Deck 7: Cash Flow Analysis

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/88

Play

Full screen (f)

Deck 7: Cash Flow Analysis

1

Beginning and ending accounts receivable are $76,000 and $42,000, respectively. Sales for the period total $384,000, of which $40,000 was directly for cash. How much cash was collected from making sales and collecting accounts receivable?

A)$344,000

B)$418,000

C)$378,000

D)$376,000

A)$344,000

B)$418,000

C)$378,000

D)$376,000

B

2

The following cash flow data of Signet Sales for the year ended December 31, 2005 are as follows:

a. Prepare a statement of cash flows for Signet Sales in accordance using the direct method.

b. Discuss, from an analyst's viewpoint, the purpose of classifying cash flows into the categories required by GAAP

a. Prepare a statement of cash flows for Signet Sales in accordance using the direct method.

b. Discuss, from an analyst's viewpoint, the purpose of classifying cash flows into the categories required by GAAP

a.

b. Operating cash flows provide a measure of internally generated funds that can be used to fund expansion, pay off debt, and pay dividends to shareholders. Operating cash flows are not a performance measure, but rather should be considered a liquidity measure. The larger the operating cash flows the less likely a company will need external financing to fund growth, and the less likely they are to need to liquidate assets.

Investing cash flows show us where a company is investing its cash and whether it is liquidating assets. Examination of the investing section will determine if the company is maintaining and/or growing asset base. Financing cash flows provide information about the financing of a company—whether it is raising capital to support operations, to finance growth, or whether it is decreasing or increasing leverage.

b. Operating cash flows provide a measure of internally generated funds that can be used to fund expansion, pay off debt, and pay dividends to shareholders. Operating cash flows are not a performance measure, but rather should be considered a liquidity measure. The larger the operating cash flows the less likely a company will need external financing to fund growth, and the less likely they are to need to liquidate assets.

Investing cash flows show us where a company is investing its cash and whether it is liquidating assets. Examination of the investing section will determine if the company is maintaining and/or growing asset base. Financing cash flows provide information about the financing of a company—whether it is raising capital to support operations, to finance growth, or whether it is decreasing or increasing leverage.

3

Under the accrual basis of accounting, which of the following statements is true? I. Reported net income provides a measure of operating performance.II. Revenue is recognized when cash is received, and expenses are recognized when payment is made.III. Cash inflows are recognized when they are received, and cash outflows are recognized when they are made.

A)I only

B)III only

C)I and III

D)I, II, and III

A)I only

B)III only

C)I and III

D)I, II, and III

C

4

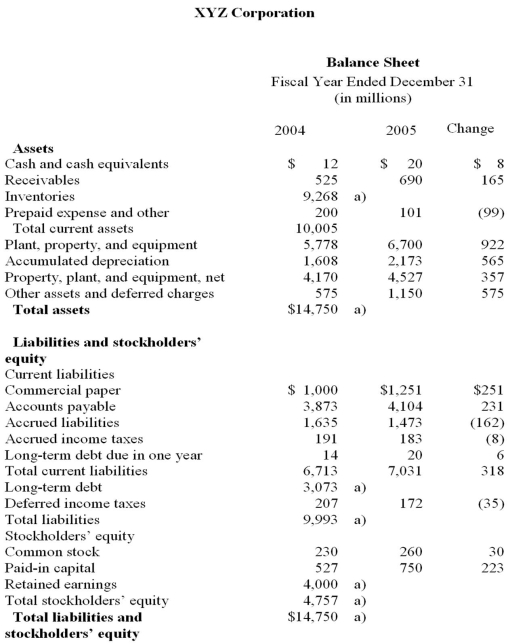

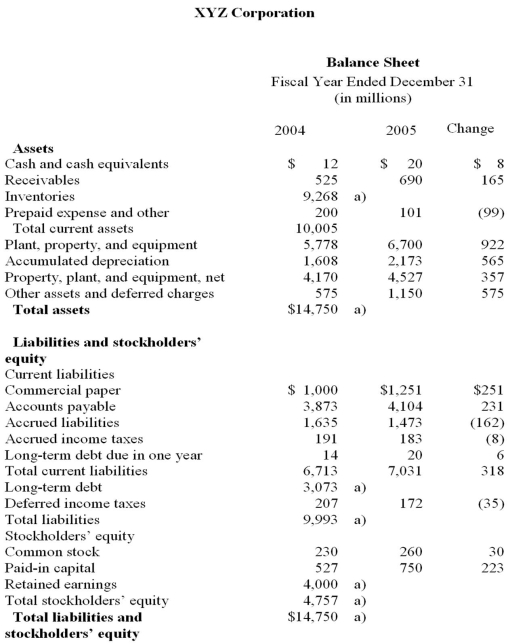

You are trying to determine how much money your company, XYZ Corporation, will need to borrow from the bank, if any. You are in the middle of preparing the pro forma financial statements for 2005. On the next pages is the completed income statement and partially completed balance sheet for your company for 2005.

a. Using the information provided below complete the balance sheet for 2005. (Put your answers in the blank spaces on the balance sheet.)

• Inventory turnover (using end-of-year inventory) is 4.

• Your silent partners demand that 50% of net income is paid out in dividends.

• You will borrow if you have a cash shortage, and will reduce long-term debt if there is an excess of cash

b. When you have completed part a, prepare a statement of cash flows.

a. Using the information provided below complete the balance sheet for 2005. (Put your answers in the blank spaces on the balance sheet.)

• Inventory turnover (using end-of-year inventory) is 4.

• Your silent partners demand that 50% of net income is paid out in dividends.

• You will borrow if you have a cash shortage, and will reduce long-term debt if there is an excess of cash

b. When you have completed part a, prepare a statement of cash flows.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

5

A firm has net sales of $6,000, cash expenses (including taxes) of $2,800, and depreciation of $1,000. If accounts receivable increased in the period by $800, cash flows from operations equal:

A)$2,400.

B)$3,200.

C)$3,400.

D)$4,200.

A)$2,400.

B)$3,200.

C)$3,400.

D)$4,200.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following represents an investing activity in the statement of cash flows?

A)Depreciation of plant assets

B)Sale of plant assets at a loss

C)Stock dividend

D)Purchase of inventory

A)Depreciation of plant assets

B)Sale of plant assets at a loss

C)Stock dividend

D)Purchase of inventory

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

7

Beginning accounts receivable are $76,000. Sales for the period total $384,000, of which $40,000 was directly for cash. $418,000 was collected from making sales and collecting accounts receivable. What is the ending balance for accounts receivable?

A)$42,000

B)$62,000

C)$82,000

D)$68,000

A)$42,000

B)$62,000

C)$82,000

D)$68,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

8

The following information should be used to according to the provisions of GAAP (Statement of Cash flows) and using the following data.

-What is net cash flow from operations?

A)$58,000

B)$55,000

C)$54,000

D)$48,000

-What is net cash flow from operations?

A)$58,000

B)$55,000

C)$54,000

D)$48,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

9

The following information should be used to according to the provisions of GAAP (Statement of Cash flows) and using the following data.

-What is net cash flow from financing?

A)$6,000

B)$3,000

C)($14,000)

D)($17,000)

-What is net cash flow from financing?

A)$6,000

B)$3,000

C)($14,000)

D)($17,000)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following would require an adjustment in the computation of cash flow from operations using the indirect method? I. Sale of machinery for $50,000 with a net book value of $35,000

II) Purchase of supplies for cash

III) Remittance by customer in payment of goods purchased this accounting period

IV) Acquisition of land with simultaneous issuance of long-term note

A)I

B)I and II

C)I and III

D)IV

II) Purchase of supplies for cash

III) Remittance by customer in payment of goods purchased this accounting period

IV) Acquisition of land with simultaneous issuance of long-term note

A)I

B)I and II

C)I and III

D)IV

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

11

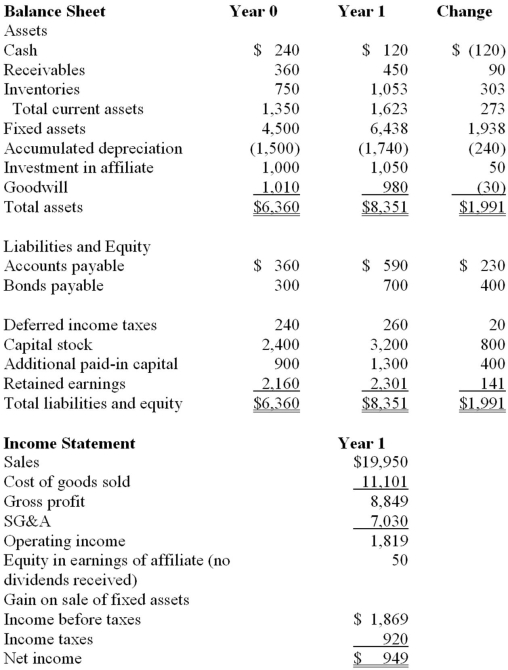

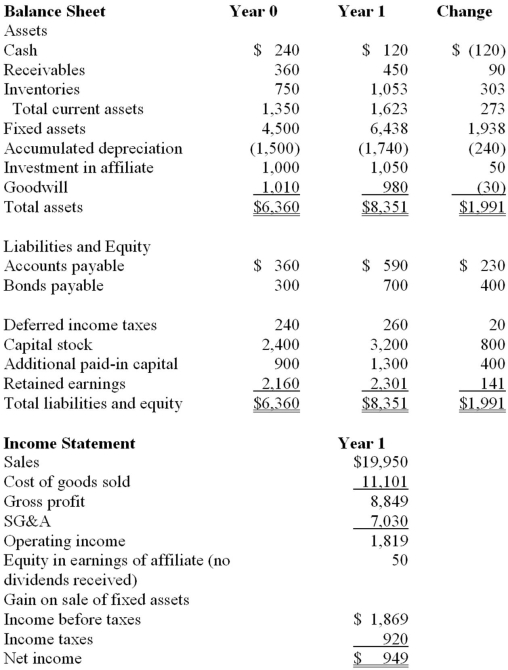

Below are the balance sheet and income statement for Anderson Corporation.

Additional Information

1. In Year 1, Anderson sold machinery bought at $36, for $18, resulting in a $2 gain on income statement.

2. $810 in dividends were paid in Year 1.

3. SG&A expense includes $50 of interest expense, and amortization expense of $30.

4. Cost of good sold includes depreciation of $260.

5. Income tax expense includes deferred tax liability of $20.

a. Prepare cash flows from operations using the direct method.

b. Prepare statement of cash flows from operations using the Indirect method.

Additional Information

1. In Year 1, Anderson sold machinery bought at $36, for $18, resulting in a $2 gain on income statement.

2. $810 in dividends were paid in Year 1.

3. SG&A expense includes $50 of interest expense, and amortization expense of $30.

4. Cost of good sold includes depreciation of $260.

5. Income tax expense includes deferred tax liability of $20.

a. Prepare cash flows from operations using the direct method.

b. Prepare statement of cash flows from operations using the Indirect method.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

12

a. Is it possible to have a positive net income and negative cash flow from operations? If your answer is no, explain fully. If your answer is yes, provide two examples when one might find this.b. Is it possible to have a negative net income and positive cash flow from operations? If your answer is no, explain fully. If your answer is yes, provide two examples when one might find this.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following would require an adjustment in the computation of cash flow from operations using the indirect method? I. Depreciation expense

II) Loss on sale of asset

III) Sale of services to customers for cash

IV) Utility bill received and paid in cash

A)I

B)I and II

C)I and III

D)IV

II) Loss on sale of asset

III) Sale of services to customers for cash

IV) Utility bill received and paid in cash

A)I

B)I and II

C)I and III

D)IV

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

14

Which of the following is not a financing activity in the statement of cash flows?

A)Cash dividend

B)Repurchase of common stock

C)Payment of interest on debt

D)Issuance of new debt

A)Cash dividend

B)Repurchase of common stock

C)Payment of interest on debt

D)Issuance of new debt

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

15

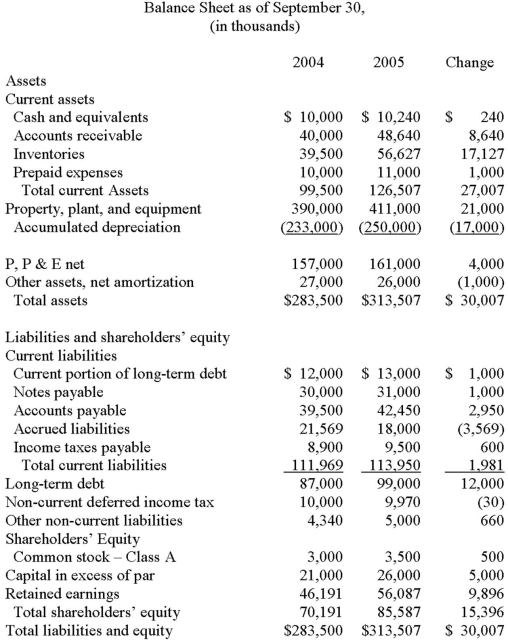

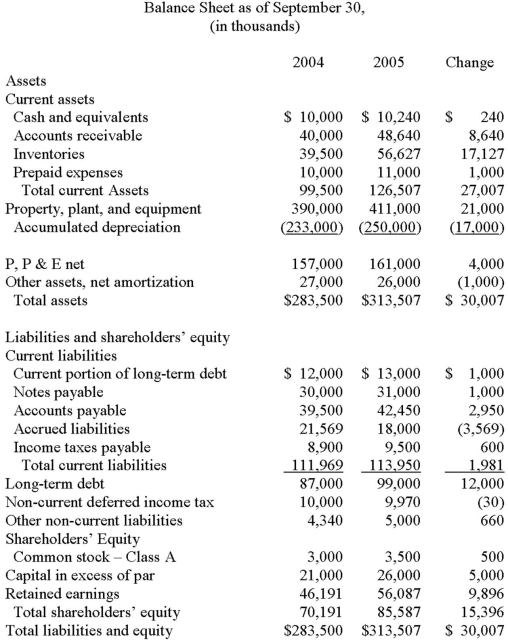

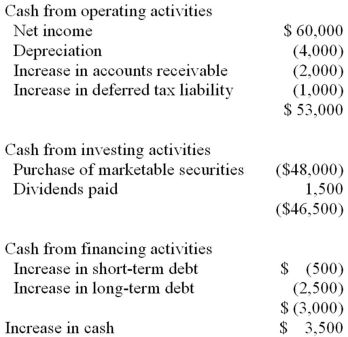

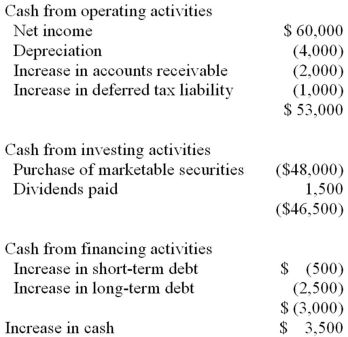

Below is the income statement and balance sheet of Closely Held Corporation. From this information prepare a statement of cash flows for the year ended September 30, 2005.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

16

Use the following selected data about Tiles Ltd. and prepare the operating activities section of a statement of cash flows for the company for 2005 using the indirect method.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

17

GAAP requires that the Statement of Cash flows (SCFs) is prepared in a specific manner. For the following items, discuss in which section (operating, investing, or financing) of the SCFs they are found, where they might more appropriately be placed and why?

a. Dividends received

b. Interest paid

c. Income taxes

a. Dividends received

b. Interest paid

c. Income taxes

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

18

Identify whether each of the following is an operating, investing, or financing cash outflow or inflow or if it is a noncash flow, under GAAP.Purchase marketable equity securities

Dividends on marketable equity securities

Wages to employees

Depreciation

Issuance of new stock

Interest paid

Goodwill amortization

Acquisition of company using purchase accounting

Sale of land

Tax paid on sale of land

Cash paid by customers

Dividends on marketable equity securities

Wages to employees

Depreciation

Issuance of new stock

Interest paid

Goodwill amortization

Acquisition of company using purchase accounting

Sale of land

Tax paid on sale of land

Cash paid by customers

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

19

The following information should be used to according to the provisions of GAAP (Statement of Cash flows) and using the following data.

-What is net cash flow from investing?

A)$10,000

B)$5,000

C)($5,000)

D)($15,000)

-What is net cash flow from investing?

A)$10,000

B)$5,000

C)($5,000)

D)($15,000)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

20

JEM Company's comparative balance sheets for 2004 and 2005 appear below.

The following additional information is available: net income for the year 2005 (as reported on the income statement) was $50,000; dividends of $40,000 were declared and paid; and equipment that cost $8,000 and had a book value of $1,000 was sold during the year for $2,500.

Based on the information provided, answer the following:

a. What was cash provided by operations?

b. What was cash provided by investing activity?

c. How much was cash provided by financing activity?

d. What is the total change in cash for 2005?

The following additional information is available: net income for the year 2005 (as reported on the income statement) was $50,000; dividends of $40,000 were declared and paid; and equipment that cost $8,000 and had a book value of $1,000 was sold during the year for $2,500.

Based on the information provided, answer the following:

a. What was cash provided by operations?

b. What was cash provided by investing activity?

c. How much was cash provided by financing activity?

d. What is the total change in cash for 2005?

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

21

The following information should be used to according to the provisions of GAAP (Statement of Cash flows) and using the following data.

-What is change in cash?

A)$49,000

B)$46,000

C)$45,000

D)$39,000

-What is change in cash?

A)$49,000

B)$46,000

C)$45,000

D)$39,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

22

Firms report payments for capital leases in the cash flow statement:

A)only as financing cash flows.

B)only as investing cash flows.

C)partly as operating cash flows and partly as investing cash flows.

D)partly as operating cash flows and partly as financing cash flows.

A)only as financing cash flows.

B)only as investing cash flows.

C)partly as operating cash flows and partly as investing cash flows.

D)partly as operating cash flows and partly as financing cash flows.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

23

Tracy Company reports the following in its statement of cash flows:

-If Tracy shows cost of goods sold of $2,050 on its income statement, cash paid to suppliers is:

A)$1,550.

B)$1,950.

C)$2,150.

D)$2,650.

-If Tracy shows cost of goods sold of $2,050 on its income statement, cash paid to suppliers is:

A)$1,550.

B)$1,950.

C)$2,150.

D)$2,650.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following would affect cash flow from operations?

A)Sale of land for a gain

B)Payment of dividends

C)Depreciation of fixed assets

D)Capitalizing costs that were previously expensed

A)Sale of land for a gain

B)Payment of dividends

C)Depreciation of fixed assets

D)Capitalizing costs that were previously expensed

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

25

Below is an example of an incorrectly prepared statement of cash flows. The descriptions of activities are correct.

-The correct change in cash for the year is:

A)$4,000

B)$15,000

C)$16,500

D)None of the above

-The correct change in cash for the year is:

A)$4,000

B)$15,000

C)$16,500

D)None of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following is true of depreciation?

A)It is recorded so that net book value represents fair value of assets.

B)It does not affect the amount of cash realized from operations as it is a noncash flow.

C)It is added back to net income to calculate cash from operations under the direct method.

D)It represents a fund from which to purchase future assets.

A)It is recorded so that net book value represents fair value of assets.

B)It does not affect the amount of cash realized from operations as it is a noncash flow.

C)It is added back to net income to calculate cash from operations under the direct method.

D)It represents a fund from which to purchase future assets.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following items is deducted from net income to arrive at cash flow from operations when using the indirect method?

A)Depreciation expense

B)Amortization expense

C)Decrease in accounts receivable

D)Decrease in accounts payable

A)Depreciation expense

B)Amortization expense

C)Decrease in accounts receivable

D)Decrease in accounts payable

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

28

An increase in accounts payable would be considered:

A)a source of cash.

B)a use of cash.

C)an adjusting entry.

D)a noncash charge to income.

A)a source of cash.

B)a use of cash.

C)an adjusting entry.

D)a noncash charge to income.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

29

Tracy Company reports the following in its statement of cash flows:

-Tracy used the indirect method of determining cash flow from operations (CFO). If it had used the direct method:

A)CFO would have been higher as gains are not deducted in arriving at CFO.

B)CFO would have been lower as losses and depreciation are not added back in arriving at CFO.

C)CFO would have been the same.

D)it is not possible to determine what CFO would have been without more information.

-Tracy used the indirect method of determining cash flow from operations (CFO). If it had used the direct method:

A)CFO would have been higher as gains are not deducted in arriving at CFO.

B)CFO would have been lower as losses and depreciation are not added back in arriving at CFO.

C)CFO would have been the same.

D)it is not possible to determine what CFO would have been without more information.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

30

Which of the following statements are correct? I. A company's choice of accounting principles for financial reporting purposes affects net cash flow for the accounting period.II. A company's choice of accounting principles for financial reporting purposes does not affect operating cash flow.III. If a company sells its receivables, this will increase operating cash flow.IV. If a company sells its receivables, this will increase financing cash flow.

A)I and III

B)I, II, and III

C)II and IV

D)I and IV

A)I and III

B)I, II, and III

C)II and IV

D)I and IV

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

31

On a statement of cash flows that uses the indirect approach, calculation of cash flow from operations treats depreciation as an adjustment to reported net income because:

A)depreciation is a direct source of cash.

B)depreciation is an outflow of cash to a reserve account for the replacement of assets.

C)depreciation reduces net income and involves an outflow of cash.

D)depreciation reduces net income but does not involve an outflow of cash.

A)depreciation is a direct source of cash.

B)depreciation is an outflow of cash to a reserve account for the replacement of assets.

C)depreciation reduces net income and involves an outflow of cash.

D)depreciation reduces net income but does not involve an outflow of cash.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

32

Below is an example of an incorrectly prepared statement of cash flows. The descriptions of activities are correct.

-The correct cash flows from operating activities is:

A)$65,500.

B)$63,500.

C)$53,500.

D)None of the above

-The correct cash flows from operating activities is:

A)$65,500.

B)$63,500.

C)$53,500.

D)None of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

33

Below is an example of an incorrectly prepared statement of cash flows. The descriptions of activities are correct.

The management of a company wishes to window-dress its cash flow from operations. Which of the following will improve cash flow from operations? I. Factoring accounts receivable

II) Paying suppliers more quickly

III) Selling of some excess marketable securities

IV) Deferring payment of taxes

A)IV only

B)III and IV

C)II, III, and IV

D)I and IV

The management of a company wishes to window-dress its cash flow from operations. Which of the following will improve cash flow from operations? I. Factoring accounts receivable

II) Paying suppliers more quickly

III) Selling of some excess marketable securities

IV) Deferring payment of taxes

A)IV only

B)III and IV

C)II, III, and IV

D)I and IV

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

34

The following information should be used according to the provisions of GAAP (Statement of Cash flows) and using the following data.

-What is net cash flow from operations?

A)$74,000

B)$75,000

C)$83,000

D)$85,000

-What is net cash flow from operations?

A)$74,000

B)$75,000

C)$83,000

D)$85,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

35

Below is an example of an incorrectly prepared statement of cash flows. The descriptions of activities are correct.

-The correct cash flows from financing activities is:

A)($4,500).

B)$3,000.

C)$1,000.

D)None of the above

-The correct cash flows from financing activities is:

A)($4,500).

B)$3,000.

C)$1,000.

D)None of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

36

Tracy Company reports the following in its statement of cash flows:

-If Tracy shows depreciation expense of $275 in its income statement, cash paid for amortization is:

A)$0

B)$75

C)$525

D)not determinable

-If Tracy shows depreciation expense of $275 in its income statement, cash paid for amortization is:

A)$0

B)$75

C)$525

D)not determinable

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

37

Compared with firms with capital leases, firms with operating leases generally report:

A)higher cash flow from operations.

B)lower cash flow from operations.

C)identical cash flow from operations.

D)lower or higher cash flow from operations depending upon market interest rates.

A)higher cash flow from operations.

B)lower cash flow from operations.

C)identical cash flow from operations.

D)lower or higher cash flow from operations depending upon market interest rates.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

38

Hupta Corporation reports for the year ended December 31, 2005, sales of $9,430 and cost of goods sold of $6,500. Other information as of December 31 is as follows:

-Cash collected from customers for the year ended December 31, 2005, is:

A)$9,480.

B)$9,430.

C)$8,930.

D)$8,980.

-Cash collected from customers for the year ended December 31, 2005, is:

A)$9,480.

B)$9,430.

C)$8,930.

D)$8,980.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

39

Below is an example of an incorrectly prepared statement of cash flows. The descriptions of activities are correct.

-The correct cash flows from investing activities is:

A)($41,000).

B)($45,500).

C)($48,000).

D)None of the above

-The correct cash flows from investing activities is:

A)($41,000).

B)($45,500).

C)($48,000).

D)None of the above

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

40

Hupta Corporation reports for the year ended December 31, 2005, sales of $9,430 and cost of goods sold of $6,500. Other information as of December 31 is as follows:

-Cash paid to suppliers for year ended December 31, 2005, is:

A)$6,480.

B)$6,440.

C)$5,520.

D)$6,560.

-Cash paid to suppliers for year ended December 31, 2005, is:

A)$6,480.

B)$6,440.

C)$5,520.

D)$6,560.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

41

Cash flow from operations is usually less volatile than net income.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

42

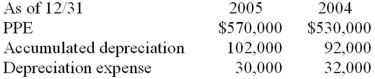

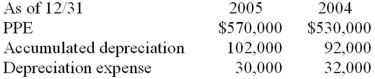

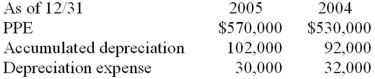

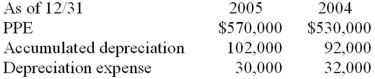

The following information is given for Building Inc.:

During 2005 new assets were purchased for of $78,000, and plant assets were sold at a $10,000 loss.

The balance for supplies is $41,000 and $27,000 for 12/31/05 and 12/31/06, respectively. During the 2006, the company recorded $30,500 of supplies expense was recorded. How much new supplies were purchased?

A)$44,500

B)$16,500

C)$14,000

D)$30,500

During 2005 new assets were purchased for of $78,000, and plant assets were sold at a $10,000 loss.

The balance for supplies is $41,000 and $27,000 for 12/31/05 and 12/31/06, respectively. During the 2006, the company recorded $30,500 of supplies expense was recorded. How much new supplies were purchased?

A)$44,500

B)$16,500

C)$14,000

D)$30,500

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

43

Which of the following would be considered a use of cash?

A)Depreciation

B)An increase in working capital

C)Sale of bonds

D)An increase in wages payable

A)Depreciation

B)An increase in working capital

C)Sale of bonds

D)An increase in wages payable

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

44

Schwerin Corporation reports the following on its 2005 financial statements.

-If the beginning and ending property, plant, and equipment are $500 million and $550 million respectively, the gross book value of equipment sold was:

A)$120 million

B)$100 million

C)$80 million

D)$60 million

-If the beginning and ending property, plant, and equipment are $500 million and $550 million respectively, the gross book value of equipment sold was:

A)$120 million

B)$100 million

C)$80 million

D)$60 million

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

45

Beginning and ending plant assets are $325,000 and $370,000 respectively. Beginning and ending accumulated depreciation are $82,800 and $95,000 respectively. Depreciation expense for the period was $30,000, and new assets of $76,000 were purchased. Plant assets were sold at a $10,500 loss. What were the cash proceeds from the sale?

A)$17,800

B)$3,100

C)$2,700

D)$31,000

A)$17,800

B)$3,100

C)$2,700

D)$31,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

46

The following information should be used according to the provisions of GAAP (Statement of Cash flows) and using the following data.

-What is net cash flow from financing?

A)($5,000)

B)($10,000)

C)($11,000)

D)($13,000)

-What is net cash flow from financing?

A)($5,000)

B)($10,000)

C)($11,000)

D)($13,000)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

47

Companies can construct the statement of cash flows using either the direct method or the indirect method.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

48

Cash flow from investing when averaged over an extended period of time would normally be expected to be negative (i.e. net outflow).

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

49

The cash flow adequacy ratio:

A)measures a company's ability to generate sufficient cash flow from investing to cover debt repayments.

B)measures a company's ability to generate sufficient cash flows from operations to cover capital expenditures and debt repayment.

C)measures a company's ability to generate sufficient cash flows from operations to cover capital expenditures, inventory additions, and cash dividends.

D)measures a company's ability to generate sufficient cash flows from operations to cover capital expenditures, debt repayment, and dividends.

A)measures a company's ability to generate sufficient cash flow from investing to cover debt repayments.

B)measures a company's ability to generate sufficient cash flows from operations to cover capital expenditures and debt repayment.

C)measures a company's ability to generate sufficient cash flows from operations to cover capital expenditures, inventory additions, and cash dividends.

D)measures a company's ability to generate sufficient cash flows from operations to cover capital expenditures, debt repayment, and dividends.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

50

The only time a company experiences a negative cash flow from operations is when they are in trouble.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

51

The following information is given for Building Inc.:

During 2005 new assets were purchased for of $78,000, and plant assets were sold at a $10,000 loss.

Beginning and ending prepaid insurance is $36,000 and $26,500 respectively. During the period, $30,500 of insurance expense was recorded. How much new insurance was purchased?

A)$2,500

B)$15,600

C)$49,000

D)$21,000

During 2005 new assets were purchased for of $78,000, and plant assets were sold at a $10,000 loss.

Beginning and ending prepaid insurance is $36,000 and $26,500 respectively. During the period, $30,500 of insurance expense was recorded. How much new insurance was purchased?

A)$2,500

B)$15,600

C)$49,000

D)$21,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

52

The following information should be used according to the provisions of GAAP (Statement of Cash flows) and using the following data.

-What is change in cash?

A)$81,000

B)$72,000

C)$71,000

D)$62,000

-What is change in cash?

A)$81,000

B)$72,000

C)$71,000

D)$62,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following is true? The choice of LIFO versus FIFO will:

A)not affect net income or cash flow from operations.

B)not affect net income but will affect cash flow from operations.

C)affect both net income and cash flow from operations.

D)affect net income but will not affect cash flow from operations.

A)not affect net income or cash flow from operations.

B)not affect net income but will affect cash flow from operations.

C)affect both net income and cash flow from operations.

D)affect net income but will not affect cash flow from operations.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

54

Cash flow from financing is normally negative during the start-up phase for a company.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

55

The following information is given for Building Inc.:

During 2005 new assets were purchased for of $78,000, and plant assets were sold at a $10,000 loss.

-What were the cash proceeds from the sale?

A)$38,000

B)$18,000

C)$10,000

D)$8,000

During 2005 new assets were purchased for of $78,000, and plant assets were sold at a $10,000 loss.

-What were the cash proceeds from the sale?

A)$38,000

B)$18,000

C)$10,000

D)$8,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

56

The following information should be used according to the provisions of GAAP (Statement of Cash flows) and using the following data.

-What is net cash flow from investing?

A)$11,000

B)$7,000

C)($2,000)

D)($12,000)

-What is net cash flow from investing?

A)$11,000

B)$7,000

C)($2,000)

D)($12,000)

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

57

The following information is given for Building Inc.:

During 2005 new assets were purchased for of $78,000, and plant assets were sold at a $10,000 loss.

-What was the book value of the sold assets?

A)$38,000

B)$18,000

C)$10,000

D)$8,000

During 2005 new assets were purchased for of $78,000, and plant assets were sold at a $10,000 loss.

-What was the book value of the sold assets?

A)$38,000

B)$18,000

C)$10,000

D)$8,000

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

58

Cash flow from operations will often be negative for companies experiencing tremendous growth.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

59

A cash flow adequacy ratio, when measured over the last several years, of less than one:

A)indicates that a company's net income is too low relative to its sales level.

B)indicates that a company should decrease its dividend payout ratio.

C)indicates that a company needs to pay down its debt to decrease interest costs.

D)indicates that a company's internally generated cash flows have not been sufficient to cover dividend payments and support current operating growth levels.

A)indicates that a company's net income is too low relative to its sales level.

B)indicates that a company should decrease its dividend payout ratio.

C)indicates that a company needs to pay down its debt to decrease interest costs.

D)indicates that a company's internally generated cash flows have not been sufficient to cover dividend payments and support current operating growth levels.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

60

Schwerin Corporation reports the following on its 2005 financial statements.

-The net book value of equipment sold was:

A)$120 million

B)$100 million

C)$80 million

D)$60 million

-The net book value of equipment sold was:

A)$120 million

B)$100 million

C)$80 million

D)$60 million

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

61

Cash flows from operations is better measure of profitability than net income as it is less susceptible to manipulation by management.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

62

An increase in accounts receivable does not require adjusting net income, if preparing the statement of cash flows using the indirect method.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

63

Depreciation expense decreases net income, but is not a use of cash.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

64

In firms that are experiencing tremendous growth, it is rare that net income will exceed cash generated by all activities.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

65

A decrease in liabilities would usually show as an outflow in the statement of cash flows.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

66

Payment of a 5% stock dividend will not appear in the statement of cash flows.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

67

Taxes paid on capital gains from the sale of marketable securities are recorded as cash outflows from operations.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

68

A gain on sale of an asset would require adjusting net income, if preparing the statement of cash flows using the indirect method.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

69

Depreciation and amortization expense needs to be added back to net income if preparing the statement of cash flows using the indirect method.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

70

An increase in assets would usually show as an outflow in the statement of cash flows.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

71

The financing section of the statement of cash flows (prepared in accordance with GAAP) contains all cash inflows and cash outflows, relating to the financing of a company.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

72

Amortization of goodwill reduces net income and is a cash outflow.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

73

Net cash flow is not affected by a company's choice of accounting principles for financial reporting purposes.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

74

Interest income is recorded as an operating inflow of cash.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

75

Many financial analysts subtract interest paid from cash from operations and reclassify it as part of cash from financing activities.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

76

Over an extended period of time average cash flow from operations would be expected to be higher than average net income.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

77

An increase in a liability is a use of cash.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

78

Increases in working capital are a source of funds.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

79

Practice requires separate disclosure of cash flows in the statement of cash flows.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck

80

Users sometimes compute net income plus depreciation and amortization (for example EBITDA) as a crude proxy for operating cash flows.

Unlock Deck

Unlock for access to all 88 flashcards in this deck.

Unlock Deck

k this deck