Deck 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/29

Play

Full screen (f)

Deck 4: Intercompany Transactions: Merchandise, Plant Assets, and Notes

1

Pease Corporation owns 100% of Sade Corporation common stock. On January 2, 20X6, Pease sold machinery with a carrying amount of $30,000 to Sade for $50,000. Sade is depreciating the acquired machinery over a 5-year life using the straight-line method. The related net adjustments to compute the 20X6 and 20X7 consolidated income before income tax would be an increase (decrease) of

A

2

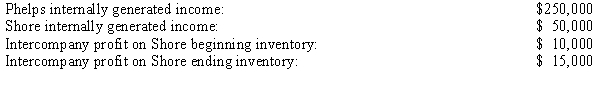

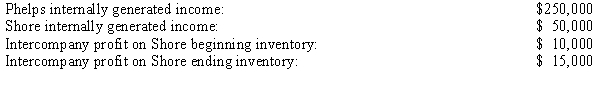

Phelps Co. uses the sophisticated equity method to account for the 80% investment in its subsidiary Shore Corp. Based upon the following information what amount does Phelps Co. record as subsidiary income?

A) $50,000

B) $44,000

C) $40,000

D) $36,000

A) $50,000

B) $44,000

C) $40,000

D) $36,000

D

3

Schiff Company owns 100% of the outstanding common stock of the Viel Company. During 20X1, Schiff sold merchandise to Viel that Viel, in turn, sold to unrelated firms. There were no such goods in Viel's ending inventory. However, some of the intercompany purchases from Schiff had not yet been paid. Which of the following amounts will be incorrect in the consolidated statements if no adjustments are made?

A) inventory, accounts payable, net income

B) inventory, sales, cost of goods sold, accounts receivable

C) sales, cost of goods sold, accounts receivable, accounts payable.

D) accounts receivable, accounts payable

A) inventory, accounts payable, net income

B) inventory, sales, cost of goods sold, accounts receivable

C) sales, cost of goods sold, accounts receivable, accounts payable.

D) accounts receivable, accounts payable

C

4

Sally Corporation, an 80%-owned subsidiary of Reynolds Company, buys half of its raw materials from Reynolds. The transfer price is exactly the same price as Sally pays to buy identical raw materials from outside suppliers and the same price as Reynolds sells the materials to unrelated customers. In preparing consolidated statements for Reynolds Company and Subsidiary Sally Corporation,

A) the intercompany transactions can be ignored because the transfer price represents arm's length bargaining.

B) any unrealized profit from intercompany sales remaining in Reynolds' ending inventory must be offset against the unrealized profit in Reynolds' beginning inventory.

C) any unrealized profit on the intercompany transactions in Sally's ending inventory is eliminated in its entirety.

D) eighty percent of any unrealized profit on the intercompany transactions in Sally's ending inventory is eliminated.

A) the intercompany transactions can be ignored because the transfer price represents arm's length bargaining.

B) any unrealized profit from intercompany sales remaining in Reynolds' ending inventory must be offset against the unrealized profit in Reynolds' beginning inventory.

C) any unrealized profit on the intercompany transactions in Sally's ending inventory is eliminated in its entirety.

D) eighty percent of any unrealized profit on the intercompany transactions in Sally's ending inventory is eliminated.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

5

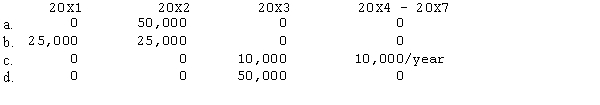

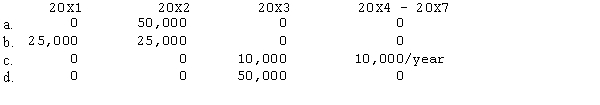

Company P owns 100% of the common stock of Company S. Company P is constructing an asset for Company S that will be used in Company S's manufacturing operations over a 5-year period. The asset was 50% complete at the end of 20X1 and was completed on December 31, 20X2. Company P is recording the construction under the percentage of completion method. The asset was put into use by Company S on January 1, 20X3. The profit on the asset was estimated to be $50,000. Actual results complied to the estimate. On the consolidated statements, the profit recognized will be

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

6

The material sale of inventory items by a parent company to an affiliated company

A) enters the consolidated revenue computation only if the transfer was the result of arm's length bargaining.

B) affects consolidated net income under a periodic inventory system but not under a perpetual inventory system.

C) does not result in consolidated income until the merchandise is sold to outside entities.

D) does not require a working paper adjustment if the merchandise was transferred at cost.

A) enters the consolidated revenue computation only if the transfer was the result of arm's length bargaining.

B) affects consolidated net income under a periodic inventory system but not under a perpetual inventory system.

C) does not result in consolidated income until the merchandise is sold to outside entities.

D) does not require a working paper adjustment if the merchandise was transferred at cost.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

7

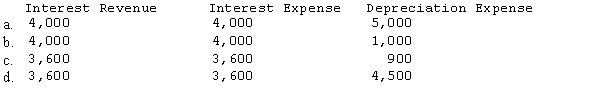

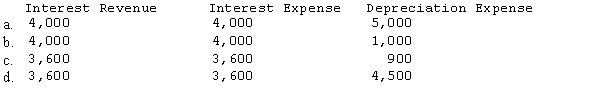

Porch Company owns a 90% interest in the Screen Company. Porch sold Screen a milling machine on January 1, 20X1, for $50,000 when the book value of the machine on Porch's books was $40,000. Porch financed the sale with Screen signing a 3-year, 8% interest, note for the entire $50,000. The machine will be used for 10 years and depreciated using the straight-line method. The following amounts related to this transaction were located on the companies trial balances: Interest Revenue

$4,000

Interest Expense

$4,000

Depreciation Expense

$5,000

Based upon the information related to this transaction what will be the amounts eliminated in preparing the 20X1 consolidated financial statements?

$4,000

Interest Expense

$4,000

Depreciation Expense

$5,000

Based upon the information related to this transaction what will be the amounts eliminated in preparing the 20X1 consolidated financial statements?

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

8

Perry, Inc. owns a 90% interest in Brown Corp. During 20X6, Brown sold $100,000 in merchandise to Perry at a 30% gross profit. Ten percent of the goods are unsold by Perry at year end. The noncontrolling interest will receive what gross profit as a result of these sales?

A) $0

B) $2,700

C) $3,000

D) $27,000

A) $0

B) $2,700

C) $3,000

D) $27,000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

9

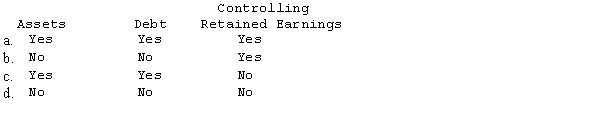

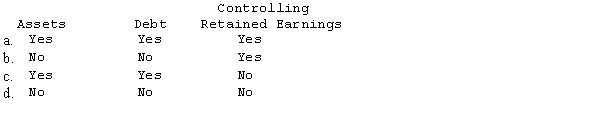

On January 1, 20X1, a parent loaned $30,000 to its 100%-owned subsidiary on a 5-year, 8% note. The note requires a principal payment at the end of each year of $6,000 plus payment of interest accrued to date. The following accounts require adjustment in the consolidation process:

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

10

Cattle Company sold inventory with a cost of $40,000 to its 90%-owned subsidiary, Range Corp., for $100,000 in 20X1. Range resold $75,000 of this inventory for $100,000 in 20X1. Based on this information, the amount of inventory reported on the consolidated financial statements at the end of 20X1 is ____.

A) $10,000

B) $18,000

C) $21,000

D) $30,000

A) $10,000

B) $18,000

C) $21,000

D) $30,000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

11

Diller owns 80% of Lake Company common stock. During October 20X7, Lake sold merchandise to Diller for $300,000. On December 31, 20X7, one-half of this merchandise remained in Diller's inventory. For 20X7, gross profit percentages were 30% for Diller and 40% for Lake. The amount of unrealized profit in the ending inventory on December 31, 20X7 that should be eliminated in consolidation is ____.

A) $80,000

B) $60,000

C) $32,000

D) $30,000

A) $80,000

B) $60,000

C) $32,000

D) $30,000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

12

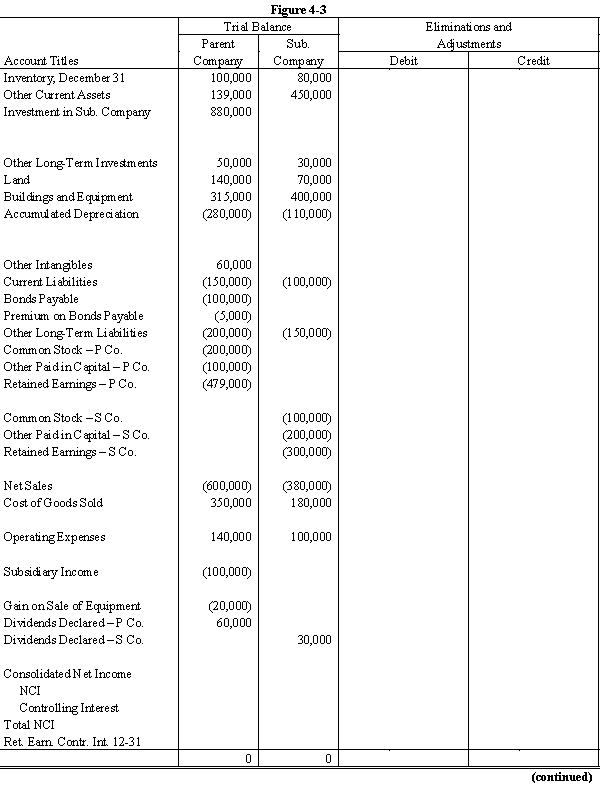

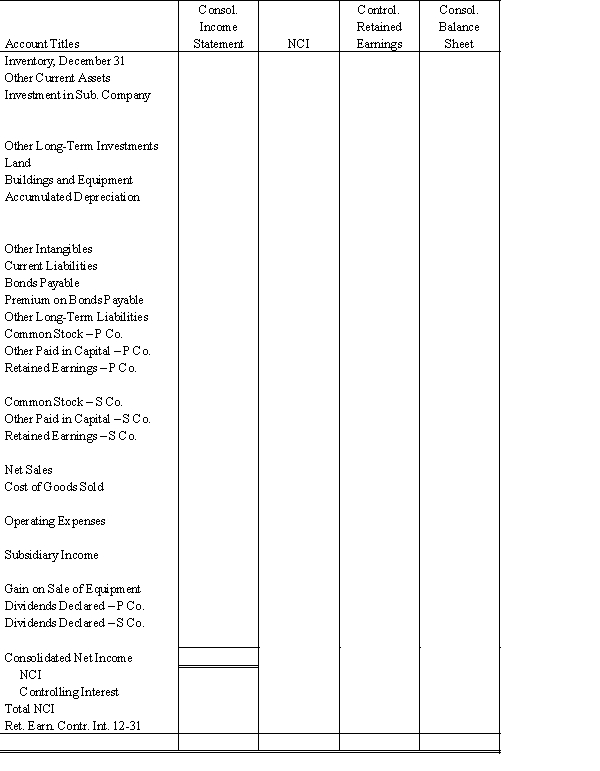

Scenario 4-1

Stroud Corporation is an 80%-owned subsidiary of Pennie, Inc., acquired by Pennie several years ago. On January 1, 20X2, Pennie sold land with a book value of $60,000 to Stroud for $90,000. Stroud resold the land to an unrelated party for $100,000 on September 26, 20X3.

Refer to Scenario 4-1. The gain from sale of land that will appear in the consolidated income statements for 20X2 and 20X3, respectively, is ____.

A) $0 and $10,000

B) $0 and $40,000

C) $30,000 and $10,000

D) $30,000 and $40,000

Stroud Corporation is an 80%-owned subsidiary of Pennie, Inc., acquired by Pennie several years ago. On January 1, 20X2, Pennie sold land with a book value of $60,000 to Stroud for $90,000. Stroud resold the land to an unrelated party for $100,000 on September 26, 20X3.

Refer to Scenario 4-1. The gain from sale of land that will appear in the consolidated income statements for 20X2 and 20X3, respectively, is ____.

A) $0 and $10,000

B) $0 and $40,000

C) $30,000 and $10,000

D) $30,000 and $40,000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

13

Williard Corporation regularly sells inventory items to its subsidiary, Petty, Inc. If unrealized profits in Petty's 20X1 year-end inventory exceed the unrealized profits in its 20X2 year-end inventory, 20X2 combined

A) cost of sales will be less than consolidated cost of sales in 20X2.

B) gross profit will be greater than consolidated gross profit in 20X2.

C) sales will be less than consolidated sales in 20X2.

D) cost of sales will be greater than consolidated cost of sales in 20X2.

A) cost of sales will be less than consolidated cost of sales in 20X2.

B) gross profit will be greater than consolidated gross profit in 20X2.

C) sales will be less than consolidated sales in 20X2.

D) cost of sales will be greater than consolidated cost of sales in 20X2.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

14

The following accounts were noted in reviewing the trial balance for Parent Co. and Subsidiary Corp.: Assets under Construction

Contracts Receivable

Billings on Construction in Progress

Earned Income on Long-Term Contracts

Contracts Payable

Which of these accounts do you expect to eliminate when producing Parent Co. consolidated financial statements?

A) Assets under Construction; Billings on Construction in Progress; Earned Income on Long-Term Contracts

B) Contracts Receivable; Billings on Construction in Progress; Earned Income on Long-Term Contracts

C) Assets under Construction; Contracts Receivable; Billings on Construction in Progress; Earned Income on Long-Term Contracts; Contracts Payable

D) Contracts Receivable; Billings on Construction in Progress; Earned Income on Long-Term Contracts; Contracts Payable

Contracts Receivable

Billings on Construction in Progress

Earned Income on Long-Term Contracts

Contracts Payable

Which of these accounts do you expect to eliminate when producing Parent Co. consolidated financial statements?

A) Assets under Construction; Billings on Construction in Progress; Earned Income on Long-Term Contracts

B) Contracts Receivable; Billings on Construction in Progress; Earned Income on Long-Term Contracts

C) Assets under Construction; Contracts Receivable; Billings on Construction in Progress; Earned Income on Long-Term Contracts; Contracts Payable

D) Contracts Receivable; Billings on Construction in Progress; Earned Income on Long-Term Contracts; Contracts Payable

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

15

On January 1, 20X1 Bullock, Inc. sells land to its 80%-owned subsidiary, Humphrey Corporation, at a $20,000 gain. The land is still held by Humphrey on December 31, 20X3. What is the effect of the intercompany sale of land on 20X3 consolidated net income?

A) Consolidated net income will be the same as it would have been had the sale not occurred.

B) Consolidated net income will be $20,000 less than it would have been had the sale not occurred.

C) Consolidated net income will be $16,000 less than it would have been had the sale not occurred.

D) Consolidated net income will be $20,000 greater than it would have been had the sale not occurred.

A) Consolidated net income will be the same as it would have been had the sale not occurred.

B) Consolidated net income will be $20,000 less than it would have been had the sale not occurred.

C) Consolidated net income will be $16,000 less than it would have been had the sale not occurred.

D) Consolidated net income will be $20,000 greater than it would have been had the sale not occurred.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

16

Scenario 4-1

Stroud Corporation is an 80%-owned subsidiary of Pennie, Inc., acquired by Pennie several years ago. On January 1, 20X2, Pennie sold land with a book value of $60,000 to Stroud for $90,000. Stroud resold the land to an unrelated party for $100,000 on September 26, 20X3.

Refer to Scenario 4-1. The land will be included in the December 31, 20X2 consolidated balance sheet of Pennie, Inc. and Subsidiary at ____.

A) $48,000

B) $60,000

C) $72,000

D) $90,000

Stroud Corporation is an 80%-owned subsidiary of Pennie, Inc., acquired by Pennie several years ago. On January 1, 20X2, Pennie sold land with a book value of $60,000 to Stroud for $90,000. Stroud resold the land to an unrelated party for $100,000 on September 26, 20X3.

Refer to Scenario 4-1. The land will be included in the December 31, 20X2 consolidated balance sheet of Pennie, Inc. and Subsidiary at ____.

A) $48,000

B) $60,000

C) $72,000

D) $90,000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

17

During 20X3, a parent company billed its 100%-owned subsidiary for computer services at the rate of $1,000 per month. At year end, one month's bill remained unpaid. As a part of the consolidation process, net income

A) should be reduced $12,000.

B) should be reduced $1,000.

C) needs no adjustment.

D) needs an adjustment, but the amount is not provided by this information.

A) should be reduced $12,000.

B) should be reduced $1,000.

C) needs no adjustment.

D) needs an adjustment, but the amount is not provided by this information.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

18

On 1/1/X1 Peck sells a machine with a $20,000 book value to its subsidiary Shea for $30,000. Shea intends to use the machine for 4 years. On 12/31/X2 Shea sells the machine to an outside party for $14,000. What amount of gain or (loss) for the sale of assets is reported on the consolidated financial statements?

A) loss of $6,000

B) loss of $1,000

C) gain of $4,000

D) gain of $14,000

A) loss of $6,000

B) loss of $1,000

C) gain of $4,000

D) gain of $14,000

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

19

Emron Company owns a 100% interest in the common stock of the Dietz Company. On January 1, 20X2, Emron sold Dietz a fixed asset that Dietz will use over a 5-year period. The asset was sold at a $5,000 profit. In the consolidated statements, this profit will

A) not be recorded.

B) be recognized over 5 years.

C) be recognized in the year of sale.

D) be recognized when the asset is resold to outside parties at the end of its period of use.

A) not be recorded.

B) be recognized over 5 years.

C) be recognized in the year of sale.

D) be recognized when the asset is resold to outside parties at the end of its period of use.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

20

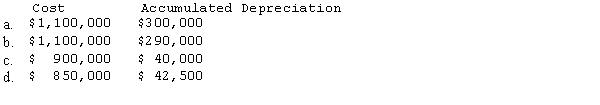

On January 1, 20X1, Poe Corp. sold a machine for $900,000 to Saxe Corp., its wholly-owned subsidiary. Poe paid $1,100,000 for this machine. On the sale date, accumulated depreciation was $250,000. Poe estimated a $100,000 salvage value and depreciated the machine on the straight-line method over 20 years, a policy that Saxe continued. In Poe's December 31, 20X1, consolidated balance sheet, this machine should be included in cost and accumulated depreciation as

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

21

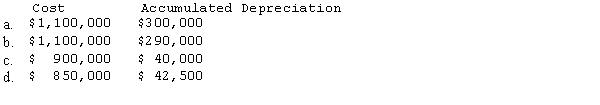

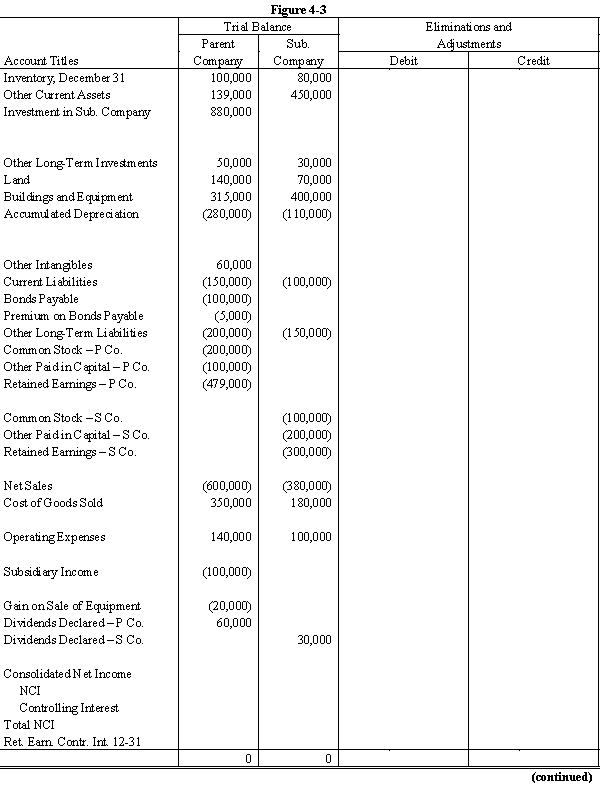

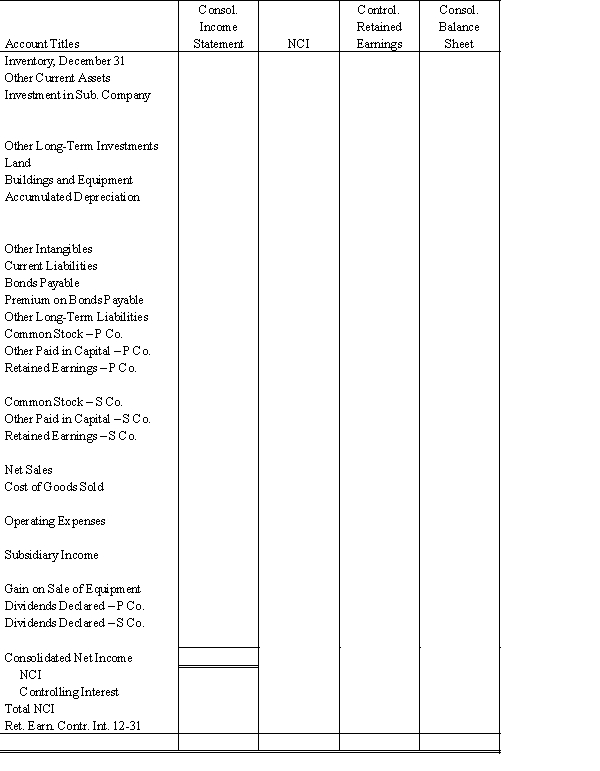

On January 1, 20X1, Parent Company acquired 100% of the common stock of Subsidiary Company for $750,000. On this date Subsidiary had total owners' equity of $540,000.

Any excess of cost over book value is attributable to land, undervalued $10,000, and to goodwill.

During 20X1 and 20X2, Parent has appropriately accounted for its investment in Subsidiary using the simple equity method.

On January 1, 20X2, Parent held merchandise acquired from Subsidiary for $10,000. During 20X2, Subsidiary sold merchandise to Parent for $100,000, of which $20,000 is held by Parent on December 31, 20X2. Subsidiary's usual gross profit on affiliated sales is 40%.

On December 31, 20X2, Parent still owes Subsidiary $20,000 for merchandise acquired in December.

On January 1, 20X2, Parent sold to Subsidiary some equipment with a cost of $50,000 and a book value of $20,000. The sales price was $40,000. Subsidiary is depreciating the equipment over a five-year life, assuming no salvage value and using the straight-line method.

Required:

Complete the Figure 4-3 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Any excess of cost over book value is attributable to land, undervalued $10,000, and to goodwill.

During 20X1 and 20X2, Parent has appropriately accounted for its investment in Subsidiary using the simple equity method.

On January 1, 20X2, Parent held merchandise acquired from Subsidiary for $10,000. During 20X2, Subsidiary sold merchandise to Parent for $100,000, of which $20,000 is held by Parent on December 31, 20X2. Subsidiary's usual gross profit on affiliated sales is 40%.

On December 31, 20X2, Parent still owes Subsidiary $20,000 for merchandise acquired in December.

On January 1, 20X2, Parent sold to Subsidiary some equipment with a cost of $50,000 and a book value of $20,000. The sales price was $40,000. Subsidiary is depreciating the equipment over a five-year life, assuming no salvage value and using the straight-line method.

Required:

Complete the Figure 4-3 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

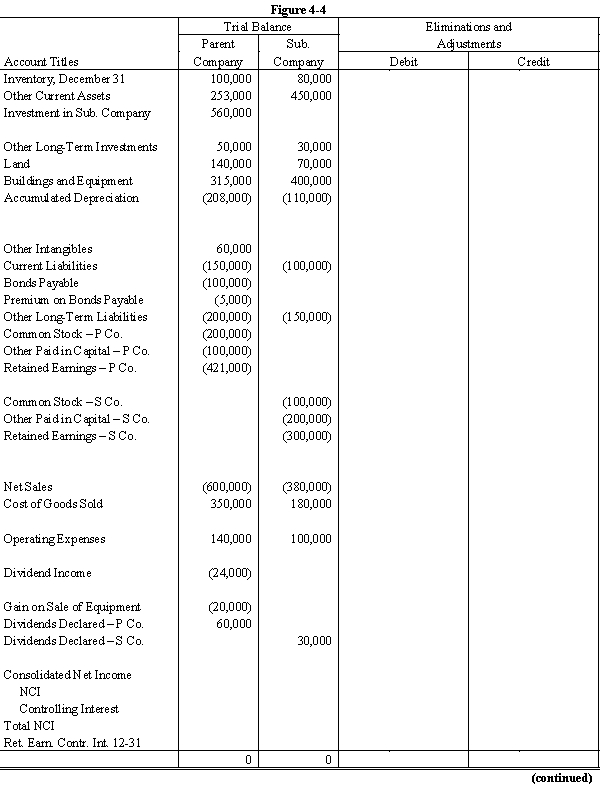

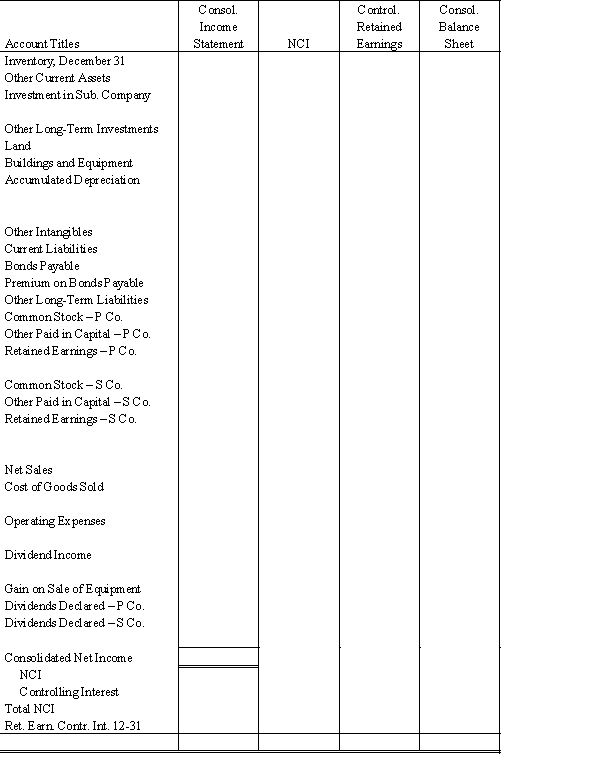

22

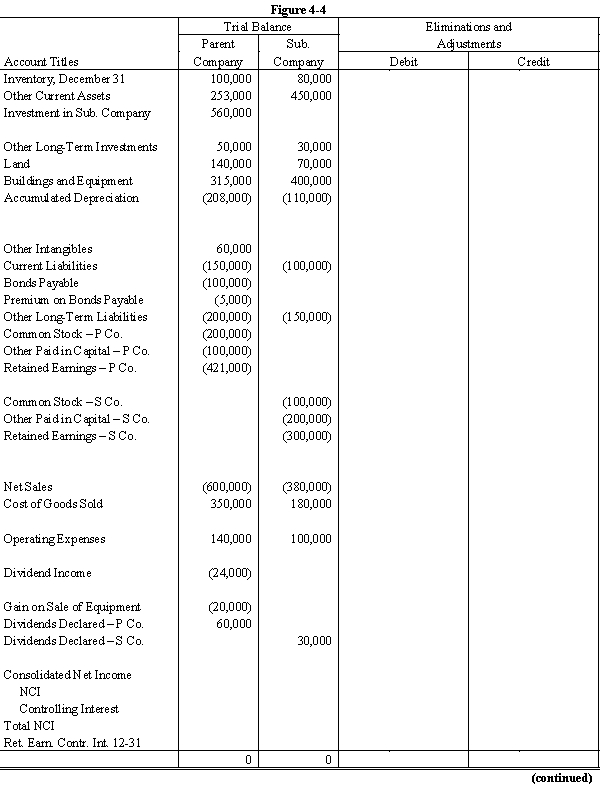

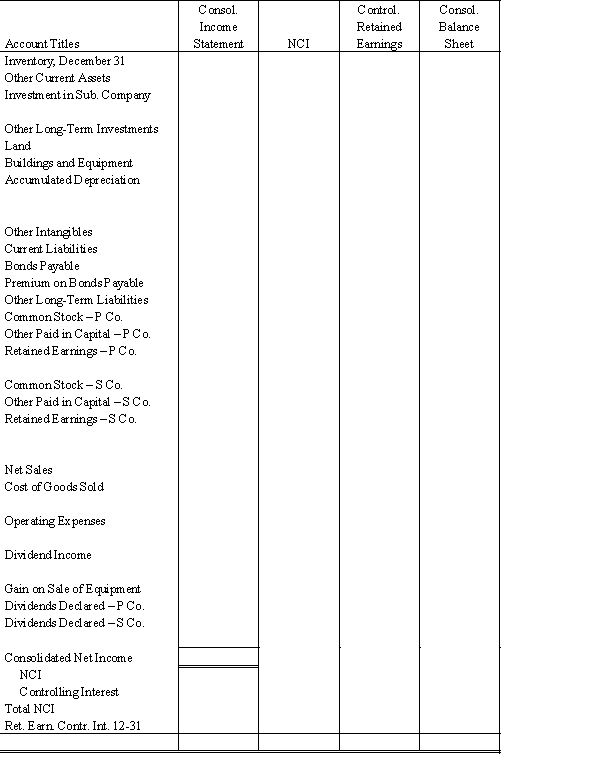

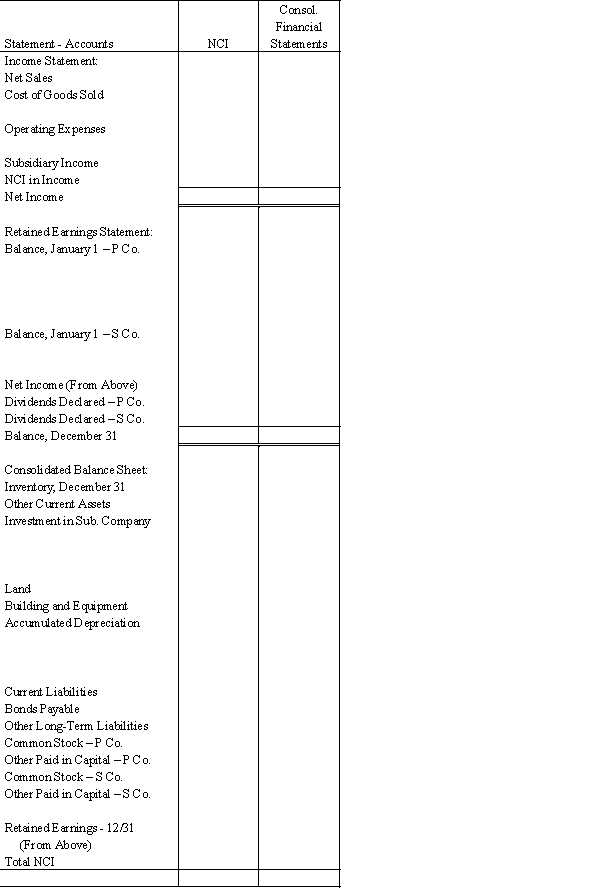

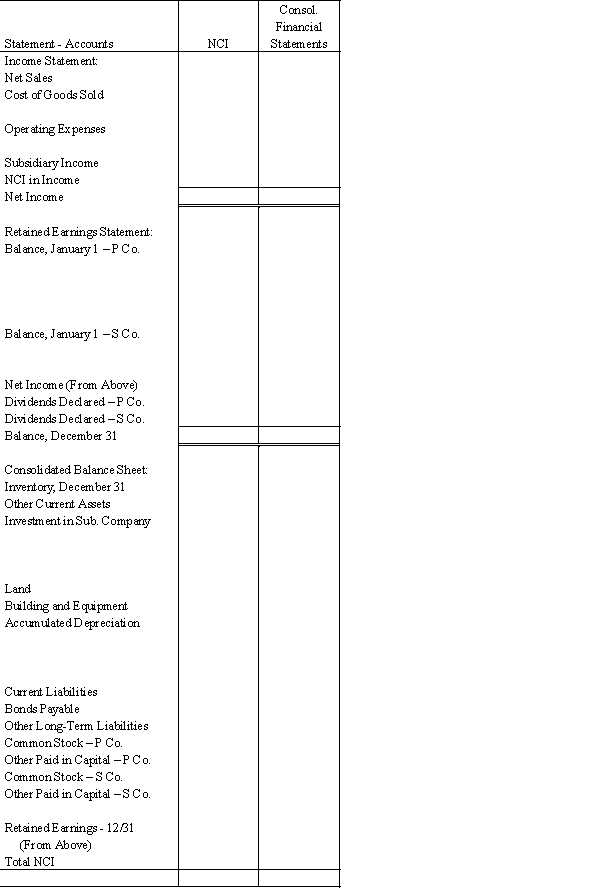

On January 1, 20X1, Parent Company acquired 80% of the common stock of Subsidiary Company for $560,000. On this date Subsidiary had total owners' equity of $540,000, including retained earnings of $240,000. During 20X1, Subsidiary had net income of $60,000 and paid no dividends.

Any excess of cost over book value is attributable to land, undervalued $10,000, and to goodwill.

During 20X1 and 20X2, Parent has appropriately accounted for its investment in Subsidiary using the cost method.

On January 1, 20X2, Parent held merchandise acquired from Subsidiary for $10,000. During 20X2, Subsidiary sold merchandise to Parent for $100,000, of which $20,000 is held by Parent on December 31, 20X2. Subsidiary's usual gross profit on affiliated sales is 40%.

On December 31, 20X2, Parent still owes Subsidiary $20,000 for merchandise acquired in December.

On January 1, 20X2, Parent sold to Subsidiary some equipment with a cost of $50,000 and a book value of $20,000. The sales price was $40,000. Subsidiary is depreciating the equipment over a five-year life, assuming no salvage value and using the straight-line method.

Required:

Complete the Figure 4-4 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Any excess of cost over book value is attributable to land, undervalued $10,000, and to goodwill.

During 20X1 and 20X2, Parent has appropriately accounted for its investment in Subsidiary using the cost method.

On January 1, 20X2, Parent held merchandise acquired from Subsidiary for $10,000. During 20X2, Subsidiary sold merchandise to Parent for $100,000, of which $20,000 is held by Parent on December 31, 20X2. Subsidiary's usual gross profit on affiliated sales is 40%.

On December 31, 20X2, Parent still owes Subsidiary $20,000 for merchandise acquired in December.

On January 1, 20X2, Parent sold to Subsidiary some equipment with a cost of $50,000 and a book value of $20,000. The sales price was $40,000. Subsidiary is depreciating the equipment over a five-year life, assuming no salvage value and using the straight-line method.

Required:

Complete the Figure 4-4 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

23

On January 1, 20X1, Pep Company acquired 80% of the common stock of Sky Company for $195,000. On this date Sky had total owners' equity of $200,000 (common stock, other paid-in capital, and retained earning of $10,000, $90,000, and $100,000 respectively).

Any excess of cost over book value is attributable to inventory (worth $6,250 more than cost), to equipment (worth $12,500 more than book value), and to patents. FIFO is used for inventories. The equipment has a remaining life of five years and straight-line depreciation is used. The excess attributable to the patents is to be amortized over 20 years.

During 20X1 and 20X2, Pep has appropriately accounted for its investment in Sky using the simple equity method.

On January 1, 20X2, Pep held merchandise acquired from Sky for $10,000. During 20X2, Sky sold merchandise to Pep for $50,000, $20,000 of which is still held by Pep on December 31, 20X2. Sky's usual gross profit on affiliated sales is 50%.

On December 31, 20X1, Pep sold equipment to Sky at a gain of $10,000. During 20X2, the equipment was used by Sky. Depreciation is being computed using the straight-line method, a five-year life, and no salvage value.

Required:

a.

Using the information above or on the Figure 4-8 worksheet, prepare a determination and distribution of excess schedule.

b.

Complete the Figure 4-8 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Any excess of cost over book value is attributable to inventory (worth $6,250 more than cost), to equipment (worth $12,500 more than book value), and to patents. FIFO is used for inventories. The equipment has a remaining life of five years and straight-line depreciation is used. The excess attributable to the patents is to be amortized over 20 years.

During 20X1 and 20X2, Pep has appropriately accounted for its investment in Sky using the simple equity method.

On January 1, 20X2, Pep held merchandise acquired from Sky for $10,000. During 20X2, Sky sold merchandise to Pep for $50,000, $20,000 of which is still held by Pep on December 31, 20X2. Sky's usual gross profit on affiliated sales is 50%.

On December 31, 20X1, Pep sold equipment to Sky at a gain of $10,000. During 20X2, the equipment was used by Sky. Depreciation is being computed using the straight-line method, a five-year life, and no salvage value.

Required:

a.

Using the information above or on the Figure 4-8 worksheet, prepare a determination and distribution of excess schedule.

b.

Complete the Figure 4-8 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

24

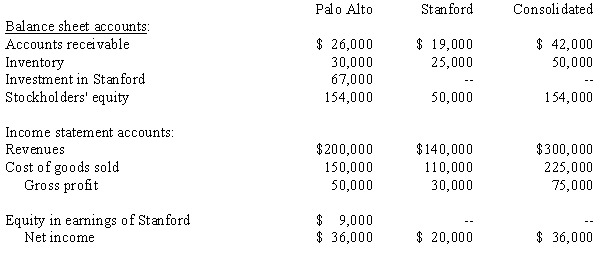

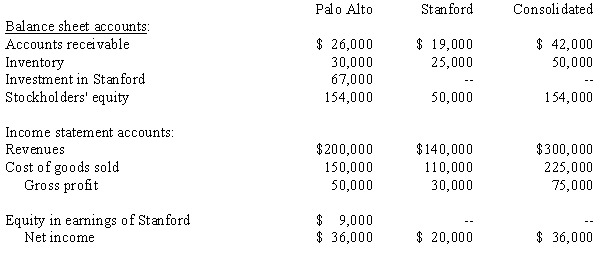

Selected information from the separate and consolidated balance sheets and income statements of Palo Alto, Inc. and its subsidiary, Stanford Co., as of December 31, 20X1, and for the year then ended is as follows:

Additional information:

Additional information:

During 20X1, Palo Alto sold goods to Stanford at the same markup on cost that Palo Alto uses for all sales. At December 31, 20X1, Stanford had not paid for all of these goods and still held 50% of them in inventory.

Palo Alto acquired its interest in Stanford five years earlier (as of December 31, 20X1).

Required:

For each of the following items, calculate the required amount.

a.

The amount of intercompany sales from Palo Alto to Stanford during 20X1.

b.

The amount of Stanford's payable to Palo Alto for intercompany sales as of December 31, 20X1.

c.

In Palo Alto's December 31, 20X1, consolidated balance sheet, the carrying amount of the inventory that Stanford purchased from Palo Alto.

Additional information:

Additional information:During 20X1, Palo Alto sold goods to Stanford at the same markup on cost that Palo Alto uses for all sales. At December 31, 20X1, Stanford had not paid for all of these goods and still held 50% of them in inventory.

Palo Alto acquired its interest in Stanford five years earlier (as of December 31, 20X1).

Required:

For each of the following items, calculate the required amount.

a.

The amount of intercompany sales from Palo Alto to Stanford during 20X1.

b.

