Deck 12: Intangibles

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

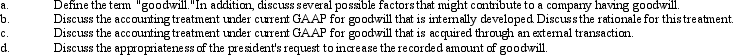

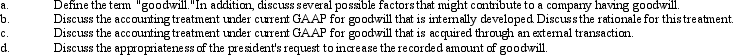

Question

Question

Question

Question

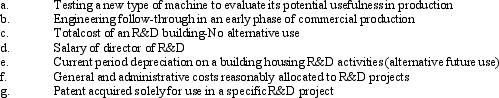

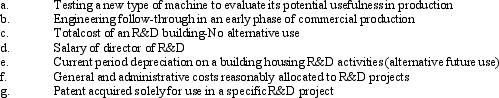

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/81

Play

Full screen (f)

Deck 12: Intangibles

1

The Walters Company made the following expenditures for research and development early in 2010: $40, 000 for materials, $50, 000 for contract services, $40, 000 for employee salaries, and $400, 000 for a building with an expected life of 20 years to be used for current and future research projects.Walters uses straight-line depreciation.The company allocated $10, 000 in overhead to research and development.What is Walters' research and development expense for 2010?

A)$100, 000

B)$110, 000

C)$160, 000

D)$350, 000

A)$100, 000

B)$110, 000

C)$160, 000

D)$350, 000

C

2

At the date of purchase, materials, equipment, facilities, and intangibles purchased from others that have alternative future uses in research and development should be

A)capitalized

B)charged directly to retained earnings

C)included in R&D expense immediately

D)charged as a loss from continuing operations

A)capitalized

B)charged directly to retained earnings

C)included in R&D expense immediately

D)charged as a loss from continuing operations

A

3

Which of the following describes the appropriate accounting for intangible assets with a finite life?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

I

4

Which of the following characteristics is not common to both tangible and intangible assets?

A)held for use and not for investment

B)expected life of more than one year

C)derive value from the ability to generate revenue

D)may have value only to a particular company

A)held for use and not for investment

B)expected life of more than one year

C)derive value from the ability to generate revenue

D)may have value only to a particular company

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

5

At the date of purchase, materials, equipment, facilities, and intangibles purchased from others that have no alternative future uses in research and development or other activities should be

A)capitalized

B)charged directly to retained earnings

C)included in R&D expense immediately

D)charged as a loss from continuing operations

A)capitalized

B)charged directly to retained earnings

C)included in R&D expense immediately

D)charged as a loss from continuing operations

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

6

Which of the following is not required to be disclosed in an entity's financial statements or accompanying footnotes?

A)the total amount of research and development costs charged to expense during the current year

B)the method used to amortize the entity's intangible assets

C)a material amount of internally developed goodwill

D)accumulated amortization on the entity's intangibles as of its year-end

A)the total amount of research and development costs charged to expense during the current year

B)the method used to amortize the entity's intangible assets

C)a material amount of internally developed goodwill

D)accumulated amortization on the entity's intangibles as of its year-end

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

7

Which amortization method should be used for intangibles that are amortized?

A)a method based on the expected pattern of benefits to be produced by the asset

B)a method based on an annual review for impairment

C)the straight-line method; all others are inappropriate

D)any method is appropriate

A)a method based on the expected pattern of benefits to be produced by the asset

B)a method based on an annual review for impairment

C)the straight-line method; all others are inappropriate

D)any method is appropriate

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following is not a characteristic of an intangible asset which distinguishes it from a tangible asset?

A)generally a higher degree of uncertainty regarding the future benefit that may be derived

B)value is subject to narrower fluctuations because it is less sensitive to competitive conditions

C)may have value to only a particular company

D)an intangible with an indefinite life is not expensed

A)generally a higher degree of uncertainty regarding the future benefit that may be derived

B)value is subject to narrower fluctuations because it is less sensitive to competitive conditions

C)may have value to only a particular company

D)an intangible with an indefinite life is not expensed

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

9

Smith Corporation is interested in acquiring Dawson Company and has obtained the following information about Dawson:

Daws on's net income has averaged for the past five years. This average is expected to continue in perpetuity The book value of Dawson's recorded net ass ets is

Dawson owns a fully depreciated building with a market value of .

Dawson has title to a patent with a market value of , which is not included in Dawson's recorded net as sets.

The market value of Dawson's recorded net assets(excluding and above) is .

In evaluating the Dawson data, Smith believes that a 12% discount rate is appropriate.

Required:

Calculate each of the following and provide all necessary computations to support your

a. Based on the information provided, what price shoudd Smith be willing to pay to acquire Dawson?

b. What portion of the puchase price should Smith capitalize as purchased goodwill?

Daws on's net income has averaged for the past five years. This average is expected to continue in perpetuity The book value of Dawson's recorded net ass ets is

Dawson owns a fully depreciated building with a market value of .

Dawson has title to a patent with a market value of , which is not included in Dawson's recorded net as sets.

The market value of Dawson's recorded net assets(excluding and above) is .

In evaluating the Dawson data, Smith believes that a 12% discount rate is appropriate.

Required:

Calculate each of the following and provide all necessary computations to support your

a. Based on the information provided, what price shoudd Smith be willing to pay to acquire Dawson?

b. What portion of the puchase price should Smith capitalize as purchased goodwill?

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following methods is used to amortize intangible assets over their useful lives?

A)declining balance

B)straight line

C)annual review for impairment

D)none of these since intangible assets are not amortized

A)declining balance

B)straight line

C)annual review for impairment

D)none of these since intangible assets are not amortized

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following expenditures cannot be included in R&D costs?

A)indirect costs

B)intangibles purchased from others

C)personnel costs

D)contract services performed for others

A)indirect costs

B)intangibles purchased from others

C)personnel costs

D)contract services performed for others

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

12

Costs for which of the following activities should not be included in research and development (R&D)?

A)modification of the formulation or design of a product or process

B)design of tools, jigs, molds, and dies involving new technology

C)design, construction, and testing of preproduction prototypes and models

D)trouble-shooting in connection with breakdowns during commercial production

A)modification of the formulation or design of a product or process

B)design of tools, jigs, molds, and dies involving new technology

C)design, construction, and testing of preproduction prototypes and models

D)trouble-shooting in connection with breakdowns during commercial production

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following research and development costs should always be capitalized?

A)costs of intangibles purchased from others

B)costs of materials, equipment, and intangibles with alternative future uses purchased from others

C)costs of equipment with an expected life greater than three years

D)costs of contract services purchased from others

A)costs of intangibles purchased from others

B)costs of materials, equipment, and intangibles with alternative future uses purchased from others

C)costs of equipment with an expected life greater than three years

D)costs of contract services purchased from others

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

14

Burrell Co.incurred the following costs during 2010 in the development and production of a new product:  How much should be included in R&D expense for 2010?

How much should be included in R&D expense for 2010?

A)$165, 000

B)$480, 000

C)$510, 000

D)$545, 000

How much should be included in R&D expense for 2010?

How much should be included in R&D expense for 2010?A)$165, 000

B)$480, 000

C)$510, 000

D)$545, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

15

IFRS and GAAP differ in the application of the fair value concept for impairment tests applied to intangible assets.

Required:

Describe the fair value concept as it is applied for impairment tests in IFRS and GAAP, highlighting the differences.

Required:

Describe the fair value concept as it is applied for impairment tests in IFRS and GAAP, highlighting the differences.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following costs should always be expensed as incurred?

A)the costs of externally acquired identifiable intangible assets

B)the externally incurred costs directly associated with internally developed identifiable intangible assets

C)the costs of internally developed unidentifiable intangible assets

D)the costs of externally acquired unidentifiable intangible assets

A)the costs of externally acquired identifiable intangible assets

B)the externally incurred costs directly associated with internally developed identifiable intangible assets

C)the costs of internally developed unidentifiable intangible assets

D)the costs of externally acquired unidentifiable intangible assets

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following groups would be classified as intangible assets for financial accounting and reporting purposes?

A)long-term notes receivable, copyrights, goodwill, and trademarks

B)patents, computer software costs, franchises, and trademarks

C)computer software costs, research and development costs for internally developed patents, patents, and goodwill

D)organization costs, goodwill, costs of employee training programs, and trademarks

A)long-term notes receivable, copyrights, goodwill, and trademarks

B)patents, computer software costs, franchises, and trademarks

C)computer software costs, research and development costs for internally developed patents, patents, and goodwill

D)organization costs, goodwill, costs of employee training programs, and trademarks

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following relationships between category of intangibles and amortization is not true?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following is not true regarding the accounting for the cost of intangibles per GAAP?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

20

The cost of an internally developed unidentifiable intangible is expensed as incurred.Accordingly, which one of the following costs would be expensed in the year it was incurred?

A)legal cost of obtaining a patent

B)cost of improvements with a three-year life made to an asset that is being leased by the company for a five-year period

C)deferred charges

D)cost incurred to train management-level employees

A)legal cost of obtaining a patent

B)cost of improvements with a three-year life made to an asset that is being leased by the company for a five-year period

C)deferred charges

D)cost incurred to train management-level employees

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

21

In January 2009, Waterman Co.purchased a patent for $500, 000 that had an estimated remaining economic life of ten years.On January 2, 2012, the company incurred $56, 000 in legal fees to successfully defend the validity of the patent.In January 2014, the company incurred $48, 000 in legal fees in a new infringement lawsuit.In this situation, the lawsuit was lost, and the patent was determined to be worthless as a result.The expense to be recognized in 2014 by Waterman with regard to the patent is

A)$234, 000

B)$250, 000

C)$290, 000

D)$338, 000

A)$234, 000

B)$250, 000

C)$290, 000

D)$338, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

22

In 1970, Ramirez Company had acquired copyrights for $750, 000 on several literary works from some obscure 18th century authors.These copyrights were fully amortized by 2010.In early 2010, a new anthropological discovery made these copyrights worth $2, 500, 000.As a result, Ramirez should report which of the following in its financial statements for 2010?

A)$2, 500, 000 as a holding gain

B)$ 750, 000 as copyrights-based recovery of value limited to historical cost

C)$2, 500, 000 as an extraordinary item

D)Footnote disclosure if the amount is material

A)$2, 500, 000 as a holding gain

B)$ 750, 000 as copyrights-based recovery of value limited to historical cost

C)$2, 500, 000 as an extraordinary item

D)Footnote disclosure if the amount is material

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

23

During the period from 2008 to the end of 2009, Innovation, Inc.spent $90, 000 on research and development for an invention that was patented on January 1, 2010.Innovation estimated that the patented invention would be useful in its production for 10 years.At the beginning of 2012, Innovation paid $16, 000 in legal fees in a successful defense of the patent.What is Innovation's patent amortization expense for 2012?

A)$25, 000

B)$11, 000

C)$10, 600

D)$ 2, 000

A)$25, 000

B)$11, 000

C)$10, 600

D)$ 2, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

24

During 2010, Farver Company incurred $240, 000 in legal fees in defending a patent with a carrying value of $2, 500, 000 against an infringement.Farver's lawyers were not successful with the defense of the patent.The legal fees should be

A)expensed in 2010 and classified as ordinary expense

B)classified as an extraordinary item on the income statement for 2010

C)capitalized and amortized over the remaining legal life of the patent

D)capitalized and amortized over the remaining economic life or legal life of the patent, whichever is shorter

A)expensed in 2010 and classified as ordinary expense

B)classified as an extraordinary item on the income statement for 2010

C)capitalized and amortized over the remaining legal life of the patent

D)capitalized and amortized over the remaining economic life or legal life of the patent, whichever is shorter

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

25

For financial reporting purposes, GAAP requires organization costs to be

A)expensed in the period in which they are incurred

B)capitalized and amortized over 20 years

C)capitalized and amortized over the first five years of the company's existence

D)capitalized and treated as an intangible asset with an indefinite life

A)expensed in the period in which they are incurred

B)capitalized and amortized over 20 years

C)capitalized and amortized over the first five years of the company's existence

D)capitalized and treated as an intangible asset with an indefinite life

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

26

Based on GAAP, most software production costs are likely to be

A)expensed as R&D costs

B)allocated to inventory and expensed to cost of goods sold when the software is sold

C)capitalized and amortized over a 40-year period

D)capitalized and amortized over a relatively short period, such as five years

A)expensed as R&D costs

B)allocated to inventory and expensed to cost of goods sold when the software is sold

C)capitalized and amortized over a 40-year period

D)capitalized and amortized over a relatively short period, such as five years

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

27

GAAP requires that research and development costs be

A)capitalized

B)expensed as incurred

C)accumulated until the existence of future benefits is determined

D)expensed in part and capitalized in part

A)capitalized

B)expensed as incurred

C)accumulated until the existence of future benefits is determined

D)expensed in part and capitalized in part

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

28

A patent is amortized over its expected useful life or 20 years.The expected useful life can be impacted by all of the following except

A)a successful lawsuit against a competitor

B)the federal government renewing the original patent

C)technical innovations by a competitor

D)product improvements by the patent holder

A)a successful lawsuit against a competitor

B)the federal government renewing the original patent

C)technical innovations by a competitor

D)product improvements by the patent holder

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

29

When deciding how to account for research and development costs, FASB had to choose between

A)predicative value and timeliness

B)verifiability and neutrality

C)relevance and reliability

D)understandability and decision usefulness

A)predicative value and timeliness

B)verifiability and neutrality

C)relevance and reliability

D)understandability and decision usefulness

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

30

The Fallen Company began business early in 2010, when Fallen paid an initial fee of $100, 000 to purchase a franchise.In forming the company, Fallen also spent $11, 000 on legal fees and $4, 500 on accounting fees.During the year, Fallen spent $7, 500 on product development and paid $10, 000 in continuing franchise fees.What amount should Fallen capitalize for intangible assets in 2010?

A)$100, 000

B)$115, 500

C)$123, 000

D)$133, 000

A)$100, 000

B)$115, 500

C)$123, 000

D)$133, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following accounting principles or conventions is contradictory to the GAAP requirement to expense R&D costs immediately?

A)historical cost principle

B)comparability

C)conservatism

D)matching principle

A)historical cost principle

B)comparability

C)conservatism

D)matching principle

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

32

In January 2010, the Remy Corporation purchased a patent for $231, 000 from Nel Company that had a remaining legal life of 14 years.Remy estimated that the remaining economic life would be seven years.In January 2014, the company incurred $30, 000 in legal costs to defend the patent from an infringement.Remy's lawyers were successful, and the remaining years of benefit from the patent were estimated to be six years.The patent amortization expense for 2014 is

A)$ 7, 615

B)$ 9, 923

C)$16, 500

D)$21, 500

A)$ 7, 615

B)$ 9, 923

C)$16, 500

D)$21, 500

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

33

Which of the following statements is not true with regard to international accounting standards for research and development costs?

A)Some countries require research costs to be expensed and development costs to be capitalized.

B)Some countries allow the capitalization of R&D costs.

C)The universal practice with regard to R&D costs is to capitalize the expenditures.

D)R&D costs are accounted for in different ways in different countries.

A)Some countries require research costs to be expensed and development costs to be capitalized.

B)Some countries allow the capitalization of R&D costs.

C)The universal practice with regard to R&D costs is to capitalize the expenditures.

D)R&D costs are accounted for in different ways in different countries.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

34

Costs for which of the following activities would not be included as part of research and development (R&D)costs?

A)testing in search for or evaluation of product or process alternatives

B)adaptation of an existing capability to a particular requirement or customer's need as part of a continuing commercial activity

C)laboratory research aimed at discovery of new knowledge

D)modification of the formulation or design of a product or process

A)testing in search for or evaluation of product or process alternatives

B)adaptation of an existing capability to a particular requirement or customer's need as part of a continuing commercial activity

C)laboratory research aimed at discovery of new knowledge

D)modification of the formulation or design of a product or process

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

35

A Company registered a patent on January 1, 2010.B Company purchased the patent from A Company for $450, 000 on January 1, 2015, and began to amortize the patent over its remaining legal life.In early 2016, B Company determined that the patent's economic benefits would last only until the end of 2021.What amount should B Company record for patent amortization in 2016?

