Deck 11: Stockholders Equity

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/146

Play

Full screen (f)

Deck 11: Stockholders Equity

1

All other things being equal,the higher the return on equity ratio,the better the financial performance of the company.

True

2

A major advantage of debt financing is that interest expense is tax deductible.

True

3

A company that pays no dividends is always a poor investment.

False

4

A stock dividend decreases the market price of the company's stock.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

5

Treasury stock is a corporation's own stock that has been issued and subsequently repurchased by the corporation.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

6

Unpaid dividends on cumulative preferred stock are called dividends in arrears.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

7

Corporations are governed by federal law.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

8

The par value of stock indicates what the stock is worth.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

9

Preferred stock is generally classified as stockholders' equity under both GAAP and IFRS.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

10

State laws often restrict dividends to the amount of retained earnings.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

11

One reason why a company may choose a stock split over a stock dividend is that the stock split does not reduce retained earnings.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

12

A liability for dividends is recorded on the date of record.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

13

The price-earnings ratio reveals information about the stock market's expectations for a company's future growth in earnings.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

14

When a company reissues shares of its treasury stock,it must report a gain or a loss on the sale.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

15

Income tax expense would be found on the income statement of a corporation,but not on the income statement of a sole proprietorship.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

16

A stock split increases total stockholders' equity.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

17

A corporation does not have a legal obligation to pay dividends.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

18

Issuing stock to obtain financing is called equity financing.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

19

Dividends in arrears are reported as liabilities on the balance sheet.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

20

A corporation's charter establishes the number of shares of stock to be issued.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

21

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company sells 12 million shares to investors and later buys back 3 million shares.The number of authorized shares after these transactions are accounted for is:

A)12 million shares.

B)20 million shares.

C)9 million shares.

D)17 million shares.

A)12 million shares.

B)20 million shares.

C)9 million shares.

D)17 million shares.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

22

Which of the following statements is not true of a corporation?

A)A corporation is taxed as a separate legal entity.

B)A corporation has easy transferability of ownership.

C)A corporation may have the ability to raise large amounts of capital.

D)A corporation's owners have unlimited liability.

A)A corporation is taxed as a separate legal entity.

B)A corporation has easy transferability of ownership.

C)A corporation may have the ability to raise large amounts of capital.

D)A corporation's owners have unlimited liability.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

23

When a company sells stock to the public for the first time,the sale is called a(n):

A)initial public offering (IPO).

B)first time issue (FTI).

C)seasoned new issue (SNI).

D)initial stock offering (ISO).

A)initial public offering (IPO).

B)first time issue (FTI).

C)seasoned new issue (SNI).

D)initial stock offering (ISO).

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

24

A company sells 1 million shares of stock with no par value for $15 a share.In recording the transaction,it would:

A)debit Cash for $15 million and credit Additional Paid-in Capital for $15 million.

B)debit Cash for $15 million and credit Common Stock for $15 million.

C)debit Common Stock for $15 million,credit Cash for $15 million.

D)debit Common Stock for $15 million and credit Additional Paid-in Capital for $15 million.

A)debit Cash for $15 million and credit Additional Paid-in Capital for $15 million.

B)debit Cash for $15 million and credit Common Stock for $15 million.

C)debit Common Stock for $15 million,credit Cash for $15 million.

D)debit Common Stock for $15 million and credit Additional Paid-in Capital for $15 million.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

25

The right of current stockholders to purchase additional shares of newly issued stock in order to maintain the same percentage ownership is called:

A)liquidation.

B)preemptive rights.

C)cumulative preference.

D)voting rights.

A)liquidation.

B)preemptive rights.

C)cumulative preference.

D)voting rights.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

26

For a business to be considered a corporation:

A)its stock must be sold in very large amounts.

B)it must be organized as a separate legal entity.

C)it must issue both common and preferred stock.

D)it must pay dividends.

A)its stock must be sold in very large amounts.

B)it must be organized as a separate legal entity.

C)it must issue both common and preferred stock.

D)it must pay dividends.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following statements regarding dividends is true?

A)Some companies do not pay dividends even when the company is profitable.

B)Stock dividends immediately increase the total value of the stockholders' investment.

C)Cash dividends and stock dividends both decrease total stockholders' equity.

D)A corporation has a legal obligation to pay dividends each year.

A)Some companies do not pay dividends even when the company is profitable.

B)Stock dividends immediately increase the total value of the stockholders' investment.

C)Cash dividends and stock dividends both decrease total stockholders' equity.

D)A corporation has a legal obligation to pay dividends each year.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

28

Which of the following statements regarding a stock split is true?

A)A stock split decreases retained earnings.

B)Stock splits do not require a journal entry.

C)Stock splits are the same as stock dividends.

D)Stock splits increase the par value per share.

A)A stock split decreases retained earnings.

B)Stock splits do not require a journal entry.

C)Stock splits are the same as stock dividends.

D)Stock splits increase the par value per share.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

29

Which of the following statements regarding repurchased stock is true?

A)It is generally less costly for a company to give employees repurchased shares than to issue new shares.

B)When a company records a stock repurchase,it is tracking a stockholder's sale of stock to another investor.

C)Treasury stock is reported on the balance sheet as an asset.

D)Treasury stock is repurchased stock that has been authorized but is not issued.

A)It is generally less costly for a company to give employees repurchased shares than to issue new shares.

B)When a company records a stock repurchase,it is tracking a stockholder's sale of stock to another investor.

C)Treasury stock is reported on the balance sheet as an asset.

D)Treasury stock is repurchased stock that has been authorized but is not issued.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

30

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company sells 12 million shares to investors and later buys back 3 million shares.The current number of outstanding shares after these transactions have been accounted for is:

A)8 million shares.

B)20 million shares.

C)10 million shares.

D)9 million shares.

A)8 million shares.

B)20 million shares.

C)10 million shares.

D)9 million shares.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

31

Which of the following statements regarding treasury stock is true?

A)When a company reissues treasury stock for more than it originally paid for the stock,it does not report a gain.

B)When a company purchases treasury stock or pays a dividend,it increases total stockholders' equity.

C)Treasury stock is reported as an asset on the balance sheet.

D)Treasury stock is reported as issued and outstanding stock.

A)When a company reissues treasury stock for more than it originally paid for the stock,it does not report a gain.

B)When a company purchases treasury stock or pays a dividend,it increases total stockholders' equity.

C)Treasury stock is reported as an asset on the balance sheet.

D)Treasury stock is reported as issued and outstanding stock.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

32

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company sells 12 million shares to investors and later buys back 3 million shares.The number of issued shares after these transactions have been accounted for is:

A)12 million shares.

B)9 million shares.

C)10 million shares.

D)17 million shares.

A)12 million shares.

B)9 million shares.

C)10 million shares.

D)17 million shares.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

33

A corporate charter specifies that the company may sell up to 20 million shares of stock.The company sells 12 million shares to investors and later buys back 3 million shares.The current number of shares of treasury stock after these transactions have been accounted for is:

A)3 million shares.

B)8 million shares.

C)9 million shares.

D)17 million shares.

A)3 million shares.

B)8 million shares.

C)9 million shares.

D)17 million shares.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

34

Which one of the following statements regarding earnings per share (EPS)is true?

A)The EPS ratio is important because it signals the ability of the company to pay future dividends,which investors factor into the stock price.

B)Earnings per share is generally reported in the balance sheet under stockholders' equity.

C)Earnings per share is the best way to compare the performance of different companies.

D)EPS,in its basic form,is calculated by dividing net income by the average number of all shares issued.

A)The EPS ratio is important because it signals the ability of the company to pay future dividends,which investors factor into the stock price.

B)Earnings per share is generally reported in the balance sheet under stockholders' equity.

C)Earnings per share is the best way to compare the performance of different companies.

D)EPS,in its basic form,is calculated by dividing net income by the average number of all shares issued.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements regarding business forms is true?

A)A sole proprietorship is an unincorporated business owned by one person.

B)All partnerships are owned by two people.

C)A corporation is not a legal entity.

D)An LLC (limited liability company)has the same tax treatment as a corporation.

A)A sole proprietorship is an unincorporated business owned by one person.

B)All partnerships are owned by two people.

C)A corporation is not a legal entity.

D)An LLC (limited liability company)has the same tax treatment as a corporation.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

36

Holders of common stock receive certain benefits,such as a residual claim,which:

A)is the right of stockholders to be paid back their investment before anyone else if the company ceases operation.

B)is the right to oversee management of the company.

C)is the right to share in any remaining assets after creditors have been paid off,should the company cease operations.

D)is the continuing right to receive a share of the company's profits in the form of dividends.

A)is the right of stockholders to be paid back their investment before anyone else if the company ceases operation.

B)is the right to oversee management of the company.

C)is the right to share in any remaining assets after creditors have been paid off,should the company cease operations.

D)is the continuing right to receive a share of the company's profits in the form of dividends.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

37

A company sells 1 million shares of common stock with a par value of $0.02 for $15 a share.To record the transaction,the company would:

A)debit Cash for $20,000 and credit Common Stock for $20,000.

B)debit Cash for $15 million and credit Common Stock for $15 million.