The amount of Stanford's payable to Palo Alto for intercompany sales as of December 31, 20X1.

c.

In Palo Alto's December 31, 20X1, consolidated balance sheet, the carrying amount of the inventory that Stanford purchased from Palo Alto.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

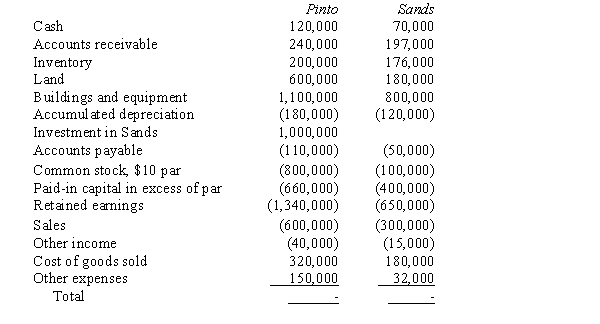

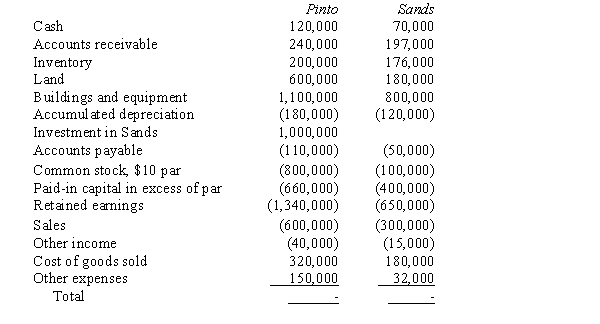

25

On January 1, 20X1, Pinto Company purchased an 80% interest in Sands Inc. for $1,000,000. The equity balances of Sands at the time of the purchase were as follows:

Any excess of cost over book value is attributable to goodwill.

Any excess of cost over book value is attributable to goodwill.

No dividends were paid by either firm during 20X6. The following trial balances were prepared for Pinto Company and its subsidiary, Sands Inc., on December 31, 20X6:

Sands sold a machine to Pinto Company for $40,000 on January 1, 20X6. The machine cost Sands $50,000, and $25,000 of accumulated depreciation had been recorded as of the sale date. The machine had a 5-year remaining life and no salvage value. Pinto Company is using straight-line depreciation.

Sands sold a machine to Pinto Company for $40,000 on January 1, 20X6. The machine cost Sands $50,000, and $25,000 of accumulated depreciation had been recorded as of the sale date. The machine had a 5-year remaining life and no salvage value. Pinto Company is using straight-line depreciation.

Since the purchase date, Pinto has sold merchandise for resale to Sands, Inc. at a mark-up on cost of 25%. Sales during 20X6 were $150,000. The inventory of these goods held by Sands was $15,000 on January 1, 20X6, and $18,000 on December 31, 20X6.

Required:

Prepare a consolidated income statement for 20X6, including income distribution schedules to support your distribution of income to the noncontrolling and controlling interest interests.

Any excess of cost over book value is attributable to goodwill.

Any excess of cost over book value is attributable to goodwill.No dividends were paid by either firm during 20X6. The following trial balances were prepared for Pinto Company and its subsidiary, Sands Inc., on December 31, 20X6:

Sands sold a machine to Pinto Company for $40,000 on January 1, 20X6. The machine cost Sands $50,000, and $25,000 of accumulated depreciation had been recorded as of the sale date. The machine had a 5-year remaining life and no salvage value. Pinto Company is using straight-line depreciation.

Sands sold a machine to Pinto Company for $40,000 on January 1, 20X6. The machine cost Sands $50,000, and $25,000 of accumulated depreciation had been recorded as of the sale date. The machine had a 5-year remaining life and no salvage value. Pinto Company is using straight-line depreciation.Since the purchase date, Pinto has sold merchandise for resale to Sands, Inc. at a mark-up on cost of 25%. Sales during 20X6 were $150,000. The inventory of these goods held by Sands was $15,000 on January 1, 20X6, and $18,000 on December 31, 20X6.

Required:

Prepare a consolidated income statement for 20X6, including income distribution schedules to support your distribution of income to the noncontrolling and controlling interest interests.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

26

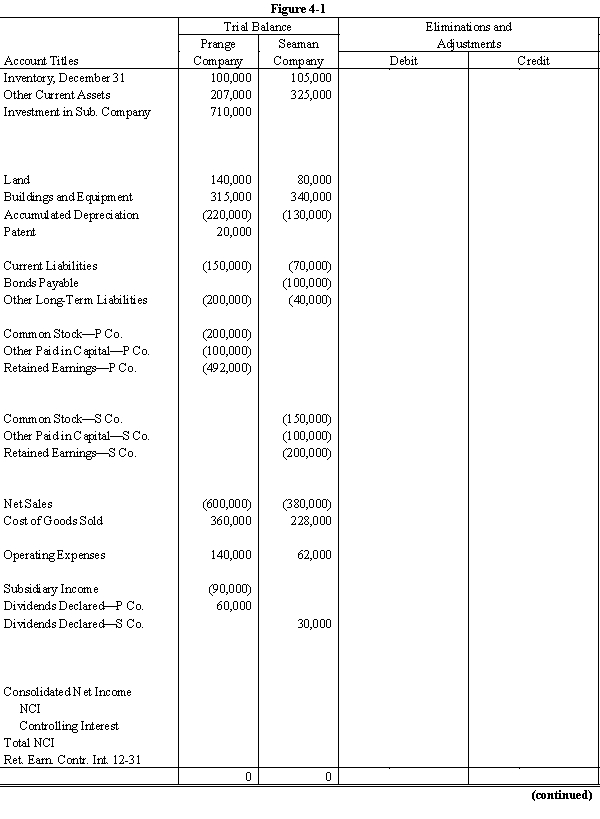

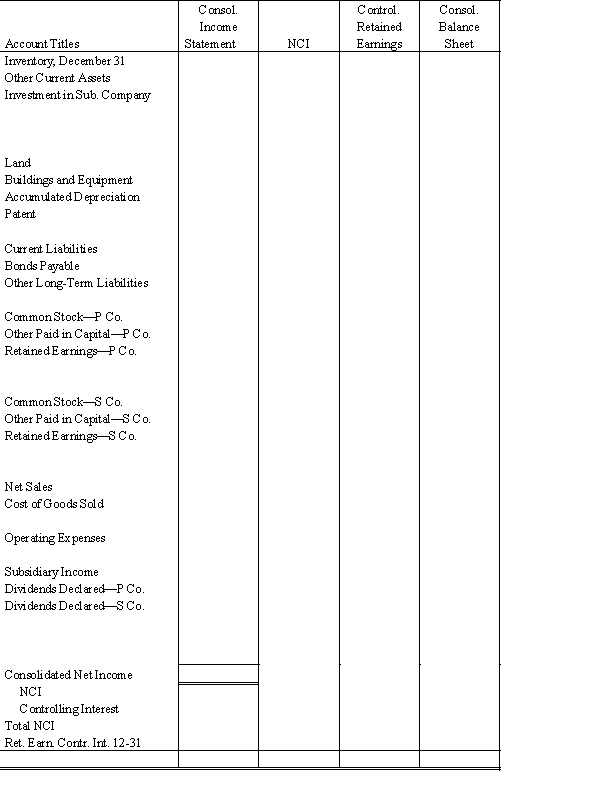

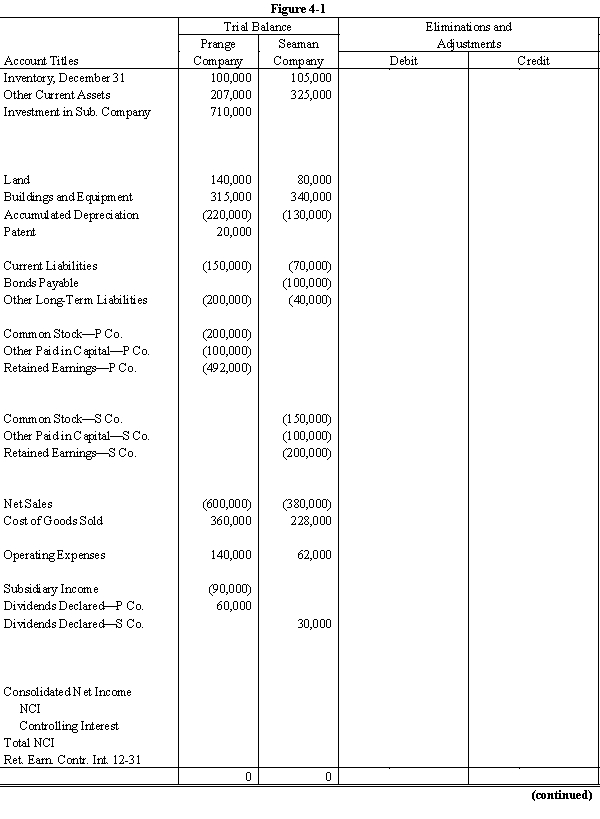

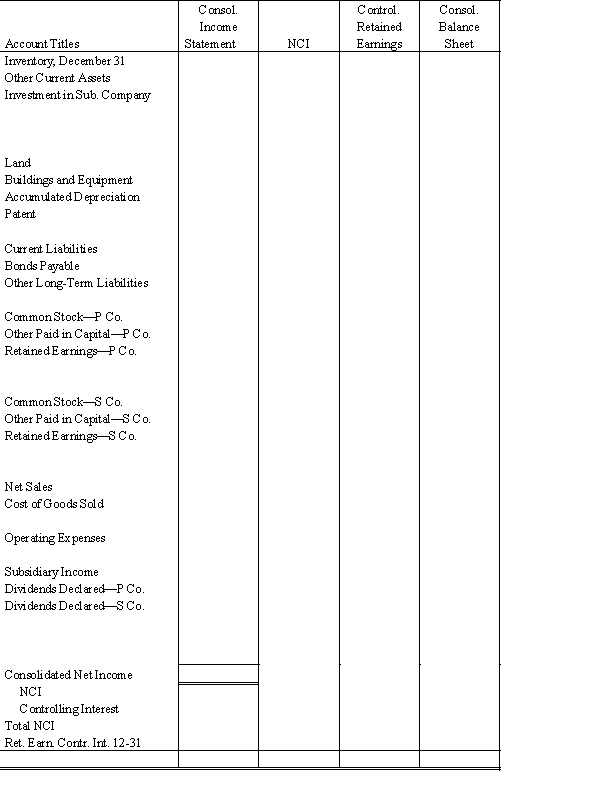

On January 1, 20X1, Prange Company acquired 100% of the common stock of Seaman Company for $600,000. On this date Seaman had total owners' equity of $400,000. Any excess of cost over book value is attributable to a patent, which is to be amortized over 10 years.

During 20X1 and 20X2, Prange has appropriately accounted for its investment in Seaman using the simple equity method.

On January 1, 20X2, Prange held merchandise acquired from Seaman for $30,000. During 20X2, Seaman sold merchandise to Prange for $100,000, of which $20,000 is held by Prange on December 31, 20X2. Seaman's gross profit on all sales is 40%.

On December 31, 20X2, Prange still owes Seaman $20,000 for merchandise acquired in December.

Required:

Complete the Figure 4-1 worksheet for consolidated financial statements for the year ended December 31, 20X2.

During 20X1 and 20X2, Prange has appropriately accounted for its investment in Seaman using the simple equity method.

On January 1, 20X2, Prange held merchandise acquired from Seaman for $30,000. During 20X2, Seaman sold merchandise to Prange for $100,000, of which $20,000 is held by Prange on December 31, 20X2. Seaman's gross profit on all sales is 40%.

On December 31, 20X2, Prange still owes Seaman $20,000 for merchandise acquired in December.

Required:

Complete the Figure 4-1 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

27

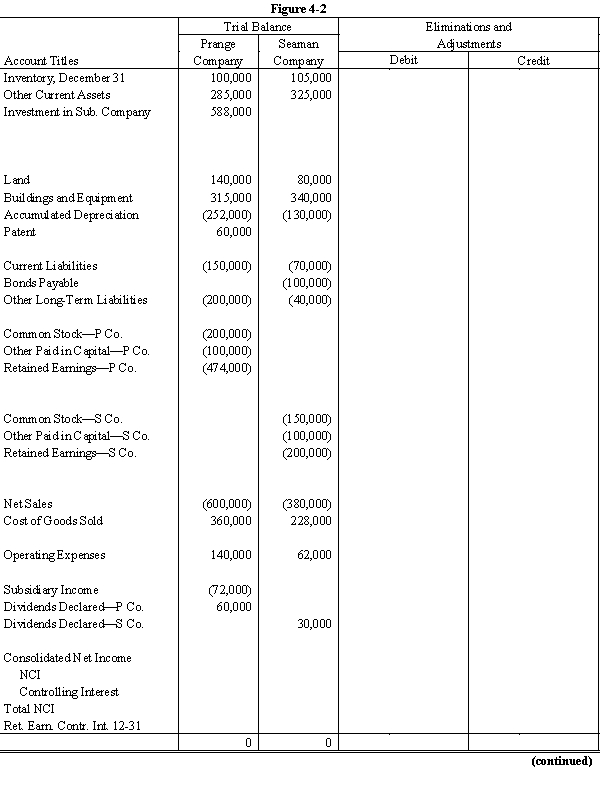

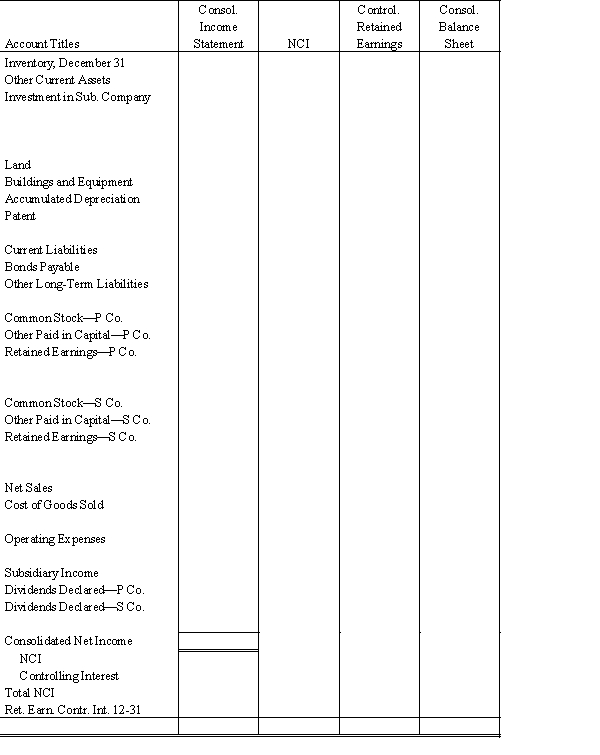

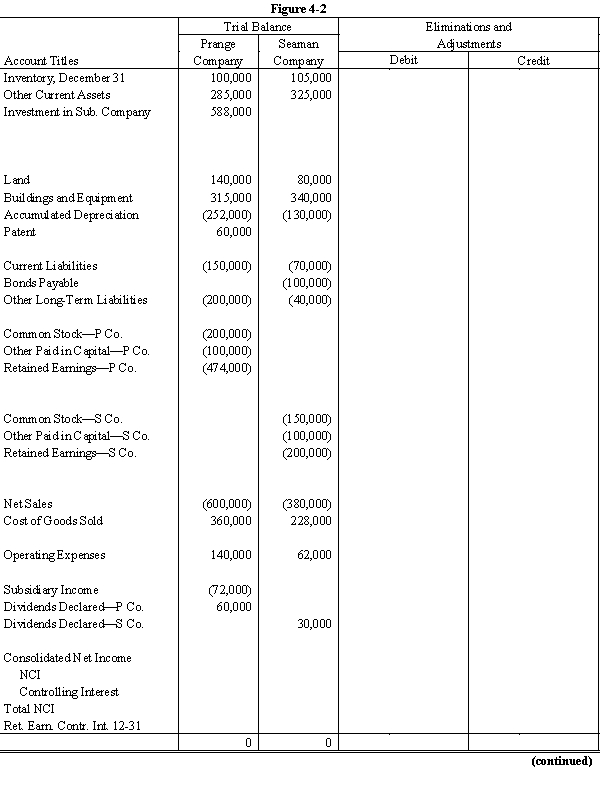

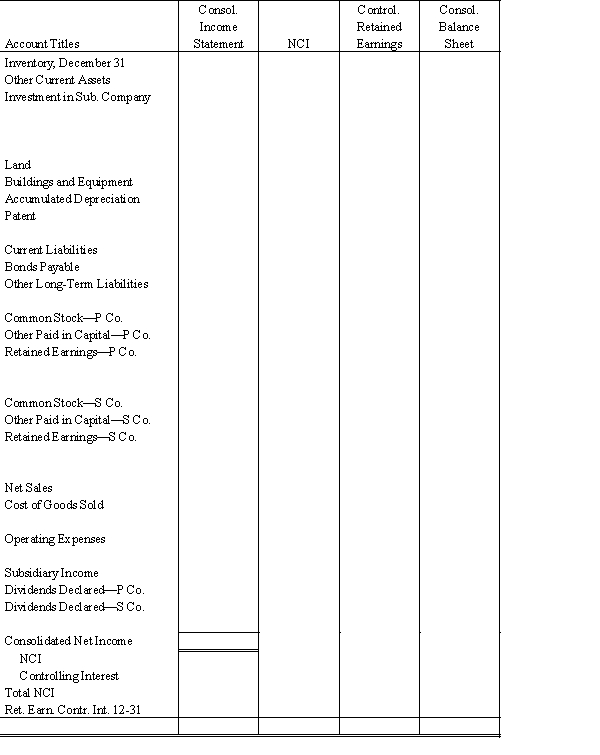

On January 1, 20X1, Prange Company acquired 80% of the common stock of Seaman Company for $500,000. On this date Seaman had total owners' equity of $400,000. Any excess of cost over book value is attributable to patent, which is to be amortized over 20 years.

During 20X1 and 20X2, Prange has appropriately accounted for its investment in Seaman using the simple equity method.

On January 1, 20X2, Prange held merchandise acquired from Seaman for $30,000. During 20X2, Seaman sold merchandise to Prange for $100,000, of which $20,000 is held by Prange on December 31, 20X2. Seaman's gross profit on all sales is 40%.

On December 31, 20X2, Prange still owes Seaman $20,000 for merchandise acquired in December.

Required:

Complete the Figure 4-2 worksheet for consolidated financial statements for the year ended December 31, 20X2.

During 20X1 and 20X2, Prange has appropriately accounted for its investment in Seaman using the simple equity method.

On January 1, 20X2, Prange held merchandise acquired from Seaman for $30,000. During 20X2, Seaman sold merchandise to Prange for $100,000, of which $20,000 is held by Prange on December 31, 20X2. Seaman's gross profit on all sales is 40%.

On December 31, 20X2, Prange still owes Seaman $20,000 for merchandise acquired in December.

Required:

Complete the Figure 4-2 worksheet for consolidated financial statements for the year ended December 31, 20X2.

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

28

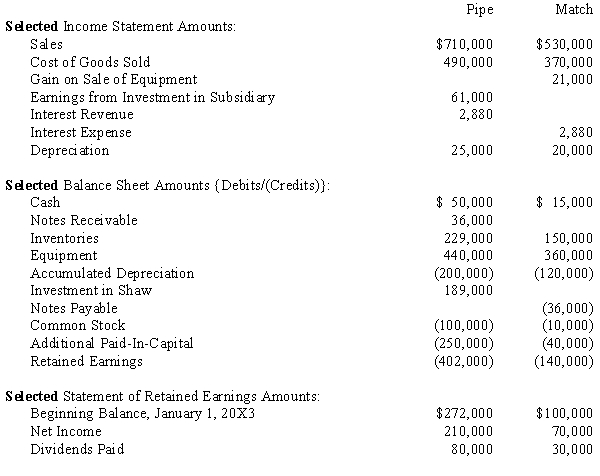

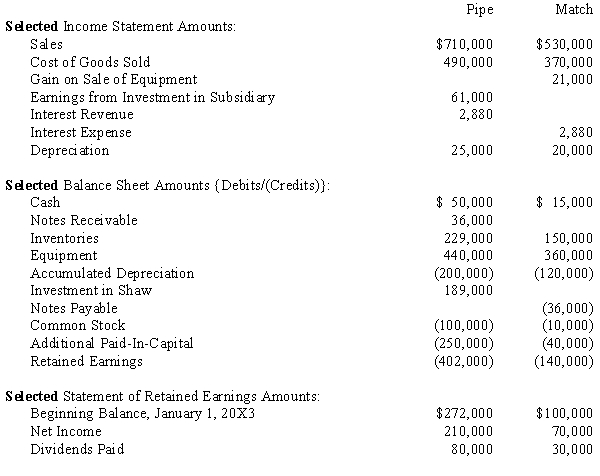

Account balances are as of December 31, 20X3 except where noted.

Additional Information:

Additional Information:

On January 2, 20X3 Pipe purchased 90% of Match for $155,000. On that date Match's shareholders' equity equaled $150,000 and the fair values of Match's assets and liabilities equaled their carrying amounts. Excess, if any, is attributed to patents and is amortized over 10 years.

On September 4, 20X3 Match paid cash dividends of $30,000.

On January 3, 20X3 Match sold equipment with an original cost of $30,000 and a carrying value of $15,000 to Pipe for $36,000. The equipment had a remaining useful life of 3 years. Straight-line depreciation is used.

On January 4, 20X3 Match signed an 8% Note Payable. All interest payments were made as of December 31, 20X3.

During the year Match sold merchandise to Pipe for $60,000, which included a profit of $20,000. At year end 50% of the merchandise remained in Pipe's inventory.

Required:

1.Which method is Pipe using to account for the investment in Match? How do you know?

2.What elimination entry(ies) are associated with the elimination of intercompany profits due to the sale of merchandise?

3.What elimination entry(ies) are necessary with the sale of equipment by Match to Pipe?

4.What elimination entry(ies) are associated with the note to Match? Why are the entry(ies) made?

Additional Information:

Additional Information:On January 2, 20X3 Pipe purchased 90% of Match for $155,000. On that date Match's shareholders' equity equaled $150,000 and the fair values of Match's assets and liabilities equaled their carrying amounts. Excess, if any, is attributed to patents and is amortized over 10 years.

On September 4, 20X3 Match paid cash dividends of $30,000.

On January 3, 20X3 Match sold equipment with an original cost of $30,000 and a carrying value of $15,000 to Pipe for $36,000. The equipment had a remaining useful life of 3 years. Straight-line depreciation is used.

On January 4, 20X3 Match signed an 8% Note Payable. All interest payments were made as of December 31, 20X3.

During the year Match sold merchandise to Pipe for $60,000, which included a profit of $20,000. At year end 50% of the merchandise remained in Pipe's inventory.

Required:

1.Which method is Pipe using to account for the investment in Match? How do you know?

2.What elimination entry(ies) are associated with the elimination of intercompany profits due to the sale of merchandise?

3.What elimination entry(ies) are necessary with the sale of equipment by Match to Pipe?

4.What elimination entry(ies) are associated with the note to Match? Why are the entry(ies) made?

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck

29

For each of the following intercompany transactions, state the principle to be used in accounting for intercompany gains on current and future consolidated income statements:

a.

Gains on merchandise sales

b.

Gains on the sale of land

c.

Gains on the sale of depreciable fixed assets

d.

Interest on intercompany notes

a.

Gains on merchandise sales

b.

Gains on the sale of land

c.

Gains on the sale of depreciable fixed assets

d.

Interest on intercompany notes

Unlock Deck

Unlock for access to all 29 flashcards in this deck.

Unlock Deck

k this deck