Deck 1: Introduction to Taxation

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/56

Play

Full screen (f)

Deck 1: Introduction to Taxation

1

_____ 1.The 16th Amendment to the US Constitution that provided for an income tax was ratified in 1913.

True

2

Which of these persons never pays taxes directly?

A)Individual

B)Partnership

C)C corporation

D)Fiduciary

A)Individual

B)Partnership

C)C corporation

D)Fiduciary

B

3

Which of these entities is taxed directly on its income?

A)Limited Liability Company

B)C Corporation

C)Partnership

D)Sole Proprietorship

A)Limited Liability Company

B)C Corporation

C)Partnership

D)Sole Proprietorship

B

4

_____ 2.The first codification of the Internal Revenue Code took place in 1954.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

5

_____ 6.A married person filing a separate return has the lowest standard deduction amount.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following nominal rates does not apply to a C corporation?

A)10%

B)15%

C)25%

D)35%

A)10%

B)15%

C)25%

D)35%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

7

_____ 7.The lowest tax rate on the tax rate schedules for taxable incomes is the same for individuals and C corporations.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

8

_____ 15.A flat tax generally would be considered a regressive tax.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

9

_____ 13.The person giving the gift pays the gift tax.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

10

_____ 11.Partnerships and S corporations are flow-through entities.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

11

_____ 4.All interest paid to a taxpayer must be included in gross income.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following types of taxes is not levied by the federal government?

A)Excise tax

B)Income tax

C)Value added tax

D)Gift tax

A)Excise tax

B)Income tax

C)Value added tax

D)Gift tax

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

13

_____ 3.There are three basic taxable entities: the individual,the fiduciary,and the C corporation.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

14

_____ 10.All limited liability companies (LLCs)can file their tax returns as partnerships,or electively,as corporations.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

15

_____ 12.Both sales and use taxes are collected in the state in which the sale takes place.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

16

_____ 9.Only corporations are allowed to carry their operating losses both backwards and forwards.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

17

_____ 16.Adam Smith's four canons of taxation are Equity,Certainty,Economy and Convenience.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

18

_____ 5.A taxpayer's filing status determines the basic standard deduction allowed.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

19

_____ 14.The value added tax is a type of consumption tax.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

20

_____ 8.The alternative minimum tax is a tax determined on a broadened definition of income with no deductions permitted.

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is an objective of taxation?

A)Raise revenue

B)Foster social goals

C)Stimulate the economy

D)All of the above

E)None of the above

A)Raise revenue

B)Foster social goals

C)Stimulate the economy

D)All of the above

E)None of the above

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

22

What is a corporation's annual deduction for capital losses?

A)$3,000

B)An amount equal to capital gains only

C)$10,000

D)Corporations cannot deduct capital losses

A)$3,000

B)An amount equal to capital gains only

C)$10,000

D)Corporations cannot deduct capital losses

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

23

What is the marginal tax rate for a corporation with $110,000 of taxable income?

A)15%

B)25%

C)34%

D)39%

A)15%

B)25%

C)34%

D)39%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

24

Which of the following is not a business organization for tax purposes?

A)Estate

B)Limited liability partnership

C)C corporation

D)Sole proprietorship

A)Estate

B)Limited liability partnership

C)C corporation

D)Sole proprietorship

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

25

What is a corporation's alternative minimum tax rate?

A)15%

B)20%

C)26%

D)28%

A)15%

B)20%

C)26%

D)28%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

26

What is George's gross income if he has the following: Salary = $78,000;Dividends = $4,000;interest on city of San Francisco bonds = $2,000;a gain of $14,000 on a stock sale and a $4,000 loss on a small sole proprietorship that he owns.

A)$78,000

B)$84,000

C)$92,000

D)$96,000

A)$78,000

B)$84,000

C)$92,000

D)$96,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

27

Sara is single and has no dependents.What is the total amount of her standard deduction and personal exemption for 2013?

A)0

B)$3,900

C)$6,100

D)$10,000

A)0

B)$3,900

C)$6,100

D)$10,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following is never included in gross income?

A)Loss on stock sale

B)Social security benefits

C)Unemployment benefits

D)Gifts

A)Loss on stock sale

B)Social security benefits

C)Unemployment benefits

D)Gifts

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following is a tax?

A)Dog license

B)Parking fine

C)Water usage fee

D)Import duty

A)Dog license

B)Parking fine

C)Water usage fee

D)Import duty

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

30

By what right does the U.S.levy an income tax on individuals?

A)The 13th Amendment to the Constitution

B)Public Law 1913

C)The 16th Amendment to the Constitution

D)An Act of Congress ratified by the states

A)The 13th Amendment to the Constitution

B)Public Law 1913

C)The 16th Amendment to the Constitution

D)An Act of Congress ratified by the states

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following is normally not included in gross income?

A)Cash dividend

B)Corporate bond interest income

C)Stock dividend

D)All are included in gross income

E)None are included in gross income

A)Cash dividend

B)Corporate bond interest income

C)Stock dividend

D)All are included in gross income

E)None are included in gross income

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

32

Wilma and Barney are married and have 4 dependent children.What is the total amount of their personal and dependency exemptions for 2013?

A)$8,400

B)$16,800

C)$23,400

D)$35,200

A)$8,400

B)$16,800

C)$23,400

D)$35,200

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following best describes vertical equity?

A)All taxpayers should pay some taxes on their incomes

B)As income increases,taxes should increase

C)Persons with equal incomes should pay the same amount of taxes

D)A person with capital gains should pay less tax than a person with the same amount of salary income

A)All taxpayers should pay some taxes on their incomes

B)As income increases,taxes should increase

C)Persons with equal incomes should pay the same amount of taxes

D)A person with capital gains should pay less tax than a person with the same amount of salary income

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

34

What is the marginal tax rate for a single individual with $60,000 of taxable income?

A)15%

B)25%

C)28%

D)33%

A)15%

B)25%

C)28%

D)33%

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

35

When was the last time the Internal Revenue Code was recodified?

A)1913

B)1939

C)1954

D)1986

A)1913

B)1939

C)1954

D)1986

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following best describes horizontal equity?

A)All taxpayers should pay some taxes on their incomes

B)As income increases,taxes should increase

C)Persons with equal incomes should pay the same amount of taxes

D)A person with capital gains should pay less tax than a person with the same amount of salary income

A)All taxpayers should pay some taxes on their incomes

B)As income increases,taxes should increase

C)Persons with equal incomes should pay the same amount of taxes

D)A person with capital gains should pay less tax than a person with the same amount of salary income

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

37

Which of the following is not a deduction FROM adjusted gross income?

A)Standard deduction

B)Personal exemption

C)Tax credit

D)Itemized deduction

A)Standard deduction

B)Personal exemption

C)Tax credit

D)Itemized deduction

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

38

What is an individual's maximum annual deduction for capital losses?

A)$3,000

B)An amount equal to capital gains plus $3,000

C)$10,000

D)Individuals cannot deduct capital losses

A)$3,000

B)An amount equal to capital gains plus $3,000

C)$10,000

D)Individuals cannot deduct capital losses

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

39

What is the gain or loss on the sale of an asset for $68,000 if the asset cost $185,000,depreciation expense deducted was $124,000,and there was a $19,000 major addition to the asset?

A)$0

B)$12,000 loss

C)$7,000 gain

D)$117,000 loss

A)$0

B)$12,000 loss

C)$7,000 gain

D)$117,000 loss

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

40

What is the earliest year to which a corporation can carry a net operating loss realized in 2013?

A)2012

B)2011

C)2010

D)2009

A)2012

B)2011

C)2010

D)2009

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

41

John earns $25,000 and pays $2,000 in taxes.Marcy earns $60,000 and pays $4,000 in taxes.How would you characterize this tax system?

A)A flat tax system

B)A proportional system

C)A regressive system

D)A progressive system

A)A flat tax system

B)A proportional system

C)A regressive system

D)A progressive system

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

42

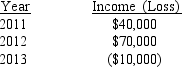

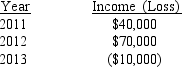

Hoku Corporation (a C corporation)had the following history of income and loss:  How much of a tax refund can Hoku Corporation receive by carrying back its 2013 loss?

How much of a tax refund can Hoku Corporation receive by carrying back its 2013 loss?

A)$1,500

B)$2,500

C)$3,500

D)None;it cannot carry its loss back

How much of a tax refund can Hoku Corporation receive by carrying back its 2013 loss?

How much of a tax refund can Hoku Corporation receive by carrying back its 2013 loss?A)$1,500

B)$2,500

C)$3,500

D)None;it cannot carry its loss back

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

43

Crystal invested $8,000 cash in CRK Partnership for a 30% general partnership interest.In its first year of operations,CRK lost $15,000.In its second year of operations,CRK lost an additional $14,000.How much of the second year's losses can Crystal deduct?

A)$700

B)$2,400

C)$3,500

D)$4,200

A)$700

B)$2,400

C)$3,500

D)$4,200

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

44

Ted owns 20% of Genco (a C corporation)that had taxable income of $100,000 and paid a total of $50,000 in dividends to its shareholders.Ted also owns a 10% of Subco (an S corporation)that had $100,000 of taxable income and distributed a total of $60,000 to its shareholders.How much must Ted include in his gross income as a result of being a shareholder in these two corporations?

A)$16,000

B)$20,000

C)$26,000

D)$30,000

A)$16,000

B)$20,000

C)$26,000

D)$30,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following is not a tax credit allowed a corporation?

A)Foreign tax credit

B)Education credit

C)Investment tax credit

D)Orphan drug credit

A)Foreign tax credit

B)Education credit

C)Investment tax credit

D)Orphan drug credit

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

46

Which of the following is a type of wealth tax?

A)A tax on a person's salary

B)A tax on stocks owned by the taxpayer

C)A tax on purchases made at a department store

D)A tax on property given to a grandchild

A)A tax on a person's salary

B)A tax on stocks owned by the taxpayer

C)A tax on purchases made at a department store

D)A tax on property given to a grandchild

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following is not a characteristic of both S corporations and partnerships?

A)Both are flow through entities

B)Owners increase basis for debt undertaken by S corporation or partnership

C)Both forms limit owner's participation in tax-free fringe benefits

D)Owner's increase basis for gains and decrease basis for losses

A)Both are flow through entities

B)Owners increase basis for debt undertaken by S corporation or partnership

C)Both forms limit owner's participation in tax-free fringe benefits

D)Owner's increase basis for gains and decrease basis for losses

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

48

Lisa invested $18,000 in Carson (a C corporation)for a 10% interest and also invested $30,000 in Samson (an S corporation)for a 20% interest.For the current year,Carson had a taxable loss of $80,000 and Samson had a taxable loss of $60,000.No distributions were made.If Lisa is in the 35% marginal tax bracket,what is the maximum that she would be able to save in taxes in the current year as a result of these corporate losses?

A)$16,800

B)$12,000

C)$7,000

D)$4,200

E)$2,800

A)$16,800

B)$12,000

C)$7,000

D)$4,200

E)$2,800

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

49

Jason purchased a 20 percent interest in JKL Partnership for $20,000 at the beginning of the year.At year-end,the partnership reported net income of $15,000 and distributed $2,000 cash to Jason.What is Jason's year-end basis?

A)$20,000

B)$21,000

C)$23,000

D)$33,000

A)$20,000

B)$21,000

C)$23,000

D)$33,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following are included in Adam Smith's characteristics of a good tax?

A)Certainty

B)Economy

C)Convenience

D)All are included

E)None are included

A)Certainty

B)Economy

C)Convenience

D)All are included

E)None are included

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following business entities does not file a separate tax return to report business operations?

A)Sole proprietorship

B)S corporation

C)C corporation

D)Partnership

A)Sole proprietorship

B)S corporation

C)C corporation

D)Partnership

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

52

In which of the following entities may an owner-employee benefit from all employee tax-free fringe benefits?

A)C Corporation

B)S Corporation

C)Partnership

D)Sole Proprietorship

A)C Corporation

B)S Corporation

C)Partnership

D)Sole Proprietorship

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

53

The Mercury Corporation must decide whether to invest in some new machinery for its business.Which tax rate is the most relevant for making this decision?

A)The average tax rate

B)The marginal tax rate

C)The nominal tax rate

D)The effective tax rate

A)The average tax rate

B)The marginal tax rate

C)The nominal tax rate

D)The effective tax rate

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

54

Terri owns a 50 percent interest in the TT Partnership.At the beginning of the year,her basis in her partnership interest was $75,000.The partnership reports a $40,000 loss for the year and distributes $4,000 cash to Terri.What is her basis in her partnership interest at the end of the year?

A)$111,000

B)$75,000

C)$51,000

D)$31,000

A)$111,000

B)$75,000

C)$51,000

D)$31,000

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

55

Which of the following business entities has no provision that limits some or all of the liability of the owner?

A)C Corporation

B)Sole Proprietorship

C)S Corporation

D)Limited Liability Company

A)C Corporation

B)Sole Proprietorship

C)S Corporation

D)Limited Liability Company

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck

56

Which of the following is not a characteristic of an S corporation?

A)Owners have limited liability

B)The corporation is taxed directly on operating income

C)The corporation can have no more than 100 shareholders

D)Shareholders must consent to the S election by the corporation

A)Owners have limited liability

B)The corporation is taxed directly on operating income

C)The corporation can have no more than 100 shareholders

D)Shareholders must consent to the S election by the corporation

Unlock Deck

Unlock for access to all 56 flashcards in this deck.

Unlock Deck

k this deck