A)$15, 000

B)$30, 000

C)$60, 000

D)$70, 000

A)$15, 000

B)$30, 000

C)$60, 000

D)$70, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

36

The amortization period for a patent is

A)indefinite; patents should be reviewed for impairment annually

B)20 years

C)20 years or the expected useful life of the patent, whichever is longer

D)20 years or the expected useful life of the patent, whichever is shorter

A)indefinite; patents should be reviewed for impairment annually

B)20 years

C)20 years or the expected useful life of the patent, whichever is longer

D)20 years or the expected useful life of the patent, whichever is shorter

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

37

Marsha acquired a franchise to operate a beauty salon from Envincta, Inc., for $88, 000.She incurred an additional $4, 000 in legal costs to negotiate the terms with the franchisor.In five years, the franchise contract will be renegotiated.The current contract also states that there will be a $3, 000 annual fee plus a two percent charge based on the store's annual revenue, which is expected to average 90, 000 per year.The franchise cost that should be capitalized is

A)$ 88, 000

B)$ 92, 000

C)$107, 000

D)$116, 000

A)$ 88, 000

B)$ 92, 000

C)$107, 000

D)$116, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

38

Production costs related to computer software that is to be sold, leased, or otherwise marketed should be accounted for in which of the following ways?

A)All software production costs should be recorded as R&D expense.

B)All software production costs should be capitalized.

C)All software production costs should be recorded as R&D expense until technological feasibility is established.

D)All software production costs should be recorded in R&D expense until the product is available for general release to customers.

A)All software production costs should be recorded as R&D expense.

B)All software production costs should be capitalized.

C)All software production costs should be recorded as R&D expense until technological feasibility is established.

D)All software production costs should be recorded in R&D expense until the product is available for general release to customers.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following is an intangible asset that is not typically amortized?

A)patent

B)copyright

C)franchise

D)trademark

A)patent

B)copyright

C)franchise

D)trademark

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

40

During 2010, Farver Company incurred $200, 000 in legal fees in defending a patent with a carrying value of $2, 500, 000 against an infringement.Farver's lawyers were successful with the defense of the patent.The legal fees should be

A)expensed in 2010 and classified as ordinary expense

B)classified as an extraordinary item on the income statement for 2010

C)capitalized and amortized over the remaining legal life of the patent

D)capitalized and amortized over the remaining economic life or legal life of the patent, whichever is shorter

A)expensed in 2010 and classified as ordinary expense

B)classified as an extraordinary item on the income statement for 2010

C)capitalized and amortized over the remaining legal life of the patent

D)capitalized and amortized over the remaining economic life or legal life of the patent, whichever is shorter

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements concerning intangibles is true?

A)A copyright should be considered an intangible with an indefinite life.

B)Organization costs must be expensed as incurred.

C)A patent should be amortized over the shorter of the inventor's life or its economic life.

D)The registration of a trademark or trade name lasts for 20 years and is nonrenewable.

A)A copyright should be considered an intangible with an indefinite life.

B)Organization costs must be expensed as incurred.

C)A patent should be amortized over the shorter of the inventor's life or its economic life.

D)The registration of a trademark or trade name lasts for 20 years and is nonrenewable.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

42

Which of the following is not a required disclosure regarding intangible assets in the period a company acquires intangible assets?

A)the cost of any intangible assets acquired, separated into assets subject to amortization, assets not subject to amortization, and goodwill

B)for assets subject to amortization, the residual value and the weighted-average amortization period

C)the cost of any research and development acquired and written off, and where it is included in the income statement

D)the rate of return used to estimate the value of goodwill purchased

A)the cost of any intangible assets acquired, separated into assets subject to amortization, assets not subject to amortization, and goodwill

B)for assets subject to amortization, the residual value and the weighted-average amortization period

C)the cost of any research and development acquired and written off, and where it is included in the income statement

D)the rate of return used to estimate the value of goodwill purchased

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

43

Concerning computer software to be sold, leased, or otherwise marketed, which of the following costs are inventoriable and thus included in cost of goods sold?

A)maintenance and customer support costs

B)design, coding, and testing costs incurred before technological feasibility is established

C)costs of software developed for internal use

D)costs of disks, software duplication, and training materials

A)maintenance and customer support costs

B)design, coding, and testing costs incurred before technological feasibility is established

C)costs of software developed for internal use

D)costs of disks, software duplication, and training materials

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

44

On January 1, 2010, Cooseck Co.purchased for $360, 000 a patent that had been granted two years earlier.On January 1, 2012, legal costs of $64, 000 were incurred in a successful defense of the patent.Assuming the maximum period allowable is used for patent amortization, what is Cooseck's patent amortization expense for 2012?

A)$18, 000

B)$20, 000

C)$21, 555

D)$24, 000

A)$18, 000

B)$20, 000

C)$21, 555

D)$24, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

45

The cost of a copyright should

A)be amortized over a period not to exceed the life of the author plus 50 years

B)be amortized over a period not to exceed 20 years, unless the right is renewed

C)not be amortized and the cost should be capitalized as an asset with indefinite life

D)be amortized over a period not to exceed its economic life

A)be amortized over a period not to exceed the life of the author plus 50 years

B)be amortized over a period not to exceed 20 years, unless the right is renewed

C)not be amortized and the cost should be capitalized as an asset with indefinite life

D)be amortized over a period not to exceed its economic life

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

46

The Hui Company incurred the following expenditures in January 2010: (1)research and development costs of $210, 000 that resulted in a new product that was patented near year-end, (2)$6, 000 in legal fees to have the patent registered, (3)$90, 000 in advertising costs to develop a trademark for the newly patented product, (4)Legal fees of $8, 000 incurred with the registration of the trademark, and (5)$18, 000 of advertising costs to promote its good name.Benefits to be derived from the patent are expected to last for five years.The president believes the promotion of Hui's good name will benefit the firm for three years.How much amortization expense should Hui recognize for 2010?

A)$ 1, 200

B)$ 2, 800

C)$ 8, 800

D)$44, 800

A)$ 1, 200

B)$ 2, 800

C)$ 8, 800

D)$44, 800

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

47

Which statement regarding goodwill is true?

A)Goodwill is an unidentifiable intangible asset.

B)Internally developed goodwill should be capitalized while purchased goodwill should be expensed.

C)Goodwill can be defined as the value attached to the ability of a company to earn a higher than normal rate of return on the book value of its identifiable assets.

D)In some situations, GAAP requires that negative goodwill be recorded.

A)Goodwill is an unidentifiable intangible asset.

B)Internally developed goodwill should be capitalized while purchased goodwill should be expensed.

C)Goodwill can be defined as the value attached to the ability of a company to earn a higher than normal rate of return on the book value of its identifiable assets.

D)In some situations, GAAP requires that negative goodwill be recorded.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

48

Which statement about negative goodwill is true?

A)Negative goodwill is the amount by which the fair value of identifiable net assets acquired exceeds the price paid.

B)Negative goodwill results when the cash paid for a company exceeds the fair market value of the net assets acquired.

C)Negative goodwill should be recorded as a direct credit to retained earnings.

D)Negative goodwill should first be allocated proportionately to reduce the cost of all assets acquired (except long-term investments in marketable securities)on the basis of their relative market values.

A)Negative goodwill is the amount by which the fair value of identifiable net assets acquired exceeds the price paid.

B)Negative goodwill results when the cash paid for a company exceeds the fair market value of the net assets acquired.

C)Negative goodwill should be recorded as a direct credit to retained earnings.

D)Negative goodwill should first be allocated proportionately to reduce the cost of all assets acquired (except long-term investments in marketable securities)on the basis of their relative market values.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

49

Which of the following statements regarding goodwill is not true?

A)Goodwill is never amortized for financial reporting purposes.

B)A company must review its goodwill for impairment annually.

C)A company must review its goodwill for impairment whenever events or changes in circumstances occur that would more likely than not reduce the fair value below its carrying value.

D)A company records goodwill at the time that it acquires another company or at the time it determines that material intellectual capital exists in its employees.

A)Goodwill is never amortized for financial reporting purposes.

B)A company must review its goodwill for impairment annually.

C)A company must review its goodwill for impairment whenever events or changes in circumstances occur that would more likely than not reduce the fair value below its carrying value.

D)A company records goodwill at the time that it acquires another company or at the time it determines that material intellectual capital exists in its employees.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

50

Which of the following is not an internally developed intangible?

A)intellectual capital

B)advantageous geographical location

C)reputation for quality products

D)recorded goodwill

A)intellectual capital

B)advantageous geographical location

C)reputation for quality products

D)recorded goodwill

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is not a required disclosure regarding goodwill for each period a company presents a balance sheet?

A)the amount of goodwill acquired

B)the amount of goodwill sold

C)the amount of any impairment loss recognized

D)the amount of any goodwill included in the disposal of a reporting unit

A)the amount of goodwill acquired

B)the amount of goodwill sold

C)the amount of any impairment loss recognized

D)the amount of any goodwill included in the disposal of a reporting unit

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

52

As computer software to be sold, leased, or otherwise marketed is developed, software production costs should be accounted for according to which of the following?

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

53

Trademarks or trade names

A)must be renewed every 40 years

B)can be considered intangibles with indefinite lives

C)are developed internally and thus should not have any related costs capitalized and amortized

D)are synonymous with internally developed goodwill

A)must be renewed every 40 years

B)can be considered intangibles with indefinite lives

C)are developed internally and thus should not have any related costs capitalized and amortized

D)are synonymous with internally developed goodwill

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements concerning internally developed goodwill is true?

A)It is a separately identifiable asset.

B)It is capitalized at its cost.

C)The costs associated with its development are expensed as incurred.

D)Measuring its value is relatively easy and reliable.

A)It is a separately identifiable asset.

B)It is capitalized at its cost.

C)The costs associated with its development are expensed as incurred.

D)Measuring its value is relatively easy and reliable.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

55

At the beginning of 2010, Billy Co.purchased Willie Corp.The agreed fair value of Willie's net assets was $900, 000.The expected annual income for Willie was $60, 000.The normal return for the industry was 6%.Excess earnings were capitalized at 10%.How much of a premium (in excess of $900, 000)did Billy pay for Willie?

A)$ 600

B)$ 6, 000

C)$60, 000

D)$40, 000

A)$ 600

B)$ 6, 000

C)$60, 000

D)$40, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

56

At the beginning of 2010, Rector Corporation is considering the purchase of the Daphne Corporation.Daphne's recorded book value of its net assets is $390, 000, but the current market value of these net assets is $490, 000.In addition, the market value of an unrecorded identifiable intangible asset of the company is $75, 000.The estimated annual income of Daphne is $68, 000.The purchase price will be equal to the income is to be discounted in perpetuity at 10%.If Rector acquires Daphne, how much goodwill will be reported in the consolidated financial statements prepared at the end of 2010?

