Deck 9: Withholding, Estimated Payments, and Payroll Taxes

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 9: Withholding, Estimated Payments, and Payroll Taxes

1

For 2011,calculate Betty's total self-employment tax liability (Social Security and Medicare taxes)if Betty's self-employment income is $200,000.

A)$8,232

B)$11,107

C)$16,463

D)$5,356

A)$8,232

B)$11,107

C)$16,463

D)$5,356

C

2

What minimum amount of tips must an employer report as allocated to employees if gross food and beverage sales in the restaurant are $175,000?

A)$10,500

B)$17,500

C)$21,000

D)$14,000

E)$26,250

A)$10,500

B)$17,500

C)$21,000

D)$14,000

E)$26,250

D

3

Edwina worked at three jobs during 2011.She earned $30,000,$40,000,and $9,000 respectively from the jobs and had $10,000 from self-employment income.What amount can Edwina apply as a credit against her 2011 income tax liability for overpayment of FICA taxes?

A)$765

B)$6,808

C)$1,291

D)$6,622

E)None of the above

A)$765

B)$6,808

C)$1,291

D)$6,622

E)None of the above

E

4

In 2011,Wilhelm Company had five employees.Four of the employees worked full-time and earned salaries of $20,000,$25,000,$30,000,and $35,000 respectively.The fifth employee worked only part-time during the first 6 months of the year and earned $3,000.The employer timely paid state unemployment tax equal to 5.4 percent of employee wages.How much federal unemployment tax was paid by Wilhelm Company for 2011?

A)$6,102

B)$904

C)$1,674

D)$248

E)$1,922

A)$6,102

B)$904

C)$1,674

D)$248

E)$1,922

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

Brett works as a mild-mannered reporter by day and a self-employed superstar guitar hero at night.He estimates that his current year taxes,including self-employment taxes,will be $13,600 based on his adjusted gross income of $60,000.Brett also estimates that his current year withholding from his newspaper job will be $4,000.His tax liability in the prior year was $10,500.What is the calculation that yields the minimum amount of estimated payments that Brett should make for the current year?

A)Brett does not need to make any estimated payments.

B)90 percent of current year taxes.

C)100 percent of last year taxes.

D)110 percent of last year's taxes.

A)Brett does not need to make any estimated payments.

B)90 percent of current year taxes.

C)100 percent of last year taxes.

D)110 percent of last year's taxes.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Gail is 42 years old and Martin is 45 years old.They are married with four dependent children over age 17,and Martin has one job.Assuming that Gail has bad eyesight and is unemployed,how many allowances should Martin claim on his Form W-4,assuming no extra allowances for deductions or adjustments?

A)Five

B)Six

C)Seven

D)Eight

E)Two.

A)Five

B)Six

C)Seven

D)Eight

E)Two.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

Self-employment taxes,

A)Are not imposed if self-employment income is less than $1,000.

B)Are imposed on all self-employment income regardless of the amount of wages earned.

C)Result in a partial deduction for adjusted gross income.

D)Are limited to 2.90 percent of $106,800 for 2011 for the Medicare portion.

A)Are not imposed if self-employment income is less than $1,000.

B)Are imposed on all self-employment income regardless of the amount of wages earned.

C)Result in a partial deduction for adjusted gross income.

D)Are limited to 2.90 percent of $106,800 for 2011 for the Medicare portion.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Choose the correct statement.

A)The purpose of Form W-4 is to calculate the amount of Social Security taxes to withhold from an employee's wages.

B)The employer is the one to calculate the number of withholding allowances.

C)If no Form W-4 is completed,then the employer is required to withhold as if the employee is single with no exemptions.

D)Employees must prove to their employer that they are entitled to the number of allowances claimed on the W-4 form.

A)The purpose of Form W-4 is to calculate the amount of Social Security taxes to withhold from an employee's wages.

B)The employer is the one to calculate the number of withholding allowances.

C)If no Form W-4 is completed,then the employer is required to withhold as if the employee is single with no exemptions.

D)Employees must prove to their employer that they are entitled to the number of allowances claimed on the W-4 form.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Please choose the correct statement.

A)An employer must deposit federal unemployment tax for any quarter when the amount for the quarter plus any other amounts from previous quarters during the calendar year exceed $500.

B)The federal unemployment tax liability is reported on Form 941.

C)The first $106,800 of an employee's wages is subject to the federal unemployment tax.

D)The federal unemployment tax is deducted from the employee's wages.

A)An employer must deposit federal unemployment tax for any quarter when the amount for the quarter plus any other amounts from previous quarters during the calendar year exceed $500.

B)The federal unemployment tax liability is reported on Form 941.

C)The first $106,800 of an employee's wages is subject to the federal unemployment tax.

D)The federal unemployment tax is deducted from the employee's wages.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

Dividends paid to a stockholder by a corporation should be reported on which of the following forms?

A)1099-R

B)1099-INT

C)1099-MISC

D)1099-B

E)1099-DIV

A)1099-R

B)1099-INT

C)1099-MISC

D)1099-B

E)1099-DIV

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

A taxpayer must pay FICA and Medicare for the following employee who works at the taxpayer's house:

A)The maid who is employed through the Molly Maid cleaning service.

B)The au pair who takes care of the taxpayer's children

C)The neighbor's 15-year-old child who walks the taxpayer's dog after school.

D)The Terminix exterminator who comes out monthly to spray for bugs.

A)The maid who is employed through the Molly Maid cleaning service.

B)The au pair who takes care of the taxpayer's children

C)The neighbor's 15-year-old child who walks the taxpayer's dog after school.

D)The Terminix exterminator who comes out monthly to spray for bugs.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

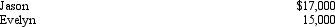

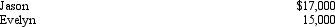

12

Orlando has two employees who earned the following amounts evenly during 2011:  If Orlando timely pays 5.4 percent for state unemployment tax,what is the amount of his 2011 FUTA after the state tax credit?

If Orlando timely pays 5.4 percent for state unemployment tax,what is the amount of his 2011 FUTA after the state tax credit?

A)$1,728

B)$756

C)$256

D)$112

E)$0

If Orlando timely pays 5.4 percent for state unemployment tax,what is the amount of his 2011 FUTA after the state tax credit?

If Orlando timely pays 5.4 percent for state unemployment tax,what is the amount of his 2011 FUTA after the state tax credit?A)$1,728

B)$756

C)$256

D)$112

E)$0

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Which of the following forms is used by an employer to report quarterly wages and federal payroll tax withholdings and deposits?

A)Form W-2

B)Form 941-V

C)Form 1099

D)Form W-4

E)Form 941

A)Form W-2

B)Form 941-V

C)Form 1099

D)Form W-4

E)Form 941

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

In regards to employers' requirements for depositing employment taxes:

A)New employers are deemed to be monthly depositors.

B)If employers have yearly employment tax liabilities of $10,000 or less,then they are allowed to file once a year.

C)Typically,employers are either weekly or monthly depositors.

D)To determine their deposit schedule,employers estimate their employment taxes for the year.

A)New employers are deemed to be monthly depositors.

B)If employers have yearly employment tax liabilities of $10,000 or less,then they are allowed to file once a year.

C)Typically,employers are either weekly or monthly depositors.

D)To determine their deposit schedule,employers estimate their employment taxes for the year.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following items may not be subject to the self-employment tax?

A)A partner's distributive share of partnership business income

B)Amounts paid to an independent contractor who is the sole proprietor of his company.

C)Amounts paid to a consultant who is the sole proprietor of his company

D)Rental income from apartments owned by an individual whose regular source of income is wages and salaries.

E)Amounts received by an author as royalties from a book he wrote.

A)A partner's distributive share of partnership business income

B)Amounts paid to an independent contractor who is the sole proprietor of his company.

C)Amounts paid to a consultant who is the sole proprietor of his company

D)Rental income from apartments owned by an individual whose regular source of income is wages and salaries.

E)Amounts received by an author as royalties from a book he wrote.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

For 2011,the Social Security portion of the FICA tax is imposed at a rate of:

A).08 percent for the employee and 5.4 percent for the employer

B)1.45 percent for the employee and 1.45 percent for the employer

C)6.2 percent for only the employer

D)4.2 percent for the employee and 6.2 percent for the employer

E)6.2 percent for the employee and 7.65 percent for the employer

A).08 percent for the employee and 5.4 percent for the employer

B)1.45 percent for the employee and 1.45 percent for the employer

C)6.2 percent for only the employer

D)4.2 percent for the employee and 6.2 percent for the employer

E)6.2 percent for the employee and 7.65 percent for the employer

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

A taxpayer who employs household employees:

A)Is required to pay federal unemployment taxes if he or she pays more than $1,000 in cash wages to household employees during any calendar quarter.

B)Must withhold federal income taxes from the employee's wages.

C)Must pay FICA taxes on cash payments of $1,000 or more during a calendar year.

D)Must report the employment taxes every quarter.

A)Is required to pay federal unemployment taxes if he or she pays more than $1,000 in cash wages to household employees during any calendar quarter.

B)Must withhold federal income taxes from the employee's wages.

C)Must pay FICA taxes on cash payments of $1,000 or more during a calendar year.

D)Must report the employment taxes every quarter.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

Edward worked at three jobs during 2011.He earned $40,000,$37,000,and $9,000 respectively from the jobs and claimed three allowances on each of his W-4s.What is the total amount of FICA (Social Security and Medicare)tax that would have been withheld from Edward's wages?

A)$4,859

B)$8,170

C)$5,332

D)$1,247

E)$1,549

A)$4,859

B)$8,170

C)$5,332

D)$1,247

E)$1,549

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

In general,estimated payments for individual taxpayers are due on:

A)March 15,June 15,September 15 and December 15.

B)March 15,June 15,September 15 and January 15 of the following year.

C)April 15,June 15,September 15 and December 15.

D)April 15,June 15,September 15 and January 15 of the following year.

A)March 15,June 15,September 15 and December 15.

B)March 15,June 15,September 15 and January 15 of the following year.

C)April 15,June 15,September 15 and December 15.

D)April 15,June 15,September 15 and January 15 of the following year.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

Employers must provide a Form W-2:

A)To the employee by February 28.

B)If requested by a terminated employee,the later of 30 days of the employee's request for his/her Form W-2 or within 30 days after the last wage payment is made.

C)To the Social Security Administration by January 31 after the end of the year.

D)To the state of the employee's residence by January 31.

A)To the employee by February 28.

B)If requested by a terminated employee,the later of 30 days of the employee's request for his/her Form W-2 or within 30 days after the last wage payment is made.

C)To the Social Security Administration by January 31 after the end of the year.

D)To the state of the employee's residence by January 31.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck