Deck 3: Business Income and Expenses, Part I

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 3: Business Income and Expenses, Part I

1

Karl has a net operating loss in 2011.If he does not make any special elections,what is the first year to which Karl can carry the net operating loss?

A)2011

B)2031

C)2010

D)2009

E)2008

A)2011

B)2031

C)2010

D)2009

E)2008

D

2

Which of the following taxpayers may not use the standard mileage method of calculating transportation costs?

A)A self-employed CPA who drives a computer-equipped minivan to visit clients.

B)A tree surgeon who travels to clients either from his office or his home.

C)A real estate salesperson who drives a $75,000 BMW while showing houses.

D)A limousine owner with a fleet of 15 limousines.

E)All of the above taxpayers may use the standard mileage method.

A)A self-employed CPA who drives a computer-equipped minivan to visit clients.

B)A tree surgeon who travels to clients either from his office or his home.

C)A real estate salesperson who drives a $75,000 BMW while showing houses.

D)A limousine owner with a fleet of 15 limousines.

E)All of the above taxpayers may use the standard mileage method.

D

3

To file a Schedule C-EZ,the taxpayer must:

A)Have gross receipts of $35,000 or more from the business.

B)Have business expenses of $5,000 or more.

C)Have no inventory during or at the end of the year.

D)Have no more than 2 businesses.

E)Have no more than 5 employees during the year.

A)Have gross receipts of $35,000 or more from the business.

B)Have business expenses of $5,000 or more.

C)Have no inventory during or at the end of the year.

D)Have no more than 2 businesses.

E)Have no more than 5 employees during the year.

C

4

Better Brands Corporation,a calendar year taxpayer,has ending inventory of $180,000 on December 31,2011.During the year,the corporation purchased additional inventory of $670,000.If cost of goods sold for 2011 is $615,000,what was the beginning inventory at January 1,2011?

A)$55,000

B)$235,000

C)$125,000

D)$435,000

E)None of the above

A)$55,000

B)$235,000

C)$125,000

D)$435,000

E)None of the above

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

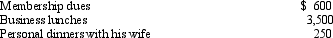

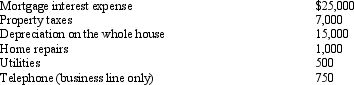

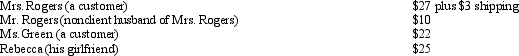

Mr.Gold has a membership at the University Club.He pays the following during the year:  How much may Mr.Gold deduct as entertainment expenses?

How much may Mr.Gold deduct as entertainment expenses?

A)$1,750

B)$2,050

C)$4,100

D)$4,350

How much may Mr.Gold deduct as entertainment expenses?

How much may Mr.Gold deduct as entertainment expenses?A)$1,750

B)$2,050

C)$4,100

D)$4,350

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Tonie loaned a friend $5,000 to take a cruise.In the current year,Tonie's friend declares bankruptcy and the debt is considered totally worthless.What amount may Tonie deduct on her individual income tax return for the current year as a result of the worthless debt,assuming she has no other capital gains or losses for the year?

A)$3,000 short-term capital loss

B)$5,000 short-term capital loss

C)$2,000 short-term capital loss

D)$5,000 ordinary loss

E)$3,000 ordinary loss

A)$3,000 short-term capital loss

B)$5,000 short-term capital loss

C)$2,000 short-term capital loss

D)$5,000 ordinary loss

E)$3,000 ordinary loss

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

If an employer chooses a per diem method of substantiation for travel expenses,

A)The high-low method allows employees traveling mostly in high-cost areas the same high-cost per diem rate all year.

B)The high-low method averages the high-cost locality and low-cost locality per diem rates to arrive at an average rate.

C)The meals and incidental expenses method requires actual cost records to substantiate lodging expenses.

D)Actual expense records substantiating the business reason for the trip and the dates of arrival and departure are not required.

E)The employer need not use an accountable plan for reimbursing employees for travel expenses.

A)The high-low method allows employees traveling mostly in high-cost areas the same high-cost per diem rate all year.

B)The high-low method averages the high-cost locality and low-cost locality per diem rates to arrive at an average rate.

C)The meals and incidental expenses method requires actual cost records to substantiate lodging expenses.

