Deck 9: Taxation of Corporations

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 9: Taxation of Corporations

1

_____ 6.A corporate net operating loss can be carried forward indefinitely after being carried back two years.

False

2

_____ 3.Corporations are allowed a charitable contribution deduction equal to 10% of gross profit.

False

3

_____ 9.The corporate alternative tax is paid in place of the regular corporate income tax.

False

4

_____ 15.If property is distributed to a shareholder as a dividend,the dividend is equal to the property's fair market value.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

_____ 19.A controlled corporate group can consist of a parent and subsidiary or two corporations owned by the same individual.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

_____ 7.A corporation is allowed a general business credit,but the credit cannot reduce the tax liability to zero.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

_____ 14.A corporation that only has accumulated earnings and profits cannot make a dividend distribution.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

_____ 11.All corporations whose income tax liability is less than $1,000,000 in the current year can avoid an underpayment penalty if each of their estimated tax payments is 25 percent or more of their immediately preceding tax year's tax liability.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

_____ 16.An individual shareholder may always receive sale treatment on a corporate redemption if the shareholder has all of his or her stock redeemed and no related parties own any of the same corporation's stock.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

_____ 10.The unextended due date for a corporate tax return is the 15th day of the third month after the close of its tax year.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

_____ 5.In 2013,a corporation's deduction for qualified U.S.production activities is 9% of qualified production activities income up to a maximum of 50% of wages paid during the year.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

_____ 18.The accumulated earnings tax and the personal holding company tax can both apply to a corporation in place of the regular corporate income tax.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

_____ 17.A partial liquidation occurs when only a few of a corporation's shareholders have their stock redeemed by a corporation.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

_____ 1.Regular corporations are free to choose any fiscal or calendar year as their tax year.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

_____ 20.A corporation must have positive earnings and profits in both its current earnings and profits account and its accumulated earnings and profits account to make a taxable dividend distribution.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

_____ 12.In determining consolidated net income,each corporation first must compute separate taxable income.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

_____ 4.A corporation can elect to carry a capital loss back first to the third preceding tax year before it is carried forward five years,but it would otherwise only carry the capital loss forward.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

_____ 13.Intercompany dividends are one of many items eliminated in preparing a consolidated tax return.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

_____ 2.The tax rate on corporate income from $100,000 to $335,000 is a rate higher than for any other increment of corporate income.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

_____ 8.The Schedule L of Form 1120 is a corporate balance sheet as determined by the tax laws.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

Cloud Corporation has a taxable income of $100,000 in 2013 along with a $30,000 general business credit.What is the amount of its credit carryover and the last year to which the carryover could be used?

A)$70,000,2033

B)$7,750,2033

C)$7,750,2018

D)$13,125,2033

A)$70,000,2033

B)$7,750,2033

C)$7,750,2018

D)$13,125,2033

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

Coho is a corporation that has $1,100,000 of gross revenue and $1,021,000 of deductible expenses? What is its income tax liability?

A)$79,000

B)$30,494

C)$26,860

D)$15,110

E)None of the above

A)$79,000

B)$30,494

C)$26,860

D)$15,110

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

Soho is a personal service corporation that has $1,100,000 of gross revenue and $1,021,000 of deductible expenses? What is its income tax liability?

A)$79,000

B)$30,494

C)$27,650

D)$26,860

E)$15,110

A)$79,000

B)$30,494

C)$27,650

D)$26,860

E)$15,110

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

The Willow Corporation reported $400,000 of taxable income.In making a conversion to book income,the accountant had to adjust for the following: a $25,000 Section 179 deduction,but book depreciation would have been $5,000;a fine of $12,500 for overweight trucks;and a net capital loss of $10,000.What is Willow Corporation's book income?

A)$422,500

B)$412,500

C)$402,500

D)$397,500

E)None of the above

A)$422,500

B)$412,500

C)$402,500

D)$397,500

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

A corporation has pre-tax book income of $324,000.In determining this income,the corporation included $2,000 of tax-exempt interest,$6,000 of dividends from an affiliated corporation,a capital loss of $50,000 and $3,000 of excess book depreciation.What is the corporation's taxable income?

A)$369,000

B)$328,000

C)$269,000

D)$263,000

A)$369,000

B)$328,000

C)$269,000

D)$263,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

Jude received a $25,000 distribution from BC Corporation that the corporation identified as $15,000 dividend and $10,000 return of capital.What effect does this distribution have on Jude's taxable income if his basis in the stock of BC is $8,000?

A)Increase of $25,000

B)Increase of $17,000

C)Increase of $15,000

D)Increase of $10,000

A)Increase of $25,000

B)Increase of $17,000

C)Increase of $15,000

D)Increase of $10,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

Corporation P owns 85 percent of Corporation S1;Corporation S1 owns 60 percent of Corporation S2;Corporation S2 owns 90 percent of S3;Corporation S3 owns 60 percent of Corporation S4 and 15 percent of Corporation S2;Corporation S4 owns 100 percent of Corporation S5.Identify the consolidated group(s)of corporations.

A)P-S1-S2-S3-S4-S5

B)P-S1 only

C)P-S1and S2-S3-S4-S5

D)P-S1;S2-S3;and S4-S5

E)P-S1 and S2-S3

A)P-S1-S2-S3-S4-S5

B)P-S1 only

C)P-S1and S2-S3-S4-S5

D)P-S1;S2-S3;and S4-S5

E)P-S1 and S2-S3

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

Borneo Corporation has $21,000 in current earnings and profits and $5,000 of accumulated earnings and profits.Borneo distributes $20,000 of income to its shareholders on June 15 and another $10,000 on December 15.How much of the December 15 distribution is taxable as a dividend?

A)$21,000

B)$10,000

C)$7,000

D)$5,000

A)$21,000

B)$10,000

C)$7,000

D)$5,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

The maximum marginal corporate tax rate excluding surtaxes is:

A)Less than the maximum individual tax rate

B)More than the maximum individual tax rate

C)34 percent

D)39 percent

E)None of the above

A)Less than the maximum individual tax rate

B)More than the maximum individual tax rate

C)34 percent

D)39 percent

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

A corporation has a June 30 year end.What is the last date it can file its return due for its June 30,2013 year-end if it files an extension?

A)December 31,2013

B)September 15,2013

C)January 30,2014

D)March 15,2014

A)December 31,2013

B)September 15,2013

C)January 30,2014

D)March 15,2014

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

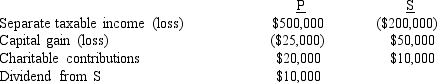

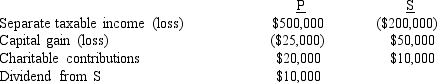

Corporation P files a consolidated return with Corporation S.In preparing a consolidated return,their accountant finds the following:  What is the consolidated return taxable income?

What is the consolidated return taxable income?

A)$365,000

B)$295,000

C)$280,000

D)$315,000

What is the consolidated return taxable income?

What is the consolidated return taxable income?A)$365,000

B)$295,000

C)$280,000

D)$315,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

The Shepherd Corporation has $40,000 of taxable income,$200,000 of positive adjustments,and a $10,000 preference item.What is its alternative minimum taxable income?

A)$250,000

B)$235,000

C)$230,00

D)$225,000

E)None of the above

A)$250,000

B)$235,000

C)$230,00

D)$225,000

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following is not a characteristic of a corporation?

A)Associates

B)Limited life

C)Limited liability

D)Profit-motive

E)Central management

A)Associates

B)Limited life

C)Limited liability

D)Profit-motive

E)Central management

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

34

Which of these is not considered an advantage of the corporate business form?

A)A shareholder employee's salary is fully deductible from corporate income

B)Shareholders are not taxed on corporate income until it is distributed to them

C)Shareholder-employees can participate in employee fringe benefits

D)Corporate shareholders cannot deduct corporate losses from their income

E)A corporation is free to select any fiscal tax year

A)A shareholder employee's salary is fully deductible from corporate income

B)Shareholders are not taxed on corporate income until it is distributed to them

C)Shareholder-employees can participate in employee fringe benefits

D)Corporate shareholders cannot deduct corporate losses from their income

E)A corporation is free to select any fiscal tax year

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

What is Gigantic Corporation's net tax liability if its taxable income is $325,000 and it has a general business credit of $125,000?

A)$200,000

B)$63,750

C)$21,250

D)0

E)None of the above

A)$200,000

B)$63,750

C)$21,250

D)0

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

36

Margolin Corporation has regular taxable income of $120,000.It has positive adjustment of $90,000,preference items of $50,000 and negative adjustments of $40,000.What is its alternative minimum tax?

A)0

B)$9,450

C)$39,500

D)$44,000

E)None of the above

A)0

B)$9,450

C)$39,500

D)$44,000

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

A corporation that owns 72 percent of all the outstanding stock of another corporation:

A)May not file a consolidate return

B)May file a consolidated return

C)May take a 100 percent dividend received deduction

D)May take a 70 percent dividend received deduction

E)Is the parent of the 72 percent-owned company

A)May not file a consolidate return

B)May file a consolidated return

C)May take a 100 percent dividend received deduction

D)May take a 70 percent dividend received deduction

E)Is the parent of the 72 percent-owned company

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

Which of the following would be an indication that corporate debt is disguised equity?

A)Debt is issued to the shareholders in the same proportion as stock

B)The debt has a specified maturity date

C)The debt has a specified interest rate

D)Interest is paid annually

E)None of the above

A)Debt is issued to the shareholders in the same proportion as stock

B)The debt has a specified maturity date

C)The debt has a specified interest rate

D)Interest is paid annually

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

A clothing manufacturing corporation donates last year's inventory to the Red Cross for use in its disaster relief efforts.The clothes have a fair market value of $200,000 and a basis to the corporation of $75,000.What is its charitable contribution deduction?

A)$200,000

B)$150,000

C)$137,500

D)$75,000

A)$200,000

B)$150,000

C)$137,500

D)$75,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following is not a positive adjustment to taxable income to determine current earnings and profits?

A)Federal income taxes paid

B)Proceeds of life insurance

C)Capital loss carryovers

D)Dividend received deduction

A)Federal income taxes paid

B)Proceeds of life insurance

C)Capital loss carryovers

D)Dividend received deduction

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following is an indication of the accumulation of earnings and profits beyond the reasonable needs of the business?

a.A $200,000 earnings and profits balance

b.$200,000 accumulated to retire debt

c.$600,000 accumulated for shareholder loans

d.$12,000,000 accumulated to expand operating facilities

a.A $200,000 earnings and profits balance

b.$200,000 accumulated to retire debt

c.$600,000 accumulated for shareholder loans

d.$12,000,000 accumulated to expand operating facilities

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

42

Avalanche Corporation has $70,000 of net income from operations during the current year.In addition it received $180,000 of dividend income from another corporation in which it has a 10% ownership interest.What is Avalanche's dividends received deduction for this year?

A)$70,000

B)$126,000

C)$144,000

D)$180,000

A)$70,000

B)$126,000

C)$144,000

D)$180,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

What is JJ Corporation's balance in accumulated earnings and profits at the beginning of year 2 if in year 1 it made a $40,000 distribution to its shareholders,its current earnings and profits was $35,000,and its accumulated earnings and profits was $25,000 at the beginning of year 1?

A)$65,000

B)$30,000

C)$25,000

D)$20,000

A)$65,000

B)$30,000

C)$25,000

D)$20,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

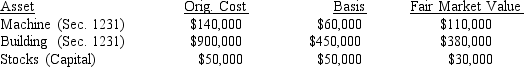

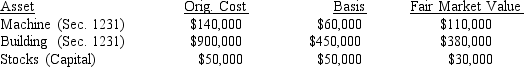

Casey Corporation has three assets when it decides to liquidate:  The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder.What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?

The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder.What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?

A)$6,750

B)$5,000

C)$3,750

D)$750

E)0

The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder.What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?

The corporation sells the stock for its fair market value and distributes the other two assets to its sole shareholder.What is its tax liability on its final tax return if it had $45,000 of income from operations prior to liquidating?A)$6,750

B)$5,000

C)$3,750

D)$750

E)0

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

Tom owns 60 percent of CDF Corporation.CDF rents a building from Tom for $4,500 per month.Fair rental value for the building is only $3,000 per month.In addition,CDF employs Tom's son as the general manager at a salary of $350,000 annually.Similar positions in similar businesses pay $200,000 annually.How much rental and dividend income should Tom report on his tax return for the year?

A)$54,000 rental income

B)$54,000 rental income;$150,000 dividend income

C)$36,000 rental income;$18,000 dividend income

D)$36,000 rental income;$168,000 dividend income

A)$54,000 rental income

B)$54,000 rental income;$150,000 dividend income

C)$36,000 rental income;$18,000 dividend income

D)$36,000 rental income;$168,000 dividend income

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

A sole shareholder receives a piece of land from a corporation as a dividend distribution.The land has a basis of $40,000 and a fair market value of $80,000;the shareholder's basis in his stock is $20,000,and this distribution is the only corporate activity for the year except for paying any tax owed on the distribution.At the beginning of the year,the corporation had only $5,000 in accumulated earnings and profits.How will this distribution be treated for tax purposes by the shareholder?

a.$80,000 dividend

b.$39,000 dividend;$41,000 capital gain

c.$39,000 dividend;$20,000 return of capital;$21,000 capital gain

d.$60,000 dividend;$20,000 return of capital

e.None of the above

a.$80,000 dividend

b.$39,000 dividend;$41,000 capital gain

c.$39,000 dividend;$20,000 return of capital;$21,000 capital gain

d.$60,000 dividend;$20,000 return of capital

e.None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

Moranza Corporation,which has current earnings and profits (CE&P)of $10,000 and accumulated earnings and profits (AE&P)of $30,000,makes a $15,000 distribution to its sole shareholder,Justin,at the end of the current year.Justin has a basis in his Moranza stock of $2,000.What is the amount of taxable income Justin must report from the Moranza distribution?

A)0

B)$10,000

C)$12,000

D)$15,000

A)0

B)$10,000

C)$12,000

D)$15,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

A corporation owns 90 percent of the voting power of a second corporation but only 70 percent of its total stock value.The corporations are:

A)Affiliated

B)A controlled group

C)Brother-sister corporations

D)Consolidated group

A)Affiliated

B)A controlled group

C)Brother-sister corporations

D)Consolidated group

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

A corporation is subject to both the personal holding company tax and the accumulated earnings tax.Its regular taxable income is $200,000.Its adjusted taxable income for imposing the personal holding company tax is $170,000 and its taxable income for determining the accumulated earnings tax is $230,000.What is the corporation's total tax liability?

A)$73,250

B)$95,250

C)$120,250

D)$141,250

E)None of the above

A)$73,250

B)$95,250

C)$120,250

D)$141,250

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

Ponoco Corporation,which has current earnings and profits (CE&P)of $10,000 and accumulated earnings and profits (AE&P)of $30,000,makes a $41,000 distribution to its sole shareholder,Greg,at the end of the current year.Greg has a basis in his Ponoco stock of $2,000.What is the amount of taxable income Greg must report from the Ponoco distribution?

A)$1,000

B)$10,000

C)$40,000

D)$41,000

A)$1,000

B)$10,000

C)$40,000

D)$41,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

Joe owns 40 percent of the stock of AD Corporation's 2,000 outstanding shares.If Joe sells some stock back to the corporation,what is the maximum percentage of ownership that Joe can have of the outstanding stock after the sale to qualify for capital gain treatment rather than having dividend income?

A)79.9%

B)39.9%

C)31.9%

D)29.9%

E)None of the above

A)79.9%

B)39.9%

C)31.9%

D)29.9%

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

BarBRanch has had taxable income of $450,000,$570,000,$760,000 and $680,000 in years 2010 through 2013,respectively.What were the equal minimum quarterly estimated tax payments for 2013 that BarBRanch should have made in 2013 to avoid any penalty?

A)$57,676

B)$57,800

C)$64,600

D)$170,000

A)$57,676

B)$57,800

C)$64,600

D)$170,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

What is the minimum number of individuals who must own a corporation to have it avoid meeting the personal holding company designation?

A)One

B)Five

C)Nine

D)Ten

A)One

B)Five

C)Nine

D)Ten

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

Whyley Corporation,a C corporation,has gross profits on sales of $50,000 and deductible expenses of $60,000.In addition,Whyley has a net capital gain of $30,000.Whyley's taxable income is:

A)0

B)$10,000

C)$20,000

D)$30,000

E)$80,000

A)0

B)$10,000

C)$20,000

D)$30,000

E)$80,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

Soledad received one stock right for every two shares of stock she owned.She owned 100 shares that she purchased two years ago for $1,000.Each of the 50 rights that she received allows her to purchase one share of stock for $15.The stock is currently selling for $22 per share.What is her basis in the 50 stock rights?

A)$0

B)$137.25

C)$159.09

D)$274.51

E)None of the above

A)$0

B)$137.25

C)$159.09

D)$274.51

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

Marlin Inc. ,a calendar-year corporation,has gross income from operations of $160,000 and dividend income of $100,000 from a 25% owned domestic corporation for the current year.Deductible business expenses for the year are $170,000.What is Marlin's dividend received deduction for this year?

A)$70,000

B)$72,000

C)$80,000

D)$100,000

A)$70,000

B)$72,000

C)$80,000

D)$100,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck