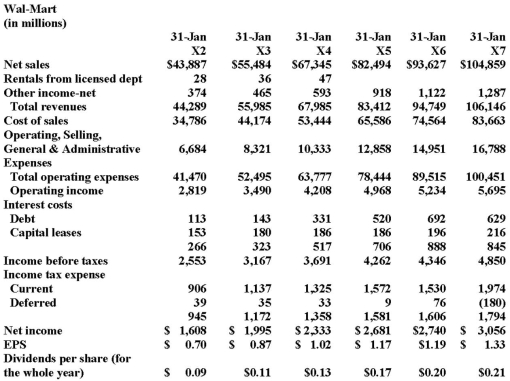

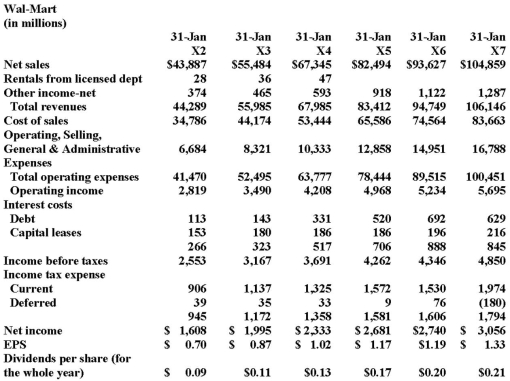

a. Refer to Wal-Mart financial statements, above. Prepare a forecasted income statement for Year 8 assuming:

• Total revenues are expected to increase by 12% from Year 7 to Year 8.• Operating income as a percentage of total revenues will remain unchanged from Year 7 to Year 8.• Total interest costs will increase by 10%.• Effective tax rate is 37%.b. What additional information will Wal-Mart need in order to assess whether it needs additional outside funding?

• Total revenues are expected to increase by 12% from Year 7 to Year 8.• Operating income as a percentage of total revenues will remain unchanged from Year 7 to Year 8.• Total interest costs will increase by 10%.• Effective tax rate is 37%.b. What additional information will Wal-Mart need in order to assess whether it needs additional outside funding?

Pro Formas -Wal-Mart

3

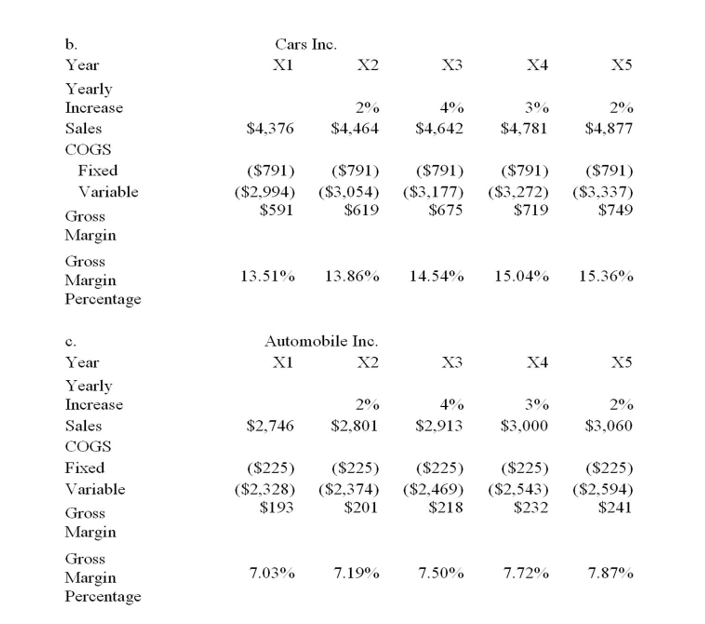

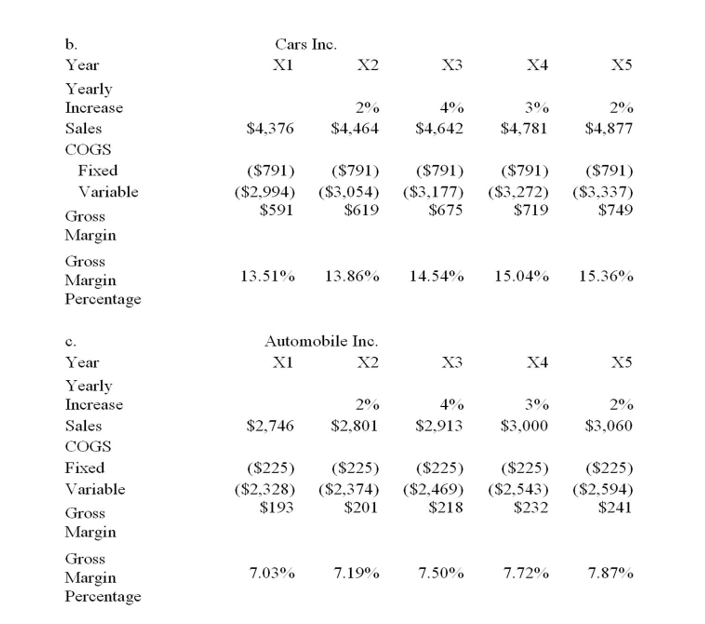

Cars Inc. and Automobile Inc. are two car manufactures. Cars Inc. manufactures high quality cars whereas Automobile Inc. manufactures lower end cars. Cars Inc. is more capital intensive than Automobile Inc., and relies more on fixed assets for its production. You are given the following information about the companies for year X1 (amounts in millions):

The car manufacturing industry expects the following increases in sales in the following years (all compared to the previous year): year X2 2%, year X3 4%, year X4 3%, year X5 2%.

a. Comment on the cost structure for both companies and on the likely effect of the cost structure and type of cars manufactured on the price and gross margin of both companies.

b. Prepare a forecast of Cars Inc. sales, COGS, gross margin for years X2 to X5 based on the information given above.

c. Prepare a forecast of Automobile Inc. sales, COGS, gross margin for years X2 to X5 based on the information given above.

d. Comment on your results compared to your answer in part a.

The car manufacturing industry expects the following increases in sales in the following years (all compared to the previous year): year X2 2%, year X3 4%, year X4 3%, year X5 2%.

a. Comment on the cost structure for both companies and on the likely effect of the cost structure and type of cars manufactured on the price and gross margin of both companies.

b. Prepare a forecast of Cars Inc. sales, COGS, gross margin for years X2 to X5 based on the information given above.

c. Prepare a forecast of Automobile Inc. sales, COGS, gross margin for years X2 to X5 based on the information given above.

d. Comment on your results compared to your answer in part a.

a. Cars Inc. is more capital intensive than Automobile Inc. and hence has a higher proportion of fixed costs and a lower proportion of variable costs. Since Cars Inc. offers a higher end product than Automobile Inc., and given the cost structure it is likely that Cars Inc. will have a higher price for its products and a higher gross margin percentage.

d. As expected, our calculations show that Cars Inc. has an average gross margin percentage of 14.46% as opposed to 7.46% for Automobile Inc. Additionally, the gross margin percentage for Cars Inc. has a higher standard deviation ratio to the mean as compared to Automobile Inc. (0.0538 and 0.0474 for Cars Inc. and Automobile Inc., respectively). This higher variability results from Cars Inc.'s higher proportion of fixed costs.

d. As expected, our calculations show that Cars Inc. has an average gross margin percentage of 14.46% as opposed to 7.46% for Automobile Inc. Additionally, the gross margin percentage for Cars Inc. has a higher standard deviation ratio to the mean as compared to Automobile Inc. (0.0538 and 0.0474 for Cars Inc. and Automobile Inc., respectively). This higher variability results from Cars Inc.'s higher proportion of fixed costs.

4

When preparing a projected income statement, which of the following additional information, other than the financial statements would probably not be relevant?

A)The competitive environment

B)New versus old store mix

C)Expected capital expenditure

D)Expected level of macroeconomic activity

A)The competitive environment

B)New versus old store mix

C)Expected capital expenditure

D)Expected level of macroeconomic activity

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

5

The statement of cash flows for Georgey Company for 2004 and 2005 is as follows:

-Which of the following statements is correct?

A)Restructuring is a major use of cash for Georgey.

B)Accounts receivable increased in 2005.

C)Depreciation is a major source of cash for Georgey.

D)Major use of cash for paying long-term debt resulted in decreased leverage.

-Which of the following statements is correct?

A)Restructuring is a major use of cash for Georgey.

B)Accounts receivable increased in 2005.

C)Depreciation is a major source of cash for Georgey.

D)Major use of cash for paying long-term debt resulted in decreased leverage.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

6

The treasurer of Simmons Corporation, a newly formed software company is trying to ascertain Simmons cash flows for the next three months. Expected sales are:

50% of sales are made for cash. Simmons expects to receive 25% in the month following the sale and 20% in the second month following the sale. The remaining 5% are expected to be un-collectible. Gross margin is 20%, and purchases are made one month prior to sale. Purchases are paid one month after received.

-Recorded bad debt expense for March should be:

A)$12.5.

B)$11.

C)$10.

D)$15.

50% of sales are made for cash. Simmons expects to receive 25% in the month following the sale and 20% in the second month following the sale. The remaining 5% are expected to be un-collectible. Gross margin is 20%, and purchases are made one month prior to sale. Purchases are paid one month after received.

-Recorded bad debt expense for March should be:

A)$12.5.

B)$11.

C)$10.

D)$15.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

7

The treasurer of Simmons Corporation, a newly formed software company is trying to ascertain Simmons cash flows for the next three months. Expected sales are:

50% of sales are made for cash. Simmons expects to receive 25% in the month following the sale and 20% in the second month following the sale. The remaining 5% are expected to be un-collectible. Gross margin is 20%, and purchases are made one month prior to sale. Purchases are paid one month after received.

-Cash outflows in March for purchases will be:

A)$240.

B)$220.

C)$200.

D)$176.

50% of sales are made for cash. Simmons expects to receive 25% in the month following the sale and 20% in the second month following the sale. The remaining 5% are expected to be un-collectible. Gross margin is 20%, and purchases are made one month prior to sale. Purchases are paid one month after received.

-Cash outflows in March for purchases will be:

A)$240.

B)$220.

C)$200.

D)$176.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

8

The treasurer of Simmons Corporation, a newly formed software company is trying to ascertain Simmons cash flows for the next three months. Expected sales are:

50% of sales are made for cash. Simmons expects to receive 25% in the month following the sale and 20% in the second month following the sale. The remaining 5% are expected to be un-collectible. Gross margin is 20%, and purchases are made one month prior to sale. Purchases are paid one month after received.

-The cash inflows in March from sales will be:

A)$250.

B)$245.

C)$220.

D)None of the above

50% of sales are made for cash. Simmons expects to receive 25% in the month following the sale and 20% in the second month following the sale. The remaining 5% are expected to be un-collectible. Gross margin is 20%, and purchases are made one month prior to sale. Purchases are paid one month after received.

-The cash inflows in March from sales will be:

A)$250.

B)$245.

C)$220.

D)None of the above

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

9

The statement of cash flows for Georgey Company for 2004 and 2005 is as follows:

-The cash flow from operations and cash flow from investing are both positive. Which of the following best describes the situation of Georgey?

A)The cash flow statement would indicate there are no reasons for concern.

B)Repayment of long-term debt indicates the company is becoming more profitable.

C)Georgey appears to be liquidating assets of the company that may affect future profitability.

D)Increased operating and investing cash flows in 2005, relative to 2004 indicate increased profitability of Georgey in 2005.

-The cash flow from operations and cash flow from investing are both positive. Which of the following best describes the situation of Georgey?

A)The cash flow statement would indicate there are no reasons for concern.

B)Repayment of long-term debt indicates the company is becoming more profitable.

C)Georgey appears to be liquidating assets of the company that may affect future profitability.

D)Increased operating and investing cash flows in 2005, relative to 2004 indicate increased profitability of Georgey in 2005.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

10

The statement of cash flows for Georgey Company for 2004 and 2005 is as follows:

-Which of the following statements is correct?

A)Inventory was a use of cash for Georgey in 2005.

B)Current liabilities increased in 2005.

C)Georgey has a net outflow of cash in 2005.

D)Restructuring charges were a use of cash for Georgey in 2004.

-Which of the following statements is correct?

A)Inventory was a use of cash for Georgey in 2005.

B)Current liabilities increased in 2005.

C)Georgey has a net outflow of cash in 2005.

D)Restructuring charges were a use of cash for Georgey in 2004.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

11

You have just prepared pro forma income statements and balance sheets for your company for the next three years. Describe three procedures you might perform to check the reasonableness of your projections, explaining how and why they are reasonableness checks.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

12

What is the correct order of the following steps in preparing a projected income statement (not all steps may be shown)? I. Project future net sales

II) Project future net income

III) Project future cost of goods sold

IV) Project future interest expense

A)I, II, III, IV

B)II, IV, III, I

C)I, III, II, IV

D)I, III, IV, II

II) Project future net income

III) Project future cost of goods sold

IV) Project future interest expense

A)I, II, III, IV

B)II, IV, III, I

C)I, III, II, IV

D)I, III, IV, II

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

13

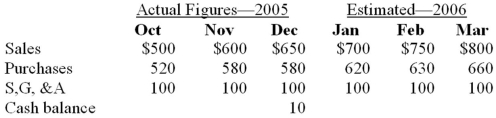

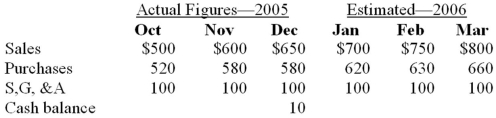

You are the treasurer of Hodgkiss Suppliers Corporation (HSC), a sporting goods equipment distributor. You are trying to determine the cash flow needs for the company for the first three months of 2006.Other information:

• 50% of sales are on a cash basis, of the remaining 50% half is collected in the following month and the other half two months later.• All purchases are paid for in the following month.• Selling, general, and administrative (S, G, & A) costs are fixed, and are paid as incurred.• Dividends payable in February are $20.• Interest payment is due in March of $50.• Minimum cash balance required is $10.a. Estimate what if any, HSC requires in the way of additional external financing at the beginning of January to ensure they have enough cash to maintain a $10 cash balance through until the end of March.b. If additional external financing is not available, name three approaches HSC might use in order to avoid the need for external financing.

• 50% of sales are on a cash basis, of the remaining 50% half is collected in the following month and the other half two months later.• All purchases are paid for in the following month.• Selling, general, and administrative (S, G, & A) costs are fixed, and are paid as incurred.• Dividends payable in February are $20.• Interest payment is due in March of $50.• Minimum cash balance required is $10.a. Estimate what if any, HSC requires in the way of additional external financing at the beginning of January to ensure they have enough cash to maintain a $10 cash balance through until the end of March.b. If additional external financing is not available, name three approaches HSC might use in order to avoid the need for external financing.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

14

What is the correct order of the following steps in preparing a projected balance sheet (not all steps may be shown)? I. Project future cash

II) Project future accounts receivable

III) Project future accounts payable

IV) Project future property plant and equipment

A)I, II, IV, III

B)II, IV, III, I

C)I, III, II, IV

D)I, III, IV, II

II) Project future accounts receivable

III) Project future accounts payable

IV) Project future property plant and equipment

A)I, II, IV, III

B)II, IV, III, I

C)I, III, II, IV

D)I, III, IV, II

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

15

The reliability of short-term cash forecast depends most heavily on the quality of:

A)cost of goods sold forecast.

B)current ratio forecast.

C)sales forecast.

D)shares outstanding forecast.

A)cost of goods sold forecast.

B)current ratio forecast.

C)sales forecast.

D)shares outstanding forecast.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

16

Other things held constant, which of the following actions would increase the need for a company to borrow money in the short-term? I. Extending more credit to customers

II) Increasing accounts receivable turnover

III) Expensing advertising expenses rather than capitalizing them

IV) Contributing more to pension plan

A)I, II, and III

B)I and III

C)I, III, and IV

D)I and IV

II) Increasing accounts receivable turnover

III) Expensing advertising expenses rather than capitalizing them

IV) Contributing more to pension plan

A)I, II, and III

B)I and III

C)I, III, and IV

D)I and IV

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is the most useful in assessing short-term liquidity of a company?