D)Actual expense records substantiating the business reason for the trip and the dates of arrival and departure are not required.

E)The employer need not use an accountable plan for reimbursing employees for travel expenses.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Which of the following statements is true in regards to the home office deduction?

A)The property taxes and mortgage interest expense are allocated first to the net income of the home office.Maintenance and depreciation expense are deducted next to the extent that the activity generated income for the year.

B)The home office deduction may create a loss.

C)If you use the work area for both personal use and business use,you still may qualify for the home office deduction.

D)If a professor has an office at the college,he may still take a home office deduction for grading papers at home.

A)The property taxes and mortgage interest expense are allocated first to the net income of the home office.Maintenance and depreciation expense are deducted next to the extent that the activity generated income for the year.

B)The home office deduction may create a loss.

C)If you use the work area for both personal use and business use,you still may qualify for the home office deduction.

D)If a professor has an office at the college,he may still take a home office deduction for grading papers at home.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

During 2011,Trish,a self-employed healthcare consultant,travels from Los Angeles to Atlanta for a 1 week business trip.While in Atlanta,Trish decides to stay for an additional 5 days of vacation.She pays $750 for airfare,$220 for meals,$150 for entertaining clients,and $600 for lodging while on business.The costs of meals and lodging while on vacation were $250 and $500,respectively.How much may Trish deduct as travel expenses for the trip?

A)$970

B)$1,570

C)$1,720

D)$1,460

E)None of the above.

A)$970

B)$1,570

C)$1,720

D)$1,460

E)None of the above.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

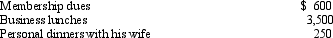

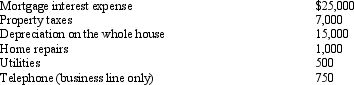

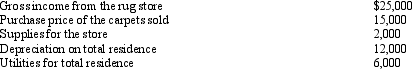

Debbie,a pharmaceutical salesperson,works exclusively from her home.She has a 200 square foot room in her 2,000 square foot house,in which she conducts her business.She makes $120,000 a year before her home office deduction.Debbie's expenses for the year are as follows:  How much may Debbie include as home office expense?

How much may Debbie include as home office expense?

A)$4,850

B)$4,925

C)$48,500

D)$49,250

How much may Debbie include as home office expense?

How much may Debbie include as home office expense?A)$4,850

B)$4,925

C)$48,500

D)$49,250

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

In year one,Dr.Drill,an accrual basis dentist,recorded $5,000 of taxable income for dental services performed but not paid in cash by Mr.Cashless.In year two,Mr.Cashless is bankrupt and Dr.Drill has decided that the debt is uncollectible.In year two,Dr.Drill may:

A)Deduct $5,000 as an ordinary business loss.

B)Deduct $5,000 as a short-term capital loss.

C)Deduct $3,000 as an ordinary business loss.

D)Deduct $5,000 as a long-term capital loss.

A)Deduct $5,000 as an ordinary business loss.

B)Deduct $5,000 as a short-term capital loss.

C)Deduct $3,000 as an ordinary business loss.

D)Deduct $5,000 as a long-term capital loss.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

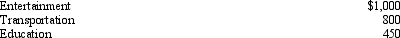

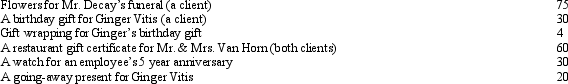

Nathan owns a small business supplies store.During 2011,Nathan gives business gifts with these costs to the following individuals:  What is the amount of Nathan's deduction for business gifts?

What is the amount of Nathan's deduction for business gifts?

A)$0

B)$50

C)$62

D)$97

E)None of the above.

What is the amount of Nathan's deduction for business gifts?

What is the amount of Nathan's deduction for business gifts?A)$0

B)$50

C)$62

D)$97

E)None of the above.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

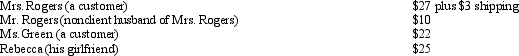

Charlene,a self-employed consultant,incurred business-related expenses in 2011 as follows:  How much of these expenses should she deduct on her 2011 Schedule C?

How much of these expenses should she deduct on her 2011 Schedule C?

A)$800

B)$1,250

C)$2,250

D)$1,750

E)None of the above.

How much of these expenses should she deduct on her 2011 Schedule C?

How much of these expenses should she deduct on her 2011 Schedule C?A)$800

B)$1,250

C)$2,250

D)$1,750

E)None of the above.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

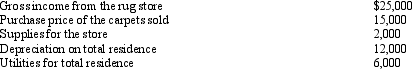

Richard operates an oriental rug store out of his home.400 of the 1,600 square feet of floor space are allocated to the rug display and sales area.Other information is as follows:  What amount of income or loss from the rug business should Richard show on his return?

What amount of income or loss from the rug business should Richard show on his return?

A)$10,000 loss

B)$2,000 loss

C)$0

D)$3,500 income

E)None of the above.

What amount of income or loss from the rug business should Richard show on his return?

What amount of income or loss from the rug business should Richard show on his return?A)$10,000 loss

B)$2,000 loss

C)$0

D)$3,500 income

E)None of the above.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

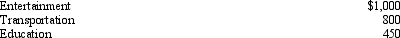

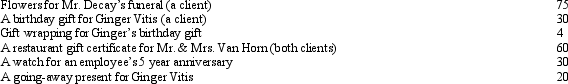

The following are gifts that Dr.Smile,a dentist,made throughout the year:  How much may Dr.Smile deduct for the above expenses?

How much may Dr.Smile deduct for the above expenses?

A)$129

B)$134

C)$154

D)$219

How much may Dr.Smile deduct for the above expenses?

How much may Dr.Smile deduct for the above expenses?A)$129

B)$134

C)$154

D)$219

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following statements regarding net operating losses is true?

A)You may only carry the loss forward 20 years.No carrybacks are allowed.

B)A net operating loss may be generated by a large medical deduction.

C)You may select which years would be most beneficial to deduct the net operating loss.

D)You may make an irrevocable election to opt out of carrying the loss back 2 years.

A)You may only carry the loss forward 20 years.No carrybacks are allowed.

B)A net operating loss may be generated by a large medical deduction.

C)You may select which years would be most beneficial to deduct the net operating loss.

D)You may make an irrevocable election to opt out of carrying the loss back 2 years.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

Which of the following expenses,incurred while on travel,does not qualify as a travel expense?

A)Taxi.

B)Dry cleaning of blouse.

C)Dinner at a sushi bar.

D)Book purchased to read while waiting in airport.

E)None of the above.

A)Taxi.

B)Dry cleaning of blouse.

C)Dinner at a sushi bar.

D)Book purchased to read while waiting in airport.

E)None of the above.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

Of the following expenses,which is considered to be entertainment expense subject to the 50 percent limitation?

A)Dues to the country club.

B)Tickets to a sporting event with a prospective client.

C)The cost of the yacht where clients will be invited.

D)Personal membership fees to a fitness club.

A)Dues to the country club.

B)Tickets to a sporting event with a prospective client.

C)The cost of the yacht where clients will be invited.

D)Personal membership fees to a fitness club.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

Which of the following scenarios is the one in which the educational expense would be deductible (assuming that the taxpayers do not qualify for the higher educational expenses discussed in Section 5.8 and the education credits in Section 6.4)?

A)A law student taking a review course for the LSAT test.

B)A manager taking a training class on effective leadership skills.

C)A CPA taking courses in order to obtain her investment broker license.

D)A cook at McDonald's going to college for a marketing degree in order to obtain a job at McDonald's headquarters.

A)A law student taking a review course for the LSAT test.

B)A manager taking a training class on effective leadership skills.

C)A CPA taking courses in order to obtain her investment broker license.

D)A cook at McDonald's going to college for a marketing degree in order to obtain a job at McDonald's headquarters.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

Which of the following would be allowable as a deductible uniform expense?

A)A suit purchased by a CPA to wear to work.

B)A movie ticket taker required to wear a white button down collared shirt,black pants and black shoes.

C)An alteration for an airline pilot's uniform.

D)A lifeguard required to purchase a red bathing suit.

A)A suit purchased by a CPA to wear to work.

B)A movie ticket taker required to wear a white button down collared shirt,black pants and black shoes.

C)An alteration for an airline pilot's uniform.

D)A lifeguard required to purchase a red bathing suit.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck