Deck 20: Estates and Trusts: Their Nature and the Accountants Role

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/46

Play

Full screen (f)

Deck 20: Estates and Trusts: Their Nature and the Accountants Role

1

Which of the following statements is true concerning the maximum gift that can be given within a year without incurring any gift tax or using any of the unified credit?

A) A single individual is limited to gifts of $12,000 in cash or property with a fair market value of $24,000 to an individual.

B) Consenting spouses can give each other a maximum of $24,000.

C) Consenting spouses together can give an individual $24,000.

D) A single individual is limited to a gift of $12,000 to a qualified charity.

A) A single individual is limited to gifts of $12,000 in cash or property with a fair market value of $24,000 to an individual.

B) Consenting spouses can give each other a maximum of $24,000.

C) Consenting spouses together can give an individual $24,000.

D) A single individual is limited to a gift of $12,000 to a qualified charity.

C

2

Which of the following would NOT be included in the corpus or principal of an estate?

A) accrued interest and declared dividends on investments held by decedent

B) personal valuables

C) life insurance proceeds where designated beneficiary is the estate

D) all of the above are included

A) accrued interest and declared dividends on investments held by decedent

B) personal valuables

C) life insurance proceeds where designated beneficiary is the estate

D) all of the above are included

D

3

The starting point for the computation of federal estate tax is the gross estate. Which of the following statements is NOT true regarding the computation of the gross estate?

A) The gross estate for tax purposes is often greater than the estate for probate purposes

B) The taxable estate does not include transfers of property made during decedent's lifetime

C) The gross estate for tax purposes also includes certain transfers by the deceased during life in which certain rights are retained by the decedent

D) The taxable estate can be reduced by certain allowable deductions

A) The gross estate for tax purposes is often greater than the estate for probate purposes

B) The taxable estate does not include transfers of property made during decedent's lifetime

C) The gross estate for tax purposes also includes certain transfers by the deceased during life in which certain rights are retained by the decedent

D) The taxable estate can be reduced by certain allowable deductions

B

4

Which of the following is NOT an advantage of forming an inter vivos trust?

A) it is a popular way to transfer property to one's heirs without a will, thereby avoiding probate

B) it is formed during the decedent's lifetime

C) any trust is not recognized as a taxable entity

D) the decedent is the trustee until death, then a successor trustee is appointed

A) it is a popular way to transfer property to one's heirs without a will, thereby avoiding probate

B) it is formed during the decedent's lifetime

C) any trust is not recognized as a taxable entity

D) the decedent is the trustee until death, then a successor trustee is appointed

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following items is not included in the estate principal subsequent to the date of death?

A) Assets discovered after the date of death

B) Gains on the sale of principal assets

C) Losses on the sale of principal

D) All affect the estate principal.

A) Assets discovered after the date of death

B) Gains on the sale of principal assets

C) Losses on the sale of principal

D) All affect the estate principal.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

6

In a testate distribution, a gift of property left after all other legacies have been assigned is referred to as a

A) general legacy.

B) demonstrative legacy.

C) residuary legacy.

D) specific legacy.

A) general legacy.

B) demonstrative legacy.

C) residuary legacy.

D) specific legacy.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

7

The primary purpose of accounting for estates is to facilitate reporting to the court during the fiduciary's term. Therefore, which of the following concepts is least important?

A) GAAP for revenue recognition

B) Inflows and outflows of assets

C) Distinction between principal and income

D) All are important in accounting for estates.

A) GAAP for revenue recognition

B) Inflows and outflows of assets

C) Distinction between principal and income

D) All are important in accounting for estates.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

8

An administrator differs from an executor of a will in that an administrator

A) has fiduciary responsibility for real property.

B) has fiduciary responsibility for personal property.

C) has fiduciary responsibility in a testate distribution.

D) is appointed by the court.

A) has fiduciary responsibility for real property.

B) has fiduciary responsibility for personal property.

C) has fiduciary responsibility in a testate distribution.

D) is appointed by the court.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

9

Which of the following statements is true concerning federal income tax laws and estates?

A) Estates are subject to estate taxes and, therefore, exempt from income tax.

B) The income tax on the earnings from an estate is levied only on the beneficiary.

C) The income tax on the earnings from an estate is levied only on the estate.

D) The income tax on the earnings from an estate is levied either on the estate or the beneficiary.

A) Estates are subject to estate taxes and, therefore, exempt from income tax.

B) The income tax on the earnings from an estate is levied only on the beneficiary.

C) The income tax on the earnings from an estate is levied only on the estate.

D) The income tax on the earnings from an estate is levied either on the estate or the beneficiary.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

10

Which of the following items are chargeable against the income of an estate?

A) Costs incurred in probating the will

B) A loss on the sale of estate assets

C) Legal fees incurred to protect income flow

D) All of the above

A) Costs incurred in probating the will

B) A loss on the sale of estate assets

C) Legal fees incurred to protect income flow

D) All of the above

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

11

Which of the following statements is true concerning the election of the alternate valuation date?

A) Only the properties that have decreased in value are valued on the alternate date.

B) All of the estate property is revalued on the alternative date, whether sold, distributed or remaining in the estate.

C) Property distributed is revalued while property sold is not.

D) The alternate date can only be used if the revaluation results in a lower total gross estate and lower estate taxes.

A) Only the properties that have decreased in value are valued on the alternate date.

B) All of the estate property is revalued on the alternative date, whether sold, distributed or remaining in the estate.

C) Property distributed is revalued while property sold is not.

D) The alternate date can only be used if the revaluation results in a lower total gross estate and lower estate taxes.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

12

When determining a decedent's gross estate for federal tax purposes, which of the following items would not be included?

A) fair market value of real property

B) fair market value of intangible property

C) fair market value of property left to a surviving spouse

D) all of the above items would be included in the gross estate

A) fair market value of real property

B) fair market value of intangible property

C) fair market value of property left to a surviving spouse

D) all of the above items would be included in the gross estate

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

13

In an intestate distribution, personal property is distributed

A) under the laws of the state where the property is located.

B) under the laws of the state in which the decedent was domiciled.

C) directly to the devisee.

D) directly to the legatee.

A) under the laws of the state where the property is located.

B) under the laws of the state in which the decedent was domiciled.

C) directly to the devisee.

D) directly to the legatee.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

14

The unified tax credit equals:

A) the exclusion amount in any given year

B) a flat rate applied against the taxable estate

C) the tentative tax that would be calculated on the exclusion amount

D) gift tax calculated on pre 1981 gifts

A) the exclusion amount in any given year

B) a flat rate applied against the taxable estate

C) the tentative tax that would be calculated on the exclusion amount

D) gift tax calculated on pre 1981 gifts

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

15

Jane Ramos owned stock with a cost of $200,000. The stock has a market value on Jane's date of death of $375,000. The stock was willed to Jane's niece Jenny. Which of the following is true?

A) Jenny's basis is $200,000; the stock's value in the gross estate is $100,000.

B) Jenny's basis is $375,000; the stock's value in the gross estate is $100,000.

C) Jenny's basis is $200,000; the stock's value in the gross estate is $375,000.

D) Jenny's basis is $375,000; the stock's value in the gross estate is $375,000.

A) Jenny's basis is $200,000; the stock's value in the gross estate is $100,000.

B) Jenny's basis is $375,000; the stock's value in the gross estate is $100,000.

C) Jenny's basis is $200,000; the stock's value in the gross estate is $375,000.

D) Jenny's basis is $375,000; the stock's value in the gross estate is $375,000.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

16

The gross estate of a decedent:

A) is the same as the probate estate

B) includes all assets owned by a decedent at the moment of death, regardless of whether they pass to others by means of will, joint tenancy, or community property laws

C) includes assets measured only at historical cost

D) does not include transfers made through gifts

A) is the same as the probate estate

B) includes all assets owned by a decedent at the moment of death, regardless of whether they pass to others by means of will, joint tenancy, or community property laws

C) includes assets measured only at historical cost

D) does not include transfers made through gifts

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

17

The alternate valuation date is how many months after the decedent's death?

A) 3

B) 6

C) 9

D) 12

A) 3

B) 6

C) 9

D) 12

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

18

Which of the following is not a legacy?

A) a tract of land bequeathed to the local humane society

B) a diamond and pearl necklace to a family member

C) $20,000 left to a nephew

D) a Ford Explorer left to a niece

A) a tract of land bequeathed to the local humane society

B) a diamond and pearl necklace to a family member

C) $20,000 left to a nephew

D) a Ford Explorer left to a niece

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

19

The effect of the marital deduction is:

A) total elimination of estate taxes for both the decedent and their spouse

B) to reduce the taxable estate of the decedent's spouse

C) deferral of estate taxes until the death of the decedent's spouse

D) increase the available unified tax credit

A) total elimination of estate taxes for both the decedent and their spouse

B) to reduce the taxable estate of the decedent's spouse

C) deferral of estate taxes until the death of the decedent's spouse

D) increase the available unified tax credit

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following items is not charged against the income of an estate?

A) Ordinary repairs to income-producing property

B) Expenses incurred to protect income flow

C) Loss on the sale of an estate asset

D) All of the above are charged against the income

A) Ordinary repairs to income-producing property

B) Expenses incurred to protect income flow

C) Loss on the sale of an estate asset

D) All of the above are charged against the income

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

21

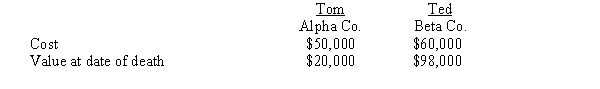

Mr. Riekoff died and left the following stocks to his two sons:

Required:

Required:

a.

If both sons sold their stocks ten months after their father's death for $50,000 and the alternate valuation was not used, what would their respective capital gains/losses be?

b.

Assuming that the price of the stock remained constant in the year prior to Mr. Riekoff's death, what might have been a better method of handling the stocks from a tax planning perspective? Explain why.

Required:

Required: a.

If both sons sold their stocks ten months after their father's death for $50,000 and the alternate valuation was not used, what would their respective capital gains/losses be?

b.

Assuming that the price of the stock remained constant in the year prior to Mr. Riekoff's death, what might have been a better method of handling the stocks from a tax planning perspective? Explain why.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

22

A trust created through a will is called a(n)

A) inter vivos trust.

B) living trust.

C) testamentary trust.

D) devisee trust.

A) inter vivos trust.

B) living trust.

C) testamentary trust.

D) devisee trust.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

23

The double trial balance for estate and trust accounting indicates the need to segregate

A) real property from personal property.

B) devices from legacies.

C) principal items from income items.

D) assets of the estate from claims against the estate.

A) real property from personal property.

B) devices from legacies.

C) principal items from income items.

D) assets of the estate from claims against the estate.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

24

The primary purpose of an estate's charge and discharge statement is to detail

A) cash flow as to principal and as to income.

B) income and expenses of the estate.

C) transactions affecting principal and income.

D) the profit or loss during the period of stewardship.

A) cash flow as to principal and as to income.

B) income and expenses of the estate.

C) transactions affecting principal and income.

D) the profit or loss during the period of stewardship.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

25

For estate planning purposes, Albert began distributing gifts in 2008. Already, in 2008, Albert has given his daughter stocks costing $5,000, with a current market value of $10,000.

Required:

What is the maximum additional gift Albert can give in 2008 to his daughter in cash without incurring any gift tax liability assuming that:

a.

Albert is single.

b.

Albert is married and his wife is willing to give the maximum amount the couple is allowed.

Required:

What is the maximum additional gift Albert can give in 2008 to his daughter in cash without incurring any gift tax liability assuming that:

a.

Albert is single.

b.

Albert is married and his wife is willing to give the maximum amount the couple is allowed.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

26

Which of the following best describes the accounting for discounts and premiums for bonds purchased by a fiduciary for an estate?

A) Premiums are amortized, but discounts are not.

B) Discounts are amortized, but premiums are not.

C) GAAP guidelines for amortization are followed, i.e., both are amortized.

D) Like bonds purchased prior to the death, neither discounts nor premiums are amortized.

A) Premiums are amortized, but discounts are not.

B) Discounts are amortized, but premiums are not.

C) GAAP guidelines for amortization are followed, i.e., both are amortized.

D) Like bonds purchased prior to the death, neither discounts nor premiums are amortized.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

27

Beginning in 1999

A) only gifts to U.S. citizens may be considered as nontaxable.

B) estates are taxed at a higher rate than income.

C) the annual allowable maximum exclusion for taxable gifts is adjusted for inflation.

D) the marital deduction is lowered for federal tax purposes.

A) only gifts to U.S. citizens may be considered as nontaxable.

B) estates are taxed at a higher rate than income.

C) the annual allowable maximum exclusion for taxable gifts is adjusted for inflation.

D) the marital deduction is lowered for federal tax purposes.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

28

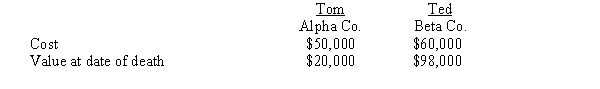

Assuming that no stipulation is made in the will, indicate by placing a check mark in the appropriate column whether the typical accounting treatment of each of the following items would affect principal only, income only, or both principal and income accounts of an estate.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

29

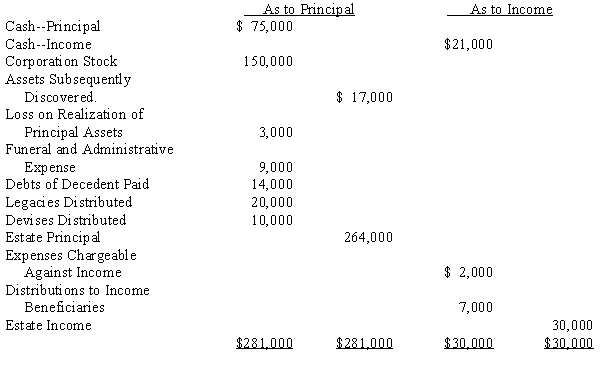

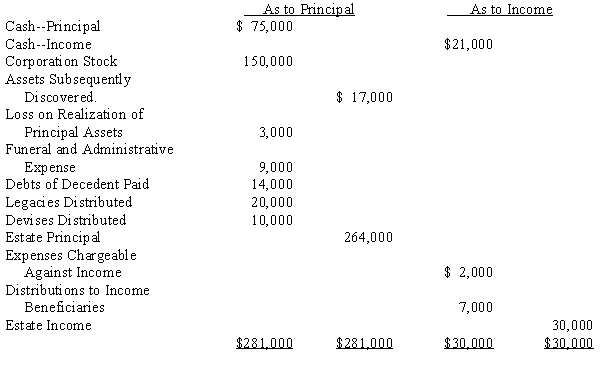

Betty Bloome died on February 28, 20X5. The following trial balance was prepared by the executor of Betty's estate as of October 31, 20X5:

Required:

Required:

Prepare a charge and discharge statement as of December 31, 20X5.

Required:

Required:Prepare a charge and discharge statement as of December 31, 20X5.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

30

Adequate estate planning is critical for an individual or family with a sizable net worth. List the goals of estate planning for large, more complex estates.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

31

Estate planning can be a complex process because of the many factors and objectives that must be considered. Not the least of these factors are the tax consequences of estate planning activities. From an estate tax perspective, list the major considerations relevant to proper planning.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

32

Which of the following statements is not true?

A) Medical payments made on someone else's behalf are considered taxable gifts.

B) An inter vivos trust allows a person to pass property to heirs without having a will.

C) The corpus of an estate is made up of assets.

D) Estate tax rates are progressive.

A) Medical payments made on someone else's behalf are considered taxable gifts.

B) An inter vivos trust allows a person to pass property to heirs without having a will.

C) The corpus of an estate is made up of assets.

D) Estate tax rates are progressive.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

33

If the funds in an estate are insufficient to satisfy all valid claims against it, state laws provide a priority for settlement.

Required:

a.

Reorder the list of claims below in the most common order of priority:

(1)

Wages due domestic servants for a period of not more than one year prior to date of death and medical claims for the same period.

(2)

Taxes: income, estate, and inheritance.

(3)

Claims having a special lien against property, but not to exceed the value of the property.

(4)

Debts due the United States and various states.

(5)

All other claims.

(6)

Funeral and administrative expenses.

(7)

Judgments of any court of competent jurisdiction.

b.

If funds are insufficient to satisfy all of the claims within a class, explain how claims are paid.

Required:

a.

Reorder the list of claims below in the most common order of priority:

(1)

Wages due domestic servants for a period of not more than one year prior to date of death and medical claims for the same period.

(2)

Taxes: income, estate, and inheritance.

(3)

Claims having a special lien against property, but not to exceed the value of the property.

(4)

Debts due the United States and various states.

(5)

All other claims.

(6)

Funeral and administrative expenses.

(7)

Judgments of any court of competent jurisdiction.

b.

If funds are insufficient to satisfy all of the claims within a class, explain how claims are paid.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

34

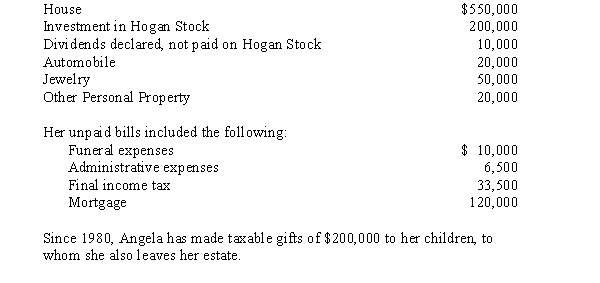

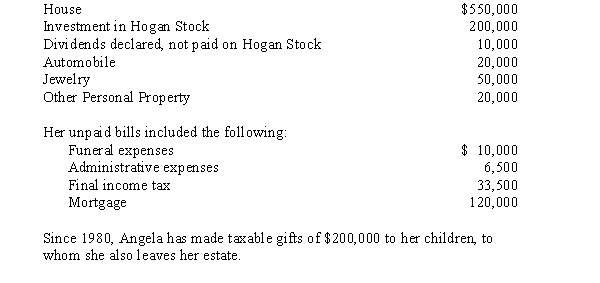

Angela Burke died in 20X8 leaving a gross estate that consists of the following assets: (values given are market values on date of death or valuation):

Required:

Required:

Determine, in good form, the tax base for the estate.

Required:

Required:Determine, in good form, the tax base for the estate.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

35

Which of the following statements is true concerning the handling of discounts and premiums for bonds that are part of an estate at the time of death?

A) Straight-line amortization is normally used to amortize discounts and premiums.

B) Effective amortization is the preferred method.

C) Either straight-line or effective amortization can be used.

D) Discounts and premiums are not amortized.

A) Straight-line amortization is normally used to amortize discounts and premiums.

B) Effective amortization is the preferred method.

C) Either straight-line or effective amortization can be used.

D) Discounts and premiums are not amortized.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

36

Which of the following statements concerning accounting for depreciation and depletion in an estate is not true?

A) For any depreciation taken, an equal amount of income is transferred to principal.

B) Depreciation is a common charge against income.

C) Depletion is generally taken for wasting assets.

D) All of the above.

A) For any depreciation taken, an equal amount of income is transferred to principal.

B) Depreciation is a common charge against income.

C) Depletion is generally taken for wasting assets.

D) All of the above.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

37

In the initial journal entry recording the inventory of the estate, liabilities incurred by the decedent are

A) not recorded.

B) credited to specific liability accounts.

C) credited to the account Claims Against Estate Principal.

D) credited to the account Claims Against Estate Income.

A) not recorded.

B) credited to specific liability accounts.

C) credited to the account Claims Against Estate Principal.

D) credited to the account Claims Against Estate Income.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

38

The party to which legal title and management responsibilities are initially given in a trust agreement is referred to as the

A) trustee.

B) remainderman.

C) grantor.

D) beneficiary.

A) trustee.

B) remainderman.

C) grantor.

D) beneficiary.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

39

A charitable remainder trust

A) splits assets between a surviving spouse and a trust

B) distributes income on a trust to a charitable organization for a period of time, after which, the principal assets are transferred to a beneficiary

C) is the same as a Q-TIP trust

D) distributes income from trust assets to individual beneficiaries for a period of time, after which, the principal assets are transferred to a remainderman, which must be a charitable organization

A) splits assets between a surviving spouse and a trust

B) distributes income on a trust to a charitable organization for a period of time, after which, the principal assets are transferred to a beneficiary

C) is the same as a Q-TIP trust

D) distributes income from trust assets to individual beneficiaries for a period of time, after which, the principal assets are transferred to a remainderman, which must be a charitable organization

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

40

On February 1, 20X8, Sharon Kane died. Sharon left a valid will. Events in 20X8 related to the estate are as follows:

Required:

Required:

a.

As the executor of the estate, record the 20X8 events in general journal form.

b.

Prepare a Charge and Discharge Statement for the period February 1, 20X8 to June 30, 20X8.

Required:

Required: a.

As the executor of the estate, record the 20X8 events in general journal form.

b.

Prepare a Charge and Discharge Statement for the period February 1, 20X8 to June 30, 20X8.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

41

What are some of the tax planning strategies which may be employed to reduce the tax on the decedent's gross estate?

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

42

Mr. Arnold Schwartz died on January 23, 20X5. He owned the following items on the date of his death:

He also had the following liabilities:

He also had the following liabilities:

His funeral and administrative expenses were $10,000. He also had a life insurance policy with no cash value for $150,000 payable to his son.

His funeral and administrative expenses were $10,000. He also had a life insurance policy with no cash value for $150,000 payable to his son.

Arnold's will specified the following:

(1)

Mercy Hospice was to receive $15,000 in cash.

(2)

His son was to receive the rental property and one-fourth of the stocks.

(3)

His wife was to receive the remainder of the assets.

Required:

Assuming Arnold made $100,000 in taxable gifts since 1976, compute his tax base for estate tax purposes.

He also had the following liabilities:

He also had the following liabilities: His funeral and administrative expenses were $10,000. He also had a life insurance policy with no cash value for $150,000 payable to his son.

His funeral and administrative expenses were $10,000. He also had a life insurance policy with no cash value for $150,000 payable to his son.Arnold's will specified the following:

(1)

Mercy Hospice was to receive $15,000 in cash.

(2)

His son was to receive the rental property and one-fourth of the stocks.

(3)

His wife was to receive the remainder of the assets.

Required:

Assuming Arnold made $100,000 in taxable gifts since 1976, compute his tax base for estate tax purposes.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

43

Complete the following statements by filling in the blanks:

a. Real property disposed of under a valid will is called a(n) __________.

b. A person who dies without a valid will is said to die __________.

c. The personal representative of the decedent under a valid will is called the __________.

d. For an unmarried person, the amount of property exempted from the federal estate tax is referred to as the __________.

e. Since estate rates increase as the tax base increases, the rates are said to be __________.

f. With spousal consent, nontaxable gifts per individual per year amount to __________.

g. Under appropriate conditions, the fiduciary of an estate may value assets at a date six months after death. The date is called the __________.

h. A valid will says, "My nephew shall receive the gold Canadian maple leaf coins in my Greenwood Trust safety deposit box." This is an example of a(n) __________ legacy.

i. Income from an asset may be assigned to one party called the __________. After a stipulated period of time, the asset itself may be distributed to another party called the __________.

:

a.

Real property disposed of under a valid will is called a(n) __________.

b.

A person who dies without a valid will is said to die __________.

c.

The personal representative of the decedent under a valid will is called the __________.

d.

For an unmarried person, the amount of property exempted from the federal estate tax is referred to as the __________.

e.

Since estate rates increase as the tax base increases, the rates are said to be __________.

a. Real property disposed of under a valid will is called a(n) __________.

b. A person who dies without a valid will is said to die __________.

c. The personal representative of the decedent under a valid will is called the __________.

d. For an unmarried person, the amount of property exempted from the federal estate tax is referred to as the __________.

e. Since estate rates increase as the tax base increases, the rates are said to be __________.

f. With spousal consent, nontaxable gifts per individual per year amount to __________.

g. Under appropriate conditions, the fiduciary of an estate may value assets at a date six months after death. The date is called the __________.

h. A valid will says, "My nephew shall receive the gold Canadian maple leaf coins in my Greenwood Trust safety deposit box." This is an example of a(n) __________ legacy.

i. Income from an asset may be assigned to one party called the __________. After a stipulated period of time, the asset itself may be distributed to another party called the __________.

:

a.

Real property disposed of under a valid will is called a(n) __________.

b.

A person who dies without a valid will is said to die __________.

c.

The personal representative of the decedent under a valid will is called the __________.

d.

For an unmarried person, the amount of property exempted from the federal estate tax is referred to as the __________.

e.

Since estate rates increase as the tax base increases, the rates are said to be __________.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

44

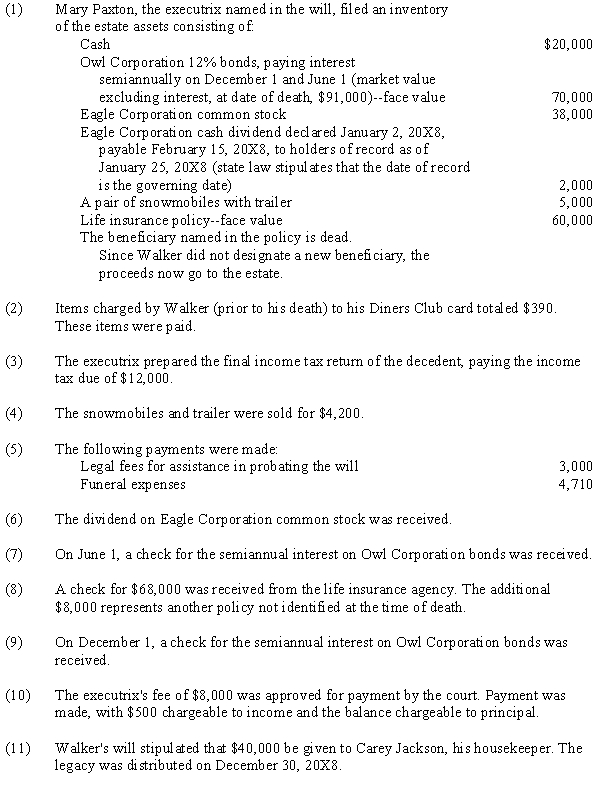

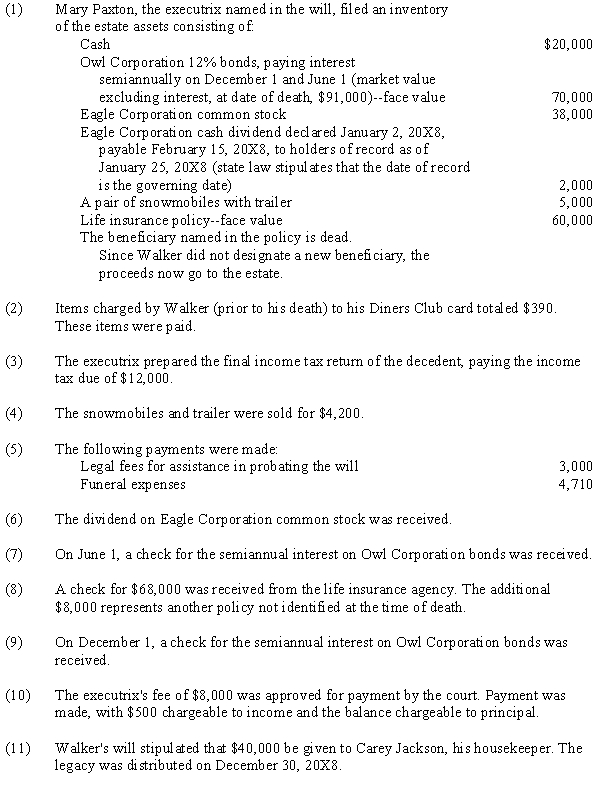

Willie Walker, a widower, died on February 1, 20X8. He had no living relatives. The following selected events occurred after Walker's death:

Required:

Required:

Prepare journal entries to record the above events. Upon completion of the journal entries, prepare a double trial balance for the estate of Willie Walker as of December 31, 20X8.

Required:

Required:Prepare journal entries to record the above events. Upon completion of the journal entries, prepare a double trial balance for the estate of Willie Walker as of December 31, 20X8.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

45

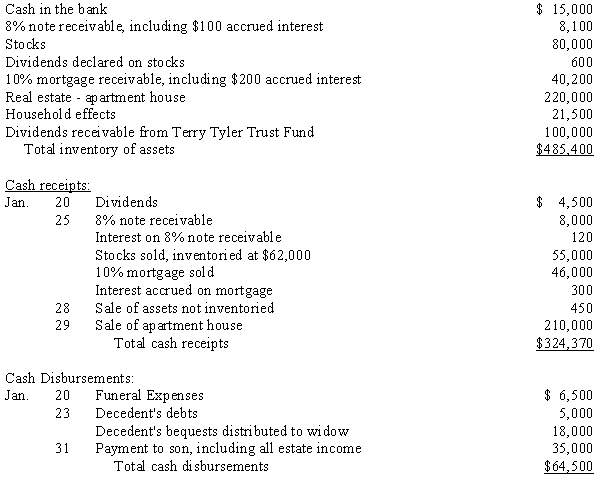

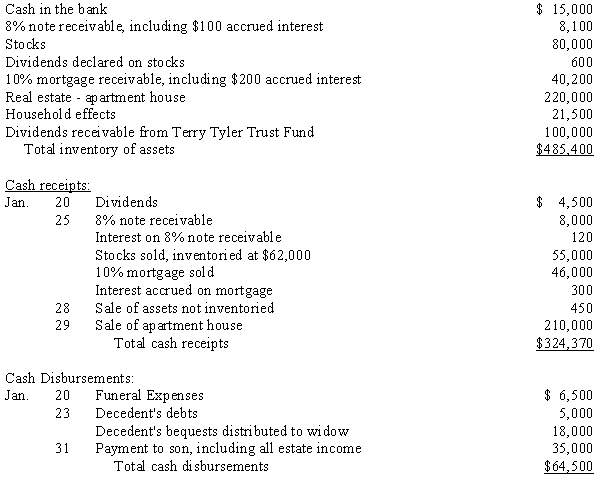

Trent Tyler died on January 15, 20X9. Records disclose the following estate:

Required:

Required:

Prepare a charge and discharge statement for the period January 15 through January 31, 20X9.

Required:

Required:Prepare a charge and discharge statement for the period January 15 through January 31, 20X9.

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck

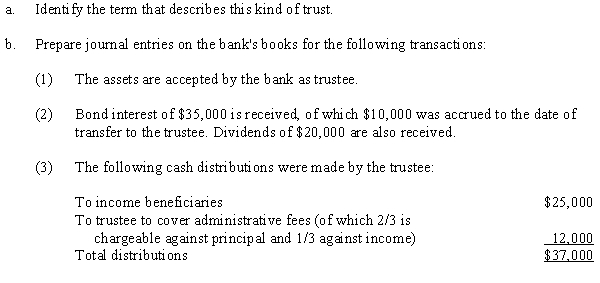

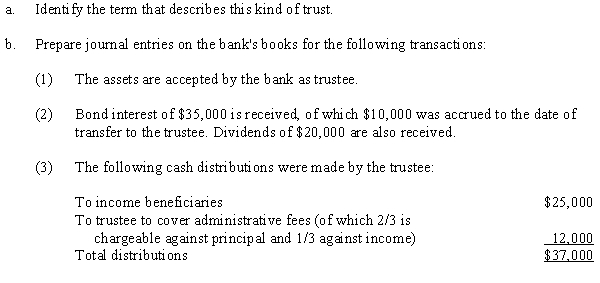

46

In his will, Andrew Baker provided for the establishment of a trust that will include the bulk of his estate assets. At the time of his death, his net assets had a market value of $430,000 consisting of $75,000 in cash, $125,000 of U.S. Treasury bonds including accrued interest, and the remainder in various securities. Income beneficiaries of the trust will be the same as the income beneficiaries of the estate. Fiduciary Bank will act as trustee.

Required:

Required:

Unlock Deck

Unlock for access to all 46 flashcards in this deck.

Unlock Deck

k this deck