C)debit Cash for $15 million,credit Common Stock for $20,000 and credit Additional Paid-in Capital for $14,980,000.

D)debit Cash for $20,000,debit Capital Receivable for $14,980,000,credit Common Stock for $20,000 and credit Additional Paid-in Capital for $14,980,000.

A)debit Cash for $20,000 and credit Common Stock for $20,000.

B)debit Cash for $15 million and credit Common Stock for $15 million.

C)debit Cash for $15 million,credit Common Stock for $20,000 and credit Additional Paid-in Capital for $14,980,000.

D)debit Cash for $20,000,debit Capital Receivable for $14,980,000,credit Common Stock for $20,000 and credit Additional Paid-in Capital for $14,980,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

38

Stock dividends and stock splits are similar in all of the following ways except

A)they both involve a pro rata distribution of shares to existing stockholders.

B)they both reduce the stock price.

C)they both decrease retained earnings.

D)have no effect on cash.

A)they both involve a pro rata distribution of shares to existing stockholders.

B)they both reduce the stock price.

C)they both decrease retained earnings.

D)have no effect on cash.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

39

Which of the following statements regarding dividends in arrears is true?

A)Dividends in arrears do not appear on the balance sheet or require a journal entry.

B)Dividends in arrears are not disclosed to stockholders.

C)Dividends in arrears applies to common stock.

D)Dividends in arrears are legal liabilities.

A)Dividends in arrears do not appear on the balance sheet or require a journal entry.

B)Dividends in arrears are not disclosed to stockholders.

C)Dividends in arrears applies to common stock.

D)Dividends in arrears are legal liabilities.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

40

Which of the following statements regarding issued and outstanding stock is true?

A)Outstanding stock includes all stock issued by a corporation.

B)Issued stock equals the sum of outstanding stock and treasury stock.

C)Issued stock is equal to authorized stock.

D)Outstanding stock includes stock in the hands of investors,as well as treasury stock in the hands of the corporation.

A)Outstanding stock includes all stock issued by a corporation.

B)Issued stock equals the sum of outstanding stock and treasury stock.

C)Issued stock is equal to authorized stock.

D)Outstanding stock includes stock in the hands of investors,as well as treasury stock in the hands of the corporation.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

41

Typically,a profitable company that pays relatively high dividends:

A)is an attractive investment for those seeking a steady income,like retired people.

B)will reinvest more profit which can lead to smaller growth potential.

C)will experience more growth in stock price over time.

D)is a bad investment.

A)is an attractive investment for those seeking a steady income,like retired people.

B)will reinvest more profit which can lead to smaller growth potential.

C)will experience more growth in stock price over time.

D)is a bad investment.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

42

Stockholders' equity is:

A)the amount the company received for all stock when issued plus the amount of retained earnings minus treasury stock.

B)the amount the company received for all stock authorized plus the amount of retained earnings and treasury stock.

C)the par value the company received for all stock issued plus the amount of retained earnings minus treasury stock.

D)the amount the company received for all stock when issued minus the amount of retained earnings and treasury stock.

A)the amount the company received for all stock when issued plus the amount of retained earnings minus treasury stock.

B)the amount the company received for all stock authorized plus the amount of retained earnings and treasury stock.

C)the par value the company received for all stock issued plus the amount of retained earnings minus treasury stock.

D)the amount the company received for all stock when issued minus the amount of retained earnings and treasury stock.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

43

IBM issues 200,000 shares of stock with a par value of $0.01 for $150 per share.Three years later,it repurchases these shares for $80 per share.IBM records the repurchase in which of the following ways?

A)Debit Common Stock for $2,000,debit Additional Paid-in Capital for $29,998,000 and credit Cash for $30 million.

B)Debit Treasury Stock for $16 million and credit Cash for $16 million.

C)Debit Common Stock for $2,000,debit Additional Paid-in Capital for $15,998,000 and credit Cash for $16 million.

D)Debit Stockholders' Equity for $30 million,credit Additional Paid-in Capital for $16 million and credit Cash for $16 million.

A)Debit Common Stock for $2,000,debit Additional Paid-in Capital for $29,998,000 and credit Cash for $30 million.

B)Debit Treasury Stock for $16 million and credit Cash for $16 million.

C)Debit Common Stock for $2,000,debit Additional Paid-in Capital for $15,998,000 and credit Cash for $16 million.

D)Debit Stockholders' Equity for $30 million,credit Additional Paid-in Capital for $16 million and credit Cash for $16 million.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

44

AMD buys back 300,000 shares of its stock from investors at $6.50 a share.Two years later,it reissues this stock for $6.00 a share.The stock reissue would be recorded as:

A)a debit to Cash of $1.8 million,a debit to Additional Paid-in Capital of $150,000,and a credit to Treasury Stock of $1.95 million.

B)a debit to Cash of $1.95 million,a credit to Treasury Stock of $1.8 million,and a credit to Additional Paid-in Capital of $150,000.

C)a debit to Cash of $1.95 million and a credit to Treasury Stock of $1.95 million.

D)a debit to Cash of $1.8 million and a credit to Treasury Stock of $1.8 million.

A)a debit to Cash of $1.8 million,a debit to Additional Paid-in Capital of $150,000,and a credit to Treasury Stock of $1.95 million.

B)a debit to Cash of $1.95 million,a credit to Treasury Stock of $1.8 million,and a credit to Additional Paid-in Capital of $150,000.

C)a debit to Cash of $1.95 million and a credit to Treasury Stock of $1.95 million.

D)a debit to Cash of $1.8 million and a credit to Treasury Stock of $1.8 million.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

45

Which of the following statements about stock dividends is true?

A)Stock dividends are reported on the income statement.

B)Stock dividends are reported on the Statement of Stockholders' Equity.

C)Stock dividends increase total stockholders' equity.

D)Stock dividends decrease total stockholders' equity.

A)Stock dividends are reported on the income statement.

B)Stock dividends are reported on the Statement of Stockholders' Equity.

C)Stock dividends increase total stockholders' equity.

D)Stock dividends decrease total stockholders' equity.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

46

A stock dividend:

A)is accounted for like a stock split.

B)will reduce stockholders' equity like a cash dividend does.

C)will not change any of the accounts within stockholders' equity.

D)will reduce retained earnings like a cash dividend does.

A)is accounted for like a stock split.

B)will reduce stockholders' equity like a cash dividend does.

C)will not change any of the accounts within stockholders' equity.

D)will reduce retained earnings like a cash dividend does.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

47

Which of the following statements accurately explains why the board of directors of a company whose financial future contains some uncertainties might issue a 2-for-1 stock split rather than declare a 100% stock dividend?

A)A stock split would not reduce the market price per share,whereas a stock dividend would.

B)A stock split would reduce the market price per share,whereas a stock dividend would not.

C)A stock split would increase total stockholders' equity,whereas a stock dividend would not.

D)A stock split would not reduce retained earnings,whereas a stock dividend would.

A)A stock split would not reduce the market price per share,whereas a stock dividend would.

B)A stock split would reduce the market price per share,whereas a stock dividend would not.

C)A stock split would increase total stockholders' equity,whereas a stock dividend would not.

D)A stock split would not reduce retained earnings,whereas a stock dividend would.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

48

The combined effect of the declaration and payment of a cash dividend on a company's financial statements is to:

A)increase total liabilities and decrease stockholders' equity.

B)increase total expenses and decrease assets.

C)increase total assets and increase stockholders' equity.

D)decrease total assets and decrease stockholders' equity.

A)increase total liabilities and decrease stockholders' equity.

B)increase total expenses and decrease assets.

C)increase total assets and increase stockholders' equity.

D)decrease total assets and decrease stockholders' equity.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

49

On February 16,a company declares a 34¢ dividend to be paid on April 5.There are 2 million shares of common stock issued and 100,000 shares of treasury stock.What does the company record on April 5?

A)A debit to Dividends Payable and a credit to Cash for $680,000.

B)A debit to Dividends Declared and a credit to Dividends Payable for $646,000.

C)A debit to Dividends Payable and a credit to Cash for $646,000.

D)A debit to Dividends Declared and a credit to Dividends Payable for $680,000.

A)A debit to Dividends Payable and a credit to Cash for $680,000.

B)A debit to Dividends Declared and a credit to Dividends Payable for $646,000.

C)A debit to Dividends Payable and a credit to Cash for $646,000.

D)A debit to Dividends Declared and a credit to Dividends Payable for $680,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

50

Typically,a profitable company that pays little or no dividends:

A)is a bad investment.

B)will reinvest profits which can lead to greater growth potential.

C)will experience relatively stable stock prices over time.

D)will appeal to investors who desire distributions of profit.

A)is a bad investment.

B)will reinvest profits which can lead to greater growth potential.

C)will experience relatively stable stock prices over time.

D)will appeal to investors who desire distributions of profit.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

51

Which of the following statements about dividends is not true?

A)Dividends represent a sharing of corporate profits with owners.

B)Both stock dividends and cash dividends reduce retained earnings.

C)Cash dividends paid to stockholders reduce net income.

D)Dividends are declared at the discretion of the board of directors.

A)Dividends represent a sharing of corporate profits with owners.

B)Both stock dividends and cash dividends reduce retained earnings.

C)Cash dividends paid to stockholders reduce net income.

D)Dividends are declared at the discretion of the board of directors.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

52

Treasury stock:

A)does not appear on the balance sheet.

B)is a contra-equity account.

C)is an asset account.

D)is recorded as additional paid-in capital.

A)does not appear on the balance sheet.

B)is a contra-equity account.

C)is an asset account.

D)is recorded as additional paid-in capital.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

53

Which of the following statements is true?

A)Stock splits and stock dividends both reduce the market price of a share,but only stock splits reduce the par value of a share.

B)Stock splits and stock dividends both reduce the market price of a share and the par value of a share.

C)Stock splits and stock dividends both reduce the market price of a share,but only stock dividends reduce the par value of a share.

D)Stock splits and stock dividends both reduce the market price of a share and reduce retained earnings.

A)Stock splits and stock dividends both reduce the market price of a share,but only stock splits reduce the par value of a share.

B)Stock splits and stock dividends both reduce the market price of a share and the par value of a share.

C)Stock splits and stock dividends both reduce the market price of a share,but only stock dividends reduce the par value of a share.

D)Stock splits and stock dividends both reduce the market price of a share and reduce retained earnings.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

54

Which of the following statements would not explain why a company may want to repurchase its stock?

A)To demonstrate to investors that it believes its own stock is worth purchasing.

B)To obtain shares to reissue to employees as part of an employee stock plan.

C)To obtain shares that can be reissued as payment for purchase of another company.

D)To increase the number of shares of outstanding stock.

A)To demonstrate to investors that it believes its own stock is worth purchasing.

B)To obtain shares to reissue to employees as part of an employee stock plan.

C)To obtain shares that can be reissued as payment for purchase of another company.

D)To increase the number of shares of outstanding stock.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

55

On the date of record for a dividend,the company:

A)debits Dividends Declared and credits Dividends Payable for the amount of the dividend.

B)debits Dividend Expense and credits Cash for the dividend amount.

C)debits Dividends Payable and credits Cash for the dividend amount.

D)establishes who will receive the dividend payment.

A)debits Dividends Declared and credits Dividends Payable for the amount of the dividend.

B)debits Dividend Expense and credits Cash for the dividend amount.

C)debits Dividends Payable and credits Cash for the dividend amount.

D)establishes who will receive the dividend payment.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

56

On the payment date for a dividend,the company:

A)debits Dividends Declared and credits Dividends Payable for the amount of the dividend.

B)debits Dividend Expense and credits Cash for the dividend amount.

C)debits Dividends Payable and credits Cash for the dividend amount.

D)establishes who will receive the dividend payment.

A)debits Dividends Declared and credits Dividends Payable for the amount of the dividend.

B)debits Dividend Expense and credits Cash for the dividend amount.

C)debits Dividends Payable and credits Cash for the dividend amount.

D)establishes who will receive the dividend payment.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following statements is not true about when cash dividends can be paid?

A)The retained earnings account must have an accumulated balance sufficient to cover the amount of the dividends to be paid.

B)The cash account must have a balance sufficient to pay the dividends.

C)The board of directors must have declared the dividend before it can be paid.

D)Loan covenants do not restrict the payment of dividends.

A)The retained earnings account must have an accumulated balance sufficient to cover the amount of the dividends to be paid.

B)The cash account must have a balance sufficient to pay the dividends.

C)The board of directors must have declared the dividend before it can be paid.

D)Loan covenants do not restrict the payment of dividends.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

58

On the date a dividend is declared,the company:

A)debits Dividends Declared and credits Dividends Payable for the amount of the dividend.

B)debits Dividend Expense and credits Cash for the dividend amount.

C)debits Dividends Payable and credits Cash for the dividend amount.

D)establishes who will receive the dividend payment.

A)debits Dividends Declared and credits Dividends Payable for the amount of the dividend.

B)debits Dividend Expense and credits Cash for the dividend amount.

C)debits Dividends Payable and credits Cash for the dividend amount.

D)establishes who will receive the dividend payment.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

59

GE buys back 300,000 shares of its stock from investors at $45 a share.Two years later it reissues this stock for $65 a share.The stock reissue would be recorded as:

A)a debit to Cash of $19.5 million and a credit to Treasury Stock of $19.5 million.

B)a debit to Cash of $13.5 million,a debit to Additional Paid-in Capital of $6 million,a credit to Treasury Stock of $13.5 million,and a credit to Stockholders' Equity of $6 million.

C)a debit to Cash of $19.5 million,a credit to Treasury Stock of $13.5 million,and a credit to Additional Paid-in Capital of $6 million.

D)a debit to Cash of $19.5 million,a credit to Treasury Stock of $13.5 million,and a credit to Gain on Sale of Treasury Stock of $6 million.

A)a debit to Cash of $19.5 million and a credit to Treasury Stock of $19.5 million.

B)a debit to Cash of $13.5 million,a debit to Additional Paid-in Capital of $6 million,a credit to Treasury Stock of $13.5 million,and a credit to Stockholders' Equity of $6 million.

C)a debit to Cash of $19.5 million,a credit to Treasury Stock of $13.5 million,and a credit to Additional Paid-in Capital of $6 million.

D)a debit to Cash of $19.5 million,a credit to Treasury Stock of $13.5 million,and a credit to Gain on Sale of Treasury Stock of $6 million.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

60

On February 16,a company declares a 34¢ dividend to be paid on April 5.There are 2 million shares of common stock issued and 100,000 shares of treasury stock.What does the company record in February?

A)A debit to Dividends Payable and a credit to Cash for $680,000.

B)A debit to Dividends Declared and a credit to Dividends Payable for $646,000.

C)A debit to Dividends Payable and a credit to Cash for $646,000.

D)A debit to Dividends Declared and a credit to Dividends Payable for $680,000.

A)A debit to Dividends Payable and a credit to Cash for $680,000.

B)A debit to Dividends Declared and a credit to Dividends Payable for $646,000.

C)A debit to Dividends Payable and a credit to Cash for $646,000.

D)A debit to Dividends Declared and a credit to Dividends Payable for $680,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

61

A company issues 100,000 shares of preferred stock for $40 a share.The stock has fixed annual dividend rate of 5% and a par value of $3 per share.Preferred stockholders can anticipate receiving a dividend of:

A)$5,000 each year.

B)$15,000 each year.

C)5% of net income each year.

D)$3 per share.

A)$5,000 each year.

B)$15,000 each year.

C)5% of net income each year.

D)$3 per share.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

62

Which one of the following events would not require a journal entry on a corporation's books?

A)2-for-1 stock split

B)100% stock dividend

C)2% stock dividend

D)$1 per share cash dividend

A)2-for-1 stock split

B)100% stock dividend

C)2% stock dividend

D)$1 per share cash dividend

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

63

A company reported net income of $5.6 million.At the beginning of the year,3.4 million shares of common stock were outstanding and at the end of the year,3.6 million shares were outstanding.No dividends were declared.The EPS is approximately:

A)$1.60.

B)$1.56.

C)$1.65.

D)$1.40.

A)$1.60.

B)$1.56.

C)$1.65.

D)$1.40.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

64

A company has outstanding 10 million shares of $2 par common stock and 1 million shares of $4 par preferred stock.The preferred stock has an 8% dividend rate.The company declares $300,000 in total dividends for the year.Which of the following is true if the preferred stockholders have a cumulative dividend preference?

A)Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 before the end of the current accounting period.Common stockholders will receive nothing.

B)Preferred stockholders will receive $24,000 (8% of the total dividends).Common stockholders will receive the remaining $276,000.

C)Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 sometime in the future before common stockholders will receive anything.

D)Preferred stockholders will receive the entire $300,000,but will receive nothing more relating to this dividend declaration.Common stockholders will receive nothing.

A)Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 before the end of the current accounting period.Common stockholders will receive nothing.

B)Preferred stockholders will receive $24,000 (8% of the total dividends).Common stockholders will receive the remaining $276,000.

C)Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 sometime in the future before common stockholders will receive anything.

D)Preferred stockholders will receive the entire $300,000,but will receive nothing more relating to this dividend declaration.Common stockholders will receive nothing.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

65

Use the information above to answer the following question.The journal entry to record the transaction will consist of a debit to Cash for $600,000 and a credit (or credits)to:

A)Preferred Stock for $600,000.

B)Preferred Stock for $20,000 and Additional Paid-In Capital for $580,000.

C)Preferred Stock for $20,000 and Retained Earnings for $580,000.

D)Retained Earnings for $600,000.

A)Preferred Stock for $600,000.

B)Preferred Stock for $20,000 and Additional Paid-In Capital for $580,000.

C)Preferred Stock for $20,000 and Retained Earnings for $580,000.

D)Retained Earnings for $600,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

66

Which of the following statements is not true?

A)The legal capital of a corporation represents an amount that cannot be returned to the owners while the corporation still exists.

B)Investors in a corporation are called stockholders.

C)The right to receive a dividend is one of the basic rights of preferred stockholders.

D)Compared with preferred stock,common stock usually has a favorable preference in terms of dividends.

A)The legal capital of a corporation represents an amount that cannot be returned to the owners while the corporation still exists.

B)Investors in a corporation are called stockholders.

C)The right to receive a dividend is one of the basic rights of preferred stockholders.

D)Compared with preferred stock,common stock usually has a favorable preference in terms of dividends.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

67

Preferred stock differs from common stock in that preferred stock:

A)has more voting power and,as such,greater control over the management of the company.

B)is less risky because preferred stockholders are paid dividends before common stockholders.

C)pays a tax-free dividend.

D)has no preemptive rights or residual claims.

A)has more voting power and,as such,greater control over the management of the company.

B)is less risky because preferred stockholders are paid dividends before common stockholders.

C)pays a tax-free dividend.

D)has no preemptive rights or residual claims.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

68

A company issues 100,000 shares of preferred stock for $40 a share.The stock has a fixed dividend rate of 5% and a par value of $3 per share.The company records the issuance with a:

A)debit of $4 million to Cash and a credit of $4 million to Preferred Stock.

B)debit of $300,000 to Cash and a credit of $300,000 to Preferred Stock.

C)debit of $4 million to Cash,a credit of $300,000 to Preferred Stock,and a credit of $3.7 million to Additional Paid-in Capital.

D)debit of $300,000 to Cash,a debit of $3.7 million to Long-term Investments,a credit of $300,000 to Preferred Stock,and a credit of $3.7 million to Additional Paid-in Capital.

A)debit of $4 million to Cash and a credit of $4 million to Preferred Stock.

B)debit of $300,000 to Cash and a credit of $300,000 to Preferred Stock.

C)debit of $4 million to Cash,a credit of $300,000 to Preferred Stock,and a credit of $3.7 million to Additional Paid-in Capital.

D)debit of $300,000 to Cash,a debit of $3.7 million to Long-term Investments,a credit of $300,000 to Preferred Stock,and a credit of $3.7 million to Additional Paid-in Capital.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

69

A current dividend preference means that:

A)preferred stockholders are paid current dividends before common stockholders are paid dividends.

B)unpaid dividends to preferred stockholders accumulate and must be paid before common stockholders receive dividends.

C)preferred stockholders are paid their full fixed dividend rate each period as long as the company is in operation.

D)unpaid cash dividends to preferred stockholders must be replaced with stock dividends during the current period.

A)preferred stockholders are paid current dividends before common stockholders are paid dividends.

B)unpaid dividends to preferred stockholders accumulate and must be paid before common stockholders receive dividends.

C)preferred stockholders are paid their full fixed dividend rate each period as long as the company is in operation.

D)unpaid cash dividends to preferred stockholders must be replaced with stock dividends during the current period.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

70

A company issues 500,000 shares of preferred stock for $30 a share.The stock has a fixed annual dividend rate of 5% and a par value of $9 per share.The current price of the preferred stock is $32 a share.Preferred stockholders can anticipate receiving a per share annual dividend of:

A)$.45.

B)$1.50.

C)$1.60.

D)$1.05.

A)$.45.

B)$1.50.

C)$1.60.

D)$1.05.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

71

The effect of a stock dividend is to:

A)decrease total assets and stockholders' equity.

B)change the composition of stockholders' equity.

C)decrease total assets and total liabilities.

D)increase the market value per share of common shares.

A)decrease total assets and stockholders' equity.

B)change the composition of stockholders' equity.

C)decrease total assets and total liabilities.

D)increase the market value per share of common shares.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

72

A company has outstanding 10 million shares of $2 par common stock and 1 million shares of $4 par preferred stock.The preferred stock has an 8% dividend rate.The company declares $300,000 in total dividends for the year.Which of the following is true if the preferred stockholders only have a current dividend preference?

A)Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 before the end of the current accounting period.Common stockholders will receive nothing.

B)Preferred stockholders will receive $24,000 or 8% of the total dividends.Common stockholders will receive the remaining $276,000.

C)Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 sometime in the future before common stockholders will receive anything.

D)Preferred stockholders will receive the entire $300,000,but will receive nothing more relating to this dividend declaration.Common stockholders will receive nothing.

A)Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 before the end of the current accounting period.Common stockholders will receive nothing.

B)Preferred stockholders will receive $24,000 or 8% of the total dividends.Common stockholders will receive the remaining $276,000.

C)Preferred stockholders will receive the entire $300,000,and they must also be paid $20,000 sometime in the future before common stockholders will receive anything.

D)Preferred stockholders will receive the entire $300,000,but will receive nothing more relating to this dividend declaration.Common stockholders will receive nothing.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

73

A company issues 1 million shares of preferred stock with a par value of $2 and a market price of $26 per share.The issuance should be recorded as:

A)a debit to Cash of $26 million and a credit to Preferred Stock of $26 million.

B)a debit to Cash of $2 million and a credit to Preferred Stock of $2 million.

C)a debit to Cash of $26 million,a credit to Additional Paid-in Capital of $2 million,and a credit to Preferred Stock of $24 million.

D)a debit to Cash of $26 million,a credit to Preferred Stock of $2 million,and a credit to Additional Paid-in Capital of $24 million.

A)a debit to Cash of $26 million and a credit to Preferred Stock of $26 million.

B)a debit to Cash of $2 million and a credit to Preferred Stock of $2 million.

C)a debit to Cash of $26 million,a credit to Additional Paid-in Capital of $2 million,and a credit to Preferred Stock of $24 million.

D)a debit to Cash of $26 million,a credit to Preferred Stock of $2 million,and a credit to Additional Paid-in Capital of $24 million.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

74

If a corporation declares and distributes a 10% stock dividend on its common shares,the account debited is:

A)Dividends Payable.

B)Common Stock.

C)Additional Paid-in Capital.

D)Retained Earnings.

A)Dividends Payable.

B)Common Stock.

C)Additional Paid-in Capital.

D)Retained Earnings.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

75

Use the information above to answer the following question.If the company pays the fixed dividend on the preferred stock,the transaction will:

A)decrease Preferred stock by $20,000.

B)decrease Retained earnings by $600,000.

C)decrease Cash by $20,000.

D)increase Liabilities by $20,000.

A)decrease Preferred stock by $20,000.

B)decrease Retained earnings by $600,000.

C)decrease Cash by $20,000.

D)increase Liabilities by $20,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

76

Use the information above to answer the following question.The EPS is approximately:

A)$0.40.

B)$1.76.

C)$1.86.

D)$2.00.

A)$0.40.

B)$1.76.

C)$1.86.

D)$2.00.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

77

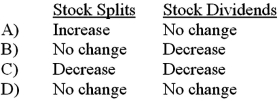

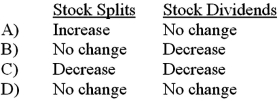

Stock splits and stock dividends have the following effects on retained earnings:

A)Option A

B)Option B

C)Option C

D)Option D

A)Option A

B)Option B

C)Option C

D)Option D

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

78

A company has outstanding 9 million shares of $2 par value common stock and 1 million shares of $4 par value preferred stock.The preferred stock has an 8% dividend rate.The company declares $600,000 in total dividends for the year.Which of the following is true if dividends in arrears are $30,000?

A)Preferred stockholders will receive $350,000.Common stockholders will receive $250,000.

B)Preferred stockholders will receive $60,000.Common stockholders will receive $540,000.

C)Preferred stockholders will receive $320,000.Common stockholders will receive $280,000.

D)Preferred stockholders will receive $90,000.Common stockholders will receive $510,000.

A)Preferred stockholders will receive $350,000.Common stockholders will receive $250,000.

B)Preferred stockholders will receive $60,000.Common stockholders will receive $540,000.

C)Preferred stockholders will receive $320,000.Common stockholders will receive $280,000.

D)Preferred stockholders will receive $90,000.Common stockholders will receive $510,000.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

79

A cumulative dividend preference means that:

A)preferred stockholders are paid dividends before common stockholders are paid dividends for the current year only.

B)unpaid dividends to preferred stockholders accumulate and must be paid before common stockholders receive dividends.

C)preferred stockholders are paid their full fixed dividend rate each period as long as the company is in operation.

D)unpaid cash dividends to preferred stockholders must be replaced with stock dividends during the current period.

A)preferred stockholders are paid dividends before common stockholders are paid dividends for the current year only.

B)unpaid dividends to preferred stockholders accumulate and must be paid before common stockholders receive dividends.

C)preferred stockholders are paid their full fixed dividend rate each period as long as the company is in operation.

D)unpaid cash dividends to preferred stockholders must be replaced with stock dividends during the current period.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck

80

In its most basic form,the earnings per share ratio is calculated as:

A)dividends paid on common stock divided by the average number of outstanding common shares.

B)net income divided by the average number of outstanding common shares.

C)total dividends paid divided by the average number of total stock shares.

D)net income divided by average stockholders' equity.

A)dividends paid on common stock divided by the average number of outstanding common shares.

B)net income divided by the average number of outstanding common shares.

C)total dividends paid divided by the average number of total stock shares.

D)net income divided by average stockholders' equity.

Unlock Deck

Unlock for access to all 146 flashcards in this deck.

Unlock Deck

k this deck