Deck 10: Credit Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/103

Play

Full screen (f)

Deck 10: Credit Analysis

1

Which of the following would be least likely to affect the quality of receivables?

A)Credit policy

B)Right of return policy

C)Collection procedures

D)Sales commissions

A)Credit policy

B)Right of return policy

C)Collection procedures

D)Sales commissions

D

2

Using LIFO rather than FIFO in a time of rising prices: I. lowers the current ratio.II. increases inventory turnover.III. increases profit margin.IV. increases debt to equity ratio.

A)I, II, and IV

B)I and II

C)II and III

D)I only

A)I, II, and IV

B)I and II

C)II and III

D)I only

A

3

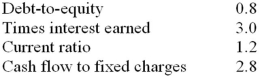

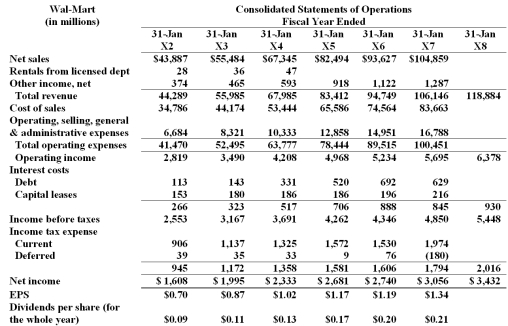

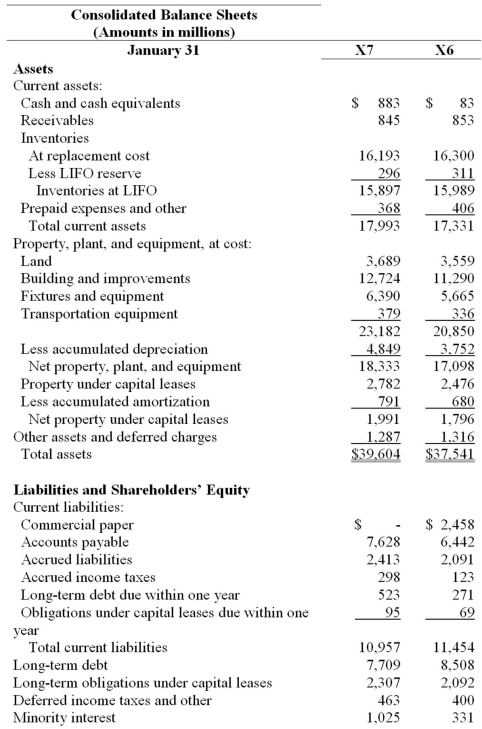

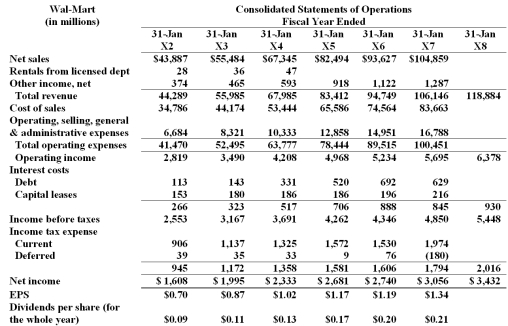

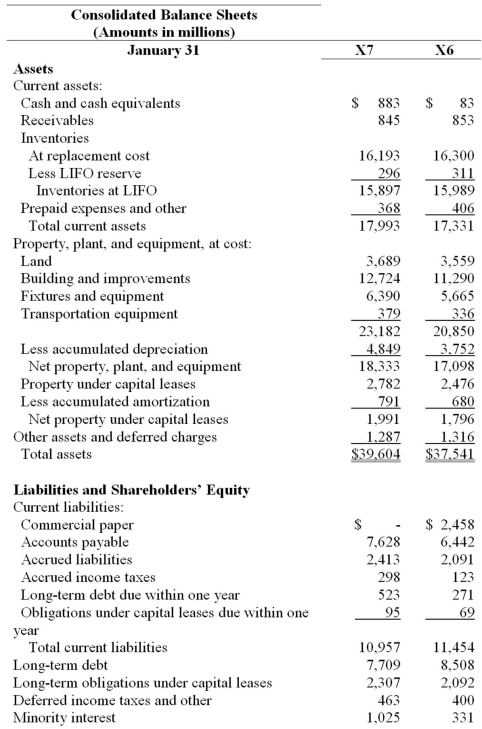

Refer to the financial statements for Wal-Mart, below

a. Calculate for X7 the ratios listed below. X6 numbers are provided for comparative purposes.b. Working capital management is an important consideration for many companies. Which component of Wal-Mart's working capital do you think it spends most time managing? That is, which component is likely to be the most important? Why? What has happened to this component from X6 to X7?

a. Calculate for X7 the ratios listed below. X6 numbers are provided for comparative purposes.b. Working capital management is an important consideration for many companies. Which component of Wal-Mart's working capital do you think it spends most time managing? That is, which component is likely to be the most important? Why? What has happened to this component from X6 to X7?

Wal-Mart

4

Following are Dell's condensed consolidated statement of financial position and condensed consolidated statement of operations, in millions (unaudited).a. Assume all net revenue are from credit sales. Using the above information, calculate the following ratios for FY05 to FY02:

1. Current ratio

2. Quick ratio

3. Working capital

4. Days' sales in accounts receivable

5. Days' sales in inventory

6. Days' purchases in accounts payable

7. Net days' working capital

8. Long-term debt to assets ratio

9. Total debt-to-equity ratio

10. Total liabilities to total assets

1. Current ratio

2. Quick ratio

3. Working capital

4. Days' sales in accounts receivable

5. Days' sales in inventory

6. Days' purchases in accounts payable

7. Net days' working capital

8. Long-term debt to assets ratio

9. Total debt-to-equity ratio

10. Total liabilities to total assets

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following increases when accounts receivable is sold?

A)Current ratio

B)Accounts receivable turnover

C)Debt-to-equity ratio

D)Days' sales in receivables

A)Current ratio

B)Accounts receivable turnover

C)Debt-to-equity ratio

D)Days' sales in receivables

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is not likely to be used to measure a company's liquidity?

A)Working capital

B)Financial leverage

C)Current ratio

D)Acid-test (quick) ratio

A)Working capital

B)Financial leverage

C)Current ratio

D)Acid-test (quick) ratio

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements concerning the current ratio is true? I. It is always larger than the acid-test (quick) ratio.II. Companies can window-dress their current ratios.III. In isolation the current ratio has little meaning.IV. It is a good indicator of solvency of a company.

A)I, II, III, and IV

B)I, II, and III

C)II, III, and IV

D)I, II, and IV

A)I, II, III, and IV

B)I, II, and III

C)II, III, and IV

D)I, II, and IV

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following industries would you expect to have the longest operating cycle?

A)Fast food industry

B)Aerospace industry

C)Discount retail store industry

D)Utility industry

A)Fast food industry

B)Aerospace industry

C)Discount retail store industry

D)Utility industry

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

9

Assume that Company ABC issues $20 million in long-term debt at par when interest rates were low, and Company DEF issued $20 million in long-term debt at par when interest rates were high. Assuming that interest rates remain high:

a. Which company will have the higher debt to capital ratio (assume no other debt and identical equity)?

b. ABC's debt matures in 18 months and DEF's debt matures in 9 years. What would be the effect on your analysis?

Chapter 10 Credit Analysis Key

a. Which company will have the higher debt to capital ratio (assume no other debt and identical equity)?

b. ABC's debt matures in 18 months and DEF's debt matures in 9 years. What would be the effect on your analysis?

Chapter 10 Credit Analysis Key

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

10

Company ABC has a large, wholly owned consolidated finance subsidiary. For each of the following ratios, state the effect (higher, lower, or no effect) that consolidation has on the ratio of Company ABC compared to the ratio it would have if it accounted for its finance subsidiary using the equity method. Briefly explain why each effect occurs.a. Debt to equity ratio

b. Return on assets

c. Times interest earned

b. Return on assets

c. Times interest earned

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

11

Indicate the effect of the following actions on cash levels and current ratio. Assume the company has a current ratio greater than one. Indicate whether the effect is to increase (I), decrease (D) or if it has no effect (NE). Consider each action independently of others.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

12

Imagine FASB passes a new rule that required the capitalization of R&D. The effect for a drug company would be to:

A)increase its current ratio.

B)decrease debt to equity ratio.

C)decrease working capital.

D)improve asset turnover.

A)increase its current ratio.

B)decrease debt to equity ratio.

C)decrease working capital.

D)improve asset turnover.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not likely to be the cause of a company's low accounts receivable turnover?

A)Poor collection efforts

B)Low price of product

C)Customers in financial distress

D)Delays in customer payments

A)Poor collection efforts

B)Low price of product

C)Customers in financial distress

D)Delays in customer payments

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

14

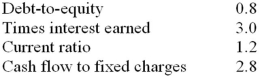

Selected ratios for Hurtal Corporation for year ended Year 1 are:

Below is a set of transactions that are not reflected in the ratios above. Consider each transaction independently and indicate its effect on the above ratios. Explain your answer.1. Decrease in tax rate for Year 1

2. Issued $1,000 in common stock to repay $1,000 of long-term debt at beginning of Year 1.3. Useful life of depreciable assets was increased at beginning of Year 1.

Below is a set of transactions that are not reflected in the ratios above. Consider each transaction independently and indicate its effect on the above ratios. Explain your answer.1. Decrease in tax rate for Year 1

2. Issued $1,000 in common stock to repay $1,000 of long-term debt at beginning of Year 1.3. Useful life of depreciable assets was increased at beginning of Year 1.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following best describes the current ratio?

A)Debt ratio

B)Operating performance ratio

C)Liquidity ratio

D)Efficiency ratio

A)Debt ratio

B)Operating performance ratio

C)Liquidity ratio

D)Efficiency ratio

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is not a measure of a company's solvency?

A)Total debt to equity capital ratio

B)Short-term debt to total debt ratio

C)Sales to assets ratio

D)Long-term debt to equity capital ratio

A)Total debt to equity capital ratio

B)Short-term debt to total debt ratio

C)Sales to assets ratio

D)Long-term debt to equity capital ratio

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

17

Refer to Wal-Mart's financial statements, below.

Shareholders' Equity

Shareholders' Equity

Preferred stock ( par value; 100 share authorized. none issued)

Common stock ( par value; 5.500 million shares authorized. 2,285 million and 2,293 million issued and

a. Calculate: total debt to equity ratio and times interest earned ratio for fiscal X6 and X7. Comment on your results.

b. Analysis of Wal-Mart's footnotes reveals the existence of significant operating leases. Explain whether this would change your answer in part a) and how you would make the changes.

Shareholders' Equity

Shareholders' EquityPreferred stock ( par value; 100 share authorized. none issued)

Common stock ( par value; 5.500 million shares authorized. 2,285 million and 2,293 million issued and

a. Calculate: total debt to equity ratio and times interest earned ratio for fiscal X6 and X7. Comment on your results.

b. Analysis of Wal-Mart's footnotes reveals the existence of significant operating leases. Explain whether this would change your answer in part a) and how you would make the changes.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

18

Consider each of the following situations independently of each other. For each of the situations provide one example of when the underlying circumstances may be such that the observed trend is unfavorable and one example of when the underlying circumstances are favorable.a. Current ratio increases from one period to the next

b. Accounts receivable turnover increases from one period to the next

c. Accounts payable turnover increases from one period to the next

b. Accounts receivable turnover increases from one period to the next

c. Accounts payable turnover increases from one period to the next

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is likely to be used to measure a company's solvency?

A)Net operating profit margin

B)Current ratio

C)Financial leverage

D)Cash to current liabilities ratio

A)Net operating profit margin

B)Current ratio

C)Financial leverage

D)Cash to current liabilities ratio

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following items would not typically be included in the components of the current ratio?

A)Inventory

B)Accounts payable

C)Capitalized software development costs

D)Deferred charges

A)Inventory

B)Accounts payable

C)Capitalized software development costs

D)Deferred charges

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

21

Two companies, A and B, both have $1 million in assets, earnings before interest and taxes (EBIT) of $160,000, and the same tax rate. Company A is all equity financed, and Company B is 50% debt financed and 50% equity financed. If Company B's pretax cost of debt is 8%, then Company A will have a ROA that is _____ and a ROE that is _____ than Company B's.

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

22

ABC Company is planning a major expansion for which it needs $5 million in external funding. It has various options as how to finance this expansion. Which of the following is correct?

A)Future ROA will be higher if it uses all equity financing than if it uses some debt financing

B)Future net income will be higher if it uses common stock rather than preferred stock to finance expansion

C)Future ROA is independent of the form of financing

D)Future net income is independent of the form of financing

A)Future ROA will be higher if it uses all equity financing than if it uses some debt financing

B)Future net income will be higher if it uses common stock rather than preferred stock to finance expansion

C)Future ROA is independent of the form of financing

D)Future net income is independent of the form of financing

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

23

Sellograph Corporation reports sales of $10 million for Year 2, with a gross profit margin of 40%. 20% of Sellograph's sales are on credit.

-Accounts receivable days outstanding at the end of Year 2 is closest to:

A)30.6 days.

B)26.0 days.

C)27.0 days.

D)6.1 days.

-Accounts receivable days outstanding at the end of Year 2 is closest to:

A)30.6 days.

B)26.0 days.

C)27.0 days.

D)6.1 days.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following statements is true? I. Pretax cost of debt is generally higher than the pretax cost of equity.II. Interest is tax deductible.III. Preferred dividends are tax deductible.IV. Total cost of capital is always greater than or equal to cost of equity.

A)II and IV

B)II, III, and IV

C)I, II, and IV

D)II only

A)II and IV

B)II, III, and IV

C)I, II, and IV

D)II only

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

25

The short-term liquidity of a company:

A)is only of concern to investors, not creditors, of a company.

B)is determinable by looking at debt to equity ratio.

C)depends largely upon prospective cash flows.

D)is determinable by calculating cash to current liabilities ratio.

A)is only of concern to investors, not creditors, of a company.

B)is determinable by looking at debt to equity ratio.

C)depends largely upon prospective cash flows.

D)is determinable by calculating cash to current liabilities ratio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following industries would you expect to have the highest inventory turnover?

A)Restaurant

B)Car dealer

C)Jewelry store

D)Department store

A)Restaurant

B)Car dealer

C)Jewelry store

D)Department store

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

27

If a company wishes to increase its current ratio, it could:

A)take out a short-term loan.

B)decrease investments in fixed assets.

C)increase useful life of machinery.

D)sell a fixed asset.

A)take out a short-term loan.

B)decrease investments in fixed assets.

C)increase useful life of machinery.

D)sell a fixed asset.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

28

Sellograph Corporation reports sales of $10 million for Year 2, with a gross profit margin of 40%. 20% of Sellograph's sales are on credit.

-Accounts payable days outstanding at the end of Year 2 is closest to:

A)57.0 days.

B)66.0 days.

C)72.0 days.

D)43.2 days.

-Accounts payable days outstanding at the end of Year 2 is closest to:

A)57.0 days.

B)66.0 days.

C)72.0 days.

D)43.2 days.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is not included in the computation of Altman's Z-score?

A)Liquidity

B)Trendline

C)Capital turnover rate

D)Profitability

A)Liquidity

B)Trendline

C)Capital turnover rate

D)Profitability

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

30

If a firm capitalizes a lease instead of treating the lease as an operating lease, the effect on the current ratio and the debt-to-equity ratio will be:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

31

An analyst should treat preferred stock on a firm's balance sheet as debt when calculating leverage ratios if the preferred stock is:

A)redeemable by shareholders.

B)convertible into common stock.

C)issued at a variable dividend rate.

D)callable by the issuer.

A)redeemable by shareholders.

B)convertible into common stock.

C)issued at a variable dividend rate.

D)callable by the issuer.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

32

Sellograph Corporation reports sales of $10 million for Year 2, with a gross profit margin of 40%. 20% of Sellograph's sales are on credit.

-Days in inventory at the end of Year 2 is closest to:

A)60.0 days.

B)69.0 days.

C)66.0 days.

D)54.0 days.

-Days in inventory at the end of Year 2 is closest to:

A)60.0 days.

B)69.0 days.

C)66.0 days.

D)54.0 days.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

33

If a company's current ratio increases from 1.2 to 1.4 from one year to the next, and its quick ratio decreases from 0.2 to 0.15 over the same time period, this indicates:

A)the liquidity must have increased.

B)the accounts receivable have decreased.

C)the inventory management should be further examined.

D)the current liabilities have decreased.

A)the liquidity must have increased.

B)the accounts receivable have decreased.

C)the inventory management should be further examined.

D)the current liabilities have decreased.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

34

Which of the following does not represent future expected cash inflows?

A)Accounts receivable

B)Prepaid expenses

C)Inventory

D)Notes receivable

A)Accounts receivable

B)Prepaid expenses

C)Inventory

D)Notes receivable

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

35

If a company's current ratio increases from 1.1 to 1.3 from one year to the next, it can be concluded that:

A)the liquidity has increased.

B)the current assets have increased.

C)the current liabilities have decreased.

D)None of the above

A)the liquidity has increased.

B)the current assets have increased.

C)the current liabilities have decreased.

D)None of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following will not affect the calculation of leverage ratios?

A)Existence of operating leases

B)Existence of assets where fair value is much lower than book value

C)Existence of significant debt covenants

D)Existence of pension liabilities where projected benefit liability is much greater than plan assets and accumulated benefit obligation

A)Existence of operating leases

B)Existence of assets where fair value is much lower than book value

C)Existence of significant debt covenants

D)Existence of pension liabilities where projected benefit liability is much greater than plan assets and accumulated benefit obligation

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is least likely to increase the overall risk of a company?

A)Increased sales variability

B)Increased debt levels

C)Increased variable costs while decreasing fixed costs

D)Increased interest rates

A)Increased sales variability

B)Increased debt levels

C)Increased variable costs while decreasing fixed costs

D)Increased interest rates

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following statements is correct with respect to the times interest earned ratio? I. It is independent of operating income.II. It is independent of the interest rate paid on debt.III. It is independent of the tax rate.IV. It is independent of the amount of dividends paid.

A)I, II, and III

B)I and III

C)I and IV

D)III and IV

A)I, II, and III

B)I and III

C)I and IV

D)III and IV

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

39

All other things being equal, which of the following actions will achieve a company's wish to increase its financial leverage? I. Repurchase stock

II) Issue more dividends

III) Sell accounts receivable at face value

IV) Split stock 2 for 1

A)I, II, and III

B)I and II

C)I and IV

D)I, II, and IV

II) Issue more dividends

III) Sell accounts receivable at face value

IV) Split stock 2 for 1

A)I, II, and III

B)I and II

C)I and IV

D)I, II, and IV

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

40

All other things being equal, if a company increased its dividend payments, what would happen to the following ratios?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

41

The earnings to fixed charges ratio:

A)indicates how efficiently assets are used.

B)typically includes depreciation in the denominator.

C)typically excludes extraordinary gains and losses from the numerator.

D)indicates the proportion of debt used to finance a company.

A)indicates how efficiently assets are used.

B)typically includes depreciation in the denominator.

C)typically excludes extraordinary gains and losses from the numerator.

D)indicates the proportion of debt used to finance a company.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is true of debt covenants? I. Limit the issuance of additional debt senior to the obligation.II. Specify minimum levels of selected financial ratios.III. Specify minimum levels of earnings coverage.IV. Prohibit excessive dividends or stock repurchases.

A)II and III

B)II and IV

C)I, III, and IV

D)I, II, III, and IV

A)II and III

B)II and IV

C)I, III, and IV

D)I, II, III, and IV

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

43

When examining the current ratio and trends in the current ratio, it is important to evaluate the turnover rate of current assets and current liabilities and trends in these turnover ratios.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

44

When examining a company's current ratio, it is important to also assess the quality of the current assets and liabilities.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

45

An increase in the credit days offered to customers by a company will improve the company's financial situation because of the likely increase in sales.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

46

All other things being equal, if a company issues a 1% stock dividend, what is the effect on the following ratios?

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

47

If a company has a current ratio greater than one then there is no chance it will go bankrupt in the next year.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

48

The higher the cash to current liabilities ratio of a company, the better is the company.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

49

Below is information for year ended 12/31/05 for Company A and Company B.

-Company A capitalized $100 in interest costs, the pension obligation, during the year. Times interest earned ratio, after necessary adjustments, for Company A is:

A)3.5.

B)2.8.

C)2.0.

D)1.2.

-Company A capitalized $100 in interest costs, the pension obligation, during the year. Times interest earned ratio, after necessary adjustments, for Company A is:

A)3.5.

B)2.8.

C)2.0.

D)1.2.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

50

Liquidity is generally measured by a company's ability to pay its short-term obligations using its short-term assets.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

51

Below is information for year ended 12/31/05 for Company A and Company B.

-Return on assets for Company A and B for 2005 are:

A)Option A

B)Option B

C)Option C

D)Option D

-Return on assets for Company A and B for 2005 are:

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

52

Which of the following transactions or events would have no immediate effect on the times interest earned ratio but will cause debt to equity ratio to decrease?

A)Issuing new debt

B)Issuing new equity

C)Having a stock split

D)Recording large contingent liability for lawsuit

A)Issuing new debt

B)Issuing new equity

C)Having a stock split

D)Recording large contingent liability for lawsuit

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

53

Liquidity depends to a large extent on prospective cash flows and to a lesser extent on the level of cash and cash equivalents.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

54

Below is information for year ended 12/31/05 for Company A and Company B.

-Financial leverage ratio for Company A and B for 2005 are:

A)Option A

B)Option B

C)Option C

D)Option D

-Financial leverage ratio for Company A and B for 2005 are:

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

55

All current assets, by definition, will result in cash inflows within the next year or operating cycle whichever is longer.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

56

While screening hundreds of companies for investment opportunities, you come across Apex Corp. It is rated AA by the major rating agencies and has a low Altman's Z-score of 1.15. You want to do detailed analysis, but you preliminarily conclude:

A)Apex debt is overvalued.

B)Apex stock should appreciate over the short-term.

C)Apex has untapped growth potential.

D)None of the above

A)Apex debt is overvalued.

B)Apex stock should appreciate over the short-term.

C)Apex has untapped growth potential.

D)None of the above

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

57

The current ratio is a superior tool to cash flow projections and pro forma financial statements in assessing short-term liquidity.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

58

Liquidity is viewed as a company's ability to meet its short-term and long-term obligations.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

59

Which of the following is not a primary motivation for a company financing its business activities through debt?

A)Trading on the equity

B)Reducing earnings variability

C)Tax deductibility of interest

D)Avoiding earnings dilution

A)Trading on the equity

B)Reducing earnings variability

C)Tax deductibility of interest

D)Avoiding earnings dilution

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

60

The higher the cash to current liabilities ratio of a company, the more liquid is the company.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

61

A decrease in provision for doubtful accounts relative to gross accounts receivable could indicate improved collection of accounts receivable or it could indicate that management has failed to make adequate provisions for non-collectible accounts.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

62

Determination of short-term liquidity is important to both investors and creditors.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

63

The use of LIFO will inflate the current ratio under normal economic conditions.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

64

For purposes of long-term solvency analysis, the calculation of balance sheet ratios such as debt to equity or debt to total capital are of limited value and are used mostly as screening mechanisms to indicate whether further analysis is warranted.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

65

If a company's days receivables outstanding increases, this could be an indication that there are problems with the quality of the company's products.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

66

One would expect restaurants to have lower inventory turnover than general merchandise stores.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

67

Management's Discussion and Analysis provides information that is useful in helping assess a company's liquidity.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

68

In assessing the quality of receivables it is important to consider the revenue recognition methods used by a company.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

69

If a company switches from FIFO to LIFO during a period of rising prices, inventory turnover will probably increase.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

70

Minority shareholders' interest on the balance sheet represents a liability to the company and should always be included in debt when calculating the debt to equity ratio.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

71

The ratio of "near-cash" assets to the total of current assets is one measure of the degree of current asset liquidity.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

72

If accounts payable turnover decreases, this could be an indication that suppliers are cutting off credit to the company.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

73

Analysis of profitability of a company is more important when considering short-term liquidity than when considering long-term solvency of a company.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

74

The higher a company's inventory turnover, the better is the company.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

75

An increase in the current ratio over time is always a good indication of increased liquidity of a firm.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

76

When calculating earnings coverage ratios, it is common to remove the effects of extraordinary gains and losses and other one-time gains and losses from the numerator.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

77

An increase in the current ratio due to increased inventory and receivables could be consistent with a recession in the economy.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

78

If a company sells its receivables, this is an indication that it has very high quality receivables.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

79

When calculating the times interest earned, adjustments should normally be made for existence of operating leases. A portion of rental payments should be reclassified as interest.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck

80

All other things being equal, the lower the equity as a proportion of total capital, the greater the risk borne by the other providers of capital.

Unlock Deck

Unlock for access to all 103 flashcards in this deck.

Unlock Deck

k this deck