A)$ 75, 000

B)$115, 000

C)$175, 000

D)$290, 000

A)$ 75, 000

B)$115, 000

C)$175, 000

D)$290, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements regarding intangible assets is true?

A)The expected useful life of an intangible asset is generally easier to estimate than the expected useful life of a tangible noncurrent asset.

B)The cost of an intangible asset is not permitted to be amortized for income tax purposes.

C)Intangible assets have a lower degree of uncertainty with regard to their expected future benefits than tangible noncurrent assets.

D)The accumulated amortization for intangible assets that are amortized must be disclosed.

A)The expected useful life of an intangible asset is generally easier to estimate than the expected useful life of a tangible noncurrent asset.

B)The cost of an intangible asset is not permitted to be amortized for income tax purposes.

C)Intangible assets have a lower degree of uncertainty with regard to their expected future benefits than tangible noncurrent assets.

D)The accumulated amortization for intangible assets that are amortized must be disclosed.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is not a required disclosure regarding intangible assets that are amortized for each period a company presents a balance sheet?

A)the total cost

B)the accumulated amortization

C)the amortization expense

D)the estimated amortization expense for the next ten years

A)the total cost

B)the accumulated amortization

C)the amortization expense

D)the estimated amortization expense for the next ten years

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

59

The Cougar Company was formed in early 2010.At the time of formation, Cougar spent the following amounts: accounting fees, $4, 000; legal fees, $8, 000; stock certificate costs, $3, 000; initial franchise fee, $10, 000; initial lease payment, $5, 000; promotional fees, $3, 000.Cougar intends to capitalize and amortize intangibles over the maximum allowable period in accordance with generally accepted accounting principles.Based on this strategy, what is Cougar's expense associated with organization costs in 2010?

A)$ 6, 000

B)$18, 000

C)$28, 000

D)$33, 000

A)$ 6, 000

B)$18, 000

C)$28, 000

D)$33, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

60

The Apple Company agreed to purchase the Pear Company for $750, 000.At the date of purchase, Pear had current assets with a fair market value of $500, 000, noncurrent assets (including no marketable securities)with a fair market value of $800, 000, and liabilities of $600, 000.In accounting for this transaction, Apple should

A)record noncurrent assets at $750, 000

B)record a debit of $50, 000 as a loss on the purchase

C)record goodwill of $50, 000 to be reviewed annually for impairment

D)record current assets at $550, 000

A)record noncurrent assets at $750, 000

B)record a debit of $50, 000 as a loss on the purchase

C)record goodwill of $50, 000 to be reviewed annually for impairment

D)record current assets at $550, 000

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

61

Consider the following information from a company's records for 2010:

Required:

Required:

a. Compute the amount of R\&D costs that should be classified as expensesin determining 2010 net income.

b. For any listed item not included in your answer to requirement 1 , provide the rationale for not expensing it.

Required:

Required:a. Compute the amount of R\&D costs that should be classified as expensesin determining 2010 net income.

b. For any listed item not included in your answer to requirement 1 , provide the rationale for not expensing it.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

62

The Jessie Company acquired a competitor company in January 2010.When Jessie's accountant recorded the purchase, she correctly recorded an amount for goodwill based on the expectation of the acquired company's earning a rate of return on its assets that was in excess of the industry's rate of return.In fact, the acquired company doubled the expected rate of return in 2010 and 2011.As a result of these increased earnings, in early 2012 the president of the Jessie Company asked the company's accountant to increase the amount recognized as goodwill.

Required:

Required:

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

63

Young Co.received a patent on a new type of machine.The legal costs and the patent application costs totaled $80, 000.R&D costs incurred to create the machine were $120, 000.In the year in which the company received the patent, $20, 000 was spent in the successful defense of a patent infringement suit.

Required:

At what amount should the patent be capitalized?

Required:

At what amount should the patent be capitalized?

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

64

FASB has argued that not amortizing certain intangible assets is inappropriate because they have indefinite lives.This argument is supported by which theoretical characteristic?

A)understandability

B)representationally faithful

C)relevance

D)decision usefulness

A)understandability

B)representationally faithful

C)relevance

D)decision usefulness

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

65

On January 1, 2010, Sable, Inc.bought a patent for $100, 000.There were ten years left of the patent's legal life.On July 1, 2012, the company successfully defended the patent in court at a cost of $30, 000.

Required:

Compute the amount of patent amortization expense for 2012.Assume Sable calculates amortization to the nearest month and uses the straight-line method.

Required:

Compute the amount of patent amortization expense for 2012.Assume Sable calculates amortization to the nearest month and uses the straight-line method.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

66

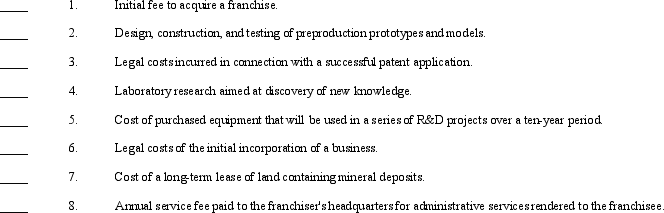

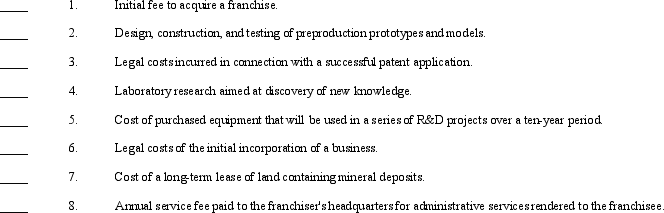

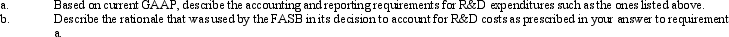

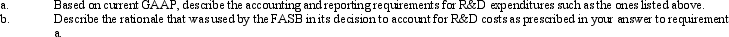

Certain activities are listed below.

