Deck 12: The Capital Budgeting Decision

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/131

Play

Full screen (f)

Deck 12: The Capital Budgeting Decision

1

Which of the following statements about the "payback period" is true?

A) The payback period considers cash flows after the payback has been reached.

B) The payback period does not consider the time value of money.

C) The payback period uses discounted cash-flow techniques.

D) The payback period generally leads to the same decision as other investment selection methods.

A) The payback period considers cash flows after the payback has been reached.

B) The payback period does not consider the time value of money.

C) The payback period uses discounted cash-flow techniques.

D) The payback period generally leads to the same decision as other investment selection methods.

B

2

Firm X is considering the replacement of an old machine with one that has a purchase price of $70,000. The current market value of the old machine is $25,000 but the book value is $32,000. What is the net cash outflow for the new machine with consideration for the sale of the old machine?

A) $70,000

B) $45,000

C) $38,000

D) $32,000

A) $70,000

B) $45,000

C) $38,000

D) $32,000

B

3

For acceptable investments, the discount rate assumption under the internal rate of return is generally:

A) higher than under the net present-value method.

B) lower than under the net present-value method.

C) at the cost of capital.

D) below the cost of capital.

A) higher than under the net present-value method.

B) lower than under the net present-value method.

C) at the cost of capital.

D) below the cost of capital.

A

4

Which of the following is not a step in creating the net present value profile?

A) Determining the net present value at a zero discount rate.

B) Determining the net present value at a normal discount rate.

C) Determining the project's internal rate of return.

D) Determining the payback period for the project.

A) Determining the net present value at a zero discount rate.

B) Determining the net present value at a normal discount rate.

C) Determining the project's internal rate of return.

D) Determining the payback period for the project.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

5

Cash flow can be said to equal:

A) income before amortization and taxes minus taxes.

B) income before amortization and taxes plus taxes.

C) income before amortization and taxes plus amortization.

D) income after taxes minus amortization.

A) income before amortization and taxes minus taxes.

B) income before amortization and taxes plus taxes.

C) income before amortization and taxes plus amortization.

D) income after taxes minus amortization.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

6

Under the capital cost allowance system:

A) the life span over which an asset may be amortized is fixed at five years.

B) all assets are amortized down to their salvage value.

C) recovery periods for different types of assets are broken down into categories.

D) the tax effect of accounting depreciation is included.

A) the life span over which an asset may be amortized is fixed at five years.

B) all assets are amortized down to their salvage value.

C) recovery periods for different types of assets are broken down into categories.

D) the tax effect of accounting depreciation is included.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

7

An investment project has a positive net present value. The internal rate of return is:

A) less than the cost of capital.

B) greater than the cost of capital.

C) equal to the cost of capital.

D) indeterminate; it depends on the length of the project.

A) less than the cost of capital.

B) greater than the cost of capital.

C) equal to the cost of capital.

D) indeterminate; it depends on the length of the project.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

8

Capital rationing:

A) is a way of preserving the assets of the firm over the long term.

B) is a less than optimal way to arrive at capital budgeting decisions.

C) assures shareholder wealth maximization.

D) assures maximum potential profitability.

A) is a way of preserving the assets of the firm over the long term.

B) is a less than optimal way to arrive at capital budgeting decisions.

C) assures shareholder wealth maximization.

D) assures maximum potential profitability.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

9

Using higher discount rates,:

A) accelerated amortization is more valuable than straight line amortization.

B) straight-line amortization is more valuable than accelerated amortization.

C) amortization policy makes no difference.

D) later year amortization has a higher net present value.

A) accelerated amortization is more valuable than straight line amortization.

B) straight-line amortization is more valuable than accelerated amortization.

C) amortization policy makes no difference.

D) later year amortization has a higher net present value.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

10

The net present value profile:

A) doesn't work if projects have a negative net present value.

B) is a substitute for the IRR.

C) graphically portrays the relationship between the discount rate and the net present value.

D) is determined by the cost of debt.

A) doesn't work if projects have a negative net present value.

B) is a substitute for the IRR.

