Deck 4: Business Income and Expenses, Part Ii

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Question

Unlock Deck

Sign up to unlock the cards in this deck!

Unlock Deck

Unlock Deck

1/20

Play

Full screen (f)

Deck 4: Business Income and Expenses, Part Ii

1

Which of the following rentals would be considered to be used "primarily" as a rental:

A)A condo in Aspen,Colorado is rented for 90 days.The owners use it 10 days during the summer and it is vacant for the rest of the year.

B)The taxpayer rents out his personal residence for the week that he is on vacation.

C)The taxpayer owns a beach front property which he lives in for most of the year.During the summer months,the taxpayer takes an extended vacation and travels throughout the United States.The taxpayer is able to rent out his residence for 60 days during the summer.

D)A person's Florida vacation home is rented out for 90 days and used for his personal use for 30 days.

A)A condo in Aspen,Colorado is rented for 90 days.The owners use it 10 days during the summer and it is vacant for the rest of the year.

B)The taxpayer rents out his personal residence for the week that he is on vacation.

C)The taxpayer owns a beach front property which he lives in for most of the year.During the summer months,the taxpayer takes an extended vacation and travels throughout the United States.The taxpayer is able to rent out his residence for 60 days during the summer.

D)A person's Florida vacation home is rented out for 90 days and used for his personal use for 30 days.

A

2

What percentage of medical insurance payments can self-employed taxpayers deduct as a deduction for adjusted gross income on their 2011 tax returns?

A)25 percent

B)30 percent

C)50 percent

D)70 percent

E)100 percent

A)25 percent

B)30 percent

C)50 percent

D)70 percent

E)100 percent

E

3

Morton has a Roth IRA to which he has made contributions of $26,000.The Roth IRA has a current value of $41,000.He is 62 years old,has met the 5-year holding requirement,and takes a distribution of $25,000.How much of the distribution will be taxable to Morton?

A)$16,000

B)$25,000

C)$26,000

D)$1,000

E)$0

A)$16,000

B)$25,000

C)$26,000

D)$1,000

E)$0

E

4

Peter has self-only coverage in a qualifying high-deductible health insurance policy.He is 28 years old and wishes to contribute the maximum amount to his HSA.How much is he allowed to contribute and deduct in 2011?

A)$1,000

B)$4,050

C)$5,950

D)$1,200

E)$3,050

A)$1,000

B)$4,050

C)$5,950

D)$1,200

E)$3,050

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

5

Which of the following is a true statement about health savings accounts (HSAs)?

A)Taxpayers who contribute to an HSA must carry health insurance,but it does not matter what kind.

B)Contributions to HSAs are deductible as itemized deductions.

C)Taxpayers covered by Medicare may not contribute to deductible HSAs.

D)Distributions from HSAs which are not used to pay qualifying medical expenses are generally subjected to a 50 percent penalty as well as income taxes.

E)Distributions from HSAs are taxable even when used to pay qualifying medical expenses.

A)Taxpayers who contribute to an HSA must carry health insurance,but it does not matter what kind.

B)Contributions to HSAs are deductible as itemized deductions.

C)Taxpayers covered by Medicare may not contribute to deductible HSAs.

D)Distributions from HSAs which are not used to pay qualifying medical expenses are generally subjected to a 50 percent penalty as well as income taxes.

E)Distributions from HSAs are taxable even when used to pay qualifying medical expenses.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

6

Pete is 45 and participates in his employer's Section 401(k)plan which allows employees to contribute up to 15 percent of their salary.His annual salary is $120,000 in 2011.What is the maximum he can contribute to this plan on a tax deferred basis under a salary reduction agreement?

A)$10,000

B)$5,000

C)$16,500

D)$18,000

E)None of the above

A)$10,000

B)$5,000

C)$16,500

D)$18,000

E)None of the above

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

7

During 2011,Henry,age 35,decided to change jobs.Henry asked his old company to give him a check for the $10,000 balance from his retirement account.Since this was not a direct transfer into a new retirement account,the company withheld 20 percent ($2,000)as federal withholding taxes,thereby giving him a net check for $8,000.In order to avoid paying taxes and penalties on this distribution,Henry:

A)Does not need to do anything.

B)Must deposit $8,000 within the 30 day rollover period.

C)Must deposit $8,000 within the 60 day rollover period.

D)Must deposit $10,000 within the 60 day rollover period.

A)Does not need to do anything.

B)Must deposit $8,000 within the 30 day rollover period.

C)Must deposit $8,000 within the 60 day rollover period.

D)Must deposit $10,000 within the 60 day rollover period.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

8

Arlene purchased interests in three limited partnerships during the previous 6 years.During 2011,Arlene had income of $22,000 from one of the partnerships and $5,000 from a second.She had a loss from the third partnership of $36,000,salary income of $55,000,and dividend income of $3,000.What is Arlene's net passive income or loss before any limitations?

A)$36,000 net loss

B)$3,000 net loss

C)$0 net loss

D)$9,000 net loss

E)None of the above

A)$36,000 net loss

B)$3,000 net loss

C)$0 net loss

D)$9,000 net loss

E)None of the above

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

9

Which type of insurance is deductible as self-employed health insurance?

A)Long-term care insurance

B)Life insurance

C)Disability insurance

D)The personal injury portion of auto insurance

E)Malpractice insurance

A)Long-term care insurance

B)Life insurance

C)Disability insurance

D)The personal injury portion of auto insurance

E)Malpractice insurance

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

10

In regards to retirement plans for self-employed individuals,choose the false statement.

A)To avoid penalties,taxpayers must make distributions from their Keogh or Simplified Employee Pension plan after they are 70 1/2 and not before they reach 59 1/2.

B)Self-employed individuals may only use Simplified Employee Pension plans as retirement plans.

C)For 2011,contribution to a Keogh plan is the lesser of 20 percent of the net earned income (before the Keogh deduction)or $49,000.

D)Contributions to a Simplified Employee Pension plan are made into a special SEP-IRA account

A)To avoid penalties,taxpayers must make distributions from their Keogh or Simplified Employee Pension plan after they are 70 1/2 and not before they reach 59 1/2.

B)Self-employed individuals may only use Simplified Employee Pension plans as retirement plans.

C)For 2011,contribution to a Keogh plan is the lesser of 20 percent of the net earned income (before the Keogh deduction)or $49,000.

D)Contributions to a Simplified Employee Pension plan are made into a special SEP-IRA account

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

11

In 2011,as a single woman,Ashley's adjusted gross income was $12,000.Ashley decided to contribute $2,000 to her IRA.How much is her "Low Income Retirement Plan Contribution Credit"?

A)$0

B)$200

C)$400

D)$1,000

A)$0

B)$200

C)$400

D)$1,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

12

In order for a plan to be a "qualified" retirement plan,it must meet all of the following requirements except:

A)The plan must be created for the exclusive benefit of the employees or their beneficiaries.

B)The contributions and benefit can discriminate in favor of the highly compensated employees.

C)The plan must meet certain participation and coverage requirements.

D)There is a minimum vesting requirement which must be met with respect to employee and employer contributions.

A)The plan must be created for the exclusive benefit of the employees or their beneficiaries.

B)The contributions and benefit can discriminate in favor of the highly compensated employees.

C)The plan must meet certain participation and coverage requirements.

D)There is a minimum vesting requirement which must be met with respect to employee and employer contributions.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

13

Lenore rents her vacation home for 9 months and lives in the home during the other 3 months of 2011.The gross rental income from the home is $7,500.For the entire year,real estate taxes are $1,000,interest is $3,500,utilities and maintenance expenses are $2,400,and depreciation expense on the entire home would be $4,000.What is Lenore's allowable net loss from renting her vacation home?

A)$2,725 loss

B)$8,175 loss

C)$675 loss

D)$0 loss

E)None of the above

A)$2,725 loss

B)$8,175 loss

C)$675 loss

D)$0 loss

E)None of the above

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

14

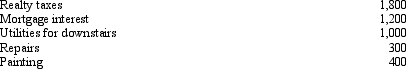

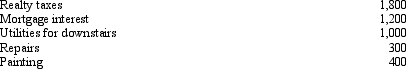

Donna owns a two-family home.She rents out the first floor and resides on the second floor.The following expenses attributable to the total building were incurred by Donna for the year ended December 31,2011:  In addition,the depreciation attributable to the first floor would be $2,000.What is the total amount of the expenses that Donna can deduct on Schedule E of Form 1040 (before any limitations)?

In addition,the depreciation attributable to the first floor would be $2,000.What is the total amount of the expenses that Donna can deduct on Schedule E of Form 1040 (before any limitations)?

A)$4,700

B)$6,700

C)$4,350

D)$4,850

E)None of the above

In addition,the depreciation attributable to the first floor would be $2,000.What is the total amount of the expenses that Donna can deduct on Schedule E of Form 1040 (before any limitations)?

In addition,the depreciation attributable to the first floor would be $2,000.What is the total amount of the expenses that Donna can deduct on Schedule E of Form 1040 (before any limitations)?A)$4,700

B)$6,700

C)$4,350

D)$4,850

E)None of the above

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

15

Which of the following is not deductible as a moving expense?

A)Moving household goods and personal effects.

B)Lodging while traveling from the old to the new residence.

C)Driving (at 19 cents per mile)from the old to the new residence.

D)Meals while traveling from the old to the new residence.

E)All of the above are deductible moving expenses.

A)Moving household goods and personal effects.

B)Lodging while traveling from the old to the new residence.

C)Driving (at 19 cents per mile)from the old to the new residence.

D)Meals while traveling from the old to the new residence.

E)All of the above are deductible moving expenses.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

16

Which of the following is deductible as a moving expense?

A)Meal expenses during the move.

B)Lodging for household members during the move.

C)The cost of a pre-move house-hunting trip.

D)A side trip to Disney World.

E)All of the above are deductible as moving expenses.

A)Meal expenses during the move.

B)Lodging for household members during the move.

C)The cost of a pre-move house-hunting trip.

D)A side trip to Disney World.

E)All of the above are deductible as moving expenses.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

17

Sharon is a lawyer (not covered by a retirement plan)with a salary of $76,000 from the firm where she is employed.She supports her husband,William,who has no earned income.Both are in their 30's.What is the maximum total amount that Sharon and William may contribute to their IRA's and deduct for the 2011 tax year?

A)$0

B)$5,000

C)$10,000

D)$7,200

E)None of the above

A)$0

B)$5,000

C)$10,000

D)$7,200

E)None of the above

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

18

The following is not true of Section 401(k)plans:

A)Section 401(k)plans allow annual employee contributions of up to $16,500 ($22,000 if age 50 or older).

B)The contributions to the Section 401(k)plan and earnings of the plan are taxable only when withdrawn.

C)Section 401(k)plans are for employers who have no more than 100 employees.

D)Some employers match employee contributions up to a certain percentage in order to encourage participation.

A)Section 401(k)plans allow annual employee contributions of up to $16,500 ($22,000 if age 50 or older).

B)The contributions to the Section 401(k)plan and earnings of the plan are taxable only when withdrawn.

C)Section 401(k)plans are for employers who have no more than 100 employees.

D)Some employers match employee contributions up to a certain percentage in order to encourage participation.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

19

Sally has the following income and loss: Salary of $42,000

Interest income of $2,000

Passive income from Acme Limited Partnership of $4,000

Passive loss from Beta Limited Partnership of $5,000

How much adjusted gross income will be reported on her

Tax return?

A)$43,000

B)$41,000

C)$44,000

D)$48,000

Interest income of $2,000

Passive income from Acme Limited Partnership of $4,000

Passive loss from Beta Limited Partnership of $5,000

How much adjusted gross income will be reported on her

Tax return?

A)$43,000

B)$41,000

C)$44,000

D)$48,000

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck

20

During 2011,Henry,age 35,decided to change jobs.Henry asked his old company to make a direct transfer of his $10,000 balance from his old company's retirement account into his IRA.In order to avoid paying taxes and penalties on this distribution,Henry:

A)Does not need to do anything.

B)Must deposit $2,000 within the 30 day rollover period,since 20 percent should have been withheld for taxes.

C)Must deposit $8,000 within the 60 day rollover period.

D)Must deposit $10,000 within the 60 day rollover period.

A)Does not need to do anything.

B)Must deposit $2,000 within the 30 day rollover period,since 20 percent should have been withheld for taxes.

C)Must deposit $8,000 within the 60 day rollover period.

D)Must deposit $10,000 within the 60 day rollover period.

Unlock Deck

Unlock for access to all 20 flashcards in this deck.

Unlock Deck

k this deck