Required:

Required:

List by letter the activities that would be considered in determining R&D costs.

Required:

Required:List by letter the activities that would be considered in determining R&D costs.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

67

Impairment losses may be reversed under

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

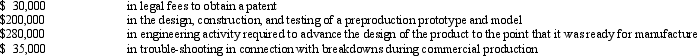

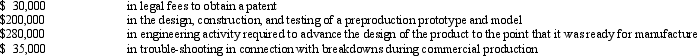

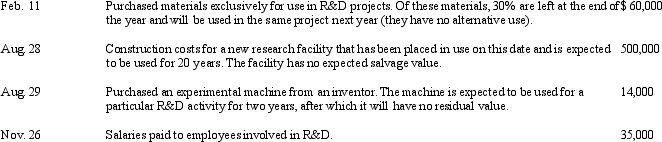

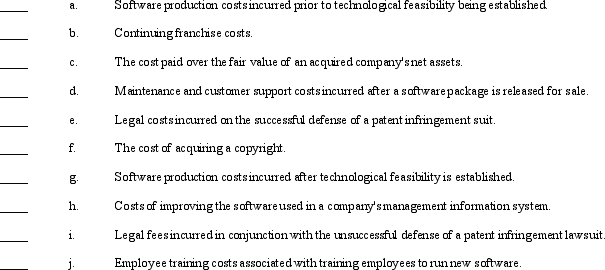

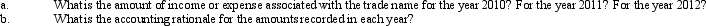

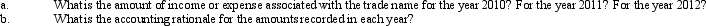

68

Costs associated with various intangibles of a company may either be expensed when incurred or capitalized and amortized.Such costs might be recorded in any of the following ways:

a. charged to the patent account and amortized

b. charged to the franchise ac count and amortized

c. charged to other appropriate asset ac counts and amortized or depreciateo

d. charged to expense when incurred

Required:

Indicate how each of the following costs should be recorded by placing the appropriate letter (a-d)in the space provided.

a. charged to the patent account and amortized

b. charged to the franchise ac count and amortized

c. charged to other appropriate asset ac counts and amortized or depreciateo

d. charged to expense when incurred

Required:

Indicate how each of the following costs should be recorded by placing the appropriate letter (a-d)in the space provided.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

69

Routine accounting for goodwill under IFRS versus GAAP is

A)the same

B)completely different

C)different because IFRS amortize goodwill in a systematic way

D)different because IFRS amortize goodwill in a rational way

A)the same

B)completely different

C)different because IFRS amortize goodwill in a systematic way

D)different because IFRS amortize goodwill in a rational way

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

70

The Arnao Corporation is contemplating building a research and development facility and performing R&D activities in the area of robotics.The president of the company is interested in the accounting required for R&D costs such as materials, facilities, personnel costs, equipment, intangibles purchased from others, and any indirect costs.Arnao's president has asked the company's controller to describe current GAAP requirements with respect to R&D expenditures.

Required:

Required:

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

71

The determination of impairment losses differs under IFRS versus GAAP in that

A)only GAAP permits a value-in-use estimate

B)only IFRS employs a disposal approach as a measure of fair value

C)only GAAP compares the fair value to cost

D)only IFRS permits a value-in-use estimate

A)only GAAP permits a value-in-use estimate

B)only IFRS employs a disposal approach as a measure of fair value

C)only GAAP compares the fair value to cost

D)only IFRS permits a value-in-use estimate

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

72

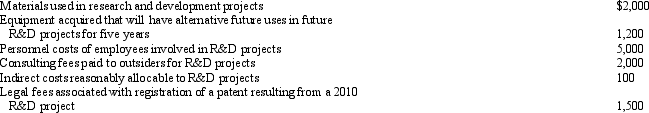

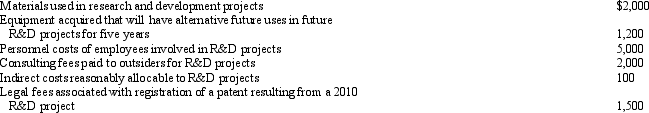

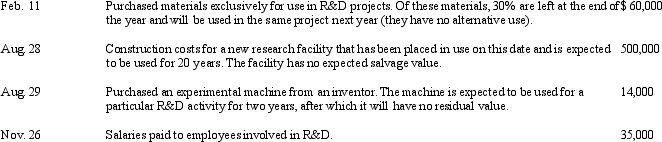

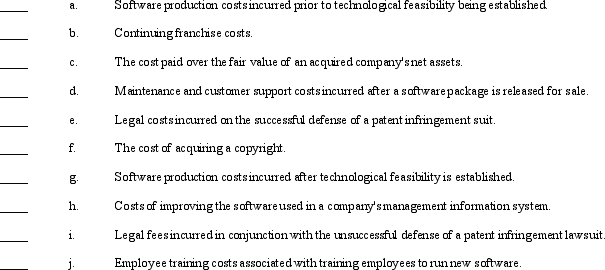

Consider the following information from a company's records for 2010:

Required:

Required:

Compute the amount of R&D expense for 2010.The company normally uses straight-line depreciation for plant assets.