C) graphically portrays the relationship between the discount rate and the net present value.

D) is determined by the cost of debt.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

11

Which statement is true about amortization?

A) Amortization is a cash expense that provides tax shield benefits.

B) The greater the amortization expenses in earlier years, the lower the present value of the project

C) The CCA amortization schedules supersede other methods for tax purposes

D) The cash inflow from amortization increases profit.

A) Amortization is a cash expense that provides tax shield benefits.

B) The greater the amortization expenses in earlier years, the lower the present value of the project

C) The CCA amortization schedules supersede other methods for tax purposes

D) The cash inflow from amortization increases profit.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

12

The net present value method is a better method of evaluation than the internal rate of return method because:

A) the NPV method discounts cash flows at the internal rate of return.

B) the NPV method is a more liberal method of analysis.

C) the NPV method discounts cash flows at the firm's more conservative cost of capital.

D) the NPV method includes accruals and other accounting discounts.

A) the NPV method discounts cash flows at the internal rate of return.

B) the NPV method is a more liberal method of analysis.

C) the NPV method discounts cash flows at the firm's more conservative cost of capital.

D) the NPV method includes accruals and other accounting discounts.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is not a time-adjusted method for ranking investment proposals?

A) Net present value method

B) Payback period

C) Internal rate of return method

D) Profitability index

A) Net present value method

B) Payback period

C) Internal rate of return method

D) Profitability index

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

14

The _________ assumes returns are reinvested at the cost of capital.

A) payback period

B) internal rate of return

C) net present value

D) capital rationing

A) payback period

B) internal rate of return

C) net present value

D) capital rationing

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

15

The reason cash flow is used in capital budgeting is because:

A) income is used to purchase new machines.

B) cash outlays need to be evaluated in terms of the present value of the resultant cash inflows.

C) to include the tax shield provided from amortization ignores the cash flow provided by the machine which should be reinvested to replace old worn out machines.

D) cash includes all accounting accruals.

A) income is used to purchase new machines.

B) cash outlays need to be evaluated in terms of the present value of the resultant cash inflows.

C) to include the tax shield provided from amortization ignores the cash flow provided by the machine which should be reinvested to replace old worn out machines.

D) cash includes all accounting accruals.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

16

In using the internal rate of return method, it is assumed that cash flows can be reinvested at:

A) the cost of equity.

B) the cost of capital.

C) the internal rate of return.

D) the prevailing interest rate.

A) the cost of equity.

B) the cost of capital.

C) the internal rate of return.

D) the prevailing interest rate.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

17

A firm is selling an old asset below book value in a replacement decision. As the firm's tax rate is raised, the net cash outflow (purchase price less proceeds from the sale of the old asset plus CCA effects) would:

A) go up.

B) go down.

C) remain the same.

D) More information required.

A) go up.

B) go down.

C) remain the same.

D) More information required.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

18

The longer the life of an investment:

A) the more significant the discount rate.

B) the less significant the discount rate.

C) Makes no difference.

D) the easier it is to determine the discount rate.

A) the more significant the discount rate.

B) the less significant the discount rate.

C) Makes no difference.

D) the easier it is to determine the discount rate.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

19

If projects are mutually exclusive:

A) they can only be accepted under capital rationing.

B) the selection of one alternative precludes the selection of other alternatives.

C) the payback method should be used.

D) the net present-value should be used.

A) they can only be accepted under capital rationing.

B) the selection of one alternative precludes the selection of other alternatives.

C) the payback method should be used.

D) the net present-value should be used.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

20

As the cost of capital increases:

A) fewer projects are accepted.

B) more projects are accepted.

C) project selection remains unchanged.

D) projects become more profitable.

A) fewer projects are accepted.

B) more projects are accepted.

C) project selection remains unchanged.

D) projects become more profitable.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

21

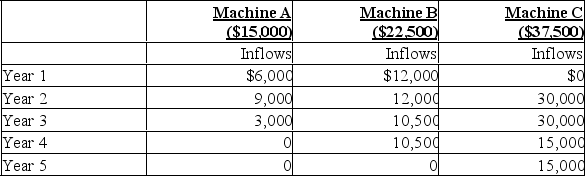

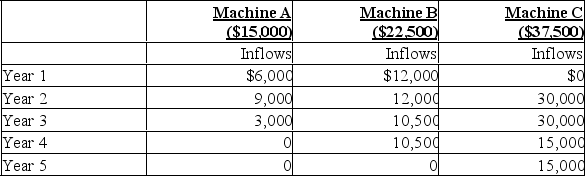

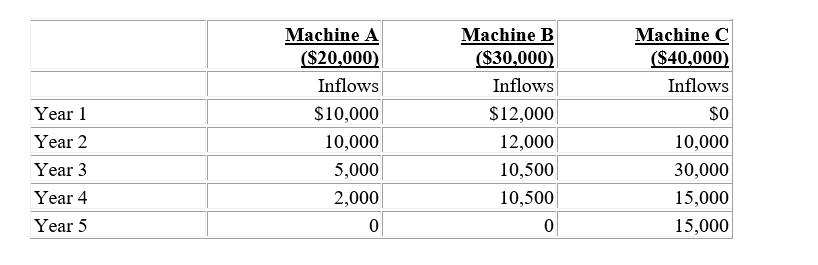

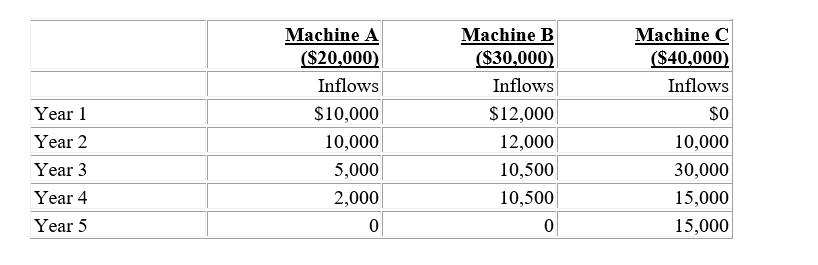

The Dammon Corp. has the following investment opportunities:  Under the payback period and assuming these machines are mutually exclusive, which machine(s) would Dammon Corp. choose?

Under the payback period and assuming these machines are mutually exclusive, which machine(s) would Dammon Corp. choose?

A) Machine A

B) Machine B

C) Machine C

D) None of the machines will be accepted.

Under the payback period and assuming these machines are mutually exclusive, which machine(s) would Dammon Corp. choose?

Under the payback period and assuming these machines are mutually exclusive, which machine(s) would Dammon Corp. choose?A) Machine A

B) Machine B

C) Machine C

D) None of the machines will be accepted.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

22

There are several disadvantages to the payback period, one of which is that:

A) payback ignores the time value of money.

B) payback emphasizes receiving money back as fast as possible for reinvestment.

C) payback is easy to use and to understand.

D) payback can be used in conjunction with time adjusted methods of evaluation.

A) payback ignores the time value of money.

B) payback emphasizes receiving money back as fast as possible for reinvestment.

C) payback is easy to use and to understand.

D) payback can be used in conjunction with time adjusted methods of evaluation.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

23

An asset just purchased, qualifies for a 20% CCA rate and qualifies for a 5% ITC. If the asset cost $60,000 what is the amortization base (UCC) in the second year before CCA is taken?

A) $54,000

B) $51,000

C) $56,000

D) $48,000

A) $54,000

B) $51,000

C) $56,000

D) $48,000

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

24

Project A has a $5,000 net present value at a zero discount rate and an internal rate of return of 12%. Project B has an $8,000 net present value at a 0% discount rate and an IRR of return of 10%. If the projects are mutually exclusive, which one should be chosen?

A) Project A because it has a higher internal rate of return.

B) Project B if the cost of capital is less than the crossover point.

C) Both projects if the net present value is positive.

D) Neither project meets the investment criteria.

A) Project A because it has a higher internal rate of return.

B) Project B if the cost of capital is less than the crossover point.

C) Both projects if the net present value is positive.

D) Neither project meets the investment criteria.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

25

The investment tax credit:

A) increases the tax bill for the year in which the asset is purchased.

