Deck 13: Partnerships: Characteristics, Formation, and Accounting for Activities

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/32

Play

Full screen (f)

Deck 13: Partnerships: Characteristics, Formation, and Accounting for Activities

1

Which of the following statements is true concerning the treatment of salaries in partnership accounting?

A) Partner salaries may be used to allocate profits and losses; they are not considered expenses of the partnership

B) Partner salaries are equal to the annual partner draw.

C) The salary of a partner is treated in the same manner as salaries of corporate employees.

D) Partner salaries are directly closed to the capital account.

A) Partner salaries may be used to allocate profits and losses; they are not considered expenses of the partnership

B) Partner salaries are equal to the annual partner draw.

C) The salary of a partner is treated in the same manner as salaries of corporate employees.

D) Partner salaries are directly closed to the capital account.

A

2

Which of the following best describes the use of interest on invested capital as a means of allocating profits?

A) If interest on invested capital is used, it must be used for all partners.

B) Interest is allocated only if there is partnership net profit.

C) Invested capital balances are never affected by drawings of the partnerships.

D) Use of beginning or ending measures of invested capital may be subject to manipulation that distorts the measure of invested capital.

A) If interest on invested capital is used, it must be used for all partners.

B) Interest is allocated only if there is partnership net profit.

C) Invested capital balances are never affected by drawings of the partnerships.

D) Use of beginning or ending measures of invested capital may be subject to manipulation that distorts the measure of invested capital.

D

3

Ace & Barnes partnership has income of $110,000 and Partner A is to be allocated a bonus of 10% of income after the bonus, Partner A's bonus would be ____.

A) $11,000

B) $10,000

C) $9,091

D) $9,000

A) $11,000

B) $10,000

C) $9,091

D) $9,000

B

4

Which of the following is NOT a characteristic of the proprietary theory that influences accounting for partnerships?

A) Partners' salaries are viewed as a distribution of income rather than a component of net income.

B) A partnership is not viewed as a separate, distinct, taxable entity.

C) A partnership is characterized by limited liability.

D) Changes in the ownership structure of a partnership result in the dissolution of the partnership.

A) Partners' salaries are viewed as a distribution of income rather than a component of net income.

B) A partnership is not viewed as a separate, distinct, taxable entity.

C) A partnership is characterized by limited liability.

D) Changes in the ownership structure of a partnership result in the dissolution of the partnership.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

5

Scenario 13-1

Partners Tuba and Drum share profits and losses of their partnership equally after 1) annual salary allowances of $25,000 for Tuba and $20,000 for Drum and 2) 10% interest is provided on average capital balances. During 2008, the partnership had earnings of $50,000; Tuba's average capital balance was $60,000 and Drum's average capital balance was $90,000.

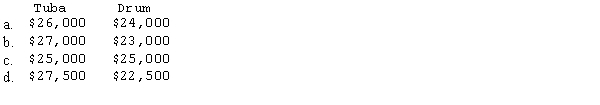

Refer to Scenario 13-1. How should the $50,000 of earnings be divided?

Partners Tuba and Drum share profits and losses of their partnership equally after 1) annual salary allowances of $25,000 for Tuba and $20,000 for Drum and 2) 10% interest is provided on average capital balances. During 2008, the partnership had earnings of $50,000; Tuba's average capital balance was $60,000 and Drum's average capital balance was $90,000.

Refer to Scenario 13-1. How should the $50,000 of earnings be divided?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

6

Partners active in a partnership business should have their share of partnership profits based on the following

A) a combination of salaries plus interest based on average capital balances.

B) a combination of salaries and percentage of net income after salaries and any other allocation basis.

C) salaries only.

D) percentage of net income after salaries is paid to inactive partners.

A) a combination of salaries plus interest based on average capital balances.

B) a combination of salaries and percentage of net income after salaries and any other allocation basis.

C) salaries only.

D) percentage of net income after salaries is paid to inactive partners.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

7

Maxwell is trying to decide whether to accept a salary of $60,000 or a salary of $25,000 plus a bonus of 20% of net income after the bonus as a means of allocating profit among the partners. What amount of income would be necessary so that Maxwell would consider the choices to be equal?

A) $35,000

B) $85,000

C) $140,000

D) $210,000

A) $35,000

B) $85,000

C) $140,000

D) $210,000

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

8

Partners A and B have a profit and loss agreement with the following provisions: salaries of $20,000 and $25,000 for A and B, respectively; a bonus to A of 10% of net income after bonus; and interest of 20% on average capital balances of $40,000 and $50,000 for A and B, respectively. Any remainder is split equally. If the partnership had net income of $88,000, how much should be allocated to Partner A?

A) $36,000

B) $44,500

C) $50,000

D) $43,500

A) $36,000

B) $44,500

C) $50,000

D) $43,500

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

9

Partners A and B have a profit and loss agreement with the following provisions: salaries of $30,000 and $45,000 for A and B, respectively; a bonus to A of 12% of net income after salaries and bonus; and interest of 10% on average capital balances of $50,000 and $65,000 for A and B, respectively. One-fourth of any remaining profits are allocated to A and the balance to B. If the partnership had net income of $108,600, how much should be allocated to Partner A?

A) $43,225

B) $43,816

C) $47,850

D) $65,375

A) $43,225

B) $43,816

C) $47,850

D) $65,375

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

10

Maxwell is a partner and has an annual salary of $30,000 per year, but he actually draws $3,000 per month. The other partner in the partnership has an annual salary of $40,000 and draws $4,000 per month. What is the total annual salary that should be used to allocate annual net income among the partners?

A) $14,000

B) $50,000

C) $70,000

D) $84,000

A) $14,000

B) $50,000

C) $70,000

D) $84,000

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements are true when comparing corporations and partnerships?

A) Partnership entities provide for taxes at the same rates used by corporations.

B) In theory, partnerships are more able to attract capital.

C) Like corporations, partnerships have an infinite life.

D) Unlike shareholders, general partners may have liability beyond their capital balances.

A) Partnership entities provide for taxes at the same rates used by corporations.

B) In theory, partnerships are more able to attract capital.

C) Like corporations, partnerships have an infinite life.

D) Unlike shareholders, general partners may have liability beyond their capital balances.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

12

Partners Acker, Becker & Checker have the following profit and loss agreement: (1)

Acker & Becker receive salaries of $40,000 each

(2)

Checker gets a bonus of 10 percent of net income after salaries and bonus (the bonus is zero if salaries exhaust net income)

(3)

Remaining profits are shared by Acker, Becker & Checker in the following ratios respectively: 3:4:3.

The partnership had a net income of $91,000. How much should be allocated to Checker?

A) $3,300

B) $10,300

C) $1,000

D) $4,000

Acker & Becker receive salaries of $40,000 each

(2)

Checker gets a bonus of 10 percent of net income after salaries and bonus (the bonus is zero if salaries exhaust net income)

(3)

Remaining profits are shared by Acker, Becker & Checker in the following ratios respectively: 3:4:3.

The partnership had a net income of $91,000. How much should be allocated to Checker?

A) $3,300

B) $10,300

C) $1,000

D) $4,000

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

13

Partners A and B have a profit and loss agreement with the following provisions: salaries of $40,000 and $45,000 for A and B, respectively; a bonus to A of 10% of net income after salaries and bonus; and interest of 15% on average capital balances of $40,000 and $60,000 for A and B, respectively. One-third of any remaining profits or losses are allocated to B and the balance to A. If the partnership had net income of $52,000, how much should be allocated to Partner A?

A) $14,000

B) $30,000

C) $38,000

D) None of the above

A) $14,000

B) $30,000

C) $38,000

D) None of the above

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

14

Partners A and B have a profit and loss agreement with the following provisions: salaries of $41,600 and $38,400 for A and B, respectively; a bonus to A of 10% of net income after salaries and bonus; and interest of 10% on average capital balances of $20,000 and $35,000 for A and B, respectively. One-third of any remaining profits are allocated to A and the balance to B. If the partnership had a net income of $36,000, how much should be allocated to Partner A, assuming that the provisions of the profit and loss agreement are ranked by order of priority starting with salaries?

A) $12,000

B) $18,000

C) $18,720

D) $41,600

A) $12,000

B) $18,000

C) $18,720

D) $41,600

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following would be least likely to be used as a means of allocating profits among partners who are active in the management of the partnership?

A) Salaries

B) Bonus as a percentage of net income before the bonus

C) Bonus as a percentage of sales in excess of a targeted amount

D) Interest on average capital balances

A) Salaries

B) Bonus as a percentage of net income before the bonus

C) Bonus as a percentage of sales in excess of a targeted amount

D) Interest on average capital balances

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

16

Partner Alta had a capital balance on January 1, 2008 of $45,000 and made additional capital contributions during 2008 totaling $50,000. During the year 2008, Alta withdrew $8,000 per month. Alta's post-closing capital balance on December 31, 2008 is $30,000. Alta's share of 2008 partnership income is ____.

A) $96,000

B) $50,000

C) $31,000

D) $8,000

A) $96,000

B) $50,000

C) $31,000

D) $8,000

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

17

Scenario 13-1

Partners Tuba and Drum share profits and losses of their partnership equally after 1) annual salary allowances of $25,000 for Tuba and $20,000 for Drum and 2) 10% interest is provided on average capital balances. During 2008, the partnership had earnings of $50,000; Tuba's average capital balance was $60,000 and Drum's average capital balance was $90,000.

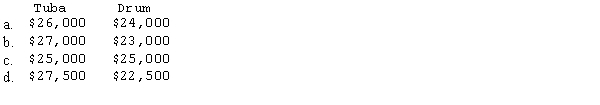

Refer to Scenario 13-1. What would be the correct answer if an order of priority was in the partnership agreement whereby salary allowances have a higher priority than interest on capital allocations?

Partners Tuba and Drum share profits and losses of their partnership equally after 1) annual salary allowances of $25,000 for Tuba and $20,000 for Drum and 2) 10% interest is provided on average capital balances. During 2008, the partnership had earnings of $50,000; Tuba's average capital balance was $60,000 and Drum's average capital balance was $90,000.

Refer to Scenario 13-1. What would be the correct answer if an order of priority was in the partnership agreement whereby salary allowances have a higher priority than interest on capital allocations?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

18

A partnership agreement calls for allocation of profits and losses by salary allocations, a bonus allocation, interest on capital, with any remainder to be allocated by preset ratios. If a partnership has a loss to allocate, generally which of the following procedures would be applied?

A) Any loss would be allocated equally to all partners.

B) Any salary allocation criteria would not be used.

C) The bonus criteria would not be used.

D) The loss would be allocated using the profit and loss ratios, only.

A) Any loss would be allocated equally to all partners.

B) Any salary allocation criteria would not be used.

C) The bonus criteria would not be used.

D) The loss would be allocated using the profit and loss ratios, only.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

19

Partner A first contributed $20,000 of capital into an existing partnership on February 1, 2008. On June 1, 2008, the partner contributed another $20,000. On September 1, 2008, the partner withdrew $15,000 from the partnership. Withdrawals in excess of $5,000 are charged to the partner's capital account. The partnership's fiscal year end is December 31. The annual weighted-average capital balance is ____.

A) $25,000

B) $26,667

C) $28,334

D) $30,000

A) $25,000

B) $26,667

C) $28,334

D) $30,000

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

20

Partnership drawings are

A) always maintained in a separate account from the partner's capital account.

B) equal to partners' salaries.

C) usually maintained in a separate draw account with any excess draws being debited directly to the capital account.

D) not discussed in the specific contract provisions of the partnership.

A) always maintained in a separate account from the partner's capital account.

B) equal to partners' salaries.

C) usually maintained in a separate draw account with any excess draws being debited directly to the capital account.

D) not discussed in the specific contract provisions of the partnership.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

21

Which of the following is not an advantage of a partnership over a corporation?

A) Ease of formation

B) Unlimited liability

C) The elimination of taxes at the entity level

D) All of the above

A) Ease of formation

B) Unlimited liability

C) The elimination of taxes at the entity level

D) All of the above

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

22

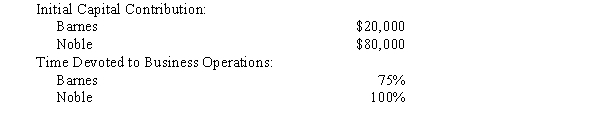

Barnes and Noble, both lawyers, have decided to form a partnership. They have asked your advice on how the profits and losses should be divided and have provided you with the following information:

Personal facts:

Personal facts:

Barnes has an excellent reputation in the community and is very well known. Substantially all new client will come from her efforts.

Noble has a very strong technical and operational background, and is an excellent supervisor of staff lawyers who are expected to do more of the legal research and initial preparation of legal documentation.

Required:

How would you advise the partners to share in profits and losses?

Personal facts:

Personal facts:Barnes has an excellent reputation in the community and is very well known. Substantially all new client will come from her efforts.

Noble has a very strong technical and operational background, and is an excellent supervisor of staff lawyers who are expected to do more of the legal research and initial preparation of legal documentation.

Required:

How would you advise the partners to share in profits and losses?

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

23

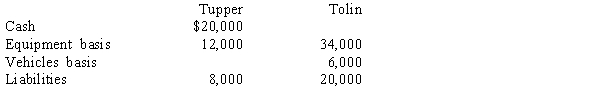

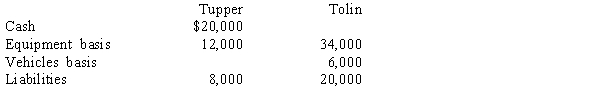

Tupper and Tolin have decided to form a partnership to provide environmental testing services to industry. The individuals will share profits equally and have conveyed the following assets and liabilities to the partnership:

Required:

Required:

Calculate the book basis of each partner in the partnership.

Required:

Required:Calculate the book basis of each partner in the partnership.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

24

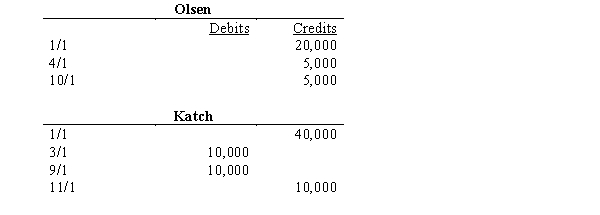

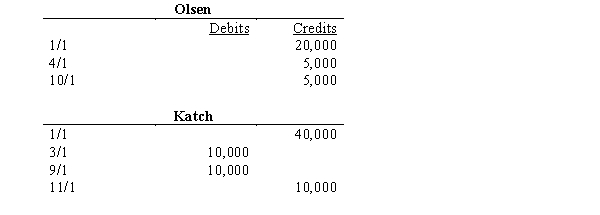

Olsen and Katch organized the OK Partnership on 1/1/01. The following entries were made into their capital accounts during 01:

The partnership agreement called for the following in the allocation of partnership profits and losses:

The partnership agreement called for the following in the allocation of partnership profits and losses:

Salaries of $48,000 and $36,000 would be allocated to Olsen and Katch, respectively

Interest of 8% on average capital balances will be allocated

Katch will receive a bonus of 10% on all partnership billings in excess of $300,000

Any remaining profits/losses will be allocated 60/40 to Olsen and Katch, respectively.

Required (account for each situation independently):

a.

Determine the distribution of partnership net income. Assume the following priority of allocation: interest, bonus, salaries, then remaining assuming partnership income of $85,000; partnership billings amounted to $400,000

b.

Determine the distribution of partnership net income of $165,000 on billings of $400,000. No specific priority is given to any of the allocation criteria.

The partnership agreement called for the following in the allocation of partnership profits and losses:

The partnership agreement called for the following in the allocation of partnership profits and losses:Salaries of $48,000 and $36,000 would be allocated to Olsen and Katch, respectively

Interest of 8% on average capital balances will be allocated

Katch will receive a bonus of 10% on all partnership billings in excess of $300,000

Any remaining profits/losses will be allocated 60/40 to Olsen and Katch, respectively.

Required (account for each situation independently):

a.

Determine the distribution of partnership net income. Assume the following priority of allocation: interest, bonus, salaries, then remaining assuming partnership income of $85,000; partnership billings amounted to $400,000

b.

Determine the distribution of partnership net income of $165,000 on billings of $400,000. No specific priority is given to any of the allocation criteria.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

25

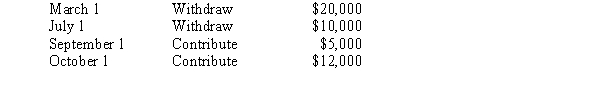

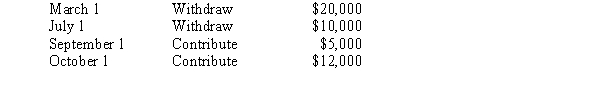

The Amato, Bergin, Chelsey partnership profit allocation agreement calls for salaries of $15,000 and $30,000 for Amato & Bergin, respectively. Amato is also to receive a bonus equal to 10% of partnership income after her bonus. Interest at the rate of 10% is to be allocated to Chelsey based on his weighted average capital after draws. Chelsey began the current year with a capital balance of $54,000 and had the following subsequent activity:

Required:

Required:

Assuming the partnership has income of $66,000, determine the amounts to be allocated to each partner.

Required:

Required:Assuming the partnership has income of $66,000, determine the amounts to be allocated to each partner.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

26

Carey and Drew formed a partnership on January 1, 2008. Carey invested $100,000, Drew $70,000. Each withdrew $12,000 on each of the following dates during 2008: February 1, August 1, and November 1. These withdrawals in total were equal to salaries for the year. Interest of 8 percent was to be paid partners on the basis of their average capital balances excluding net income. Additionally, Carey was to get a 20 percent bonus based on partnership net income after the bonus, but before the salaries and interest.

Any remaining profit (or loss) was to be allocated equally among the partners.

Required:

If partnership net income was $150,000, how was it to be allocated between Carey and Drew?

Order of allocation: bonus, salaries, interest. Round to the nearest whole dollar.

Any remaining profit (or loss) was to be allocated equally among the partners.

Required:

If partnership net income was $150,000, how was it to be allocated between Carey and Drew?

Order of allocation: bonus, salaries, interest. Round to the nearest whole dollar.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

27

Which of the following characteristics of a partnership most likely explains why a public accounting firm is organized as a partnership from a public policy viewpoint?

A) A partnership is not a taxable entity.

B) A partnership is characterized by unlimited liability.

C) A partnership is characterized by a fiduciary relationship among the partners.

D) Salaries to the partners are not considered a component of net income.

A) A partnership is not a taxable entity.

B) A partnership is characterized by unlimited liability.

C) A partnership is characterized by a fiduciary relationship among the partners.

D) Salaries to the partners are not considered a component of net income.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

28

Under the entity theory, a partnership is

A) viewed through the eyes of the partners.

B) viewed as having its own existence apart from the partners.

C) a separate legal and tax entity.

D) unable to enter into contracts in its own name.

A) viewed through the eyes of the partners.

B) viewed as having its own existence apart from the partners.

C) a separate legal and tax entity.

D) unable to enter into contracts in its own name.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

29

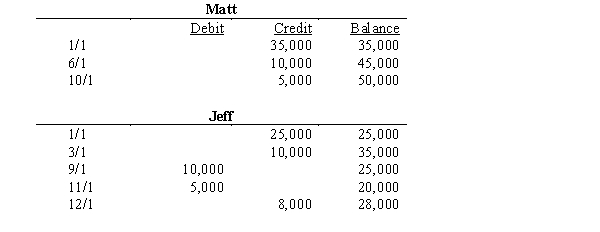

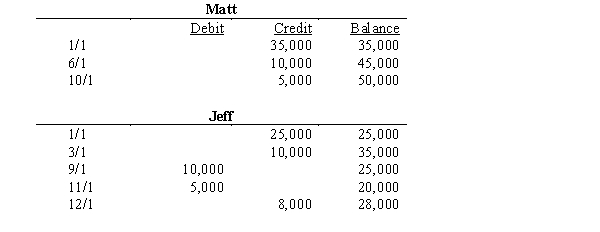

Matt and Jeff organized their partnership on 1/1/00. The following entries were made into their capital accounts during 00:

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions:

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions:

a.

Interest of 10% is allocated on weighted average capital balance and the remainder is divided equally

b.

A salary of $9,000 will be allocated to Jeff; 10% interest on ending capital is allocated to the partners; remainder is divided 60/40 to Matt and Jeff, respectively

c.

Salaries are allocated to Matt and Jeff in the amount of $10,000 and $15,000, respectively and the remainder is allocated in proportion to weighted average capital balances

d.

A bonus of 10% of partnership profits after bonus is credited to Matt, a salary of $35,000 is allocated to Jeff, a $20,000 salary is allocated to Matt, 10% interest on weighted capital is allocated, and remainder is split equally

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions:

If partnership profits for the year equaled $66,000, indicate the allocations between the partners under the following independent profit-sharing allocation conditions: a.

Interest of 10% is allocated on weighted average capital balance and the remainder is divided equally

b.

A salary of $9,000 will be allocated to Jeff; 10% interest on ending capital is allocated to the partners; remainder is divided 60/40 to Matt and Jeff, respectively

c.

Salaries are allocated to Matt and Jeff in the amount of $10,000 and $15,000, respectively and the remainder is allocated in proportion to weighted average capital balances

d.

A bonus of 10% of partnership profits after bonus is credited to Matt, a salary of $35,000 is allocated to Jeff, a $20,000 salary is allocated to Matt, 10% interest on weighted capital is allocated, and remainder is split equally

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

30

For financial accounting purposes, assets of an individual partner contributed to a partnership are recorded by the partnership at

A) historical cost.

B) book value.

C) fair market value.

D) lower of cost or market.

A) historical cost.

B) book value.

C) fair market value.

D) lower of cost or market.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

31

Van and Shapiro formed a partnership. As part of the formation, Van contributed equipment whose cost to her was $60,000, with accumulated depreciation for tax purposes of $36,000. The partnership awarded her $40,000 towards her partnership interest for the equipment. The partnership assumed $10,000 of Shapiro's personal debts when she was admitted into the partnership.

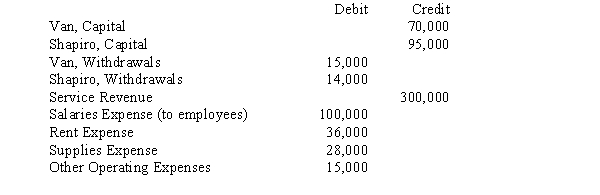

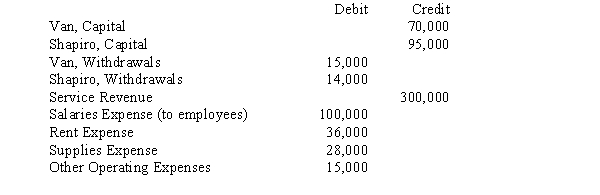

After one year of operation, the partnership had the following partial trial balance:

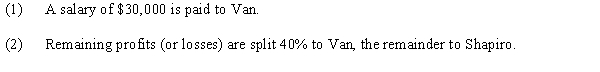

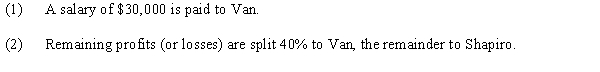

Partners split profits as follows:

Partners split profits as follows:

Required:

Required:

Calculate the two partners' ending capital balances.

After one year of operation, the partnership had the following partial trial balance:

Partners split profits as follows:

Partners split profits as follows: Required:

Required:Calculate the two partners' ending capital balances.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck

32

Cable and Jones are considering forming a partnership whereby profits will be allocated through the use of salaries and bonuses. Bonuses will be 10% of net income after total salaries and total bonuses. Cable will receive a salary of $30,000 and a 10% bonus. Jones has the option of receiving a salary of $40,000 and a 10% bonus or simply receiving a salary of $52,000.

Required:

Determine the level of income that would be necessary so that Jones would be indifferent to the profit-sharing option selected.

Required:

Determine the level of income that would be necessary so that Jones would be indifferent to the profit-sharing option selected.

Unlock Deck

Unlock for access to all 32 flashcards in this deck.

Unlock Deck

k this deck