Required:

Required:Compute the amount of R&D expense for 2010.The company normally uses straight-line depreciation for plant assets.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

73

An argument in favor of capitalizing purchased goodwill is that the cost of the purchased goodwill is supported by which theoretical characteristic?

A)relevance

B)reliability

C)decision usefulness

D)understandability

A)relevance

B)reliability

C)decision usefulness

D)understandability

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

74

GAAP requires that research and development costs be expensed and that purchased goodwill be capitalized and not be amortized.

Required:

From a conceptual viewpoint, discuss the validity of the different treatments for these two types of expenditures.

Required:

From a conceptual viewpoint, discuss the validity of the different treatments for these two types of expenditures.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

75

Listed below is a series of statements about various costs associated with intangibles.

Required:

Required:

Indicate whether each of these costs should be expensed (E)or capitalized (C)in the space provided.

Required:

Required:Indicate whether each of these costs should be expensed (E)or capitalized (C)in the space provided.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

76

The Jared Corporation is contemplating the acquisition of the Jonathan Company.Jared believes that Jonathan has goodwill, but Jared is not clear as to how to determine a value of Jonathan Company's goodwill.

Required:

Describe briefly the series of steps that should be used by Jared Corporation in calculating an estimate of the value of Jonathan Company's goodwill.

Required:

Describe briefly the series of steps that should be used by Jared Corporation in calculating an estimate of the value of Jonathan Company's goodwill.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

77

In March of 2010, Xeon Corp.applied for a trade name.Legal costs associated with the application were $25, 000.At the time of filing the application, the company projected extra annual income to be generated through having the trade name to be $100, 000.On Feb.5, 2012, the company incurred $20, 000 in an unsuccessful defense of the trade name.

Required:

Required:

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

78

An inconsistency in accounting theory can occur because

A)internally developed goodwill is expensed, while purchased goodwill is capitalized

B)both internally developed goodwill and purchased goodwill are expensed

C)internally developed goodwill is capitalized, while purchased goodwill is expensed

D)both internally developed goodwill and purchased goodwill are capitalized

A)internally developed goodwill is expensed, while purchased goodwill is capitalized

B)both internally developed goodwill and purchased goodwill are expensed

C)internally developed goodwill is capitalized, while purchased goodwill is expensed

D)both internally developed goodwill and purchased goodwill are capitalized

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

79

Related to in-process R&D, the acquiring company may

A)capitalize it

B)treat it as an intangible asset

C)increase the amount of goodwill

D)establish a patent in the name of the purchased company

A)capitalize it

B)treat it as an intangible asset

C)increase the amount of goodwill

D)establish a patent in the name of the purchased company

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck

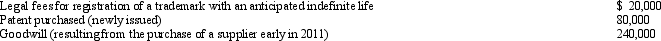

80

The Lopez Company was organized at the end of 2010.The following items acquired on January 1, 2011, were listed by the company as intangible assets at the end of 2011:

At the beginning of 2011, Lopez also purchased a research building at a cost of $275, 000.The company estimates that the building will be used in numerous projects over a 20-year period.During the year, Lopez spent $75, 000 on research and development materials and salaries.In early January 2011, Lopez purchased a patent for $60, 000 that was used exclusively for a single research project conducted during 2011.Lopez uses straight-line amortization over the maximum allowable periods.In addition, on July 1, 2011, Lopez incurred legal fees of $23, 400 to defend the new patent that had been acquired for $60, 000.Lopez's lawyers were successful in the defense of the patent.

At the beginning of 2011, Lopez also purchased a research building at a cost of $275, 000.The company estimates that the building will be used in numerous projects over a 20-year period.During the year, Lopez spent $75, 000 on research and development materials and salaries.In early January 2011, Lopez purchased a patent for $60, 000 that was used exclusively for a single research project conducted during 2011.Lopez uses straight-line amortization over the maximum allowable periods.In addition, on July 1, 2011, Lopez incurred legal fees of $23, 400 to defend the new patent that had been acquired for $60, 000.Lopez's lawyers were successful in the defense of the patent.

Required:

Determine the amortization expense for intangibles for 2011.Lopez calculates amortization expense to the nearest month.

At the beginning of 2011, Lopez also purchased a research building at a cost of $275, 000.The company estimates that the building will be used in numerous projects over a 20-year period.During the year, Lopez spent $75, 000 on research and development materials and salaries.In early January 2011, Lopez purchased a patent for $60, 000 that was used exclusively for a single research project conducted during 2011.Lopez uses straight-line amortization over the maximum allowable periods.In addition, on July 1, 2011, Lopez incurred legal fees of $23, 400 to defend the new patent that had been acquired for $60, 000.Lopez's lawyers were successful in the defense of the patent.

At the beginning of 2011, Lopez also purchased a research building at a cost of $275, 000.The company estimates that the building will be used in numerous projects over a 20-year period.During the year, Lopez spent $75, 000 on research and development materials and salaries.In early January 2011, Lopez purchased a patent for $60, 000 that was used exclusively for a single research project conducted during 2011.Lopez uses straight-line amortization over the maximum allowable periods.In addition, on July 1, 2011, Lopez incurred legal fees of $23, 400 to defend the new patent that had been acquired for $60, 000.Lopez's lawyers were successful in the defense of the patent.Required:

Determine the amortization expense for intangibles for 2011.Lopez calculates amortization expense to the nearest month.

Unlock Deck

Unlock for access to all 81 flashcards in this deck.

Unlock Deck

k this deck