Deck 1: The Environment of Financial Reporting

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Match between columns

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/39

Play

Full screen (f)

Deck 1: The Environment of Financial Reporting

1

The primary reason that financial accounting and managerial accounting have somewhat different objectives is because they

A)need information in different formats

B)provide information for different decisions

C)need information in different geographic locations

D)need information at different times

A)need information in different formats

B)provide information for different decisions

C)need information in different geographic locations

D)need information at different times

B

2

Assume that authoritative support regarding GAAP for a particular transaction is needed.A correct hierarchy of authority to be followed (highest, second, third)would be

A)FASB Statements, AICPA Accounting Interpretations, FASB Technical Bulletins

B)FASB Technical Bulletins, AICPA Accounting Interpretations, FASB Statements

C)AICPA Accounting Interpretations, FASB Technical Bulletins, FASB Statements

D)FASB Statements, FASB Technical Bulletins, AICPA Accounting Interpretations

A)FASB Statements, AICPA Accounting Interpretations, FASB Technical Bulletins

B)FASB Technical Bulletins, AICPA Accounting Interpretations, FASB Statements

C)AICPA Accounting Interpretations, FASB Technical Bulletins, FASB Statements

D)FASB Statements, FASB Technical Bulletins, AICPA Accounting Interpretations

D

3

Which of the following pronouncements issued by the FASB does not provide for the highest level of authoritative support?

A)technical bulletins

B)interpretations

C)statements of financial accounting standards

D)staff positions

A)technical bulletins

B)interpretations

C)statements of financial accounting standards

D)staff positions

A

4

Exchanges of capital stock and bonds that occur between investors take place in

A)primary markets

B)open markets

C)secondary markets

D)private markets

A)primary markets

B)open markets

C)secondary markets

D)private markets

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

5

The FASB Accounting Standards Codification is expected to provide all of the following benefits except

A)reduce the research time necessary to solve an accounting research issue

B)codify authoritative support such as results of academic research

C)provide real-time updates as new standards are issued

D)improve the usability of the authoritative accounting literature

A)reduce the research time necessary to solve an accounting research issue

B)codify authoritative support such as results of academic research

C)provide real-time updates as new standards are issued

D)improve the usability of the authoritative accounting literature

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

6

Which pronouncements are not issued by the FASB?

A)Statements of Financial Accounting Concepts

B)Technical Bulletins

C)Opinions

D)Interpretations

A)Statements of Financial Accounting Concepts

B)Technical Bulletins

C)Opinions

D)Interpretations

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

7

Which of the following statements is true?

A)In order to remain impartial, the FASB discourages public input during development of standards.

B)FASB accounting standards are the result of clearly defined objectives, an integrated body of theory, and the known consequences of actions.

C)The FASB deliberates and issues accounting standards only after receiving a formal letter of request from the SEC.

D)Accounting standards, which reflect social decisions, are often the result of compromise.

A)In order to remain impartial, the FASB discourages public input during development of standards.

B)FASB accounting standards are the result of clearly defined objectives, an integrated body of theory, and the known consequences of actions.

C)The FASB deliberates and issues accounting standards only after receiving a formal letter of request from the SEC.

D)Accounting standards, which reflect social decisions, are often the result of compromise.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

8

The organization that presently has the primary responsibility to establish generally accepted accounting principles that are applicable to the financial statements of entities in the U.S.private sector is the

A)Accounting Principles Board

B)Securities and Exchange Commission

C)Financial Accounting Standards Board

D)Committee on Accounting Procedure

A)Accounting Principles Board

B)Securities and Exchange Commission

C)Financial Accounting Standards Board

D)Committee on Accounting Procedure

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

9

Concerning FASB membership, which statement is not true?

A)Not all members are CPAs from public practice.

B)All members are full time and fully paid.

C)All members are also members of the Financial Accounting Foundation.

D)All members must sever organizational ties with their previous employer.

A)Not all members are CPAs from public practice.

B)All members are full time and fully paid.

C)All members are also members of the Financial Accounting Foundation.

D)All members must sever organizational ties with their previous employer.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

10

Exchanges of capital stock and bonds between a corporation and investors take place in

A)secondary markets

B)primary markets

C)stock exchanges

D)tertiary markets

A)secondary markets

B)primary markets

C)stock exchanges

D)tertiary markets

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following is not a decision that external users of a company's financial information would make?