B) has a provision for a cash refund.

C) increases the base upon which CCA is calculated.

D) increases the amount of CCA write-off available each year.

A) increases the tax bill for the year in which the asset is purchased.

B) has a provision for a cash refund.

C) increases the base upon which CCA is calculated.

D) increases the amount of CCA write-off available each year.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

26

An equipment replacement decision, under resultant cash flow analysis, requires:

A) calculating the present value of all cash flows associated with the new equipment minus the salvage value of the old asset.

B) calculating the present value of all changes in cash flows from the old equipment to the new equipment.

C) subtracting the purchase price of the old equipment from the purchase price of the new equipment.

D) recalculating the amortization schedule of the old equipment.

A) calculating the present value of all cash flows associated with the new equipment minus the salvage value of the old asset.

B) calculating the present value of all changes in cash flows from the old equipment to the new equipment.

C) subtracting the purchase price of the old equipment from the purchase price of the new equipment.

D) recalculating the amortization schedule of the old equipment.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

27

If the capital budgeting decision includes a replacement analysis, then:

A) a gain from the sale of the old asset will represent a tax savings inflow.

B) only incremental cash flows should be considered.

C) the sale price and tax savings will increase the cash inflows throughout the asset's life.

D) only initial cash in-flow should be considered.

A) a gain from the sale of the old asset will represent a tax savings inflow.

B) only incremental cash flows should be considered.

C) the sale price and tax savings will increase the cash inflows throughout the asset's life.

D) only initial cash in-flow should be considered.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

28

The Wet Corp. has an investment project that will reduce expenses by $15,000 per year for 3 years. The project's cost is $20,000, with a 20% CCA rate. Using a 40% tax rate, calculate the net operating cash flow at the end of year 1?

A) $-15,000

B) $+11,000

C) $+9,000

D) $+9,800

A) $-15,000

B) $+11,000

C) $+9,000

D) $+9,800

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

29

Capital budgeting is primarily concerned with:

A) capital formation in the economy.

B) planning future financing needs.

C) evaluating investment alternatives.

D) minimizing the cost of capital.

A) capital formation in the economy.

B) planning future financing needs.

C) evaluating investment alternatives.

D) minimizing the cost of capital.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

30

An investment tax credit (ITC):

A) increases the amortization base for tax purposes.

B) decreases the amortization base for tax purposes.

C) does not affect the amortization base for tax purposes.

D) may increase or decrease the amortization base for tax purposes.

A) increases the amortization base for tax purposes.

B) decreases the amortization base for tax purposes.

C) does not affect the amortization base for tax purposes.

D) may increase or decrease the amortization base for tax purposes.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

31

If a firm is experiencing no capital rationing, it should accept all investment proposals:

A) as long as it has available funds.

B) that return an amount equal to or greater than the cost of capital.

C) that return an amount greater than the cost of equity.

D) that are available, regardless of return.

A) as long as it has available funds.

B) that return an amount equal to or greater than the cost of capital.

C) that return an amount greater than the cost of equity.

D) that are available, regardless of return.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

32

Assuming that a firm has no capital rationing constraint and that a firm's investment alternatives are not mutually exclusive, the firm should accept all investment proposals:

A) for which it can obtain financing.

B) that have a positive net present value.

C) that have positive cash flows.

D) that provide returns greater than the after tax cost of debt.

A) for which it can obtain financing.

B) that have a positive net present value.

C) that have positive cash flows.

D) that provide returns greater than the after tax cost of debt.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

33

An investment tax credit (ITC) of $100 in comparison to CCA expense of $100 provides:

A) the same tax shield benefits.

B) less tax shield benefits.

C) greater tax shield benefits.

D) Cannot determine with the information given.

A) the same tax shield benefits.

B) less tax shield benefits.

C) greater tax shield benefits.

D) Cannot determine with the information given.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

34

Suppose that interest rates (and, therefore, the firm's Weighted Average Cost of Capital) increase. This would not change the capital budgeting choices a firm would make if it:

A) uses payback period analysis.

B) uses net present value analysis.

C) uses internal rate of return analysis.

D) uses profitability indexes.

A) uses payback period analysis.

B) uses net present value analysis.

C) uses internal rate of return analysis.

D) uses profitability indexes.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

35

A characteristic of capital budgeting is:

A) a large amount of money is always involved.

B) the internal rate of return must be less than the cost of capital.

C) the internal rate of return must be greater than the cost of capital.

D) the time horizon is at least five years.

A) a large amount of money is always involved.

B) the internal rate of return must be less than the cost of capital.

C) the internal rate of return must be greater than the cost of capital.

D) the time horizon is at least five years.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

36

The Net Present Value Method is a more conservative technique for selecting investment projects than the Internal Rate of Return method because the NPV method:

A) discounts cash flows at the project's internal rate of return.

B) concentrates on the liquidity aspects of investment projects.

C) discounts cash flows at the firm's weighted average cost of capital.

D) ignores cash flows after the payback period.

A) discounts cash flows at the project's internal rate of return.

B) concentrates on the liquidity aspects of investment projects.

C) discounts cash flows at the firm's weighted average cost of capital.

D) ignores cash flows after the payback period.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

37

If an old asset sells below book value (UCC) and the asset pool ends, from a tax standpoint:

A) there is a decrease in cash flow.

B) there is an increase in cash flow.

C) there is no effect on cash flow.

D) there is a decrease in net present value.

A) there is a decrease in cash flow.

B) there is an increase in cash flow.

C) there is no effect on cash flow.

D) there is a decrease in net present value.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

38

The payback period has several disadvantages, which include:

A) payback optimizes the most economical solution to a capital budgeting problem.

B) payback includes cash inflows after the payback period.

C) payback fails to choose the optimum or most economical solution to a capital budgeting problem.

D) payback ignores liquidity concerns.

A) payback optimizes the most economical solution to a capital budgeting problem.

B) payback includes cash inflows after the payback period.

C) payback fails to choose the optimum or most economical solution to a capital budgeting problem.

D) payback ignores liquidity concerns.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

39

For CCA amortization, automobiles and light trucks fit into the:

A) 30% category.

B) 20% category.

C) 10% category.

D) 5% category.

A) 30% category.

B) 20% category.

C) 10% category.

D) 5% category.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

40

With non-mutually exclusive projects:

A) the payback period will select the best project.

B) the net present value method will always select the best project.

C) the internal rate of return method will always select the best project.

D) the net present value and the internal rate of return methods will always accept or reject the same project.

A) the payback period will select the best project.

B) the net present value method will always select the best project.

C) the internal rate of return method will always select the best project.

D) the net present value and the internal rate of return methods will always accept or reject the same project.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

41

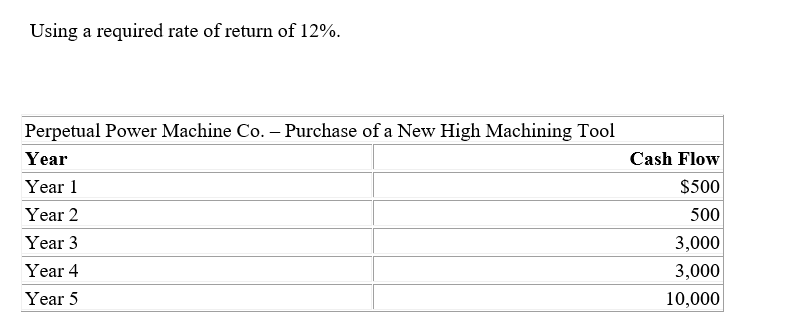

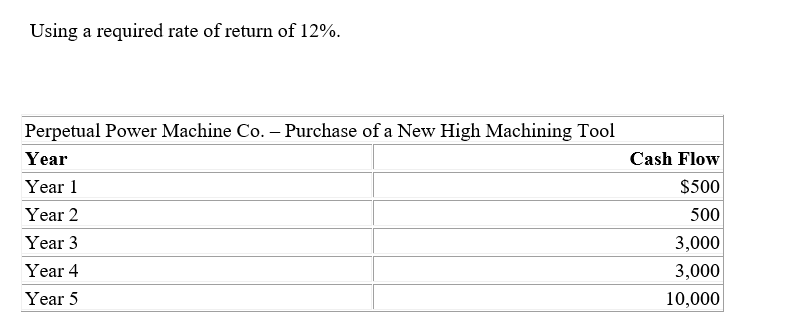

-What is this project's NPV if the initial capital investment is $7,162?

A) $3,399

B) $12,000

C) $8,500

D) $3,000

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

42

Capital rationing assumes that:

A) a limited amount of capital is available.

B) a limited number of investments are available.

C) maximum value creation will be obtained.

D) all projects are acceptable.

A) a limited amount of capital is available.

B) a limited number of investments are available.

C) maximum value creation will be obtained.

D) all projects are acceptable.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

43

Assume a project has earnings before depreciation and taxes of $15,000, depreciation of $25,000, and that the firm has a 30 percent tax bracket. What are the after-tax cash flows for the project?

A) $18,000

B) $19,000

C) A loss of $21,000

D) $25,000

A) $18,000

B) $19,000

C) A loss of $21,000

D) $25,000

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

44

-What is this project's payback period if initial capital investment is $7,500?

A) 3 years 3 months

B) 5 years

C) 9 years

D) 4 years 2 months

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

45

NPV is superior to average accounting return as a capital budgeting technique because:

A) it employs the accounting definition of income.

B) it values each cash flow equally based on dollar value.

C) it employs the actual cost of an investment.

D) it employs cash flows.

A) it employs the accounting definition of income.

B) it values each cash flow equally based on dollar value.

C) it employs the actual cost of an investment.

D) it employs cash flows.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

46

Which statement is true about amortization?

A) Amortization is a cash expense that provides tax shield benefits.

B) The lesser the amortization expenses in earlier years, the higher the present value of the project.

C) The CCA amortization schedules supersede other methods for tax purposes.

D) Amortization is a cash flow that represents the annual cost of an asset.

A) Amortization is a cash expense that provides tax shield benefits.

B) The lesser the amortization expenses in earlier years, the higher the present value of the project.

C) The CCA amortization schedules supersede other methods for tax purposes.

D) Amortization is a cash flow that represents the annual cost of an asset.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

47

Assume a corporation has earnings before depreciation and taxes of $82,000, depreciation of $45,000, and that it has a 30 percent tax bracket. What are the after-tax cash flows for the company?

A) $70,900

B) $82,000

C) $42,000

D) $37,000

A) $70,900

B) $82,000

C) $42,000

D) $37,000

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

48

The internal rate of return (IRR) assumes that funds are reinvested at the:

A) cost of capital.

B) yield on the investment.

C) minimal acceptable rate to the firm.

D) yield to maturity.

A) cost of capital.

B) yield on the investment.

C) minimal acceptable rate to the firm.

D) yield to maturity.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements about the "payback period" is true?

A) The payback period considers cash flows after the payback has been reached.

B) The payback period considers the time value of money.

C) The payback period uses discounted cash-flow techniques.

D) The payback period fails to produce an objective decision to accept or reject an individual project.

A) The payback period considers cash flows after the payback has been reached.

B) The payback period considers the time value of money.

C) The payback period uses discounted cash-flow techniques.

D) The payback period fails to produce an objective decision to accept or reject an individual project.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

50

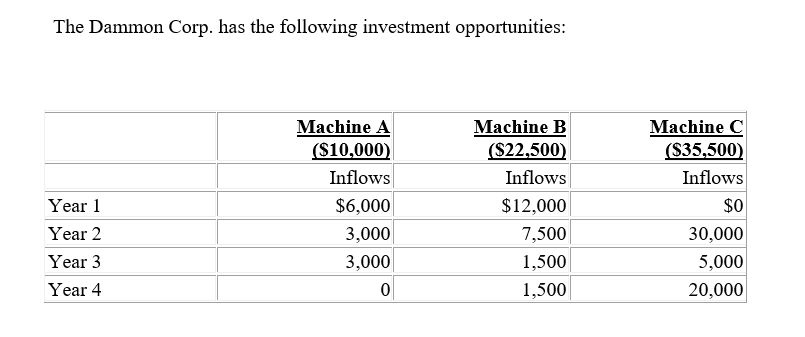

-Under NPV evaluation and assuming these machines are mutually exclusive, which machine(s) would Horne Robinson Inc. choose?

A) Machine A

B) Machine B

C) Machine C

D) Machine A and B

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

51

At higher tax rates, CCA amortization is:

A) more beneficial.

B) less beneficial.

C) decreased.

D) unaffected.

A) more beneficial.

B) less beneficial.

C) decreased.

D) unaffected.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

52

The reason cash flow is used in capital budgeting is because:

A) income rather than cash is used to purchase new machines.

B) cash outlays need not be evaluated in terms of the present value of the resultant cash inflows.

C) the tax shield provided from amortization ignores the cash flow provided by the machine which should be reinvested to replace old worn out machines.

D) cash flow includes accounting accruals.

A) income rather than cash is used to purchase new machines.

B) cash outlays need not be evaluated in terms of the present value of the resultant cash inflows.

C) the tax shield provided from amortization ignores the cash flow provided by the machine which should be reinvested to replace old worn out machines.

D) cash flow includes accounting accruals.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

53

The internal rate of return is:

A) less than the weighted average cost of capital.

B) the discount rate that produces a project net present value of zero.

C) the discount rate that produces a positive project net present value.

D) unrelated to the weighted average cost of capital.

A) less than the weighted average cost of capital.

B) the discount rate that produces a project net present value of zero.

C) the discount rate that produces a positive project net present value.

D) unrelated to the weighted average cost of capital.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

54

-Under the payback period and assuming these machines are mutually exclusive, which machine(s) would Horne Robinson Inc. choose?

A) Machine A

B) Machine B

C) Machine C

D) Machine A and B

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

55

The first step in the capital budgeting process is:

A) collection of data.

B) idea development.

C) assigning probabilities.

D) determining cash flow.

A) collection of data.

B) idea development.

C) assigning probabilities.

D) determining cash flow.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

56

The modified internal rate of return (MIRR) assumes:

A) inflows are invested at the traditional interest rate of return.

B) inflows are reinvested at the cost of capital.

C) outflows are funded with debt.

D) outflows are funded with equity.

A) inflows are invested at the traditional interest rate of return.

B) inflows are reinvested at the cost of capital.

C) outflows are funded with debt.

D) outflows are funded with equity.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

57

The net present value method is a better method of evaluation than the internal rate of return method because:

A) the NPV method discounts cash flows at the internal rate of return.

B) the NPV method is a more liberal method of analysis.

C) the NPV method discounts cash flows at higher than the firm's cost of capital.

D) the NPV method allows the financial manager to select between mutually exclusive projects.

A) the NPV method discounts cash flows at the internal rate of return.

B) the NPV method is a more liberal method of analysis.

C) the NPV method discounts cash flows at higher than the firm's cost of capital.

D) the NPV method allows the financial manager to select between mutually exclusive projects.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

58

The profitability index will give the same investment decision as:

A) the payback period.

B) the average accounting return.

C) the net present value.

D) It can be different from each of these techniques.

A) the payback period.

B) the average accounting return.

C) the net present value.

D) It can be different from each of these techniques.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

59

A firm may adapt capital rationing because:

A) it is hesitant to use external sources of financing.

B) it wishes to maximize value.

C) it is fearful of too much growth.

D) it has a constraint on the amount of funds

A) it is hesitant to use external sources of financing.

B) it wishes to maximize value.

C) it is fearful of too much growth.

D) it has a constraint on the amount of funds

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

60

The internal rate of return (IRR) and net present value (NPV) methods:

A) always give the same investment decision.

B) never give the same investment decision.

C) usually give the same investment decision.

D) always give a decision different from the payback period method.

A) always give the same investment decision.

B) never give the same investment decision.

C) usually give the same investment decision.

D) always give a decision different from the payback period method.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

61

We add amortization to net income to arrive at a true profit picture.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

62

You buy a new piece of equipment for $7,360, and you receive a cash inflow of $1,000 per year for 10 years. What is the internal rate of return?

A) 5%

B) 6%

C) 7%

D) More than 7%

A) 5%

B) 6%

C) 7%

D) More than 7%

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

63

Non-mutually exclusive alternatives can be accepted at the same time.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

64

It is not unusual for a corporate president, who deals with security analysts, to be as sensitive to after tax income as cash flow.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

65

With a higher CCA rate, the present value of tax savings increases.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

66

You require an IRR of 14% to accept a project. If the project will yield $10,000 per year for 10 years, what is the maximum amount that you would be willing to invest in the project?

A) Less than $50,000

B) More than $50,000 and less than $60,000

C) More than $60,000 and less than $70,000

D) More than $70,000

A) Less than $50,000

B) More than $50,000 and less than $60,000

C) More than $60,000 and less than $70,000

D) More than $70,000

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

67

It is the difference in the discount rate assumptions that can be significant in determining when to use the present value or internal rate of return methods.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

68

The "payback method" has the following advantages:

A) easy to understand, emphasis on liquidity, considers all cash flows.

B) easy to understand, emphasis on liquidity, quick view of investment risk.

C) easy to understand, uses the time value of money concept, quick view of investment risk.

D) accepts all projects that may add value to the firm, emphasis on liquidity, quick view of investment risk.

A) easy to understand, emphasis on liquidity, considers all cash flows.

B) easy to understand, emphasis on liquidity, quick view of investment risk.

C) easy to understand, uses the time value of money concept, quick view of investment risk.

D) accepts all projects that may add value to the firm, emphasis on liquidity, quick view of investment risk.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is not a time-adjusted method for ranking investment proposals?

A) Net present value method

B) Payback method

C) Internal rate of return method

D) Modified internal rate of return

A) Net present value method

B) Payback method

C) Internal rate of return method

D) Modified internal rate of return

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

70

The first administrative consideration in any capital budgeting process is collection of data.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

71

A long term investment:

A) may use various discount rates.

B) may ignore the discount rate.

C) is easier to determine the discount rate than a short term investment.

D) should use lower discount rates than a short term investment.

A) may use various discount rates.

B) may ignore the discount rate.

C) is easier to determine the discount rate than a short term investment.

D) should use lower discount rates than a short term investment.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

72

The payback period is easy to understand and places a heavy emphasis on liquidity.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

73

There are several disadvantages to the payback method, among them:

A) payback ignores the time value of money.

B) payback emphasizes receiving money back as fast as possible for reinvestment.

C) payback is basic to use and to understand.

D) payback can be used in conjunction with time adjusted methods of evaluation.

A) payback ignores the time value of money.

B) payback emphasizes receiving money back as fast as possible for reinvestment.

C) payback is basic to use and to understand.

D) payback can be used in conjunction with time adjusted methods of evaluation.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

74

With non-mutually exclusive events and no capital rationing, we will usually arrive at the same conclusions using either the net present value or internal rate of return methods.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

75

The payback period is not really a theoretically correct approach.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

76

The payback method has several advantages, among them:

A) payback indicates the optimum or most economical solution to a capital budgeting problem.

B) payback ignores cash inflows after the payback period.

C) payback is easy to calculate.

D) payback utilizes the time value of money.

A) payback indicates the optimum or most economical solution to a capital budgeting problem.

B) payback ignores cash inflows after the payback period.

C) payback is easy to calculate.

D) payback utilizes the time value of money.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

77

Under the capital cost allowance system of amortization, cash flow tends to decline with the passage of time.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

78

-Under the payback method and assuming these machines are mutually exclusive, which machine(s) would Dammon Corp. choose?

A) Machine A

B) Machine B

C) Machine C

D) Machine A and B

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

79

Under capital rationing, a firm will maximize profitability.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck

80

The internal rate of return is the average annual rate of return from the investment.

Unlock Deck

Unlock for access to all 131 flashcards in this deck.

Unlock Deck

k this deck