Deck 6: Business Expenses

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/119

Play

Full screen (f)

Deck 6: Business Expenses

1

_____ 13. Home office expenses that exceed the income from the related business may be carried forward to offset future income.

True

2

_____ 6. A prepaid expense is always capitalized by a cash-basis taxpayer.

False

3

_____ 1. Expenses must be ordinary, necessary, and reasonable to be fully deductible.

True

4

_____ 9. If an employer reimburses an employee for business meals and entertainment expenses, the employer can only deduct 50 percent of the reimbursement.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

5

_____ 5. The all events test is met for an accrual-basis taxpayer when the liability is determined and the service has been performed.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

6

_____ 14. Expenses of a hobby that exceed the income from the hobby may be carried forward to offset future income.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

7

_____ 7. A taxpayer cannot take a deduction for a disputed amount until the amount in dispute is settled.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

8

_____ 12. If a spouse accompanies an employee on a business trip to help entertain customers, the spouse's travel expenses are deductible.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

9

_____ 20. Foreign subsidiary income of a U.S. corporation must be reported along with the parent's income for financial accounting and must also include this income in the determination of its tax expense and deferred tax liability.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

10

_____ 18. The information in FAS 109 and the FIN 48 interpretation of FAS 109, have been incorporated into the Accounting Standards Codification Section 740.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

11

_____ 16. A deferred tax asset is the result of the taxes paid exceeding the tax expense on the financial statements.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

12

_____ 15. The UNICAP rules require inventory to include a prorated portion of advertising and distribution expenses.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

13

_____ 17. A deferred tax liability can be the result of both timing and permanent differences between revenue recognition for tax and financial accounting.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

14

_____ 3. A cash basis taxpayer recognizes an expense when the cash is paid or the expense is charged to a credit card.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

15

_____ 2. Under no circumstances are business deductions allowed for expenses that are not substantiated by a paper trail.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

16

_____ 8. A taxpayer can elect to expense immediately or amortize all organization costs over a 15-year period.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

17

_____ 11. For transportation expenses for foreign travel of less than one week to be fully deductible, the days spent on business must exceed personal days.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

18

_____ 10. A temporary assignment cannot exceed one-year.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

19

_____ 4. An accrual-basis taxpayer deducts an expense when the cash is paid even if the service for which the money is paid has not been rendered.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

20

_____ 18. In 2017, all corporations with at least $10 million in assets will be required to file Form 1120, Schedule UTP with their tax returns.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

21

What are the basic requirements for a business expense to be deductible?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

22

In year 1, Braid Corporation, a calendar-year cash-basis corporation, bought office supplies for the next six months in October for $4,500, paid $6,000 for a three-year insurance policy beginning November 1, and borrowed $200,000 on a five-year 6 percent note receiving proceeds of $198,000 on December 1. What is Braid Corporation's total expense deduction in year 1 for these transactions?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

23

What information is required to substantiate a business expense?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

24

Explain the difference between timing differences and permanent differences as related to tax and financial accounting?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

25

Briefly describe the process that a corporation must complete in order to recognize a tax benefit from an uncertain tax position that reduces a business's current or future income tax liability,

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

26

What limitations are placed on the deductibility of expenses incurred in the rental of residential property?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

27

Crib Corporation, a cash-basis corporation, has $50,000 of expenses it could pay this year or it could postpone payment until next year. What is the effect of postponing the payment, using a 6 percent discount rate, if its current marginal tax rate is 34 percent but is expected to be 39 percent next year? How would your answer change if the next year's tax rate is expected to be 25 percent? (The present value of $1 at 6% is .943.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

28

What effect do the UNICAP rules generally have on business expenses?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

29

Contrast business investigation, start-up, and organization expenses.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

30

When may an employee deduct home office expenses?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

31

What is the effect of the exception in APB 23 included in ASC 740 to the reporting of all income on consolidated statements?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