A)whether or not to extend credit to the company

B)whether or not to hold the company's stock

C)whether or not the company should add a new product line

D)whether or not to ask for an increase in employees' benefits during union contract negotiations

A)whether or not to extend credit to the company

B)whether or not to hold the company's stock

C)whether or not the company should add a new product line

D)whether or not to ask for an increase in employees' benefits during union contract negotiations

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

12

The four major financial statements of a corporation consist of the

A)income statement, balance sheet, statement of cash flows, and statement of changes in stockholders' equity

B)balance sheet, statement of cash flows, statement of retained earnings, and income statement

C)income statement, statement of cash flows, and balance sheet

D)statement of cash flows, balance sheet, income statement, and statement of capital equity

A)income statement, balance sheet, statement of cash flows, and statement of changes in stockholders' equity

B)balance sheet, statement of cash flows, statement of retained earnings, and income statement

C)income statement, statement of cash flows, and balance sheet

D)statement of cash flows, balance sheet, income statement, and statement of capital equity

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following is an internal user of a company's financial information?

A)company treasurer

B)stockholder in the company

C)bank lending to the company

D)union

A)company treasurer

B)stockholder in the company

C)bank lending to the company

D)union

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

14

Creditors' information needs revolve around all of the following decisions, except

A)extending credit

B)maintaining a credit relationship

C)not extending credit

D)investing in credit instruments

A)extending credit

B)maintaining a credit relationship

C)not extending credit

D)investing in credit instruments

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

15

Going from 1938 to the present, which is the correct sequence of accounting rule-making bodies?

A)APB-CAP-FASB

B)CAP-FASB-APB

C)CAP-APB-FASB

D)FASB-APB-CAP

A)APB-CAP-FASB

B)CAP-FASB-APB

C)CAP-APB-FASB

D)FASB-APB-CAP

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

16

Agency theory suggests that managers' behavior

A)may be to enhance the owners' financial interests at the expense of their self-interests

B)will always follow classic agency law

C)may not always be in the best interests of the owners (stockholders)

D)as agents will always be in the best interests of the owners (stockholders)

A)may be to enhance the owners' financial interests at the expense of their self-interests

B)will always follow classic agency law

C)may not always be in the best interests of the owners (stockholders)

D)as agents will always be in the best interests of the owners (stockholders)

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

17

Notes to financial statements provide

A)discussions that further explain items shown in the financial statements

B)comparative financial information with the previous year

C)management's discussions about plans for the future

D)the report of the independent auditors

A)discussions that further explain items shown in the financial statements

B)comparative financial information with the previous year

C)management's discussions about plans for the future

D)the report of the independent auditors

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

18

Which characteristic applies more to financial accounting than to managerial accounting?

A)primarily segmented reports

B)primarily quantitative information

C)Internal-decision focus

D)statement format determined by company information needs

A)primarily segmented reports

B)primarily quantitative information

C)Internal-decision focus

D)statement format determined by company information needs

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following documents includes all of the accounting standards?

A)Regulation S-X

B)The FASB Conceptual Framework

C)Statements of Financial Accounting Standards

D)none of these

A)Regulation S-X

B)The FASB Conceptual Framework

C)Statements of Financial Accounting Standards

D)none of these

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

20

How many FASB members are there?

A)5

B)7

C)21

D)33

A)5

B)7

C)21

D)33

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

21

The Securities and Exchange Commission has the legal authority to prescribe accounting principles and reporting practices for

A)all companies issuing publicly traded securities

B)all companies issuing any type of securities

C)all companies

D)all corporations

A)all companies issuing publicly traded securities

B)all companies issuing any type of securities

C)all companies

D)all corporations

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

22

Critical thinking is most important in which of the following problem-solving steps?

A)recognizing a problem

B)identifying alternative solutions

C)evaluating the alternatives

D)selecting a solution from among the alternatives

A)recognizing a problem

B)identifying alternative solutions

C)evaluating the alternatives

D)selecting a solution from among the alternatives

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

23

The Sarbanes-Oxley Act of 2002 established the Public Company Accounting Oversight Board (PCAOB).The PCAOB was established to

A)bring to justice public companies such as Enron and WorldCom for committing fraud

B)oversee the standards promulgated by the SEC related to public companies

C)protect the interests of investors by overseeing auditors of public companies

D)establish GAAP for use by public companies

A)bring to justice public companies such as Enron and WorldCom for committing fraud

B)oversee the standards promulgated by the SEC related to public companies

C)protect the interests of investors by overseeing auditors of public companies

D)establish GAAP for use by public companies

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

24

While formally the SEC is charged with the responsibility for establishing accounting principles to be followed in the preparation of SEC filings, the impact of the SEC generally has been

A)in its assistance to Congress with the development of tax law

B)in guiding the development of stock exchanges

C)ineffective in controlling foreign corporations and investors

D)its informal review and approval of standards developed in the private sector prior to their release

A)in its assistance to Congress with the development of tax law

B)in guiding the development of stock exchanges

C)ineffective in controlling foreign corporations and investors

D)its informal review and approval of standards developed in the private sector prior to their release

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

25

The purposes of the joint long-term project of the FASB and IASB to converge revenue recognition principles include all of the following except

A)eliminate inconsistencies in conceptual guidance on revenues

B)replace principle-based accounting with rule-based accounting for revenues

C)establish a single comprehensive standard on revenue recognition

D)fill voids in revenue recognition guidance

A)eliminate inconsistencies in conceptual guidance on revenues

B)replace principle-based accounting with rule-based accounting for revenues

C)establish a single comprehensive standard on revenue recognition

D)fill voids in revenue recognition guidance

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

26

Conversion to IFRS reporting by all U.S.companies would be best accomplished with a transition plan for all of the following reasons except

A)it would have to be a multi-year process

B)it needs to be an orderly process with a minimum of cost and disruption to the participants

C)certain IFRS need further improvement through continued convergence efforts

D)careful planning would enable maximum manipulation of the IFRS for the financial benefit of the United States.

A)it would have to be a multi-year process

B)it needs to be an orderly process with a minimum of cost and disruption to the participants

C)certain IFRS need further improvement through continued convergence efforts

D)careful planning would enable maximum manipulation of the IFRS for the financial benefit of the United States.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

27

Your accounting instructor allows you to look at his grade book in order to verify the points you have received to date in the final course taken by all accounting majors.While looking at your points, you notice that your best friend's score on the last exam was recorded incorrectly.He received a 68 on the test but it has been recorded as an 86 in the grade book.Your friend needs a passing grade in this class in order to graduate.If the correct score is recorded, he might not have enough points to pass the course.

Required:

Discuss the steps you should take to deal with this ethical dilemma using three ethical criteria.You need not indicate the ethical action you would take.

Required:

Discuss the steps you should take to deal with this ethical dilemma using three ethical criteria.You need not indicate the ethical action you would take.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

28

Three major organizations in the private and public sector develop U.S.and international GAAP.They include all of the following except the

A)EU (European Union)

B)SEC (Securities and Exchange Commission)

C)FASB (Financial Accounting Standards Board)

D)IASB (International Accounting Standards Board)

A)EU (European Union)

B)SEC (Securities and Exchange Commission)

C)FASB (Financial Accounting Standards Board)

D)IASB (International Accounting Standards Board)

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

29

Which organization has the most legal authority?

A)Financial Accounting Standards Board

B)Accounting Standards Executive Committee

C)Governmental Accounting Standards Board

D)Securities and Exchange Commission

A)Financial Accounting Standards Board

B)Accounting Standards Executive Committee

C)Governmental Accounting Standards Board

D)Securities and Exchange Commission

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

30

Assume you are tutoring a beginning accounting student who tells you that the members of the FASB must have a great deal of power because they have the authority to issue standards that dictate accounting procedure.

Required:

Explain why accounting standards are the result of compromise and how such compromises are reached.

Required:

Explain why accounting standards are the result of compromise and how such compromises are reached.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

31

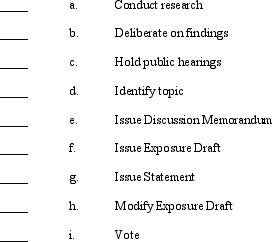

Listed below are the ten steps the FASB goes through in issuing a new Statement.

Required:

Required:

Indicate the proper sequence of these steps.

Required:

Required:Indicate the proper sequence of these steps.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

32

Issuance of a new International Accounting Standard requires approval of at least

A)5/7 of the board

B)2/3 of the board

C)3/4 of the board

D)5/6 of the board

A)5/7 of the board

B)2/3 of the board

C)3/4 of the board

D)5/6 of the board

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

33

Auditors face ethical issues because

A)GAAP permits various standards to be used to produce profits

B)auditors may express an opinion that may cause difficulty to employees of a company

C)auditors may not discover insider trading

D)GAAP does not permit fraud

A)GAAP permits various standards to be used to produce profits

B)auditors may express an opinion that may cause difficulty to employees of a company

C)auditors may not discover insider trading

D)GAAP does not permit fraud

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

34

The SEC has several reporting choices.It can require that U.S.companies use U.S.GAAP in their financial statement filings.Alternatively, the SEC can require or allow U.S.companies to use IFRS in their financial statement filings.Many issues and complexities surround the use of IFRS.

Required:

Identify and discuss five of the issues to be considered by the SEC in deliberating this proposal.

Required:

Identify and discuss five of the issues to be considered by the SEC in deliberating this proposal.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

35

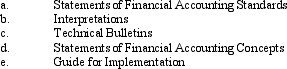

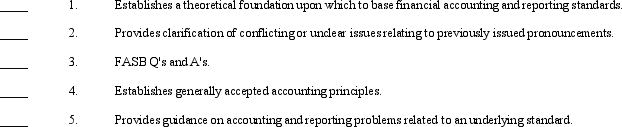

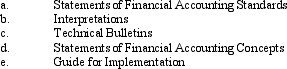

Listed below are several types of pronouncements that the FASB issues.Following the list is a series of descriptive statements.

Required:

Required:

Match each pronouncement with its descriptive statement by placing the appropriate letter in the space provided.

Required:

Required:Match each pronouncement with its descriptive statement by placing the appropriate letter in the space provided.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

36

The FASB has undertaken six key initiatives to help attain the goal of convergence of U.S.accounting standards with international accounting standards.

Required:

Identify the FASB initiatives and briefly discuss each of the six initiatives.

Required:

Identify the FASB initiatives and briefly discuss each of the six initiatives.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

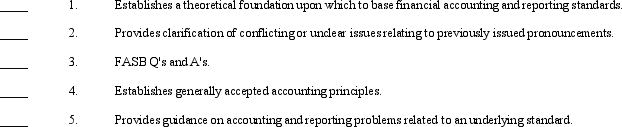

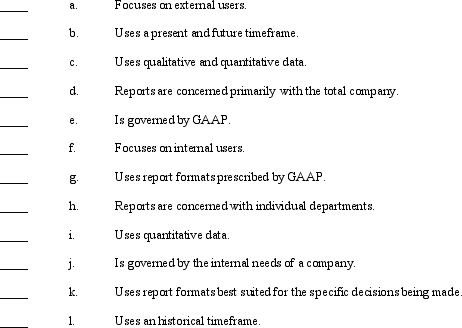

37

Listed below are 12 characteristics of accounting, some of which are more closely related to financial accounting, while others are related to managerial accounting.

Required:

Required:

Indicate which characteristic is financial and which is managerial by placing an (F)or an (M)in the space provided.

Required:

Required:Indicate which characteristic is financial and which is managerial by placing an (F)or an (M)in the space provided.

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

38

The FASB Emerging Issues Task Force issues which of the following?

A)Statements of Position to influence the development of principles

B)Consensus Positions on the implementation of standards

C)Financial Reporting Releases on guidelines for reporting issues

D)Technical Bulletins on accounting and reporting problems

A)Statements of Position to influence the development of principles

B)Consensus Positions on the implementation of standards

C)Financial Reporting Releases on guidelines for reporting issues

D)Technical Bulletins on accounting and reporting problems

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck

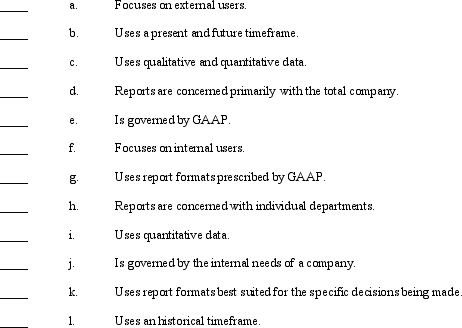

40

Match between columns

Unlock Deck

Unlock for access to all 39 flashcards in this deck.

Unlock Deck

k this deck