Deck 2: The Tax Practice Environment

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/110

Play

Full screen (f)

Deck 2: The Tax Practice Environment

1

_____ 17. A proposed regulation can be relied on when planning a transaction.

False

2

_____ 4. The Internal Revenue Service has the burden of proof when it is asserting fraud with the intent to evade taxes on the part of the taxpayer.

True

3

_____ 7. Circular 230 is issued by the AICPA to provide guidance on tax return preparation by CPAs.

False

4

_____ 13. The higher a firm's marginal tax rate used for project evaluation, the greater the net cash flow from the project.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

5

_____ 2. The Internal Revenue Service must pay interest on any refund that is not mailed within 30 days of the date the taxpayer's tax return is filed.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

6

_____ 11. If a project results in a loss, the tax effect causes a decrease in cash flow.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

7

_____ 18. Acquiescence by the Internal Revenue Service's Commissioner means that the IRS will follow the decision in the future.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

8

_____ 8. If a CPA finds an error on a previously filed tax return of a client, he or she should advise the client to file an amended return to correct the error.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

9

_____ 3. The statute of limitations for an error overstating expenses by more than 25 percent is 3 years.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

10

_____ 16. A letter ruling can only be relied on by the taxpayer for whom it is written.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

11

_____ 10. If a firm's discount rate is lower than another firm's, the present value of its future cash flows will be higher.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

12

_____ 1. The Internal Revenue Service is part of the Justice Department.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

13

_____ 9. Only CPAs, Enrolled Agents, and Attorneys who prepare tax returns for pay must obtain preparer tax identification numbers.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

14

______ 6. A transaction for which there is no legitimate business purpose is automatically assessed a 50% penalty.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

15

_____ 12. Legal income shifting includes shifting income among relatives and between a business and its owner/employee.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

16

_____ 5. Tax avoidance is the minimization of the tax burden by using acceptable, legal alternatives.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

17

_____ 14. The business purpose doctrine requires a transaction to have an economic purpose other than one based solely on tax avoidance.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

18

_____ 20. A memo to file for a client should be more detailed than the client letter.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

19

_____ 19. The Golsen rule requires the Tax Court to follow all other Federal District Court decisions in the same Circuit.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

20

_____ 15 The Cumulative Bulletin contains reports of all the committees involved in tax writing as well as statements made on the floor of the House or Senate.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

21

Kitty's tax return, which she filed on April 15, showed a balance due of $8,500. She did not have the money to pay this amount. On September 20, she was finally able to borrow sufficient money to pay the debt. What is Kitty's late payment penalty?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

22

What is meant when the Commissioner of the Internal Revenue Service acquiesces to a court decision?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

23

What is the purpose of Treasury Regulations?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

24

Explain what is meant by changing the character of income? Provide an example.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

25

What is the difference between an interpretive regulation and a legislative regulation?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

26

When may a CPA use estimates in the preparation of a client's tax return?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

27

What is the difference between a primary and a secondary source of tax authority?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

28

Which tax return preparers are required to obtain preparer tax identification numbers?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

29

What is meant by the phrase "substance-over-form"?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

30

Explain how tax compliance differs from tax planning.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

31

To which trial courts may a taxpayer contest a decision of the IRS?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

32

Explain what is meant by the statute of limitations.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

33

Joaquin did not have any money to pay his $2,000 tax liability on April 15 so he did not file his tax return. He finally filed the return on July 25 and paid $1,000 of the tax due. He paid the remaining tax due on October 18. What is his total penalty?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

34

Explain the Golsen rule.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

35

Explain the step transaction doctrine.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

36

Explain the difference between a closed fact and an open fact transaction.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

37

Explain the difference between tax avoidance and tax evasion.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

38

What are the steps that are usually required between introduction and passage of a revenue bill?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

39

What are three factors that can affect the after-tax cash flow of a project? How does each affect this cash flow?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

40

What is the difference between a letter ruling and a revenue ruling?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

41

What is the penalty for taxpayers who fail to pay their tax liability with a timely filed tax return for the taxes owing?

A) 5% per month

B) 2% per month

C) 0.5% per month

D) $100 per month

A) 5% per month

B) 2% per month

C) 0.5% per month

D) $100 per month

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

42

Place in order the steps in the tax legislative process from the list below:

___ a. The bill is referred to the House Ways and Means Committee

___ b. The bill is referred to the Joint Conference Committee

___ c. A member of the House introduces the tax bill

___ d. The bill is forwarded to the President for his signature

___ e. The Senate votes on the bill

___ f. The House votes on the bill

___ g. The bill is referred to the Senate Finance Committee

___ h. The Conference Committee sends the bill back to the House and the Senate

___ a. The bill is referred to the House Ways and Means Committee

___ b. The bill is referred to the Joint Conference Committee

___ c. A member of the House introduces the tax bill

___ d. The bill is forwarded to the President for his signature

___ e. The Senate votes on the bill

___ f. The House votes on the bill

___ g. The bill is referred to the Senate Finance Committee

___ h. The Conference Committee sends the bill back to the House and the Senate

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

43

What is the unextended due date for a corporation with a March 31 year-end?

A) April 15

B) May 15

C) June 15

D) July 15

A) April 15

B) May 15

C) June 15

D) July 15

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

44

Walter did not file his 2016 tax return that was due April 15, 2017 until June 2, 2017.

a. When does the statute of limitations expire for this return assuming he did not file for an automatic extension?

b. When does the statute of limitations expire if Walter forgot to report a land sale that occurred on January 10, 2017? He had a $20,000 gain on the transaction and he reported gross income for 2017 of $75,000?

c. When does the statute of limitations expire if Walter deliberately omitted the $20,000 gain on the land sale?

a. When does the statute of limitations expire for this return assuming he did not file for an automatic extension?

b. When does the statute of limitations expire if Walter forgot to report a land sale that occurred on January 10, 2017? He had a $20,000 gain on the transaction and he reported gross income for 2017 of $75,000?

c. When does the statute of limitations expire if Walter deliberately omitted the $20,000 gain on the land sale?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

45

The IRS must pay interest on

A) tax refunds paid later than 30 days after the due date.

B) tax refunds paid later than 45 days after the due date.

C) all tax refunds.

D) The IRS never pays interest on tax refunds.

A) tax refunds paid later than 30 days after the due date.

B) tax refunds paid later than 45 days after the due date.

C) all tax refunds.

D) The IRS never pays interest on tax refunds.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

46

Charley Careless had not read much about the preparer penalties that could be assessed for failure to have substantial authority for certain tax positions taken on his client's returns. He prepared a return for one of his clients with an issue that was clearly a problem. If he was paid $4,000 for the tax return preparation, how much would his potential fine be under the following circumstances:

a. Charley should have known that the position did not have a reasonable possibility of success but had failed to do any research.

b. Charley knew the position was "iffy" but disclosed the problem.

c. Charley knew the position could not be supported but the client expected Charley to get him a large refund.

a. Charley should have known that the position did not have a reasonable possibility of success but had failed to do any research.

b. Charley knew the position was "iffy" but disclosed the problem.

c. Charley knew the position could not be supported but the client expected Charley to get him a large refund.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

47

What is the minimum penalty for a taxpayer who fails to file his or her return for over 60 days past the due date without reasonable cause?

A) The amount owed on the return

B) $135

C) The amount owed on the return or $210, whichever is less

D) 4.5% of the amount owed on the return.

A) The amount owed on the return

B) $135

C) The amount owed on the return or $210, whichever is less

D) 4.5% of the amount owed on the return.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

48

If the due date for a tax return is extended for a taxpayer who has a $2,000 balance due, the taxpayer

A) must pay the tax due by the original due date to avoid interest

B) has 30 days following the original due date to pay the $2,000 due without interest

C) has 60 days following the original due date to pay the $2,000 due without interest

D) has 6 months following the original due date to pay the $2,000 due without interest

A) must pay the tax due by the original due date to avoid interest

B) has 30 days following the original due date to pay the $2,000 due without interest

C) has 60 days following the original due date to pay the $2,000 due without interest

D) has 6 months following the original due date to pay the $2,000 due without interest

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

49

Ryan filed his tax return 40 days after the due date and included a check for the $1,800 balance due with the return. Ryan's failure-to-file penalty is

A) 25%

B) 20% per month (or partial month)

C) 5% per month (or partial month) up to a maximum of 25%

D) 0.5% per month (or partial month) up to a maximum of 25%

A) 25%

B) 20% per month (or partial month)

C) 5% per month (or partial month) up to a maximum of 25%

D) 0.5% per month (or partial month) up to a maximum of 25%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

50

The statute of limitations for a return that inadvertently overstates expenses by 30 percent of gross revenues is

A) 3 years

B) 6 years

C) 10 years

D) Unlimited

A) 3 years

B) 6 years

C) 10 years

D) Unlimited

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

51

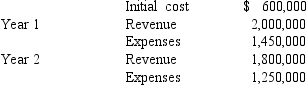

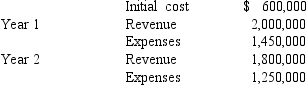

What is the after-tax net present value of a project costing $600,000 that Plud Corporation can invest in if the project has the following estimated revenues and expenses?

Plud uses an 8 percent discount rate for evaluation and expects a 34 percent marginal tax rate in the relevant years.

Plud uses an 8 percent discount rate for evaluation and expects a 34 percent marginal tax rate in the relevant years.

Plud uses an 8 percent discount rate for evaluation and expects a 34 percent marginal tax rate in the relevant years.

Plud uses an 8 percent discount rate for evaluation and expects a 34 percent marginal tax rate in the relevant years.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

52

Carol wants to invest in a project that requires a $20,000 investment. She expects a before-tax return of $16,000 in years 1 through 3 from this investment. She uses a 6 percent discount rate for evaluation but is not sure if her marginal tax rate will be 15 percent or 25 percent. What difference does the marginal tax rate make in the after-tax net present value of this investment?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

53

An individual may apply for an automatic extension of time to file a return of

A) Extensions are not permitted

B) 3 months

C) 4 months

D) 6 months

A) Extensions are not permitted

B) 3 months

C) 4 months

D) 6 months

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

54

William purchased 10,000 shares of stock for $10 per share late last month. Due to a proposed hostile takeover of the company, the stock has jumped in price to $16 per share. If he holds the stock for at least a full year, he believes the price will decline to $14 per share but he will be eligible for the 15 percent long-term capital gains rate for his gain. If he sells now, his gain will be subject to his 33 percent marginal tax rate. Should William sell now or wait one year? Use a one-year present value factor of .909 in your evaluation.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

55

For each entry in the following list, indicate with a P if it is a primary source of tax law or an S if it is a secondary source of tax law.

_____ a. A tax textbook

_____ b. Tax Court Decision

_____ c. Kiplinger Tax Letter

_____ d. Journal of Accountancy

_____ e. Legislative regulations

_____ f. Internal Revenue Code

_____ g. A Court of Federal Claims decision

_____ h. Committee reports

_____ i. The Tax Adviser

_____ j. Revenue ruling

_____ a. A tax textbook

_____ b. Tax Court Decision

_____ c. Kiplinger Tax Letter

_____ d. Journal of Accountancy

_____ e. Legislative regulations

_____ f. Internal Revenue Code

_____ g. A Court of Federal Claims decision

_____ h. Committee reports

_____ i. The Tax Adviser

_____ j. Revenue ruling

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

56

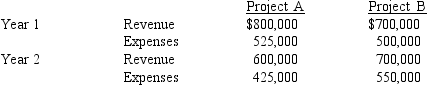

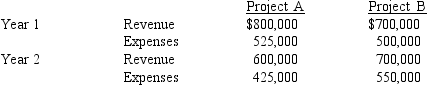

Berman Corporation can accept only one of two projects. The revenue and expenses for each of the projects is shown below. Which project should Berman accept if the corporation has a 10 percent cost of capital and a 34 percent marginal tax rate?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

57

Which of the following types of returns does not have an unextended due date of the 15th day of the 4th month after the end of the tax year?

A) S corporations

B) C Corporations

C) Individuals

D) Trusts

A) S corporations

B) C Corporations

C) Individuals

D) Trusts

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

58

The Internal Revenue Service is part of:

A) The Office of Budget and Management

B) The Justice Department

C) The Treasury Department

D) Congress

A) The Office of Budget and Management

B) The Justice Department

C) The Treasury Department

D) Congress

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

59

William just did not like figuring out his taxes each year and he usually had so little income that he didn't owe taxes. He never filed an extension even though he seldom got around to filing before October or November. He finally filed his 2016 return in September of 2017 when he remembered he had sold some stock in early 2016 for a small profit. Unfortunately, he owed $125 in taxes because of the sale. What is William's failure to file penalty?

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

60

Cynthia and John have dependent twins ages 18. Their joint income places them in the 33 percent marginal tax bracket. What are their total tax savings if they can transfer $2,000 of taxable income to each of the children? The children have no other income that is taxable.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

61

According to the Statements on Standards for Tax Services, if a CPA discovers an error in a prior return prepared by another tax return preparer, the CPA

A) is required to notify IRS immediately

B) should notify the client of the error and request permission to disclose the error to the IRS

C) must immediately withdraw from the engagement

D) is required to correct the error on the prior year's return even if it does not affect the current year's tax return

A) is required to notify IRS immediately

B) should notify the client of the error and request permission to disclose the error to the IRS

C) must immediately withdraw from the engagement

D) is required to correct the error on the prior year's return even if it does not affect the current year's tax return

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

62

Eduardo filed his 2016 tax return on March 15, 2017. Eduardo accidentally omitted $10,000 of income from his individual tax return. The total gross income shown on the tax return was $35,000. When will the statute of limitations expire for Eduardo's 2016 tax return?

A) March 15, 2020

B) March 15, 2023

C) April 15, 2020

D) April 15, 2023

A) March 15, 2020

B) March 15, 2023

C) April 15, 2020

D) April 15, 2023

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

63

If a tax preparer is convicted of criminal tax evasion, the preparer may be subject to a penalty of

A) a $100,000 fine

B) prison

C) Both a and b

D) Neither a nor b

A) a $100,000 fine

B) prison

C) Both a and b

D) Neither a nor b

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

64

A taxpayer will receive a 30-day letter

A) only if the taxpayer is more than 30 days late in filing the tax return.

B) to provide notification that the taxpayer's return has been selected for audit.

C) after a 90-day notice of deficiency notifying the taxpayer there is only a 30-day period to file a protest in court

D) as the first notice of a proposed deficiency

A) only if the taxpayer is more than 30 days late in filing the tax return.

B) to provide notification that the taxpayer's return has been selected for audit.

C) after a 90-day notice of deficiency notifying the taxpayer there is only a 30-day period to file a protest in court

D) as the first notice of a proposed deficiency

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

65

Copp Co. can invest in a project that costs $200,000. It is expected to provide a lump sum after-tax return of $300,000. If Copp uses an 8 percent discount rate for evaluation, in what year must it recover the $300,000 to produce a positive net cash flow?

A) 3rd year

B) 4th year

C) 5th year

D) 6th year

A) 3rd year

B) 4th year

C) 5th year

D) 6th year

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

66

A six-year statute of limitations applies if the taxpayer

A) understates adjusted gross income by 25%

B) understates taxable income by 25%

C) understates gross income by 25%

D) overstates deduction by 25%

A) understates adjusted gross income by 25%

B) understates taxable income by 25%

C) understates gross income by 25%

D) overstates deduction by 25%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

67

What is the first notice of a proposed deficiency that a taxpayer receives?

A) Examination letter

B) 90-day letter

C) 60-day letter

D) 30-day letter

A) Examination letter

B) 90-day letter

C) 60-day letter

D) 30-day letter

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

68

If a tax return preparer prepares a return that involves a "listed transaction," the preparer can avoid all penalties if

A) the position is not unreasonable.

B) the position has a possibility of success.

C) the preparer has substantial authority for the position

D) the position has no support but there is no evidence of fraud.

A) the position is not unreasonable.

B) the position has a possibility of success.

C) the preparer has substantial authority for the position

D) the position has no support but there is no evidence of fraud.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

69

Which of the following is not one of the Statements on Standards for Tax Services?