A)Taxes payable

B)Retained earnings

C)Next period's sales

D)Prospective cash flows

A)Taxes payable

B)Retained earnings

C)Next period's sales

D)Prospective cash flows

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

18

Yeats Corporation is trying to determine its short-term cash needs. Given the following information, how much money will Yeats need to borrow next year?

•Sales in Year 9 are expected to be $500 million

•Operating margin is expected to be 8%

•Interest expense is expected to be $6 million (ignore additional interest expense generated by additional borrowings in Year 9)

•Tax rate is 40%

•Dividend payout ratio is 30%

•Increase in working capital is 5% of sales

•Increase in fixed assets is 10% of sales

•No new equity will be issued

•Sales in Year 9 are expected to be $500 million

•Operating margin is expected to be 8%

•Interest expense is expected to be $6 million (ignore additional interest expense generated by additional borrowings in Year 9)

•Tax rate is 40%

•Dividend payout ratio is 30%

•Increase in working capital is 5% of sales

•Increase in fixed assets is 10% of sales

•No new equity will be issued

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

19

You are an analyst examining a Real Estate Investment Trust (REIT) stock. REITs acquire and manage income-producing properties, such as offices, malls, apartment blocks, etc. They are unique in that they do not have to pay corporate taxes. However, they must distribute 90% of their income as dividends. What is the effect of this distribution requirement going to mean to REITs in terms of their need for external funding, growth and leverage?

Chapter 09 Prospective Analysis Key

Chapter 09 Prospective Analysis Key

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

20

a. Developing pro forma financial statements and cash flow forecasts depends heavily upon sales forecasts. Imagine you are a financial analyst working for a major stockbroker, and you are trying to develop a one-year sales forecast for a major national department store. List five pieces of information you want to obtain to aid you in your forecast, explaining why this will aid you in your forecast.b. Now you have made your best prediction of next year's sales, you want to estimate next year's cost of goods sold. Pick two pieces of information you definitely want to obtain in order to help you with this task, being sure to explain why they will be helpful.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following would be considered the most discretionary of the following cash outflows?

A)Interest payment

B)Payment to suppliers

C)Repurchase of stock

D)Administrative expense

A)Interest payment

B)Payment to suppliers

C)Repurchase of stock

D)Administrative expense

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

22

Hiruit company's sales in December were $5,500. It expects sales to increase 10% in January and February and 15% in March. All of its sales are made on credit. The typical collection pattern is:

Gross margin is 30%. Inventory levels at the end of December are $900 and are expected to grow at the same rate as sales. Purchases are paid for the month after they are made. Net accounts receivable at the end of December are $400.

-What is the anticipated inventory level at the end of March?

A)$1,252.35

B)$1,197.90

C)$1,089

D)$900

Gross margin is 30%. Inventory levels at the end of December are $900 and are expected to grow at the same rate as sales. Purchases are paid for the month after they are made. Net accounts receivable at the end of December are $400.

-What is the anticipated inventory level at the end of March?

A)$1,252.35

B)$1,197.90

C)$1,089

D)$900

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

23

Prospective analysis can only be conducted after historical financial statements have been adjusted.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

24

Below is selected data for Gertup Corporation as of 12/31/05:

-Gertup has increased its borrowing since last year, in part to finance the increased credit terms offered to customers. Which of the following actions would not decrease its borrowing?

A)Decrease dividends paid

B)Increase profit margin

C)Change from LIFO to FIFO for inventory cost purposes

D)Replace cash dividends with stock dividends

-Gertup has increased its borrowing since last year, in part to finance the increased credit terms offered to customers. Which of the following actions would not decrease its borrowing?

A)Decrease dividends paid

B)Increase profit margin

C)Change from LIFO to FIFO for inventory cost purposes

D)Replace cash dividends with stock dividends

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

25

Below is selected data for Gertup Corporation as of 12/31/05:

-Gertup has maintained the same inventory levels throughout 2005. If end of year inventory turnover was increased to 12 through more efficient relationships with suppliers, how much cash would be freed up (pick closest number)?

A)$1,541

B)$1,233

C)$267

D)$42

-Gertup has maintained the same inventory levels throughout 2005. If end of year inventory turnover was increased to 12 through more efficient relationships with suppliers, how much cash would be freed up (pick closest number)?

A)$1,541

B)$1,233

C)$267

D)$42

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following statements is incorrect?

A)The quicker a company collects money from its customers the greater its liquidity, all else equal.

B)The more quickly a company turns over its inventory, the greater its liquidity, all else equal.

C)The lower a company's depreciation the greater its liquidity, all else equal.

D)The greater a company's profit margin the greater its liquidity, all else equal.

A)The quicker a company collects money from its customers the greater its liquidity, all else equal.

B)The more quickly a company turns over its inventory, the greater its liquidity, all else equal.

C)The lower a company's depreciation the greater its liquidity, all else equal.

D)The greater a company's profit margin the greater its liquidity, all else equal.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

27

Hiruit company's sales in December were $5,500. It expects sales to increase 10% in January and February and 15% in March. All of its sales are made on credit. The typical collection pattern is:

Gross margin is 30%. Inventory levels at the end of December are $900 and are expected to grow at the same rate as sales. Purchases are paid for the month after they are made. Net accounts receivable at the end of December are $400.

-In March, Hiruit should collect:

A)$7,653.25 cash from sales made in March and previous months.

B)$7,342.50 cash from sales made in March and previous months.

C)$7,030.10 cash from sales made in March and previous months.

D)$6,331.30 cash from sales made in March and previous months.

Gross margin is 30%. Inventory levels at the end of December are $900 and are expected to grow at the same rate as sales. Purchases are paid for the month after they are made. Net accounts receivable at the end of December are $400.

-In March, Hiruit should collect:

A)$7,653.25 cash from sales made in March and previous months.

B)$7,342.50 cash from sales made in March and previous months.

C)$7,030.10 cash from sales made in March and previous months.

D)$6,331.30 cash from sales made in March and previous months.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

28

Hiruit company's sales in December were $5,500. It expects sales to increase 10% in January and February and 15% in March. All of its sales are made on credit. The typical collection pattern is:

Gross margin is 30%. Inventory levels at the end of December are $900 and are expected to grow at the same rate as sales. Purchases are paid for the month after they are made. Net accounts receivable at the end of December are $400.

-What cash is paid for purchases in the month of March?

A)$5,520.62

B)$4,757.50

C)$4,559.50

D)$2,095.50

Gross margin is 30%. Inventory levels at the end of December are $900 and are expected to grow at the same rate as sales. Purchases are paid for the month after they are made. Net accounts receivable at the end of December are $400.

-What cash is paid for purchases in the month of March?

A)$5,520.62

B)$4,757.50

C)$4,559.50

D)$2,095.50

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

29

As per the definition of residual income model, what is the effect on stock price in a given period if the firm's cost of capital is greater than its return on equity?

A)Cannot be determined

B)No effect

C)Stock price increases.

D)Stock price decreases.

A)Cannot be determined

B)No effect

C)Stock price increases.

D)Stock price decreases.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

30

When a company is experiencing rapid growth, which of the following statements is the most correct?

A)Cash flow from operations will be greater than cash flow from investing.

B)The company will likely need more outside financing than if growth was slower.

C)Cash flow from operations will be high due to rapid growth allowing company to pay down debt.

D)Rapid growth will increase internally generated funds allowing higher dividend payments in periods of rapid growth.

A)Cash flow from operations will be greater than cash flow from investing.

B)The company will likely need more outside financing than if growth was slower.

C)Cash flow from operations will be high due to rapid growth allowing company to pay down debt.

D)Rapid growth will increase internally generated funds allowing higher dividend payments in periods of rapid growth.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements is incorrect?

A)It is possible for a profitable company to go out of business because of short-term liquidity problems.

B)If a company has a current ratio greater than 1, it will never go out of business because of liquidity problems.

C)The current ratio is always greater than or equal to the quick ratio.

D)The accuracy of a cash flow forecast is inversely related to the forecast horizon.

A)It is possible for a profitable company to go out of business because of short-term liquidity problems.

B)If a company has a current ratio greater than 1, it will never go out of business because of liquidity problems.

C)The current ratio is always greater than or equal to the quick ratio.

D)The accuracy of a cash flow forecast is inversely related to the forecast horizon.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

32

Gupta Corporation has forecasted its need for external funding in the following year. It needs to raise $2 million in either debt or equity. It would like to minimize its need for external funding without decreasing its projected growth. Which of the following would reduce its need for additional funding?

A)An increase in the dividend payout ratio

B)An increase in days' sales outstanding

C)An increase in accounts payable

D)A decrease in inventory turnover

A)An increase in the dividend payout ratio

B)An increase in days' sales outstanding

C)An increase in accounts payable

D)A decrease in inventory turnover

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

33

The reasonableness and feasibility of short-term cash forecasts can be evaluated by preparing:

A)bank reconciliation statements.

B)pro forma financial statements.

C)responsibility reports.

D)interest coverage computations.

A)bank reconciliation statements.

B)pro forma financial statements.

C)responsibility reports.

D)interest coverage computations.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

34

If a company is to successfully remain in business over the long haul, which of the following statements is most correct?

A)Total cash flow from operations, measured over an extended period, must be positive.

B)Total cash flow from investing, measured over an extended period, must be positive.

C)Total cash flow from financing, measured over an extended period, should be negative.

D)Total cash flow from financing plus total cash flow from investing, measured over an extended period, must be positive.

A)Total cash flow from operations, measured over an extended period, must be positive.

B)Total cash flow from investing, measured over an extended period, must be positive.

C)Total cash flow from financing, measured over an extended period, should be negative.

D)Total cash flow from financing plus total cash flow from investing, measured over an extended period, must be positive.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

35

Below is selected data for Gertup Corporation as of 12/31/05:

-Due to competitive pressures, Gertup has had to increase credit terms to customers to maintain sales. This resulted in Gertup's accounts receivable doubling from 12/31/04 to 12/31/05. The average accounts receivable turnover was 30 days. Without the increased credit terms, accounts receivable turnover would have remained at 12/31/04 levels. The impact of the change in credit policy was:

A)none as sales remained the same.

B)decreased liquidity and decreased available cash.

C)increased current ratio and liquidity of the company.

D)current ratio stayed the same and liquidity remained constant.

-Due to competitive pressures, Gertup has had to increase credit terms to customers to maintain sales. This resulted in Gertup's accounts receivable doubling from 12/31/04 to 12/31/05. The average accounts receivable turnover was 30 days. Without the increased credit terms, accounts receivable turnover would have remained at 12/31/04 levels. The impact of the change in credit policy was:

A)none as sales remained the same.

B)decreased liquidity and decreased available cash.

C)increased current ratio and liquidity of the company.

D)current ratio stayed the same and liquidity remained constant.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

36

Hiruit company's sales in December were $5,500. It expects sales to increase 10% in January and February and 15% in March. All of its sales are made on credit. The typical collection pattern is:

Gross margin is 30%. Inventory levels at the end of December are $900 and are expected to grow at the same rate as sales. Purchases are paid for the month after they are made. Net accounts receivable at the end of December are $400.

-Net account receivable at the end of March is closest to:

A)$7,503.51.

B)$7,886.17.

C)$8,218.93.

D)None of the above

Gross margin is 30%. Inventory levels at the end of December are $900 and are expected to grow at the same rate as sales. Purchases are paid for the month after they are made. Net accounts receivable at the end of December are $400.

-Net account receivable at the end of March is closest to:

A)$7,503.51.

B)$7,886.17.

C)$8,218.93.

D)None of the above

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following statements is most correct?

A)The cheapest form of capital is equity.

B)Companies with the highest current ratios have the most liquidity.

C)The best indicator of short-term financing needs is the cash flow adequacy ratio.

D)A faster growing company is more likely to need external financing than a slower growing company.

A)The cheapest form of capital is equity.

B)Companies with the highest current ratios have the most liquidity.

C)The best indicator of short-term financing needs is the cash flow adequacy ratio.

D)A faster growing company is more likely to need external financing than a slower growing company.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is most correct?

A)Common-size financial income statements provide information about major sources and uses of cash.

B)Companies with the highest sales growth will have the fewest liquidity problems.

C)Pro forma statements are the same as common-size statements.

D)The more efficiently a company manages its working capital the greater its liquidity, all else equal.

A)Common-size financial income statements provide information about major sources and uses of cash.

B)Companies with the highest sales growth will have the fewest liquidity problems.

C)Pro forma statements are the same as common-size statements.

D)The more efficiently a company manages its working capital the greater its liquidity, all else equal.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

39

Below is selected data for Gertup Corporation as of 12/31/05:

-If sales increased by 10% per annum for the next 20 years, sales for year 2025 would be closest to:

A)$407,000.

B)$124,459.

C)$113,000.

D)$55,500.

-If sales increased by 10% per annum for the next 20 years, sales for year 2025 would be closest to:

A)$407,000.

B)$124,459.

C)$113,000.

D)$55,500.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

40

Over time, what observation(s) best characterizes how ROE for a given firm should behave? I. ROE will increase because the firm becomes more efficient.II. ROE will decrease because competition will erode profitability.III. The answer depends on how conservative the firm's accounting policies are, which affects its reported earnings.

A)I and III

B)II and III

C)I, II, and III are all possibilities

D)None of the above

A)I and III

B)II and III

C)I, II, and III are all possibilities

D)None of the above

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

41

Ceteris paribus, the quicker a company collects money from its sales, the greater its liquidity.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

42

Projected accounts receivable can be calculated by dividing projected sales by accounts receivable turnover rate.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

43

Sensitivity analysis is used to examine the assumptions used in the preparation of projected financial statements.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

44

Cyclical companies often like to retain extra cash or marketable securities during the "good" times, in order to ensure that they have sufficient liquidity when the inevitable downturn in the business cycle arrives.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

45

If a company has excess cash it wishes to return to shareholders, it can do this by either distributing extra dividends or repurchasing stock.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

46

It is possible for a profitable company to go out of business because of severe short-term liquidity problems.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

47

The assumptions made about future changes in a company have a great effect on the quality of the projected financial statements.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

48

The major use of cash for declining companies is repurchasing of equity.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

49

If a company has the necessary cash available, it almost always makes economic sense to take a purchase discount offered by suppliers.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

50

Prospective analysis can only be used to project an income statement, a balance sheet, and a statement of cash flows.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

51

All other things being equal, if a company takes longer to pay its suppliers than before, indicates that suppliers are providing more financing for the company.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

52

The accuracy of a cash flow forecast is inversely related to the forecast horizon.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

53

In determining long-term future cash flows, it is normal to project income statement and balance sheet first and construct cash flows from these.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

54

When analyzing the liquidity of a company, the current ratio is a better indicator of liquidity than short-term cash forecasts.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

55

You construct a pro forma income statement and balance sheet in order to estimate the amount a company needs to borrow in the forthcoming period. If assets are greater than liabilities plus equity, this means the company needs to borrow money.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

56

Free cash flow in a given year is a better indicator of profitability than earnings.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

57

Once the projected financial statements are prepared, there is no need for sensitivity analysis to examine the assumptions used in the preparation.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

58

Common-size analysis of the statement of cash flows is a useful tool in determining major sources and uses of cash.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

59

The major source of cash for most mature companies is debt.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

60

As cash is the most liquid of all assets and liquidity is crucial to a company, all companies should hold as much cash as possible.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

61

When forecasting future cash flows, it is useful to perform "what if" analyses to determine the effect of various unexpected events in order to assess the company's financial flexibility.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

62

The major use of cash for rapidly growing companies is sale of investments.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

63

In the residual income model, ROE is considered a value driver because it is a component of stock price.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

64

ROE is defined as net income divided by total assets.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

65

Research shows that ROEs tend to revert to a long-run equilibrium after about 5 years.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck

66

Pro forma financial statements are another name for common-size financial statements.

Unlock Deck

Unlock for access to all 73 flashcards in this deck.

Unlock Deck

k this deck