32

George and Jeannie want to open a restaurant. They contribute $3,000 each for a survey to locate an appropriate area for their restaurant and $2,000 each for a real estate agent to locate a suitable building for them to buy. Shortly after this, Jeannie and George have a disagreement and Jeannie walks away from the plan. Although she asks George to reimburse her, he refuses. George then continues the project by himself. He spends $4,000 for legal and accounting fees to set the business up and $8,000 for staff training. What are the tax consequences to George and Jeannie for these expenditures when the restaurant opens in July?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

33

Explain the all events test for expense recognition.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

34

Differentiate a deferred tax asset from a deferred tax liability.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

35

What is a tax home?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

36

What is the difference between a "directly-related" and an "associated with" business expense classified as entertainment?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

37

What are the restrictions placed on a cash-basis taxpayer in deducting prepaid expenses?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

38

Carl, an employee of a Miami CPA firm, was sent to work in Tampa for eight months on March 1, year 1, on a financial audit. His monthly transportation expenses were $400, his monthly lodging was $1,200, and his meals were $800 per month. At the end of the sixth month, his employer determined that the audit was going to continue for eight more months due to an SEC investigation. How much of his expenses may Carl deduct if Carl's employer reimburses him for all of the expenses and includes the reimbursements in his income in years 1 and 2? How much may the employer deduct for these expenses in years 1 and 2?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

39

What are three types of expenses for which a deduction is denied?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

40

What are the rules regarding the deduction for transportation expenses related to foreign business travel?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

41

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____1. $200 interest on a loan that was used to purchase California State revenue bonds.

_____1. $200 interest on a loan that was used to purchase California State revenue bonds.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

42

Allison Corporation (marginal tax rate of 34%) has $44,000 of tax depreciation in the current year. It also has a $40,000 bad debt deduction. For financial accounting, it has a total depreciation deduction of $28,000 and adds $50,000 to its bad debt reserve, the first year it has established a reserve. Determine if the corporation has a deferred tax asset or a deferred tax liability and its amount.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

43

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 12. Mortgage interest and taxes on the home in which a sole proprietor has a home office. Gross profit from the business is only $1,500.

_____ 12. Mortgage interest and taxes on the home in which a sole proprietor has a home office. Gross profit from the business is only $1,500.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

44

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 10. Weekend meals and lodging when business meetings are held on Friday and Monday and these costs are less than the round-trip flight home.

_____ 10. Weekend meals and lodging when business meetings are held on Friday and Monday and these costs are less than the round-trip flight home.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

45

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 9. Fines by the health department for unsanitary conditions.

_____ 9. Fines by the health department for unsanitary conditions.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

46

George took a customer to dinner where they discussed business and then went to see a play. He spent $120 for the meal and left a $25 tip. Cab fare to the theater was $10 and George paid a scalper $200 for the two play tickets with a face value of $80 each. What is George's allowable deduction for these expenses?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

47

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 11. Expenses for a vacation home rented for 275 days and used 40 days by the owner.

_____ 11. Expenses for a vacation home rented for 275 days and used 40 days by the owner.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

48

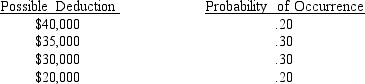

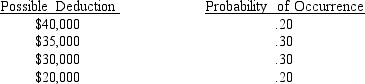

Jensen Corporation plans to take a deduction on its tax return that it believes it is more likely than not that it will be sustained. It is not sure, however, of the exact amount that will be realized. It has established the following amounts and probabilities:

What deduction should Jensen record on its financial statement?

What deduction should Jensen record on its financial statement?

What deduction should Jensen record on its financial statement?

What deduction should Jensen record on its financial statement?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

49

Sarah has a three-day meeting in Berlin. She takes an overnight flight arriving early Sunday morning. After resting several hours, she spends the rest of the day sightseeing. She attends the meetings on Monday, Tuesday, and Wednesday. She spends Thursday sightseeing and returns home on Friday. Her transportation cost $1,200 and her five night's hotel cost $1,250. Her meals were $50 per day from Monday through Thursday and $30 each on Sunday and Friday. How much can Sara deduct for this business trip?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

50

Shelley has a small photographic studio in her home where she takes portraits of a variety of pets for her clients and develops and prints the photos. Last year she earned only $5,500 and had expenses for supplies and film of $2,500. The studio takes up 300 square feet of her 1,500 square foot home. Total relevant home expenses are: Taxes = $2,100; Interest = $9,000; Utilities = $1,500; Repairs and maintenance = $600. Depreciation for the studio portion of the home = $1,000. How much of each expense can Shelley deduct for her photo studio?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

51

Taylor Corporation manufactures lawn mowers. Its annual gross receipts are in excess of $10 million. It has 200 factory personnel, 25 office employees, and 10 sales persons. The cost of office staff is $1,000,000. How much of the cost of the office staff must be allocated to inventory.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

52

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 2. Business investigation expenses incurred by a restaurant owner who investigates but abandons plans to open a hobby mart.

_____ 2. Business investigation expenses incurred by a restaurant owner who investigates but abandons plans to open a hobby mart.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

53

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 3. $2,000 of start-up expenses paid to open a suburban branch of an existing shoe store.

_____ 3. $2,000 of start-up expenses paid to open a suburban branch of an existing shoe store.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

54

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 5. Meals and lodging expenses for a foreign business trip if personal days exceed business days.

_____ 5. Meals and lodging expenses for a foreign business trip if personal days exceed business days.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

55

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 6. Entertainment associated with a business meeting.

_____ 6. Entertainment associated with a business meeting.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

56

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 7. Cost of a hunting lodge available for employees use on a nondiscriminatory basis.

_____ 7. Cost of a hunting lodge available for employees use on a nondiscriminatory basis.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

57

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 4. Transportation expenses on a business trip within the United States if business days exceed personal days.

_____ 4. Transportation expenses on a business trip within the United States if business days exceed personal days.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

58

Which of the following is not required to deduct an expenditure as a business expense?

A) ordinary and necessary

B) reasonable in amount

C) incurred by the taxpayer

D) recurring every year

A) ordinary and necessary

B) reasonable in amount

C) incurred by the taxpayer

D) recurring every year

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

59

Designate whether the following expenses are fully deductible (F), partially deductible (P), or nondeductible (N) in the year paid.

_____ 8. Rent paid for one-year by contract on November 1 by an accrual-basis taxpayer.

_____ 8. Rent paid for one-year by contract on November 1 by an accrual-basis taxpayer.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

60

Sam owns a vacation villa in Hawaii. This year he used the villa for 25 days and rented out the villa for 125 days earning $14,000 from the rentals. His total expenses for the year for the vacation home were: mortgage interest = $9,000; taxes = $4,000; utilities = $2,000; repairs and maintenance = $1,500; and depreciation = $12,000. How much can Sam deduct in total for the expenses related to the villa?

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

61

John and his family were living in New Jersey when he accepted a full-time job in Philadelphia. During the week, John lives in a rental apartment in Philadelphia that is within walking distance of his office; on weekends he drives home to be with his family in New Jersey where he also does a few hours of consulting work. Where is John's tax home?

A) Philadelphia

B) New Jersey

C) He can choose either Philadelphia or New Jersey

D) Clay has no tax home.

A) Philadelphia

B) New Jersey

C) He can choose either Philadelphia or New Jersey

D) Clay has no tax home.

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

62

Stephanie, a taxpayer in the 28% marginal tax bracket, borrows $100,000 at 7% interest to invest in 6% tax-exempt municipal bonds (annual loan interest expense is $7,000). What is Stephanie's interest expense deduction?

A) $0

B) $1,000

C) $6,000

D) $7,000

A) $0

B) $1,000

C) $6,000

D) $7,000

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

63

Carlos, a self-employed construction contractor, contributed $5,000 to the re-election campaign of the local mayor in the hopes that his planned construction project will be approved. How much is Carlos's deduction for this political contribution? . $0

B) $25

C) $2,500

D) $5,000

B) $25

C) $2,500

D) $5,000

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

64

Cleo spent $4,000 on organization costs for her business and $13,000 training staff. If the business is a calendar-year cash-basis business that starts operations on June 1, what is the current year's deduction for these expenses?

A) $17,000

B) $9,311

C) $9,000

D) $611

A) $17,000

B) $9,311

C) $9,000

D) $611

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

65

Which of the following taxes cannot be deducted by a business?

A) Sales taxes on supplies

B) Property taxes on real property

C) FICA taxes on employees' wages

D) All of these taxes are deductible

A) Sales taxes on supplies

B) Property taxes on real property

C) FICA taxes on employees' wages

D) All of these taxes are deductible

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

66

Matthew, a car dealer in Atlanta, wants to open a restaurant in Miami. He spends $8,000 investigating the location and feasibility of opening the restaurant in 2017, Matthew opens the restaurant in Miami in November and spends an additional $7,000 in start-up costs. In 2017 Matthew can:

A) Deduct the entire $15,000

B) Deduct $8,000 with the remaining $7,000 amortized over 15 years

C) Deduct $5,000 with the remaining $10,000 amortized over 15 years

D) Only amortize the entire $15,000 over 15 years

A) Deduct the entire $15,000

B) Deduct $8,000 with the remaining $7,000 amortized over 15 years

C) Deduct $5,000 with the remaining $10,000 amortized over 15 years

D) Only amortize the entire $15,000 over 15 years

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

67

In April 2017, Tobias was assigned to a job in the next county for the day. He drove 75 miles each way for the job, paid $4 in tolls, $7 for parking and $9 for lunch. What is his allowable business expense deduction?

A) $56

B) $80.25

C) $91,25

D) $93.50

A) $56

B) $80.25

C) $91,25

D) $93.50

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

68

Which of the following may qualify as a deductible business expense?

A) Membership in the local Chamber of Commerce

B) Athletic Booster Club membership

C) Country Club dues

D) Admiral's Club of American Airlines membership

A) Membership in the local Chamber of Commerce

B) Athletic Booster Club membership

C) Country Club dues

D) Admiral's Club of American Airlines membership

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

69

On October 1, 2017, Fine Brands Corporation (a cash-basis, calendar-year taxpayer) borrowed $200,000 from the bank at 9% annual interest. On December 30, 2017, Fine Brands paid $18,000 to the bank for the first year's interest on the loan. How much can Garcia deduct in 2017 for interest expense?

A) $1,500

B) $1,620

C) $4,500

D) $18,000

A) $1,500

B) $1,620

C) $4,500

D) $18,000

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

70

Attendance at a hockey game with a client would be deductible if:

A) Some business was discussed on the phone when plans were made to meet for the game

B) Business was discussed for about a minute while in the restroom

C) Business was discussed at dinner before the game

D) Business is not require to be discussed as long as this was to secure the client's goodwill

A) Some business was discussed on the phone when plans were made to meet for the game

B) Business was discussed for about a minute while in the restroom

C) Business was discussed at dinner before the game

D) Business is not require to be discussed as long as this was to secure the client's goodwill

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

71

A taxpayer may deduct a fine for illegal parking if:

A) No parking spaces are available

B) Persons making deliveries to this business regularly receive parking tickets

C) The fine does not exceed $50

D) Fines are not deductible

A) No parking spaces are available

B) Persons making deliveries to this business regularly receive parking tickets

C) The fine does not exceed $50

D) Fines are not deductible

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

72

Attendance at business-related seminars or meetings would be deductible for all of the following except:

A) Political conventions

B) Trade shows

C) Continuing education

D) Research seminars

A) Political conventions

B) Trade shows

C) Continuing education

D) Research seminars

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

73

To deduct a bad debt expense for tax purposes, the taxpayer must use:

A) The specific charge-off method

B) The aging of receivables method

C) The reserve method

D) Any other method permitted for financial accounting

A) The specific charge-off method

B) The aging of receivables method

C) The reserve method

D) Any other method permitted for financial accounting

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

74

Claudia went to the West Coast to attend several business meetings with prospective clients. She flew out on Wednesday afternoon, spent all day Thursday, Friday, Monday and Tuesday attending meetings, and then spent the rest of the week touring the area, returning home on Saturday. She spent $800 on airfare, $1,600 on hotels (10 nights at $160 per night), $400 for a rental car ($40 per day from Wednesday night through Saturday of the following week), and $300 for meals ($30 per day from Thursday through the following Friday and $15 on each of her travel days). What is her allowable deduction for travel away from home?

A) $1,505

B) $1,610

C) $2,305

D) $2,410

A) $1,505

B) $1,610

C) $2,305

D) $2,410

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

75

John, a rental car dealer on Miami Beach, is considering opening a beauty salon in San Francisco. After spending $8,000 investigating such possibilities in San Francisco, John decides not to open the salon. As a consequence, the $8,000 is:

A) Capitalized and amortized over 189 months

B) Capitalized and deductible over the life of the business

C) Deduct $5,000 and amortize the balance over 180 months

D) Not deductible

A) Capitalized and amortized over 189 months

B) Capitalized and deductible over the life of the business

C) Deduct $5,000 and amortize the balance over 180 months

D) Not deductible

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

76

Perez Corporation paid the following expenses: $14,000 country club dues and $8,000 business meals at the country club. How much can Perez deduct for these expenses?

A) $18,000

B) $11,000

C) $4,400

D) $4,000

A) $18,000

B) $11,000

C) $4,400

D) $4,000

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

77

On November 1, 2017, Hernandez Corporation (a cash-basis, calendar-year taxpayer) signed a 36-month lease with Taylor Realty Corporation for rental office space. The market rental rate for this office space is $2,000 per month but Hernandez was able to rent it for $1,900 per month by agreeing to prepay the rent for the entire 36-month period. How much can Hernandez deduct in 2017 rent expense?

A) $68,400

B) $22,800

C) $4,000

D) $3,800

A) $68,400

B) $22,800

C) $4,000

D) $3,800

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

78

Which of the following expenditures would not be deductible as a business expense?

A) Costs of holding a business meeting at a local country club

B) The fare for flying business class to an overseas meeting

C) Paying the interest on a loan for the owner's grandfather

D) Paying the owner's 17 year old son a salary of $9 per hour for cleaning and janitor services

A) Costs of holding a business meeting at a local country club

B) The fare for flying business class to an overseas meeting

C) Paying the interest on a loan for the owner's grandfather

D) Paying the owner's 17 year old son a salary of $9 per hour for cleaning and janitor services

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

79

Travel away from home on business is defined as being away from home for:

A) At least 8 hours

B) A period of time that requiring rest would be reasonable

C) No less than 24 hours

D) More than one day and night

A) At least 8 hours

B) A period of time that requiring rest would be reasonable

C) No less than 24 hours

D) More than one day and night

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck

80

Chico Corporation, a calendar-year accrual-basis corporation, paid $3,000 on April 1 for a property insurance policy for the next three years, prepaid six months interest of $450 on November 1, and paid $2,000 rent for December and January on December 1. What is his deduction in the current year for these expenses?

A) $1,900

B) $2,450

C) $2,600

D) $5,450

A) $1,900

B) $2,450

C) $2,600

D) $5,450

Unlock Deck

Unlock for access to all 119 flashcards in this deck.

Unlock Deck

k this deck