A) Tax Return Positions

B) Discovery of Fraud

C) Use of Estimates

D) Departure from a Previous Position

A) Tax Return Positions

B) Discovery of Fraud

C) Use of Estimates

D) Departure from a Previous Position

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

70

A high DIF score indicates which of the following?

A) The taxpayer is likely to get a refund

B) The taxpayer's chances of audit are substantially less than 2%

C) IRS will automatically grant an extension of time to appeal

D) The taxpayer's chances of audit are fairly high

A) The taxpayer is likely to get a refund

B) The taxpayer's chances of audit are substantially less than 2%

C) IRS will automatically grant an extension of time to appeal

D) The taxpayer's chances of audit are fairly high

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

71

How long after receiving a Statutory Notice of Deficiency does the taxpayer have to file a petition with the Tax Court?

A) 30 days

B) 60 days

C) 90 days

D) 6 months

A) 30 days

B) 60 days

C) 90 days

D) 6 months

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

72

Which type of audit is most frequently used for examination of business returns?

A) Correspondence audit

B) Office audit

C) Noncompliance audit

D) Field audit

A) Correspondence audit

B) Office audit

C) Noncompliance audit

D) Field audit

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

73

An offer in compromise is initiated by

A) The Tax Court

B) A Revenue agent

C) The taxpayer

D) IRS General Council

A) The Tax Court

B) A Revenue agent

C) The taxpayer

D) IRS General Council

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

74

Which of the following paid tax return preparers must have a preparer tax identification number?

A) CPAs

B) Attorneys

C) Enrolled Agents

D) All of the above

A) CPAs

B) Attorneys

C) Enrolled Agents

D) All of the above

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

75

Which penalty can equal 75 percent of the tax underpayment?

A) Failure to file

B) Failure to pay

C) Negligence

D) Fraud

A) Failure to file

B) Failure to pay

C) Negligence

D) Fraud

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

76

Coral Corporation (a C corporation) sold $100,000 of merchandise for which it paid $40,000. It also paid $35,000 of other expenses. All transactions were in cash. What is Coral Corporation's after-tax net cash inflow?

A) $100,000

B) $60,000

C) $25,000

D) $21,250

A) $100,000

B) $60,000

C) $25,000

D) $21,250

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

77

Which of the following does not deal with a CPA's standard of conduct

A) Treasury Circular 230

B) AICPA Code of Conduct

C) Internal Revenue Service Manual

D) Statement of Standards for Tax Services

A) Treasury Circular 230

B) AICPA Code of Conduct

C) Internal Revenue Service Manual

D) Statement of Standards for Tax Services

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

78

To which court can a taxpayer appeal an IRS deficiency notice without paying the tax?

A) District Court

B) Tax Court

C) Court of Federal Claims

D) Court of Appeals for the Federal Circuit

A) District Court

B) Tax Court

C) Court of Federal Claims

D) Court of Appeals for the Federal Circuit

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

79

Which of the following is not a requirement to qualify for innocent spouse relief?

A) The individual electing innocent spouse relief must have been abandoned by her spouse for more than 6 months.

B) The individual establishes that she did not know and had no reason to know that there was an understatement

C) It would be inequitable to hold the individual liable for the deficiency attributable to the understatement when all facts and circumstances are considered

D) The individual elects innocent spouse relief within the time period that the statute of limitation is open for collection activities.

A) The individual electing innocent spouse relief must have been abandoned by her spouse for more than 6 months.

B) The individual establishes that she did not know and had no reason to know that there was an understatement

C) It would be inequitable to hold the individual liable for the deficiency attributable to the understatement when all facts and circumstances are considered

D) The individual elects innocent spouse relief within the time period that the statute of limitation is open for collection activities.

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck

80

James can invest in a project that will cost $70,000. The project is expected to pay him $95,000 after-tax in 5 years. What is the maximum discount rate, as a whole number, that he could use to evaluate the project that would yield a positive cash flow?

A) 5%

B) 6%

C) 7%

D) 8%

A) 5%

B) 6%

C) 7%

D) 8%

Unlock Deck

Unlock for access to all 110 flashcards in this deck.

Unlock Deck

k this deck