Deck 14: Capital Investment Decisions

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/163

Play

Full screen (f)

Deck 14: Capital Investment Decisions

1

A disadvantage of the payback period is that it ignores the time value of money.

True

2

Projects that do not affect the cash flows of other projects are called mutually exclusive projects.

False

3

One way to use the payback period is to set a maximum payback period for all projects and to reject any project that exceeds this level.

True

4

In capital investment decision making,it is usually assumed that managers should select projects that attempt to maximize the wealth of the owners of the firm.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

5

Sometimes firms require riskier projects to have longer payback periods.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

6

Projects that if accepted preclude the acceptance of all other competing projects are called mutually exclusive projects.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

7

The two major categories of capital investment decision models are independent and mutually exclusive.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

8

In practice,managers often choose a discount rate that is higher than the cost of capital.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

9

Two discounting models for capital investment decision making are net present value and internal rate of return.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

10

Companies considering projects with shorter lives are interested in longer payback periods.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

11

The process of planning,setting goals and priorities,arranging financing,and using certain criteria to select long-term assets is called capital investment decisions.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

12

The minimum acceptable rate of return for a project is the required rate of return.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

13

Taxes are important consideration in forecasting cash flows.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

14

Only accounting rate of return ignores the time value of money.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

15

A disadvantage of the payback period is that it ignores a project's total profitability.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

16

In order to use the payback period model,the proposed investment must have even cash inflows.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

17

If cash flows are uneven,the payback period assumes that the inflows during the last fraction of a year occur evenly.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

18

The difference between the present value of the cash inflows and outflows associated with a project is the internal rate of return model.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

19

Before-tax cash flows must be forecasted and used in capital investment decision making.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

20

The payback period considers the profitability of a project over its entire life span.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

21

The internal rate of return is the most widely used of the capital investment techniques.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

22

Because of the postaudit,managers are more likely to make capital investment decisions in the best interests of the firm.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

23

Postaudits ensure that resources are used wisely by evaluating profitability.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

24

Companies that perform postaudits of capital projects experience a number of benefits.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

25

The interest rate that sets the present value of a project's cash inflows equal to the present value of the project's cost is called the internal rate of return.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

26

The internal audit staff is usually the best choice for performing a postaudit of a capital investment.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

27

A key element in the capital investment process is called a postaudit.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

28

A postaudit evaluates the overall outcome of the investment and proposes corrective action if needed.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

29

A disadvantage of postaudits is that they are costly.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

30

Net present value analysis and internal rate of return analysis can sometimes produce erroneous choices because they ignore the time value of money.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

31

Suppose that the actual cost of capital is 10 percent,but the firm chooses a discount rate of 18 percent.Managers of that company will be more likely to choose relatively short term investments.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

32

For independent projects,net present value analysis and internal rate of return analysis yield the same decision.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

33

Less objective results are obtainable if an independent party performs the postaudit of a capital investment.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

34

Postaudits supply feedback to managers that should help improve future decision making.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

35

One drawback to the internal rate of return model is that cash inflows must occur evenly over the life of the investment.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

36

A postaudit is an analysis of a capital project before it is implemented.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

37

The internal rate of return is the least widely used of the capital investment techniques.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

38

An obvious problem with postaudits is that the assumptions driving the original analysis may often be invalidated by changes in the actual operating environment.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

39

In general,it is best if postaudits are done by company management,since they understand the actual operating conditions.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

40

If the net present value of an investment is zero,the investment earns less than the minimum required rate of return.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

41

The ______________ is the time required for a firm to recover its original investment.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

42

_______________________ ignore the time value of money.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

43

_____________________ explicitly consider the time value of money.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

44

If the internal rate of return (IRR)is less than the required rate of return,the project is __________.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

45

The _______________________ is defined as the interest rate that sets the present value of a project's cash inflows equal to the present value of the project's cost.

or

or

or

or

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

46

The two types of capital budgeting projects are ________________ and _______________.

or

or

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

47

The internal rate of return model does not consistently result in choices that maximize firm wealth.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

48

If the internal rate of return (IRR)is greater than the required rate,the project is deemed ___________.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

49

_______________________ are the future cash flows expressed in terms of their present value.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

50

The major disadvantage of a postaudit is that it is ____________.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

51

The amount that must be invested now to produce a future value is known as the ____________ of the future amount.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

52

The process of making capital investment decisions often is referred to as ________________.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

53

The _________________________ measures the return on a project in terms of income.

or

or

or

or

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

54

When choosing among competing alternatives the ________________ model may choose an inferior project.

or

or

or

or

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

55

______________________ are projects that,if accepted or rejected,do not affect the cash flows of other projects.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

56

The difference between the present value of the cash inflows and the outflows associated with a project is known as the ___________________.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

57

_______________________ are concerned with the process of planning,setting goals and priorities,arranging financing,and using certain criteria to select long-term assets.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

58

When choosing among competing projects,the ___________________ model correctly identifies the best investment alternative.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

59

The ___________________ is the minimum acceptable rate of return.

or

or

or

or

or

or

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

60

A key element in the capital investment process is a follow-up analysis of a capital project once it is implemented; this analysis is a called a _____________.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

61

Elena Wallace invested $150,000 in a project that pays her an even amount per year for 10 years.The payback period is 6 years.What are Elena's yearly cash inflows from the project?

A)$150,000

B)$15,000

C)$25,000

D)$90,000

E)cannot be determined from this information

A)$150,000

B)$15,000

C)$25,000

D)$90,000

E)cannot be determined from this information

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

62

Which of the following is true of capital investment decision making?

A)It is used only for independent projects.

B)It is used only for mutually exclusive projects.

C)It requires that funding for a project must come from sources with the same opportunity cost of funds.

D)It is used to determine whether or not a firm should accept a special order.

E)None of these.

A)It is used only for independent projects.

B)It is used only for mutually exclusive projects.

C)It requires that funding for a project must come from sources with the same opportunity cost of funds.

D)It is used to determine whether or not a firm should accept a special order.

E)None of these.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

63

In general terms,a sound capital investment will earn

A)back its original capital outlay.

B)a return greater than existing capital investments.

C)back its original capital outlay and provide a reasonable return on the original investment.

D)back its original capital outlay by the midpoint of its useful life.

E)none of these.

A)back its original capital outlay.

B)a return greater than existing capital investments.

C)back its original capital outlay and provide a reasonable return on the original investment.

D)back its original capital outlay by the midpoint of its useful life.

E)none of these.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

64

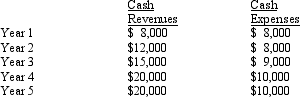

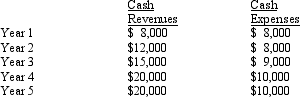

Buster Evans is considering investing $20,000 in a project with the following annual cash revenues and expenses:  Depreciation will be $4,000 per year.

Depreciation will be $4,000 per year.

What is the accounting rate of return on the investment?

A)15%

B)35%

C)70%

D)75%

E)none of these

Depreciation will be $4,000 per year.

Depreciation will be $4,000 per year.What is the accounting rate of return on the investment?

A)15%

B)35%

C)70%

D)75%

E)none of these

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following is a drawback of the payback period?

A)It ignores a project's total profitability.

B)It uses a set discount rate.

C)It considers total profitability,requiring the forecasting of all future cash flows.

D)It uses before-tax cash flows rather than after-tax cash flows.

E)It uses operating income rather than cash flows.

A)It ignores a project's total profitability.

B)It uses a set discount rate.

C)It considers total profitability,requiring the forecasting of all future cash flows.

D)It uses before-tax cash flows rather than after-tax cash flows.

E)It uses operating income rather than cash flows.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

66

If the cash flows of a project are received evenly over the life of the project,the formula for the calculating the payback period is

A)original investment/annual cash flow.

B)original investment ´ annual cash flow.

C)original investment + annual cash flow.

D)original investment - annual cash flow.

E)(original investment + annual cash flow)/annual cash flow.

A)original investment/annual cash flow.

B)original investment ´ annual cash flow.

C)original investment + annual cash flow.

D)original investment - annual cash flow.

E)(original investment + annual cash flow)/annual cash flow.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

67

The payback period provides information to managers that can be used to help

A)control the risks associated with the uncertainty of future cash flows.

B)minimize the impact of an investment on a firm's liquidity problems.

C)control the risk of obsolescence.

D)control the effect of the investment on performance measures.

E)all of these.

A)control the risks associated with the uncertainty of future cash flows.

B)minimize the impact of an investment on a firm's liquidity problems.

C)control the risk of obsolescence.

D)control the effect of the investment on performance measures.

E)all of these.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

68

Carol Harrison is considering an investment in a retail shopping mall.The initial investment is $400,000.She expects to receive cash income of $80,000 a year.What is the payback period?

A)4 year

B)3.5 years

C)5 years

D)2.5 years

E)6 years

A)4 year

B)3.5 years

C)5 years

D)2.5 years

E)6 years

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

69

When the risk of obsolescence is high,managers will want

A)a shorter payback period.

B)a longer payback period.

C)a payback period equal to the life of the investment.

D)all of these.

E)none of these.

A)a shorter payback period.

B)a longer payback period.

C)a payback period equal to the life of the investment.

D)all of these.

E)none of these.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

70

One disadvantage of the payback period is that

A)it is sometimes used as a crude measure of risk.

B)managers may choose investments with quick payback periods to maximize short term criteria on which their own bonuses,etc.may be based.

C)it cannot be used for investments with unequal cash inflows.

D)it cannot be used if the entire cost of the investment does not occur immediately.

E)all of these.

A)it is sometimes used as a crude measure of risk.

B)managers may choose investments with quick payback periods to maximize short term criteria on which their own bonuses,etc.may be based.

C)it cannot be used for investments with unequal cash inflows.

D)it cannot be used if the entire cost of the investment does not occur immediately.

E)all of these.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

71

An investment of $5,000 provides an average net cash flows of $320 with zero salvage value.Depreciation is $35 per year.The accounting rate of return using the original investment is

A)4.0%

B)5.1%

C)5.7%

D)3.2%

E)2.4%

A)4.0%

B)5.1%

C)5.7%

D)3.2%

E)2.4%

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

72

Tessa Wilson invested in a project with a payback period of 6 years.The project brings $18,000 per year for a period of 9 years.What was the initial investment?

A)$108,000

B)$107,500

C)$162,000

D)$240,000

E)cannot be determined from this information

A)$108,000

B)$107,500

C)$162,000

D)$240,000

E)cannot be determined from this information

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

73

Greg Moss has just invested $120,000 in a coffee shop.He expects to receive cash income of $15,000 a year.What is the payback period?

A)5 years

B)7.7 years

C)4.5 years

D)6.5 years

E)8 years

A)5 years

B)7.7 years

C)4.5 years

D)6.5 years

E)8 years

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

74

Managers may use the accounting rate of return to evaluate potential investment projects because

A)debt contracts require that a firm maintain certain ratios that are affected by income and long-term asset levels.

B)it serves as a screening measure to insure that new investments do not affect key financial ratios.

C)bonuses to managers may be based on accounting income and/or return on assets.

D)it can be tied to the manager's personal income.

E)all of these.

A)debt contracts require that a firm maintain certain ratios that are affected by income and long-term asset levels.

B)it serves as a screening measure to insure that new investments do not affect key financial ratios.

C)bonuses to managers may be based on accounting income and/or return on assets.

D)it can be tied to the manager's personal income.

E)all of these.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

75

A formula for the accounting rate of return is

A)average income/initial investment.

B)initial investment/annual cash flow.

C)annual cash flow/initial investment.

D)initial investment/average income.

E)(average income + initial investment)/initial investment.

A)average income/initial investment.

B)initial investment/annual cash flow.

C)annual cash flow/initial investment.

D)initial investment/average income.

E)(average income + initial investment)/initial investment.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

76

A division manager was considering a project that required a significant initial investment.If accepted,the project could have a negative impact on certain financial ratios that the firm was required to maintain to satisfy debt contracts.To ensure that the ratios would not be adversely affected by the investment,the manager would use which of the following capital investment models?

A)Payback period

B)Accounting rate of return

C)Net present value

D)Internal rate of return

E)None of these

A)Payback period

B)Accounting rate of return

C)Net present value

D)Internal rate of return

E)None of these

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

77

Neil Morrison has just invested $130,000 in a restaurant.He expects to receive income of $24,000 a year,and to have the investment for 8 years.What is the accounting rate of return?

A)5.60%

B)18.46%

C)14.52%

D)12.41%

E)4.50%

A)5.60%

B)18.46%

C)14.52%

D)12.41%

E)4.50%

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

78

The time required for a firm to recover its original investment is the

A)internal rate of return.

B)net present value.

C)life of the project.

D)accounting rate of return.

E)payback period.

A)internal rate of return.

B)net present value.

C)life of the project.

D)accounting rate of return.

E)payback period.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

79

The value of an investment at the end of its life is called its ________________.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck

80

To make a capital investment decision,a manager must estimate the

A)quantity of cash flows.

B)timing of cash flows.

C)risk of the investment.

D)impact of the investment on the firm's profitability.

E)all of these.

A)quantity of cash flows.

B)timing of cash flows.

C)risk of the investment.

D)impact of the investment on the firm's profitability.

E)all of these.

Unlock Deck

Unlock for access to all 163 flashcards in this deck.

Unlock Deck

k this deck