Deck 13: Current Liabilities and Contingencies

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/98

Play

Full screen (f)

Deck 13: Current Liabilities and Contingencies

1

Which of the following statements is true?

A)One of the essential characteristics of a liability is that the transaction or other event obligating the entity will probably occur in the future.

B)To be a liability, there must be a duty or responsibility that obligates a particular entity.

C)To qualify as a liability, there must be a legally enforceable claim.

D)In order to have a liability, the identity of the recipient must be known.

A)One of the essential characteristics of a liability is that the transaction or other event obligating the entity will probably occur in the future.

B)To be a liability, there must be a duty or responsibility that obligates a particular entity.

C)To qualify as a liability, there must be a legally enforceable claim.

D)In order to have a liability, the identity of the recipient must be known.

B

2

Which is not a characteristic of a liability?

A)There will be a probable future transfer or use of assets.

B)There is little or no discretion to avoid the future sacrifice.

C)The obligating transaction or event must have already happened.

D)A legally enforceable claim must be present.

A)There will be a probable future transfer or use of assets.

B)There is little or no discretion to avoid the future sacrifice.

C)The obligating transaction or event must have already happened.

D)A legally enforceable claim must be present.

D

3

Management of current liabilities arises, in part, because of a concern over

A)profitability

B)liquidity

C)relevance

D)reliability

A)profitability

B)liquidity

C)relevance

D)reliability

B

4

On December 1, 2010, Young Co.borrowed money at the bank by signing a 90-day non-interest-bearing note for $24, 000 that was discounted at 8%.Which of the following entries is correct?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

5

Conceptually, all liabilities should be reported on the balance sheet at

A)the present value of the future outlays they require

B)their maturity value

C)face amount

D)their current cash equivalent amount

A)the present value of the future outlays they require

B)their maturity value

C)face amount

D)their current cash equivalent amount

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

6

Current liabilities are obligations whose liquidation is reasonably expected to require the use of existing current assets or the creation of other current liabilities within

A)one year or operating cycle, whichever is longer

B)one year

C)one year or operating cycle, whichever is shorter

D)an operating cycle

A)one year or operating cycle, whichever is longer

B)one year

C)one year or operating cycle, whichever is shorter

D)an operating cycle

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

7

The operating cycle is typically defined as the time it requires to convert

A)cash to inventory to receivables

B)raw materials to finished goods

C)finished goods to receivables to cash

D)cash to inventory to receivables to cash

A)cash to inventory to receivables

B)raw materials to finished goods

C)finished goods to receivables to cash

D)cash to inventory to receivables to cash

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

8

On the balance sheet, liabilities are generally classified as

A)current or long-term

B)legal or nonlegal

C)material or immaterial

D)probable or estimated

A)current or long-term

B)legal or nonlegal

C)material or immaterial

D)probable or estimated

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

9

Under current standards of the FASB, liabilities include

A)only legal obligations

B)both legal and illegal obligations

C)both legal and nonlegal obligations

D)legal, nonlegal, and illegal obligations

A)only legal obligations

B)both legal and illegal obligations

C)both legal and nonlegal obligations

D)legal, nonlegal, and illegal obligations

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following statements is true?

A)GAAP requires that unconditional non-cancellable purchase obligations be accrued and reported as liabilities on the balance sheet.

B)Unearned revenues collected in advance should be classified as deferred credits on the balance sheet.

C)GAAP requires that footnote disclosures of future payments resulting from off-balance-sheet financing transactions be disclosed separately for only the next five years.

D)If a company sells goods and agrees to repurchase them at a specified price, both a sale and a current liability should be recorded if the requirements of GAAP are to be met.

A)GAAP requires that unconditional non-cancellable purchase obligations be accrued and reported as liabilities on the balance sheet.

B)Unearned revenues collected in advance should be classified as deferred credits on the balance sheet.

C)GAAP requires that footnote disclosures of future payments resulting from off-balance-sheet financing transactions be disclosed separately for only the next five years.

D)If a company sells goods and agrees to repurchase them at a specified price, both a sale and a current liability should be recorded if the requirements of GAAP are to be met.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements does not describe an essential characteristic of a liability?

A)A liability is a present obligation that will be settled by a probable future transfer or use of assets.

B)The obligated entity has little or no discretion to avoid the future sacrifice.

C)The identity of the recipient must be known to the obligated party.

D)The transaction or event obligating the enterprise has already occurred.

A)A liability is a present obligation that will be settled by a probable future transfer or use of assets.

B)The obligated entity has little or no discretion to avoid the future sacrifice.

C)The identity of the recipient must be known to the obligated party.

D)The transaction or event obligating the enterprise has already occurred.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

12

Which of the following statements is not true?

A)A dividend payable in shares of the issuing company's stock is not reported as a current liability.

B)Interest and dividends accrue as a liability as time passes.

C)The declaration of a dividend may not result in a current liability.

D)Undeclared dividends in arrears on cumulative preferred stock are not recognized as a liability.

A)A dividend payable in shares of the issuing company's stock is not reported as a current liability.

B)Interest and dividends accrue as a liability as time passes.

C)The declaration of a dividend may not result in a current liability.

D)Undeclared dividends in arrears on cumulative preferred stock are not recognized as a liability.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

13

All of the following are examples of legal liabilities except

A)notes payable

B)sales tax payable

C)sick pay payable (may be taken as time off)

D)property taxes payable

A)notes payable

B)sales tax payable

C)sick pay payable (may be taken as time off)

D)property taxes payable

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

14

Discount on Notes Payable should be classified as a

A)current asset

B)contra account to Notes Payable

C)part of stockholders' equity

D)deferred debit

A)current asset

B)contra account to Notes Payable

C)part of stockholders' equity

D)deferred debit

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is a legal liability?

A)sick pay that may be taken as time off

B)sales taxes payable to the state

C)gambling debt owed

D)bribes due to foreign traders

A)sick pay that may be taken as time off

B)sales taxes payable to the state

C)gambling debt owed

D)bribes due to foreign traders

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements is true?

A)A dividend payable in shares of the issuing company's stock is reported as a current liability.

B)Interest and dividends accrue as a liability as time passes.

C)Declaration of a dividend may not necessarily result in a current liability.

D)Dividends on cumulative preferred stock, even though undeclared, are a liability.

A)A dividend payable in shares of the issuing company's stock is reported as a current liability.

B)Interest and dividends accrue as a liability as time passes.

C)Declaration of a dividend may not necessarily result in a current liability.

D)Dividends on cumulative preferred stock, even though undeclared, are a liability.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following is the most appropriate way to display liabilities on the balance sheet?

A)nearness to maturity

B)relative likelihood of payment

C)order of magnitude

D)alphabetically by payee

A)nearness to maturity

B)relative likelihood of payment

C)order of magnitude

D)alphabetically by payee

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following statements regarding the gross and net methods for recording trade accounts payable is true?

A)The net method overstates accounts payable at the end of the accounting period.

B)The net method is more widely used in practice than is the gross method.

C)The gross method more accurately measures liquidity.

D)The net method highlights management inefficiency because purchase discounts lost are recorded whenever an invoice is paid after the cash discount period has expired.

A)The net method overstates accounts payable at the end of the accounting period.

B)The net method is more widely used in practice than is the gross method.

C)The gross method more accurately measures liquidity.

D)The net method highlights management inefficiency because purchase discounts lost are recorded whenever an invoice is paid after the cash discount period has expired.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

19

On December 1, 2010, Brothers, Inc.borrowed money at the bank by signing a 90-day non-interest-bearing note for $40, 000 that was discounted at 12%.Which of the following entries is not correct?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

20

With regard to liabilities, liquidity refers to

A)a company's ability to convert its assets to cash to pay its liabilities

B)a company's ability to use its financial resources to adapt to change

C)a company's operating cycle

D)only liabilities and not assets

A)a company's ability to convert its assets to cash to pay its liabilities

B)a company's ability to use its financial resources to adapt to change

C)a company's operating cycle

D)only liabilities and not assets

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

21

Sick pay benefits that are related to an employee's services already rendered, whose payment is probable and the amount reasonably estimated, must be accrued and recognized as a current liability if the obligation relates to rights that

A)I

B)II

C)III

D)IV

A)I

B)II

C)III

D)IV

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

22

GAAP relating to compensated absences

A)applies to items such as vacation pay, severance pay, sick pay, and other long-term fringe benefits

B)establishes the same accruing standards for vacation pay, holiday pay, and sick pay

C)requires the use of current pay rates to accrue for compensated absences

D)does not require the accrual of accumulated nonvested sick pay

A)applies to items such as vacation pay, severance pay, sick pay, and other long-term fringe benefits

B)establishes the same accruing standards for vacation pay, holiday pay, and sick pay

C)requires the use of current pay rates to accrue for compensated absences

D)does not require the accrual of accumulated nonvested sick pay

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

23

All of the following payroll taxes are levied against the employer except

A)FICA taxes

B)federal unemployment taxes

C)state unemployment taxes

D)federal income taxes withheld

A)FICA taxes

B)federal unemployment taxes

C)state unemployment taxes

D)federal income taxes withheld

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

24

The Ancira Company closed its books annually on December 31, while the city in which it is located has a fiscal year beginning on April 1 and ending on March 31.Taxes on property are assessed on April 1 of each year.Property taxes in the amount of $360, 000 and $400, 000 were assessed on April 1, 2010 and 2011, respectively.For the year ended December 31, 2011, the Ancira Company would report property tax expense of

A)$360, 000

B)$370, 000

C)$380, 000

D)$390, 000

A)$360, 000

B)$370, 000

C)$380, 000

D)$390, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

25

Which of the following is the best rationale for the recommended method of accounting for property taxes?

A)Governmental agencies levy arbitrary amounts to corporations for property taxes.

B)Governmental agencies levy an assessment against corporations as municipal services are utilized.

C)Government agencies levy tax assessments on a specific date but provide services throughout the year.

D)Governmental agencies levy tax assessments during the year but only provide services periodically.

A)Governmental agencies levy arbitrary amounts to corporations for property taxes.

B)Governmental agencies levy an assessment against corporations as municipal services are utilized.

C)Government agencies levy tax assessments on a specific date but provide services throughout the year.

D)Governmental agencies levy tax assessments during the year but only provide services periodically.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

26

Baker, a branch manager, is allowed a bonus of 10% of income after bonus and tax.If the tax rate is 30% and income before bonus and tax is $200, 000, what is Mr.Baker's bonus?

A)$13, 084

B)$14, 000

C)$14, 433

D)$20, 000

A)$13, 084

B)$14, 000

C)$14, 433

D)$20, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

27

Voluntary payroll deductions may include all of the following except

A)union dues

B)401K deductions

C)group hospital insurance

D)FICA taxes

A)union dues

B)401K deductions

C)group hospital insurance

D)FICA taxes

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

28

Carl's Video includes the amount of sales taxes collected directly in the price charged for merchandise, and the total amount is credited to Sales.During January, Sales was credited for $239, 680.The January 31 adjusting entry to account for a 7% state sales tax should be

A)

Sales

Sales Taxes Payable

B)

Sales Tax Expense

Sales Taxes Payable

C)

Sales

Sales Taxes Payable

D)

A)

Sales

Sales Taxes Payable

B)

Sales Tax Expense

Sales Taxes Payable

C)

Sales

Sales Taxes Payable

D)

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

29

Unearned or deferred revenue can occur when

A)services are provided prior to receipt of cash

B)goods are sold on account

C)services are provided after the receipt of cash

D)goods are sold for cash

A)services are provided prior to receipt of cash

B)goods are sold on account

C)services are provided after the receipt of cash

D)goods are sold for cash

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

30

Consolidated Business Services introduced a new machine on January 1, 2010.The machine carried a two-year warranty against defects.The estimated warranty costs related to dollar sales were 3% in the year of sale and 5% in the year after sale.Additional information follows: If the expense warranty accrual method is used, what amount relating to warranties should be reflected on the December 31, 2011, balance sheet?

A)$5, 300

B)$6, 400

C)$6, 500

D)$9, 100

A)$5, 300

B)$6, 400

C)$6, 500

D)$9, 100

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements regarding the gross and net methods for trade accounts payable is not true?

A)The net method overstates accounts payable at the end of the accounting period.

B)The net method highlights management inefficiency because purchase discounts lost are recorded whenever an invoice is paid after the cash discount period has expired.

C)The gross method is more widely used in practice.

D)The net method more accurately measures liquidity.

A)The net method overstates accounts payable at the end of the accounting period.

B)The net method highlights management inefficiency because purchase discounts lost are recorded whenever an invoice is paid after the cash discount period has expired.

C)The gross method is more widely used in practice.

D)The net method more accurately measures liquidity.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

32

Bonita places a coupon in each box of its product.Customers may send in five coupons and $3, and the company will send them a recipe book.Sufficient books were purchased at a cost of $5 each.A total of 400, 000 boxes of product were sold in 2010.It was estimated that 6% of the coupons would be redeemed.During 2010, 8, 000 coupons were redeemed.Which entry should be made at December 31, 2010?

A)

Premium Expense

Estimated Premium Claims Outstanding

B)

Premium Expense

Estimated Premium Claims Outstanding

C)

D)

Premium Expense

Estimated Premium Claims Outstanding

A)

Premium Expense

Estimated Premium Claims Outstanding

B)

Premium Expense

Estimated Premium Claims Outstanding

C)

D)

Premium Expense

Estimated Premium Claims Outstanding

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

33

Which journal entry would probably be made if the modified cash basis of accounting for warranties is in use for a sale made in 2010?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

34

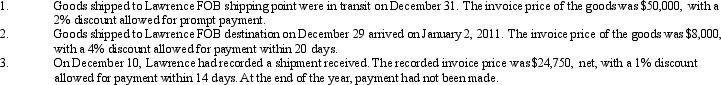

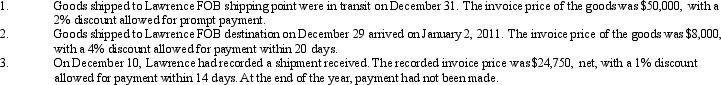

The Lawrence Company records its trade accounts payable net of any cash discounts.At the end of 2010, Lawrence had a balance of $300, 000 in its trade accounts payable account before any adjustments related to the following items:  At what amount should Lawrence report trade accounts payable on its December 31, 2010 balance sheet?

At what amount should Lawrence report trade accounts payable on its December 31, 2010 balance sheet?

A)$349, 000

B)$349, 250

C)$356, 680

D)$356, 930

At what amount should Lawrence report trade accounts payable on its December 31, 2010 balance sheet?

At what amount should Lawrence report trade accounts payable on its December 31, 2010 balance sheet?A)$349, 000

B)$349, 250

C)$356, 680

D)$356, 930

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following dividends are not considered current liabilities when declared?

A)property dividends

B)stock dividends

C)scrip dividends

D)cash dividends

A)property dividends

B)stock dividends

C)scrip dividends

D)cash dividends

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

36

According to current GAAP, which of the following is not a condition suggesting that an accrual for vacation pay be made?

A)The obligation must relate to rights that vest.

B)The payment of compensation is probable.

C)The obligation must relate to employee services already rendered.

D)The amount can be reasonably estimated.

A)The obligation must relate to rights that vest.

B)The payment of compensation is probable.

C)The obligation must relate to employee services already rendered.

D)The amount can be reasonably estimated.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

37

On January 1, 2010, the Long Company signed a six-month, non-interest-bearing note payable for $160, 000 and received $152, 800 from Friendly Bank.On January 31, 2010, what amount should Long record for interest expense, and what is the net carrying value of the note?

A)$1, 200; $151, 600

B)$ 0; $160, 000

C)$7, 200; $160, 000

D)$1, 200; $154, 000

A)$1, 200; $151, 600

B)$ 0; $160, 000

C)$7, 200; $160, 000

D)$1, 200; $154, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

38

Miller Company provides a bonus compensation plan under which key employees receive bonuses equal to 10% of Miller's income after deducting income taxes but before deducting the bonus.If income before income tax and the bonus is $400, 000 and the income tax rate is 30%, the bonuses should total

A)$27, 160

B)$28, 866

C)$36, 400

D)$40, 000

A)$27, 160

B)$28, 866

C)$36, 400

D)$40, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

39

Analysts use the quick ratio (also known as the acid test ratio)and the current ratio.The use of both ratios has become common because

A)the quick ratio is much easier to compute than the current ratio

B)interpretation of the current ratio is more difficult because of its complexity

C)the acid test is a more severe test of a company's liquidity

D)the acid test a better measure of management's effectiveness

A)the quick ratio is much easier to compute than the current ratio

B)interpretation of the current ratio is more difficult because of its complexity

C)the acid test is a more severe test of a company's liquidity

D)the acid test a better measure of management's effectiveness

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

40

Which payroll tax is imposed on both the employee and the employer?

A)federal income tax

B)state unemployment tax

C)FICA tax

D)federal unemployment tax

A)federal income tax

B)state unemployment tax

C)FICA tax

D)federal unemployment tax

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

41

Which of the following statements is not true?

A)Loss contingencies should be disclosed if there is just a reasonable possibility of a loss.

B)Indirect guarantees should normally be disclosed by footnote, not by accrual.

C)In the case of loss contingencies, accrual can be made even if the exact payee and payment date are not known.

D)Losses may be accrued for unasserted claims and other potential unfiled lawsuits.

A)Loss contingencies should be disclosed if there is just a reasonable possibility of a loss.

B)Indirect guarantees should normally be disclosed by footnote, not by accrual.

C)In the case of loss contingencies, accrual can be made even if the exact payee and payment date are not known.

D)Losses may be accrued for unasserted claims and other potential unfiled lawsuits.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

42

Exhibit 13-2 In 2010, the Markel Company sold 14, 000 washing machines.Markel estimated that 12% of the machines would require repairs under the two-year warranty at an average cost of $50.During 2010, Markel had an actual outlay of $48, 000 for repairs under warranty.Markel uses the expense warranty accrual method.

-

Refer to Exhibit 13-2.At what amount should the company record warranty expense for 2010?

A)$42, 000

B)$48, 000

C)$84, 000

D)$96, 000

-

Refer to Exhibit 13-2.At what amount should the company record warranty expense for 2010?

A)$42, 000

B)$48, 000

C)$84, 000

D)$96, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

43

Exhibit 13-1 The Jung Company includes a premium in each box of its cereal.For four premiums plus $2.00, customers are entitled to a plastic doll that costs Jung $4.50 each.Jung expects 60% of the premiums to be redeemed.In 2010, Jung sold 500, 000 boxes of cereal and distributed 25, 000 dolls.

-

Refer to Exhibit 13-1.What is Jung's premium expense for 2010?

A)$125, 000

B)$187, 500

C)$225, 000

D)$337, 500

-

Refer to Exhibit 13-1.What is Jung's premium expense for 2010?

A)$125, 000

B)$187, 500

C)$225, 000

D)$337, 500

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

44

Exhibit 13-5 Tractor Company estimates its annual warranty expense at 4% of annual net sales.The following information relates to the calendar year 2010:

- Refer to Exhibit 13-5.The amount of warranty expense for 2010 is

A)$ 80, 000

B)$120, 000

C)$140, 000

D)$240, 000

- Refer to Exhibit 13-5.The amount of warranty expense for 2010 is

A)$ 80, 000

B)$120, 000

C)$140, 000

D)$240, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

45

Concerning accounting for warranties, which of the following statements is true?

A)The expense warranty accrual method is the only method accepted for federal income tax purposes.

B)The modified cash basis is the most often used method for financial reporting.

C)The sales warranty accrual method uses a percentage of completion approach to warranty revenue recognition.

D)The modified cash basis recognizes warranty expense when cash is received on the sale.

A)The expense warranty accrual method is the only method accepted for federal income tax purposes.

B)The modified cash basis is the most often used method for financial reporting.

C)The sales warranty accrual method uses a percentage of completion approach to warranty revenue recognition.

D)The modified cash basis recognizes warranty expense when cash is received on the sale.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

46

Exhibit 13-4 During 2010, the Alexandra Company began selling a new type of machine that carries a two-year warranty against all defects.Based on past industry and company experience, estimated warranty costs should total $2, 000 per machine sold.During 2010, sales and actual warranty expenditures were $2, 000, 000 (40 machines)and $22, 000, respectively.

-

Refer to Exhibit 13-4.What amount should Alexandra report as its warranty expense for 2010?

A)$ 0

B)$ 22, 000

C)$ 80, 000

D)$160, 000

-

Refer to Exhibit 13-4.What amount should Alexandra report as its warranty expense for 2010?

A)$ 0

B)$ 22, 000

C)$ 80, 000

D)$160, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

47

Exhibit 13-5 Tractor Company estimates its annual warranty expense at 4% of annual net sales.The following information relates to the calendar year 2010:

- Refer to Exhibit 13-5.The amount of expenditures for warranty costs for 2010 is

A)$ 80, 000

B)$120, 000

C)$140, 000

D)$240, 000

- Refer to Exhibit 13-5.The amount of expenditures for warranty costs for 2010 is

A)$ 80, 000

B)$120, 000

C)$140, 000

D)$240, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

48

Prince sells a certain product for $20, 000.Included in this price is an implied service contract of $800.Fifty machines were sold in 2010.Warranty expense incurred during 2010 amounted to $25, 000.The company uses the sales warranty accrual method.Which entry would probably not be made in 2010?

A)

B)

C)

D)

A)

B)

C)

D)

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

49

Concerning accounting for warranties, which of the following statements is false?

A)The expense warranty accrual method is not an acceptable method for federal income tax purposes.

B)The modified cash basis is the most conceptually sound method for financial reporting.

C)The sales warranty accrual method uses a cost recovery approach to warranty revenue recognition.

D)The modified cash basis recognizes warranty expense when cash is paid for the repairs to merchandise under warranty.

A)The expense warranty accrual method is not an acceptable method for federal income tax purposes.

B)The modified cash basis is the most conceptually sound method for financial reporting.

C)The sales warranty accrual method uses a cost recovery approach to warranty revenue recognition.

D)The modified cash basis recognizes warranty expense when cash is paid for the repairs to merchandise under warranty.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

50

The Chipo Company includes one coupon having no expiration date with its deluxe snack pack.Upon return of 10 coupons, Chipo will send a silver chip clip, which costs Chipo $1.50 each.Past experience indicates that 30% of coupons issued will be redeemed.Chipo began this promotion in 2010 and sold 1, 000, 000 deluxe snack packs.During 2010, 90, 000 coupons were received and 9, 000 chip clips were distributed to customers.The December 31, 2010 balance sheet should include a liability for coupons outstanding of

A)$ 18, 000

B)$180, 000

C)$ 31, 500

D)$ 50, 000

A)$ 18, 000

B)$180, 000

C)$ 31, 500

D)$ 50, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following is the best rationale for the recommended method of accounting for advertising cost?

A)It is difficult to measure the benefit.

B)Advertising is very expensive.

C)GAAP provides no guidance for making this decision.

D)The marketing manager is in the best position to determine in which year the advertising expense should be recognized.

A)It is difficult to measure the benefit.

B)Advertising is very expensive.

C)GAAP provides no guidance for making this decision.

D)The marketing manager is in the best position to determine in which year the advertising expense should be recognized.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

52

Liabilities whose amounts must be estimated are disclosed in financial statements by

A)including details in the footnotes

B)describing the estimated liabilities among the liabilities on the balance sheet but not including the amounts in the liability totals

C)an appropriation of retained earnings

D)including the amounts in the liability totals

A)including details in the footnotes

B)describing the estimated liabilities among the liabilities on the balance sheet but not including the amounts in the liability totals

C)an appropriation of retained earnings

D)including the amounts in the liability totals

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

53

Exhibit 13-2 In 2010, the Markel Company sold 14, 000 washing machines.Markel estimated that 12% of the machines would require repairs under the two-year warranty at an average cost of $50.During 2010, Markel had an actual outlay of $48, 000 for repairs under warranty.Markel uses the expense warranty accrual method.

-

Refer to Exhibit 13-2.What amount should the company report for estimated liability under warranties at the end of 2010?

A)$36, 000

B)$42, 000

C)$48, 000

D)$84, 000

-

Refer to Exhibit 13-2.What amount should the company report for estimated liability under warranties at the end of 2010?

A)$36, 000

B)$42, 000

C)$48, 000

D)$84, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

54

Exhibit 13-3 Paul Company includes three coupons in each package of crackers it sells.In exchange for 20 coupons, a customer will receive a cheese plate.Paul estimates that 30% of the coupons will be redeemed.In 2010, Paul sold 4, 000, 000 boxes of crackers and purchased 150, 000 cheese plates at $2.50 each.During the year, 970, 000 coupons were redeemed.

-

Refer to Exhibit 13-3.What amount should Paul report as estimated premium claims outstanding at December 31, 2010?

A)$121, 250

B)$328, 750

C)$450, 000

D)$500, 000

-

Refer to Exhibit 13-3.What amount should Paul report as estimated premium claims outstanding at December 31, 2010?

A)$121, 250

B)$328, 750

C)$450, 000

D)$500, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

55

Battlecreek Breakfast places a coupon in each box of its cereal product.Customers may send in five coupons and $3, and the company will send them a recipe book.Sufficient books were purchased at a cost of $5 each.A total of 500, 000 boxes of product were sold in 2010.It was estimated that 4% of the coupons would be redeemed.During 2010, 9, 000 coupons were redeemed.What is Battlecreek's premium expense for 2010?

A)$ 4, 400

B)$ 8, 000

C)$20, 000

D)$40, 000

A)$ 4, 400

B)$ 8, 000

C)$20, 000

D)$40, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

56

Exhibit 13-1 The Jung Company includes a premium in each box of its cereal.For four premiums plus $2.00, customers are entitled to a plastic doll that costs Jung $4.50 each.Jung expects 60% of the premiums to be redeemed.In 2010, Jung sold 500, 000 boxes of cereal and distributed 25, 000 dolls.

-

Refer to Exhibit 13-1.What is Jung's estimated liability for unredeemed premiums on December 31, 2010?

A)$125, 000

B)$187, 500

C)$225, 000

D)$337, 500

-

Refer to Exhibit 13-1.What is Jung's estimated liability for unredeemed premiums on December 31, 2010?

A)$125, 000

B)$187, 500

C)$225, 000

D)$337, 500

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

57

Walter Corp.introduced a new machine on January 1, 2010.The machine carried a two-year warranty against defects.The estimated warranty costs related to dollar sales were 3% in the year of sale and 5% in the year after sale.Additional information follows:

If the expense warranty accrual method is used, what amount relating to warranty expense should be reflected on the December 31, 2011 income statement?

A)$2, 200

B)$4, 800

C)$5, 200

D)$7, 400

If the expense warranty accrual method is used, what amount relating to warranty expense should be reflected on the December 31, 2011 income statement?

A)$2, 200

B)$4, 800

C)$5, 200

D)$7, 400

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

58

Exhibit 13-3 Paul Company includes three coupons in each package of crackers it sells.In exchange for 20 coupons, a customer will receive a cheese plate.Paul estimates that 30% of the coupons will be redeemed.In 2010, Paul sold 4, 000, 000 boxes of crackers and purchased 150, 000 cheese plates at $2.50 each.During the year, 970, 000 coupons were redeemed.

-

Refer to Exhibit 13-3.What amount should Paul record as premium expense for 2010?

A)$121, 250

B)$450, 000

C)$375, 000

D)$500, 000

-

Refer to Exhibit 13-3.What amount should Paul record as premium expense for 2010?

A)$121, 250

B)$450, 000

C)$375, 000

D)$500, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

59

Exhibit 13-4 During 2010, the Alexandra Company began selling a new type of machine that carries a two-year warranty against all defects.Based on past industry and company experience, estimated warranty costs should total $2, 000 per machine sold.During 2010, sales and actual warranty expenditures were $2, 000, 000 (40 machines)and $22, 000, respectively.

-

Refer to Exhibit 13-4.What amount should Alexandra report as its estimated warranty liability at December 31, 2010?

A)$ 0

B)$ 22, 000

C)$120, 000

D)$ 58, 000

-

Refer to Exhibit 13-4.What amount should Alexandra report as its estimated warranty liability at December 31, 2010?

A)$ 0

B)$ 22, 000

C)$120, 000

D)$ 58, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

60

The modified cash basis to determine warranty expense

A)violates the matching concept

B)requires recognition in the period of sale of the estimated warranty expense and warranty liability

C)separates accounting for two components of the sales price: the price of the product and the price of the warranty

D)records warranty expense when the merchandise under warranty is sold

A)violates the matching concept

B)requires recognition in the period of sale of the estimated warranty expense and warranty liability

C)separates accounting for two components of the sales price: the price of the product and the price of the warranty

D)records warranty expense when the merchandise under warranty is sold

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

61

Which of the following contingencies is usually not accrued in the accounts?

A)uninsured risk of property loss by fire or other hazards

B)guarantees of indebtedness of others

C)noncollectibility of receivables

D)agreements to repurchase receivables that have been sold

A)uninsured risk of property loss by fire or other hazards

B)guarantees of indebtedness of others

C)noncollectibility of receivables

D)agreements to repurchase receivables that have been sold

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

62

Gain contingencies should

A)be accrued if they are probable and can be reasonably estimated

B)not be accrued in the accounts

C)be accrued only if they are the result of litigation or government appropriation

D)not be accrued or disclosed in the footnotes

A)be accrued if they are probable and can be reasonably estimated

B)not be accrued in the accounts

C)be accrued only if they are the result of litigation or government appropriation

D)not be accrued or disclosed in the footnotes

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

63

Short-term debt expected to be refinanced

A)may be classified as long term if both the intent to refinance and the ability to refinance exist

B)must always be reported as a current liability

C)may be classified as long term if off-balance-sheet financing has been obtained

D)may be classified as long term if there is an intent to refinance

A)may be classified as long term if both the intent to refinance and the ability to refinance exist

B)must always be reported as a current liability

C)may be classified as long term if off-balance-sheet financing has been obtained

D)may be classified as long term if there is an intent to refinance

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

64

Which of the following statements is true?

A)If ability to refinance a currently maturing obligation is present, the obligation should be classified as noncurrent debt.

B)If no reasonable estimate can be made of the minimum amount expected to be available for future refinancing, the entire outstanding short-term obligation must be disclosed as a noncurrent obligation.

C)The FASB has concluded that obligations that are due on demand should be classified as a current liability, even though liquidation of the liability is not expected within the next year or operating cycle, whichever is longer.

D)If a refinancing is soon to be accomplished by issuing common stock, a currently maturing short-term obligation should be included in stockholders' equity on the current balance sheet.

A)If ability to refinance a currently maturing obligation is present, the obligation should be classified as noncurrent debt.

B)If no reasonable estimate can be made of the minimum amount expected to be available for future refinancing, the entire outstanding short-term obligation must be disclosed as a noncurrent obligation.

C)The FASB has concluded that obligations that are due on demand should be classified as a current liability, even though liquidation of the liability is not expected within the next year or operating cycle, whichever is longer.

D)If a refinancing is soon to be accomplished by issuing common stock, a currently maturing short-term obligation should be included in stockholders' equity on the current balance sheet.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

65

In considering contingencies, IFRS and GAAP define the term "probable" as

A)IFRS - likely; GAAP - likely

B)IFRS - likely; GAAP - more likely than not

C)IFRS - more likely than not; GAAP - likely

D)IFRS - more likely than not; GAAP - more likely than not

A)IFRS - likely; GAAP - likely

B)IFRS - likely; GAAP - more likely than not

C)IFRS - more likely than not; GAAP - likely

D)IFRS - more likely than not; GAAP - more likely than not

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following loss contingencies is not usually accrued?

A)product warranty obligations

B)premium offer obligations

C)risk of loss from fire

D)noncollectibility of receivables

A)product warranty obligations

B)premium offer obligations

C)risk of loss from fire

D)noncollectibility of receivables

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

67

FASB established the use of the terms "probable, " "reasonably possible, " and "remote." It adopted these terms because

A)the available statistical techniques are not exact enough

B)future events can vary over a wide range

C)future gains are not easy to estimate

D)unnecessary estimates should not be recorded in the financial records

A)the available statistical techniques are not exact enough

B)future events can vary over a wide range

C)future gains are not easy to estimate

D)unnecessary estimates should not be recorded in the financial records

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following would not be an acceptable method of presenting current liabilities on the balance sheet?

A)alphabetically

B)in order of their average time to maturity

C)in order of their liquidation preference

D)in order of their amount (largest to smallest)

A)alphabetically

B)in order of their average time to maturity

C)in order of their liquidation preference

D)in order of their amount (largest to smallest)

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

69

A probable loss contingency is reasonably estimated within a range of possible amounts.No amount within the range is a better estimate than any other amount within the range.The amount that should be accrued should be

A)zero

B)the lower amount of the range

C)the upper amount of the range

D)the average amount within the range

A)zero

B)the lower amount of the range

C)the upper amount of the range

D)the average amount within the range

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

70

A gain contingency that is reasonably possible and for which the amount can be reasonably estimated should be

A)accrued

B)disclosed but not accrued

C)neither accrued nor disclosed

D)classified as an appropriation of retained earnings

A)accrued

B)disclosed but not accrued

C)neither accrued nor disclosed

D)classified as an appropriation of retained earnings

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

71

On December 31, 2010, the Williams Company had the following liabilities:

On December 31, Williams signed a binding agreement with its bank to refinance the 12% note through February 14, 2013, at a variable interest rate.

What is the amount of Williams' current liabilities on December 31, 2010?

A)$140, 000

B)$170, 000

C)$230, 000

D)$300, 000

On December 31, Williams signed a binding agreement with its bank to refinance the 12% note through February 14, 2013, at a variable interest rate.

What is the amount of Williams' current liabilities on December 31, 2010?

A)$140, 000

B)$170, 000

C)$230, 000

D)$300, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

72

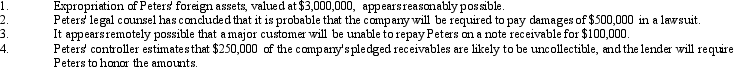

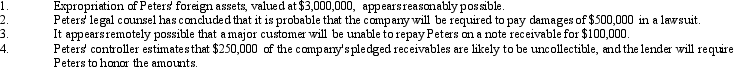

The Peters Company is affected by the following contingencies at the end of 2010:  What total amount should Peters accrue for loss contingencies in 2010?

What total amount should Peters accrue for loss contingencies in 2010?

A)$ 750, 000

B)$ 850, 000

C)$3, 500, 000

D)$3, 850, 000

What total amount should Peters accrue for loss contingencies in 2010?

What total amount should Peters accrue for loss contingencies in 2010?A)$ 750, 000

B)$ 850, 000

C)$3, 500, 000

D)$3, 850, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

73

Existing claims related to product warranties and litigation as of December 31, 2010, indicate that it is probable that a liability has been incurred.However, as of December 31, 2010, the amount of the obligation cannot be reasonably estimated.Based on these facts, an estimated loss contingency should be

A)accrued

B)disclosed but not accrued

C)neither accrued nor disclosed

D)classified as an appropriation of retained earnings

A)accrued

B)disclosed but not accrued

C)neither accrued nor disclosed

D)classified as an appropriation of retained earnings

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

74

Cooper's inventory has been financed 100% with a long-term note.The note is coming due in 2011.Cooper has received a commitment from a new lender that permits five-year refinancing of debt up to an amount equal to 50% of inventory, which is expected to range between $9, 000 and $15, 000 in 2011.At December 31, 2010, how much of the company's currently maturing note payable can be classified as long-term debt?

A)$4, 500

B)$6, 000

C)$7, 500

D)$9, 000

A)$4, 500

B)$6, 000

C)$7, 500

D)$9, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

75

Which of the following statements is true?

A)No loss contingencies should be disclosed if there is just a reasonable possibility of a loss.

B)Indirect guarantees should normally be accrued.

C)In the case of loss contingencies, accrual can be made even if the exact payee and payment date are not known.

D)Losses may be accrued for unasserted claims and other potential unfiled lawsuits.

A)No loss contingencies should be disclosed if there is just a reasonable possibility of a loss.

B)Indirect guarantees should normally be accrued.

C)In the case of loss contingencies, accrual can be made even if the exact payee and payment date are not known.

D)Losses may be accrued for unasserted claims and other potential unfiled lawsuits.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

76

Which of the following contingencies is usually accrued?

A)risk of loss from fire

B)expected proceeds from insurance settlement

C)bad debts

D)discovery of possible mineral reserves on company property

A)risk of loss from fire

B)expected proceeds from insurance settlement

C)bad debts

D)discovery of possible mineral reserves on company property

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

77

Blocker, Inc.had $10, 000 of notes coming due on January 10, 2011.On January 5, 2011, the company used $2, 000 of excess cash to pay off part of the note.On January 8, 2011, a refinancing was completed.The $2, 000 payment was refunded and added back to the note balance, and the note was extended for another two years.On the December 31, 2010 balance sheet, how much of the $10, 000 note should be shown as current?

A)$10, 000

B)$ 0

C)$ 8, 000

D)$ 2, 000

A)$10, 000

B)$ 0

C)$ 8, 000

D)$ 2, 000

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

78

Existing claims related to product warranties and litigation as of December 31, 2010, indicate that it is probable that a liability has been incurred.However, as of December 31, 2010, the exact amount of the obligation cannot be reasonably estimated, but a range of possible amounts has been determined.Based on these facts, an estimated loss contingency should be

A)accrued

B)disclosed but not accrued

C)neither accrued nor disclosed

D)classified as an appropriation of retained earnings

A)accrued

B)disclosed but not accrued

C)neither accrued nor disclosed

D)classified as an appropriation of retained earnings

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following statements concerning contingencies is true?

A)Contingent liabilities are always recorded in the body of the financial statements.

B)Contingent liabilities are always disclosed in the footnotes to the financial statements.

C)Contingent gains are sometimes disclosed in the body of the financial statements.

D)Contingent gains are sometimes disclosed in the footnotes to the financial statements.

A)Contingent liabilities are always recorded in the body of the financial statements.

B)Contingent liabilities are always disclosed in the footnotes to the financial statements.

C)Contingent gains are sometimes disclosed in the body of the financial statements.

D)Contingent gains are sometimes disclosed in the footnotes to the financial statements.

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck

80

When a contingency must be accrued under IFRS, the charge is referred to as

A)an extraordinary loss

B)a provision

C)an appropriation

D)a risk expense

A)an extraordinary loss

B)a provision

C)an appropriation

D)a risk expense

Unlock Deck

Unlock for access to all 98 flashcards in this deck.

Unlock Deck

k this deck